Global Beer Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Product & Services (Premium Beer, Subpremium Beer, Super-Premium Beer, Craft Beer, and Other Beers), By Beer Production (Macro-Brewery and Micro-Brewery), By Distribution Channel (Supermarkets & Hypermarkets, On-Trades, Specialty Stores, and Convenience Stores), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Beer Manufacturing Market Insights Forecasts to 2035

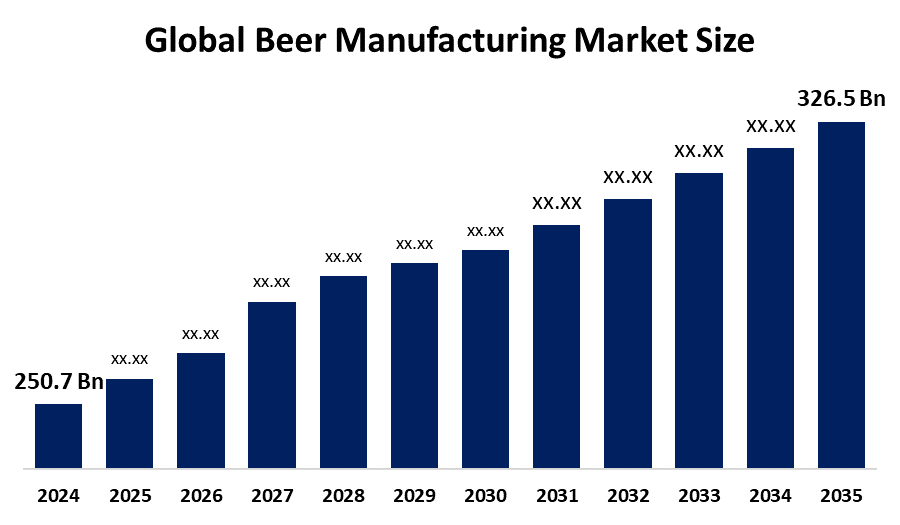

- The Global Beer Manufacturing Market Size Was Estimated at USD 250.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.43% from 2025 to 2035

- The Worldwide Beer Manufacturing Market Size is Expected to Reach USD 326.5 Billion by 2035

- North America is Expected to Grow the Fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Global Beer Manufacturing Market Size was worth around USD 250.7 Billion in 2024 and is Predicted to Grow to around USD 326.5 Billion by 2035 with a compound annual growth rate (CAGR) of 2.43% from 2025 to 2035. The growing consumer health consciousness and craft beer expansion are driving the beer manufacturing market worldwide.

Market Overview

The beer manufacturing market refers to the industry encompassing the production, distribution, and sale of beer, which is globally a popular alcoholic beverage. Beer manufacturing involves steeping of starch source (commonly cereal grains, the most popular of which is barley) in water and fermenting the resulting sweet liquid with yeast. This process of beer production is brewing, which is done in a brewery by a commercial brewer, at home by a homebrewer, or communally. There is a dramatic shift towards beer consumption patterns, with the declining consumption in traditional drinking countries where wine and spirits were traditionally consumed. Consumers’ increasing demand for environmentally friendly products and ethical responsibility is driving the shift towards sustainability. Breweries across the globe are actively adopting eco-friendly brewing techniques to reduce environmental impact. The growing popularity of craft breweries, with the rise in experiential travel and demand for immersive cultural experiences, is bolstering the market growth opportunities of beer manufacturing.

Report Coverage

This research report categorizes the beer manufacturing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the beer manufacturing market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the beer manufacturing market.

Global Beer Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 250.7 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 2.43% |

| 2035 Value Projection: | USD 326.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Beer Production, By Distribution Channel and By Region. |

| Companies covered:: | Anheuser-Busch InBev SA/NV, Heineken N.V., Carlsberg A/S, Molson Coors Beverage Company, Asahi Group Holdings, Kirin Holdings, United Breweries, China Resources Snow Breweries Limited, Yanjing Brewery, Boston Beer Company, Inc., Dogfish Head Craft Brewery, Diageo PLC, Sierra Nevada Brewing Co and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

There is increased demand for low alcohol and non-alcoholic beers among health-conscious consumers, which is responsible for driving the beer manufacturing market. Craft beer expansion due to consumers' growing need for unique, premium, and flavor-rich beer experiences is contributing to propel the market growth. Wrap-around packaging systems are ideal for craft brewers that are ready to scale up and leverage unique packaging design to raise the brand’s profile among the competition. The growing significance of custom labels in the beer industry, which contributes to shaping a brand’s image, is promoting the market demand.

Restraining Factors

The restricted provincial acts for marketing and advertising alcoholic beverages are hampering the beer manufacturing market. Further, the increased excise duties and taxation on imported and local beer are restraining the market.

Market Segmentation

The beer manufacturing market share is classified into product & services, beer production, and distribution channel.

- The premium beer segment dominated the market with the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product & services, the beer manufacturing market is divided into premium beer, subpremium beer, super-premium beer, craft beer, and other beers. Among these, the premium beer segment dominated the market with the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment includes a focus on consistent, high-quality taste and a refined drinking experience. With an upsurging trend of premiumization, consumer interest in high-quality products, especially among millennials, is driving the market in the premium beer segment.

- The macro-brewery segment accounted for a larger market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the beer production, the beer manufacturing market is divided into macro-brewery and micro-brewery. Among these, the macro-brewery segment accounted for a larger market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Macro breweries are mass-produced, often cheaper than microbreweries, producing over 6 million gallons of beer every year. With the increasing popularity of craft beers and premium beverages, the growing investments in advanced brewing technology for efficient scale operations and quality standards maintenance are driving the market.

- The supermarkets & hypermarkets segment accounted for a major market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the beer manufacturing market is divided into supermarkets & hypermarkets, on-trades, specialty stores, and convenience stores. Among these, the supermarkets & hypermarkets segment accounted for a major market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Supermarkets & hypermarkets are the large-format retail outlets providing easy access to a wide range of beer brands, such as mass-market lagers, premium imports, and craft offerings.

Regional Segment Analysis of the Beer Manufacturing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the beer manufacturing market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the beer manufacturing market over the predicted timeframe. An increasing demand for premium and expensive beer, with the changing lifestyle of the working population in urban areas, and increasing disposable income, is driving the beer manufacturing market. An increasing demand for diverse and personalized drinking experiences, driving the growth of craft breweries in the region, thereby propelling the market.

North America is expected to grow at a rapid CAGR in the beer manufacturing market during the forecast period. The increasing demand for craft and premium beers, especially among younger adults, who are seeking unique flavors and personalized drinking experiences, is driving the beer manufacturing market. Further, an expansion of the beverage industries, with the growing westernization and urbanization, is propelling the market growth.

Europe is anticipated to hold a significant share of the beer manufacturing market during the forecast period. An increasing emphasis on quality over quantity is driving the need for handcrafted beers, which are produced using conventional materials is propelling the beer manufacturing market. Further, consumers' increasing preference for unique and locally produced beer varieties aids in propelling the market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the beer manufacturing market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Anheuser-Busch InBev SA/NV

- Heineken N.V.

- Carlsberg A/S

- Molson Coors Beverage Company

- Asahi Group Holdings

- Kirin Holdings

- United Breweries

- China Resources Snow Breweries Limited

- Yanjing Brewery

- Boston Beer Company, Inc.

- Dogfish Head Craft Brewery

- Diageo PLC

- Sierra Nevada Brewing Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, SABECO launched a beer research and development centre to elevate Vietnam’s beverage industry to global standards. The Saigon Beer – Alcohol – Beverage Corporation (SABECO) has officially inaugurated the SABECO Beer Research and Development Center (SRC).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the beer manufacturing market based on the below-mentioned segments:

Global Beer Manufacturing Market, By Product & Services

- Premium Beer

- Subpremium Beer

- Super-Premium Beer

- Craft Beer

- Other Beers

Global Beer Manufacturing Market, By Beer Production

- Macro-Brewery

- Micro-Brewery

Global Beer Manufacturing Market, By Distribution Channel

- Supermarkets & Hypermarkets

- On-Trades

- Specialty Stores

- Convenience Stores

Global Beer Manufacturing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the beer manufacturing market over the forecast period?The global beer manufacturing market is projected to expand at a CAGR of 2.43% during the forecast period.

-

2. What is the market size of the beer manufacturing market?The global beer manufacturing market size is expected to grow from USD 250.7 Billion in 2024 to USD 326.5 Billion by 2035, at a CAGR of 2.43% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the beer manufacturing market?Asia Pacific is anticipated to hold the largest share of the beer manufacturing market over the predicted timeframe.

Need help to buy this report?