Global Battery Materials Market Size, Share, and COVID-19 Impact Analysis, By Battery Type (Lead-Acid, Lithium-Ion, Others), By Material Type (Cathode, Anode, Electrolyte, Separator, Others), By Application (Automotive, Household Appliances, Consumer Electronics, Grid Storage, Telecommunication, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Energy & PowerGlobal Battery Materials Market Insights Forecasts to 2030

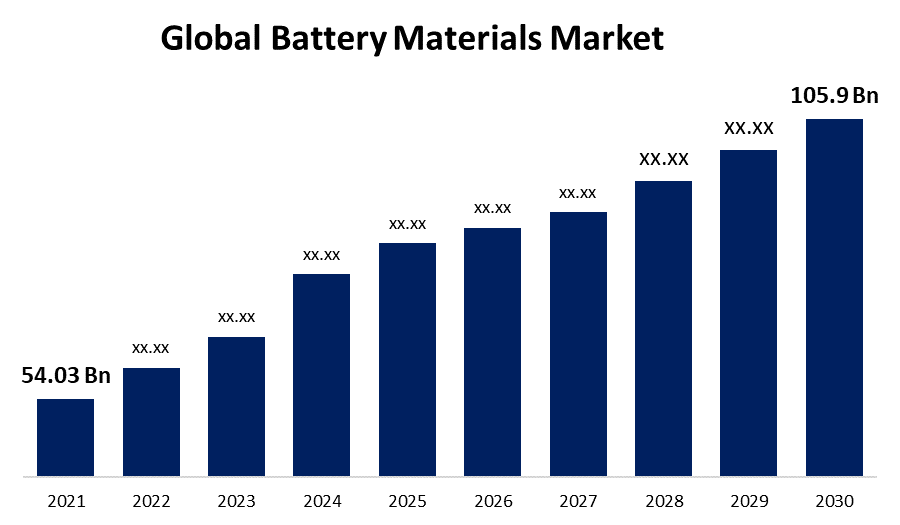

- The Global Battery Materials Market was valued at USD 54.03 Billion in 2021.

- The Market is growing at a CAGR of 9.1% from 2022 to 2030

- The Worldwide Battery Materials Market is expected to reach USD 105.9 Billion by 2030

- Europe is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Battery Materials Market is expected to reach USD 105.9 Billion by 2030, at a CAGR of 9.1% during the forecast period 2022 to 2030.

To address climate change, the world is rapidly transitioning to electric vehicles. As a result of the potential for electric car fleet and battery chemistry innovations, in addition to second-use and recycling of electric vehicle batteries, future demand for key battery materials is experiencing exponential growth. According to the report by spherical insight, the lithium nickel cobalt manganese oxide dominated the battery material market, demand is evaluated to increase by factors of 18–20 for lithium, 17–19 for cobalt, 28–31 for nickel, and 15–20 for most other materials from 2020 to 2050, requiring a drastic expansion of lithium, cobalt, and nickel supply chains and likely additional resource discovery. The increases in the electric vehicle fleet and battery capacity needs per vehicle are the major reasons propelling the battery material market.

In the battery supply chain, battery materials are the essential raw materials and substances. They mostly consist of metals such as lithium, cobalt, and nickel, among others. Materials are derived from upstream mining projects that transform mineral ores or seawater brines into refined battery metals. Battery packs are high-quality products, and they are utilized in a variety of end markets, including the automobile, consumer devices, and storage technology sectors.

Lithium-ion batteries (LIBs) are currently the most widely used EV technology2. The cathode of a typical automobile LIB contains lithium (Li), cobalt (Co), and nickel (Ni), whereas the anode contains graphite and other cell and pack components such as aluminium and copper. However, concerns have been raised about the long-term supply of battery materials due to the rapid growth of the EV market. Automobile manufacturers might see a surge in the use of batteries due to their low self-heating rate, which makes them particularly helpful in electric vehicles, increasing the need for battery raw materials.

COVID-19 Impact Battery Materials Market

Given the travel restrictions imposed on by the Covid-19 pandemic and the drop in EV demand, the industry only experienced modest growth in 2020. These impacts were still visible in 2021. The pandemic had a significant impact on the market for battery-related materials. As a result, the energy storage sector has seen severe constraints in manufacturing, shipping delays, project expansion, and R&D. Furthermore, supply-chain and transportation limitations caused by the restriction on battery raw material exports and imports are generating substantial disruptions.

Global Battery Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 54.03 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 9.1% |

| 2030 Value Projection: | USD 105.9 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Battery Type, By Material Type, By Application, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Schaeffler AG, Tenneco Inc., Harman International Industries, Inc., Samsung SDI Co., Ltd., Shaanxi Fast Auto Drive Group, Hitachi Astemo, Ltd., Dana Incorporated, Proterial, Ltd., Eaton Corporation Plc, Faurecia SE, TORAY INDUSTRIES, INC., Mitsubishi chemical holdings, Visteon Corporation, Posco, Volkswagen AG, SEAT S.A., China Molybdenum Co. Ltd., Audi AG, Targray Technology International, Hyundai Motors, Gan feng Lithium Co. Ltd., BMW AG, TCI Chemicals Pvt. Ltd., Johnson Matthey, Honda Manufacturing, BYD Automobile Industry Co., Ltd., Umicore, Asahi Kasei, Norlisk Nickel, Sheritt International Corporation, Sumitomo Chemical Co., Ltd., Kureha Corporation |

| Pitfalls & Challenges: | Covid-19 Impact Analysis |

Get more details on this report -

Key Market Drivers

Rising penetration for electric vehicles and consumer electronics to boost market demand

The increasing popularity of electric vehicles is accelerating due to the manufacturing industry's continual improvements and explosive growth. The growing drive to reduce carbon emissions, as well as the deployment of high-speed and advanced charging stations, are expected to facilitate electric vehicle sales that will boost battery material market growth. Considering the majority of battery packs for electric vehicles are lithium-based and have a combination of manganese, cobalt, graphite, nickel, and other elements.

The increased demand for computers, televisions, mobile phones, and other devices is due to the growing manufacturing of electronic products. Battery demand in smartphones, laptops, smart electronic wearables, digital cameras, and tablets is expected to boost the battery material market expansion. The market is expected to witness a rise in demand for cutting-edge electronics as a result of major investments in resources and the development of effective and innovative battery technologies.

Key Market Challenges

Concerns over battery safety and a lack of infrastructure investment may limit demand.

Certain batteries (Pb, the primary material in lead-acid batteries) include hazardous materials that could cause neurological damage, impaired cognitive and physical growth, concentration and learning disabilities in those who are susceptible to these. The usage of these kinds of materials demands specialized knowledge, safeguards, and experience.

The implementation of EVs is likely to be hindered by insufficient charging infrastructure, which is expected to stymie the battery material market growth. Major manufacturers and energy providers are still not investing in charging infrastructure because it is financially demanding and there is minimal demand for electric vehicles, stifling total market growth. Furthermore, as a result of the Ukraine war, raw material costs such as steel, copper, lithium, and plastic increased greatly.

Key Market Opportunities

Adoption of batteries in energy storage devices

In energy storage devices, lead-acid and lithium-ion batteries are mostly utilized for industrial or other applications. In a variety of applications, these batteries' indented design guarantees excellent performance and high power output. Datacenters utilize uninterrupted power supplies (UPS) to transmit power to loads because they need a steady supply of electricity. Renewable energy-generating and hybrid car systems also make use of energy storage technologies.

Market Segmentation

Battery Type Insights

The lithium-ion segment accounted the largest market share over the forecast period.

On the basis of battery type, the global battery materials market is segmented into lead-acid, lithium-ion, and others. Among these, the lithium-ion segment is dominating the market and is going to continue its dominance over the forecast period. Due to their high energy density, low discharge frequency, and voltage capacity, lithium-ion batteries are presently the most used energy storage technology. Several industries, including automotive, industrial, consumer, and portable electronics, have been widely utilizing lithium-ion batteries in various applications. Consumer electronics currently constitute production volumes in the hundreds of billions of dollars worldwide. As a result of increased demand, manufacturers have improved their distribution network, resulting in price reductions that are pushing the lithium-ion battery material market.

Material Type Insights

The cathode segment is dominating the market with the largest revenue share over the forecast period.

On the basis of material type, the global battery materials market is segmented into cathode, anode, electrolyte, separator, and others. Among these, the cathode segment is dominating the market with the largest revenue share of 26.5% over the forecast period. The cathode segment is divided into the following constituents: lithium cobalt oxide, lithium iron phosphate, lithium manganese oxide, lithium nickel cobalt aluminium oxide, and lithium nickel manganese oxide. Anode materials are also classified as artificial graphite, natural graphite, and others. Cobalt, manganese, and nickel are the key active ingredients in cathode materials. Cathode materials have an incredibly high concentration and also be exempt from foreign material contaminants, especially iron, vanadium, and sulfur. Cobalt is now gradually replaced by nickel, notably Lithium Nickel Manganese Oxide (NMC), and Nickel Cobalt Aluminium Oxide (NCA).

Application Insights

The automotive segment accounted the largest revenue share of more than 76.2% over the forecast period.

On the basis of application, the global Battery Materials market is segmented into automotive, household appliances, consumer electronics, grid storage, telecommunication, and others. Among these, the automotive segment accounted for the largest revenue share of over 76.2% over the forecast period. Automobiles with several functionalities are the culmination of technological breakthroughs in the automotive industry. Because of the market's competitive environment, this growth in features has undergone an exponential surge in the last several decades. Even entry-level automobiles now come with factors pertaining to lighting, gadgets, and car infotainment systems, among others. Lead-acid batteries are popular because of their high efficiency, competitive prices, excellent quality, and tolerance to overpricing, long life, and availability. As a result, it would increase demand for rechargeable batteries and, as a result, battery materials.

The consumer electronics industry is likely to grow at the highest CAGR in the forecast period. The increased popularity of smart electronic gadgets as a result of rising demographics and equal purchasing power, as well as shifts in choices and preferences, will boost the market growth. The demand for battery materials is also driven by increased demand for laptops, UPS, and smart gadgets, among other consumer electronics devices that require batteries for operation and portability.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 65.9% market share over the forecast period. As the world's leading battery manufacturers, China, Japan, and South Korea utilize the majority of battery raw materials. Steadily rising and sustainable developments, as well as rising consumer expenditure on electric and hybrid vehicles, are likely to boost the regional market growth. The growing utilization of compact and rechargeable battery packs in consumer electronics items such as laptops, cellphones, as well as other electronic devices that are portable is expected to propel the battery material market in the region. The battery raw material market is predicted to be driven by factors such as cheap manufacturing costs, plentiful availability of raw materials, and innovative technologies. China is an industrial powerhouse, with rising demand for battery materials. An estimated three million EVs were sold in China in 2021, and the market is progressing strongly in the initial quarter of 2022. In the forecast period, China's need for EVs is expected to drive the battery material market.

North America is expected to develop greatly as a result of technological advancement growth of electric cars and rising consumer electronics demand. The government of the United States is promoting investors in the renewable and electric transportation markets, which will lead to greater demand for rechargeable batteries energy storage technology, particularly lithium-ion battery packs, which will primarily boost market growth in the region.

Europe, on the contrary hand, is projected to showcase substantial growth revenue share throughout the forecast period. A lucrative expansion in the global market for battery materials may also be facilitated by Germany's expanding electronics and automotive sectors. Europe became the world's second-largest automotive market in 2018 after registering over one million plug-in electric passenger vehicles.

Key Market Developments

- On March 2023, Norsk Hydro ASA (Hydro) recently announced the purchase of a 12% share in Lithium de France, signaling the company's planned growth into sustainable battery materials. Hydro Batteries is a business unit within Hydro Energy with the goal of developing leading sustainable battery businesses in Europe through active value chain investments. The capital increase will be funded by the company's existing owners, including Hydro as a new stakeholder.

- On February 2023, Umicore stated that its business unit "Rechargeable Battery Materials" is crucial to the company's 2030 RISE strategy. Umicore plans to consolidate the Rechargeable Battery Materials activities inside one legal company as a next step in the implementation of its strategy. This structure will provide the greatest basis for the business unit to develop inside Umicore and maximize its financing alternatives while meeting the company's ambitious 2030 RISE targets.

- In November 2022, Farasis Energy (Ganzhou) Co., Ltd. (Farasis Energy) announced the signing of a strategic collaboration agreement with Guizhou Zhenhua E-chem Inc. (Zhenhua E-chem). Both sides committed to collaborate and obtain ternary anode materials, collaborate on sodium battery anode materials, recycle waste and old batteries, and jointly explore lithium resources.

- In August 2022, Ningbo Shanshan Co., Ltd. announced that production at the Plase 1 battery anode materials manufacturing site in Meishan City has begun, with an annual production capacity of 200,000 tons. The factory, which will cost CNY 8 billion in fixed assets, will produce 200,000 tons of lithium battery anode materials each year. The building period was scheduled to last 32 months and was divided into two stages, each with an annual production of 100,000 tons. Phase 1 of the construction project was finished in 16 months.

List of Key Market Players

- Schaeffler AG

- Tenneco Inc.

- Harman International Industries, Inc.

- Samsung SDI Co., Ltd.

- Shaanxi Fast Auto Drive Group

- Hitachi Astemo, Ltd.

- Dana Incorporated

- Proterial, Ltd.

- Eaton Corporation Plc

- Faurecia SE

- TORAY INDUSTRIES, INC.

- Mitsubishi chemical holdings

- Visteon Corporation

- Posco

- Volkswagen AG

- SEAT S.A.

- China Molybdenum Co. Ltd.

- Audi AG

- Targray Technology International

- Hyundai Motors

- Gan feng Lithium Co. Ltd.

- BMW AG

- TCI Chemicals Pvt. Ltd.

- Johnson Matthey

- Honda Manufacturing

- BYD Automobile Industry Co., Ltd.

- Umicore

- Asahi Kasei

- Norlisk Nickel

- Sheritt International Corporation

- Sumitomo Chemical Co., Ltd.

- Kureha Corporation

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the global battery materials market based on the below-mentioned segments:

Battery Materials Market, Battery Type Analysis

- Lead-Acid

- Lithium-Ion

- Others

Battery Materials Market, Material Type Analysis

- Cathode

- Anode

- Electrolyte

- Separator

- Others

Battery Materials Market, Application Analysis

- Automotive

- Household Appliances

- Consumer Electronics

- Grid Storage

- Telecommunication

- Others

Battery Materials Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which region is dominating the Battery Materials market?Asia Pacific is dominating the battery materials market with more than 65.9% market share.

-

2. Which are the key companies in the market?Schaeffler AG, Tenneco Inc., Harman International Industries, Inc., Samsung SDI Co., Ltd., Shaanxi Fast Auto Drive Group AG, Johnson Matthey, Honda Manufacturing, BYD Automobile Industry Co., Ltd., Umicore, Asahi Kasei, and Norlisk Nickel

-

3. Which segment holds the largest market share of the battery materials market?Lithium-ion segment based on battery material holds the maximum market share of the Battery Materials market.

-

4. What is the market size of the battery materials market?The global battery materials market is expected to grow from USD 54.03 Billion in 2021 to USD 105.9 Billion by 2030, at a CAGR of 9.1% during the forecast period 2021-2030.

-

5. What are the major driving factors for the battery materials market?The rising demand for electric vehicles, improving quality of industrial manufacturing in developing countries, and increased demand for energy storage systems in power generation is the key factor driving the market growth.

-

6. Which segment dominated the Battery Materials market share?The automotive segment in industry application dominated the battery materials market in 2021 and accounted for a revenue share of over 76.2%.

Need help to buy this report?