Global Barrier Films Market Size, Share, and COVID-19 Impact Analysis, By Type (Metalized Barrier Films, Transparent Barrier Films, and White Barrier Films), By Application (Food and Beverage, Pharmaceutical, Electronics, Agriculture, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Barrier Films Market Insights Forecasts To 2035

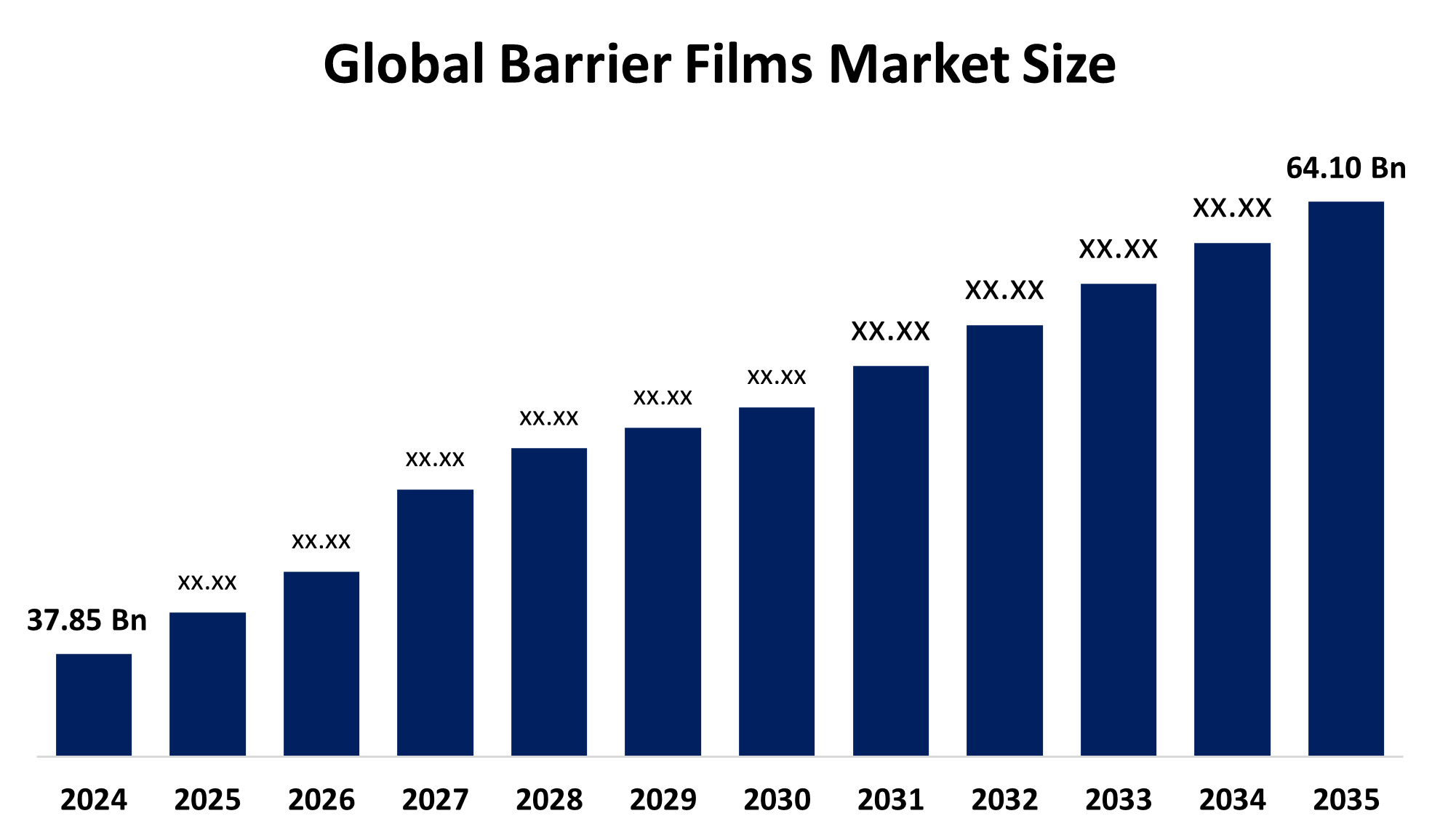

- The Global Barrier Films Market Size Was Estimated at USD 37.85 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.91% from 2025 to 2035

- The Worldwide Barrier Films Market Size is Expected to Reach USD 64.10 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Barrier Films Market Size was worth around USD 37.85 Billion in 2024, Growing to 39.70 Billion in 2025, and is Predicted To Grow to around USD 64.10 Billion by 2035 with a compound annual growth rate (CAGR) of 4.91% from 2025 to 2035. The market for barrier films has opportunities in the areas of sustainable packaging, cutting-edge multilayer technologies, rising food preservation and pharmaceutical protection needs, and expansion into new markets as a result of urbanization, e-commerce, and consumer convenience trends.

Global Barrier Films Market Forecast and Revenue Size

- 2024 Market Size: USD 37.85 Billion

- 2025 Market Size: USD 39.70 Billion

- 2035 Projected Market Size: USD 64.10 Billion

- CAGR (2025-2035): 4.91%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

The global industry devoted to the manufacture, distribution, and use of barrier films, thin plastic based or multi-layered materiais intended to limit the passage of gases, moisture, light, and other external elements, is known as the barrier films market. These barrier films are essential for maintaining product quality and prolonging shelf life, especially in the food and beverage, pharmaceutical, and personal care industries. For instance, in August 2025, Mondi announced it was ramping up production of its new Functional Barrier Paper Ultimate after a €16 million tech upgrade at its Solec, Poland plant. The ultra-high barrier paper achieves OTR < 0.5 cm³/m'd and WVTR < 0.5 g/m²d, while offering significantly lower cradle-to-grave CO, emnsions than conventional multilayer plastic or aluminium alternatives. The expansion of contemporary retail formats, including supermarkets, hypermarkets, and convenience stores, is another factor driving the barrier films market growth. The market for barrier films is expanding due to the growing demand for packaged food and beverages, as well as a growing focus on product protection and shelf life extension. Growing consumer preference for lightweight, portable, flexible packaging made with barrier films over more conventional rigid packaging like glass and cans is fueling the barrier films market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the barrier films market during the forecast period.

- In terms of type, the metalized barrier films segment is projected to lead the barrier films market throughout the forecast period

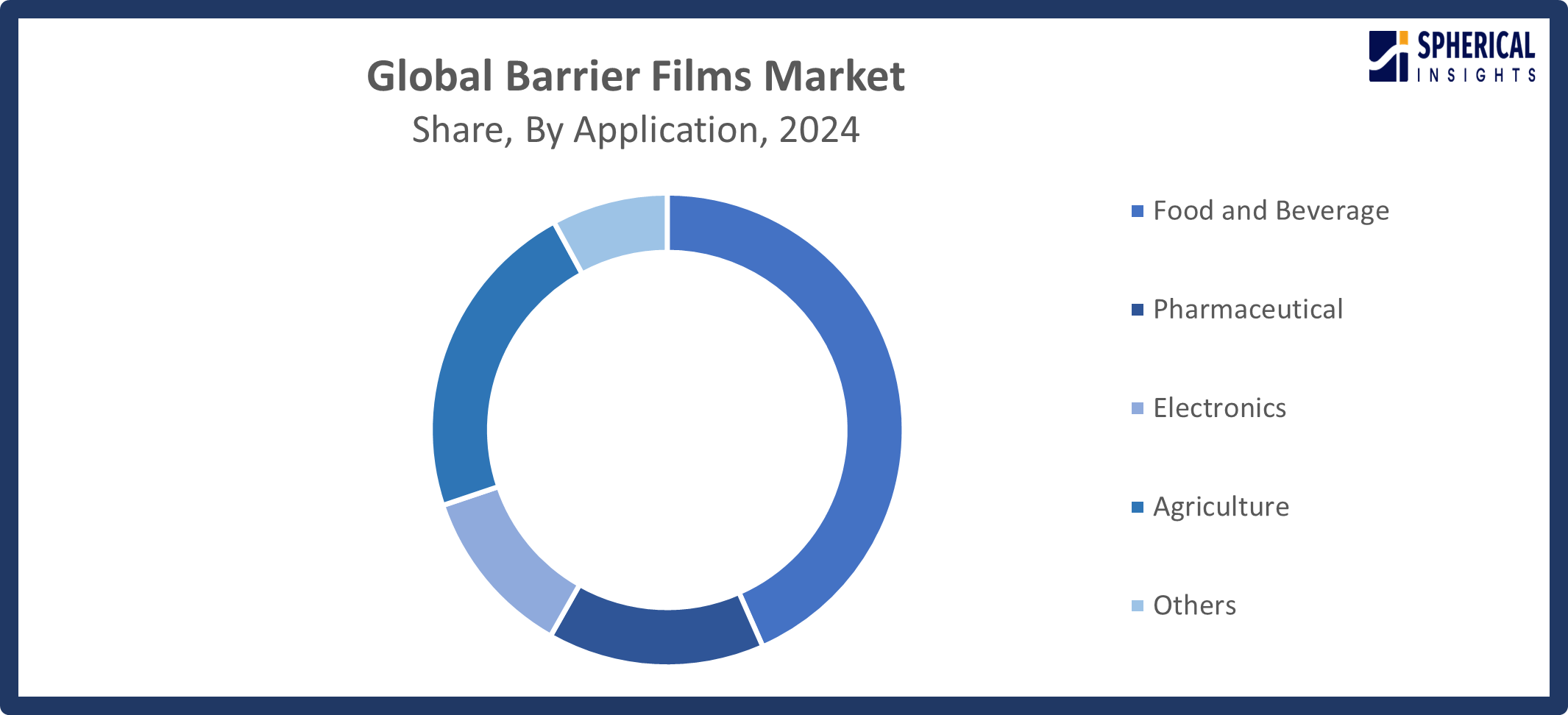

- In terms of application, the food and beverage segment captured the largest portion of the market

Barrier Films Market Trends

- Creation of barrier materials that are biobased and biodegradable.

- Increasing demand for barrier films that are reusable and sustainable.

- Increased use for shelf-life extension in the food and beverage sector.

- Increasing use in pharmaceutical packaging to safeguard delicate goods.

- Developments in films based on nanotechnology and multilayer technologies.

- The demand for protective packaging is being driven by the growth of e-commerce.

Report Coverage

This research report categorizes the barrier films market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the barrier films market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the barrier films market.

Global Barrier Films Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 37.85 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.91% |

| 2035 Value Projection: | USD 64.10 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Mondi plc, Amcor Plc, Toppan Inc., HPM Global Inc, Berry Global Inc., Cosmo Films Ltd., Royal Dutch Shell, Dupont Teijin Films, Jindal Poly Films Ltd., Evonik Industries AG, INEOS Group Limited, Sealed Air Corporation, Dow Chemical Company, Qatar Chemical Company, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving factors:

Growing consumer preference for packaged products, developments in flexible packaging technologies, and regulatory pressure for high-performance, sustainable materials are the main drivers of demand. Depending on the needs of the packaging, a variety of materials, including paper, metal, plastic, and glass, are available. It is anticipated that this will further support market expansion. Additionally, the expanding trend of online shopping is pushing packaging producers to create packaging that works for the e-commerce sector. The barrier films market expansion is being driven by the increasing preference for lightweight, portable, flexible packaging made of barrier films over conventional rigid packaging like glass and cans.

Restraining Factors:

High production costs, the restricted capacity of multi-layer films to be recycled, regulatory obstacles, and technological hurdles in creating sustainable substitutes that function on par with traditional materials are some of the problems that are restricting the barrier films market.

Market Segmentation

The global barrier films market is divided into type and application.

Global Barrier Films Market, By Type:

What are the main uses of metallized films, and why are they popular in the food and beverage packaging industry?

The metalized barrier films segment led the barrier films market, generating the largest revenue share. Metallized barrier films serve as a barrier to keep light, oxygen, gas, and water vapor out. Paper and paperboard laminations, gift wrapping, and decorative applications are only a few of the uses for them. These films' superior moisture, oxygen, and light-blocking qualities make them popular for use in packaging applications, especially in the food and beverage sector.

The transparent barrier films segment in the barrier films market is expected to grow at the fastest CAGR over the forecast period. The transparent barrier film is ideal for a variety of uses, including industrial, medical, food and beverage packaging, and display applications, due to its exceptional moisture and oxygen barrier qualities.

Global Barrier Films Market, By Application:

What are the primary factors driving the growth of the food and beverage segment in the barrier films market?

The food and beverage segment held the largest market share in the barrier films market. Consumer demand for food and beverage products that are easier to use and more convenient is driving the growth of flexible barrier packaging. Furthermore, the industry's need for barrier films is being driven by the rising popularity of packaged, ready-to-eat food and beverage goods that are delivered online.

Get more details on this report -

The agriculture segment in the barrier films market is expected to grow at the fastest CAGR over the forecast period. The demand for barrier films in agriculture is being driven by the increasing requirement for sophisticated farming technologies. The purpose of these coatings is to preserve and prolong the shelf life of seeds, fungicides, fertilizers, and insecticides.

Regional Segment Analysis of the Global Barrier Films Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific Barrier Films Market Trends

What role does urbanization play in boosting the barrier films market in Asia Pacific?

Asia Pacific, due to the increasing urbanization of developing countries like China and India. The need for more barrier films is a result of the region's growing end-use sectors, such as food and beverage, agriculture, and pharmaceuticals. Under HS 3920 for non-cellular plastic sheets and films, these films, which are mostly composed of polyethylene terephthalate (PET), ethylene vinyl alcohol (EVOH), and polyvinylidene chloride (PVDC) variants, are crucial for the encapsulation of food and beverage, pharmaceutical, and electrical products. The need for efficient barrier packaging solutions has increased due to the expansion of e-commerce and online grocery platforms, which need strong protective films to endure a variety of handling and shipping procedures.

Who is investing in recyclable and biodegradable barrier films technologies in China?

China is propelled by the growing need for industrial applications, pharmaceuticals, and food packaging. Changing consumer habits, rapid urbanization, and heightened attention to product shelf life are all major factors. Investment in recyclable and biodegradable barrier film technology is being stimulated by government rules that support sustainable packaging.

Who is promoting the development of recyclable and sustainable packaging in India?

The expansion of the food and beverage, pharmaceutical, and personal care industries is driving India. Improved retail infrastructure, growing customer demand for packaged goods, and growing knowledge of food safety and shelf life are important factors. The creation of environmentally friendly barrier films is being aided by the government's quest for recyclable and sustainable packaging.

North America Barrier Films Market Trends

Why is there an increasing demand in North America for lightweight, moisture- and oxygen-resistant packaging films?

The region's need for barrier films has increased due to consumer lifestyle trends that demand mobility and convenience in products, as well as growing demand for lightweight packaging solutions. Innovation is encouraged by U.S. government statements that impose recyclable mono materials, such as the EPA's November 2024 national plastic pollution policy and Washington's Recycling Reform Act (EPR legislation enacted May 2025). North America is driven by strict environmental regulations and growing e-commerce needs for food and pharmaceutical films that are resistant to oxygen and moisture.

What regulatory or policy pressures are influencing the development and adoption of recyclable barrier films in the U.S.?

The food and beverage, pharmaceutical, and industrial packaging industries have high demand in the United States. The use of high-performance barrier films has increased due to consumer preferences for ease of use, longer shelf life, and product safety. Key trends include growing investment in environmentally friendly packaging options and technological developments in multilayer and recyclable films.

How are Canadian laws and sustainability programs influencing the materials and design of barrier films used in packaging?

The growing pharmaceutical, healthcare, and food and beverage industries are what propel Canada. The use of barrier films is being fueled by rising customer demand for safer products, fresher, and last longer. The creation and application of recyclable and biodegradable barrier materials are being promoted by environmental laws and sustainability programs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global barrier films market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The Barrier Films Market Include

- Mondi plc

- Amcor Plc

- Toppan Inc.

- HPM Global Inc

- Berry Global Inc.

- Cosmo Films Ltd.

- Royal Dutch Shell

- Dupont Teijin Films

- Jindal Poly Films Ltd.

- Evonik Industries AG

- INEOS Group Limited

- Sealed Air Corporation

- Dow Chemical Company

- Qatar Chemical Company

- Others

Recent Development

- In March 2024, A barrier film called GL-SP was developed by Toppan and Toppan Specialty Films (TSF) of India using bi-axially oriented polypropylene (BOPP) as the substrate. In April 2024, the business began production and sales.

- In March 2024, Jindal Films announced that 30 MBH568 and BICOR 25 mono-material barrier films would be available. The new PE and PP materials are intended to support the industry's adoption of packaging that conforms with the European Union's new mechanical recycling regulations.

- In May 2023, Amcor, a pioneer in creating and manufacturing environmentally friendly packaging solutions, announced that it had finalized a deal to buy Moda Systems, a top producer of automated, cutting-edge protein packaging equipment.

- In April 2023, A non-binding letter of intent to extend their strategic cooperation for digital printing machines was approved by Koenig & Bauer AG and Sealed Air. The collaboration intends to provide cutting-edge digital printing tools, technology, and services in order to greatly enhance packaging design capabilities.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the barrier films market based on the following segments:

Global Barrier Films Market, By Type

- Metalized Barrier Films

- Transparent Barrier Films

- White Barrier Film

Global Barrier Films Market, By Application

- Food and Beverage

- Pharmaceutical

- Electronics

- Agriculture

- Others

Global Barrier Films Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the barrier films market over the forecast period?The global barrier films market is projected to expand at a CAGR of 4.91% during the forecast period.

-

2. What is the market size of the barrier films market?The global barrier films market size is expected to grow from USD 37.85 billion in 2024 to USD 64.10 billion by 2035, at a CAGR 4.91% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Barrier Films market?Asia Pacific is anticipated to hold the largest share of the barrier films market over the predicted timeframe.

-

4. Who are the top companies operating in the global barrier films market?Mondi plc, Amcor plc, Toppan Inc., HPM Global Inc., Berry Global Inc., Cosmo Films Ltd, Royal Dutch Shell, DuPont Teijin Films, Jindal Poly Films Ltd., Evonik Industries AG, INEOS Group Limited, Sealed Air Corporation, Dow Chemical Company, Qatar Chemical Company, and Others.

-

5. What factors are driving the growth of the barrier films market?Growing customer concerns about food safety and shelf life, the expansion of e-commerce, advancements in film technology, the need for packaged products and medications, and sustainability and regulatory pressure.

-

6. What are market trends in the barrier films market?Growth of recyclable / bio‑based & mono‑materials, multilayer films with enhanced barrier properties, lightweight flexible packaging, smart/active packaging, industrial expansion in Asia Pacific.

-

7. What are the main challenges restricting wider adoption of the barrier films market?High production costs, raw material price volatility, recycling difficulties with multilayer films, regulatory compliance burdens, competition from alternative packaging materials.

Need help to buy this report?