Global Ballistic Fabrics Market Size, Share, and COVID-19 Impact Analysis, By Material (Glass Fibers, Aramid Fibers, and Hybrid Fibers), By Application (Security Equipment, Helmet, Body Armor, and Aerospace), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Ballistic Fabrics Market Size Insights Forecasts to 2035

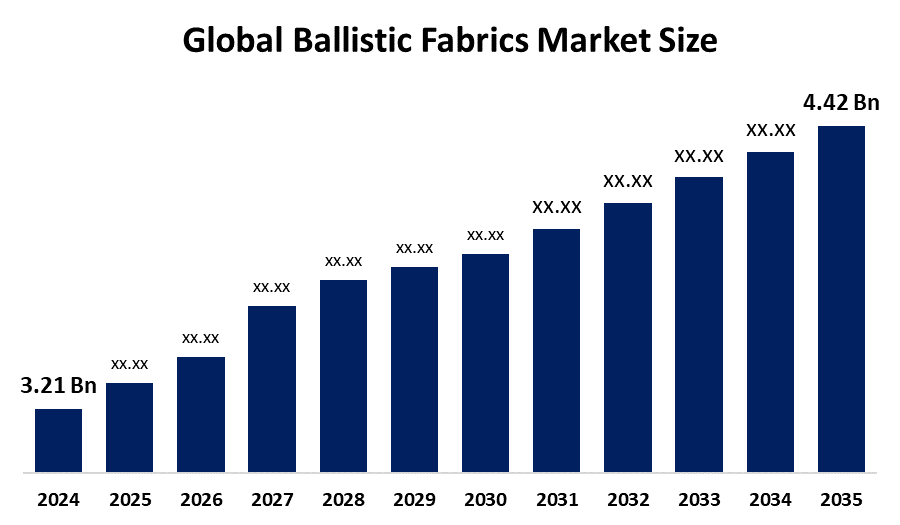

- The Global Ballistic Fabrics Market Size Was Valued at USD 3.21 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.95 % from 2025 to 2035

- The Worldwide Ballistic Fabrics Market Size is Expected to Reach USD 4.42 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Ballistic Fabrics Market Size was worth around USD 3.21 Billion in 2024 and is predicted to Grow to around USD 4.42 Billion by 2035 with a compound annual growth rate (CAGR) of 2.95% from 2025 to 2035. Opportunities in the ballistic fabrics market are fueled by growing defense spending, homeland security measures, lightweight material technical developments, expanding law enforcement modernization programs, and the global need for personal protective equipment.

Market Overview

The global industry that produces, distributes, and innovates specialist textiles designed to withstand ballistic threats, including bullets, fragments, and high-velocity projectiles, is included in the ballistic fabrics market. The core of soft and hard armor systems for body vests, helmets, vehicle panels, and security equipment is these textiles, which are mainly made of high-strength materials like glass fibers, aramid fibers, and ultra-high-molecular-weight polyethylene. The market provides coverage for various protective equipment, which includes body armor, helmets, vehicle armor, and shields which police enforcement agencies and private security companies and military personnel use.

In January 2025, Avient Corporation announced that ballistic protection specialist Dyneema launched new hard ballistic protection materials, enabling a 45% weight reduction in advanced protective armor systems. High-performance ballistic fabric solutions must be used throughout armor infrastructure due to the growth of the defense sector and advanced protection manufacturing programs. The market for ballistic fabrics is mostly driven by the military forces' modernization efforts and the consistent rise in global defense spending.

Report Coverage

This research report categorizes the ballistic fabrics market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the ballistic fabrics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the ballistic fabrics market.

Global Ballistic Fabrics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.21 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.95% |

| 2035 Value Projection: | USD 4.42 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 169 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Material, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Avient Corporation, Bally Ribbon Mills, DuPont de Nemours, Inc., FMS Enterprises Migun Ltd., Honeywell International Inc., Hyosung Corporation, Sigmatex, Solvay S.A., Teijin Limited, Toray Industries, Inc., and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Material science technology breakthroughs also play a big role in the market's expansion. The increased focus on law enforcement protection and homeland security is another important motivator. Body armor, helmets, and protection shields are being purchased more frequently as a result of growing worries about organized crime, terrorism, cross-border conflicts, and civil unrest. The use of ultra-high-molecular-weight polyethylene (UHMWPE) and advanced aramid fibers in the production of protective gear has increased as a result. Increased security risks, modernization initiatives, and advancements in high-strength fibers all contribute to the ballistic textiles sector's steady expansion.

Restraining Factors

High production costs, strict regulatory compliance requirements, price volatility for raw materials, limited product differentiation, intricate manufacturing processes, and financial limitations in defense and law enforcement procurement programs are the main factors restricting the growth of the ballistic fabrics market.

Market Segmentation

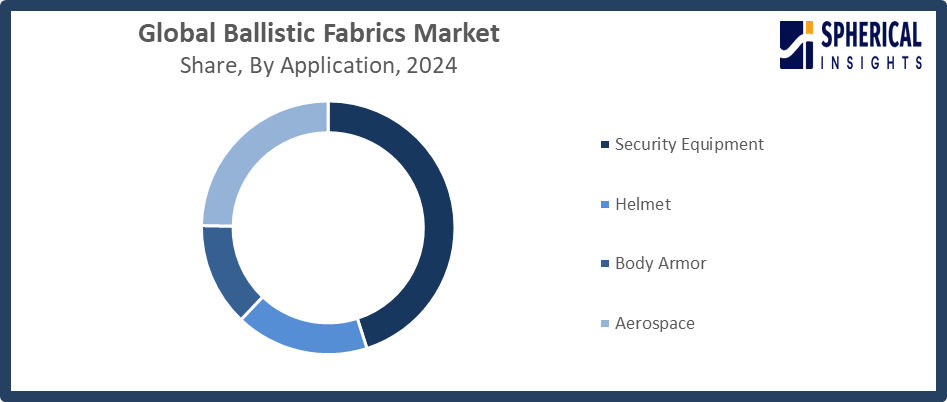

The ballistic fabrics market share is classified into material and application.

- The glass fibers segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the material, the ballistic fabrics market is divided into glass fibers, aramid fibers, and hybrid fibers. Among these, the glass fibers segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Glass fibers are frequently utilized in protective applications that need for structural strengthening and impact resistance. Glass fibers are useful for some ballistic and armor reinforcement applications considering their exceptional stiffness and thermal durability, while being heavier than advanced aramid and ultra-high-molecular-weight polyethylene (UHMWPE) fibers.

- The security equipment segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the ballistic fabrics market is divided into security equipment, helmet, body armor, and aerospace. Among these, the security equipment segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Growing expenditures in defensive infrastructure and growing worries about global security are driving the security equipment market. To lessen the threat posed by weapons and explosive fragmentation, ballistic materials are frequently used in riot shields, ballistic blankets, armored panels, guard booths, and protective vehicles.

Get more details on this report -

Regional Segment Analysis of the Ballistic Fabrics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the ballistic fabrics market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the ballistic fabrics market over the predicted timeframe. North America's strong military infrastructure and high defense spending are the main reasons behind this. The region's market position is considerably strengthened by the presence of top manufacturers, sophisticated R&D skills, and ongoing investment in next-generation defensive technologies. Investments in automation for process control and inspection are becoming more and more valued since they lower the risk of defects and increase dependability throughout repeated supply cycles. In November 2025, Hohenstein announced new comfort/mobility testing techniques for DuPont Kevlar® EXOTM, which improved the ergonomics of soft armor.

Asia Pacific is expected to grow at a rapid CAGR in the ballistic fabrics market during the forecast period. Rising defense spending, growing military modernization initiatives, and escalating geopolitical tensions in a number of the region's nations are the main drivers of this development. Launches and advancements by the government highlight India's "Make in India" and Aatmanirbhar Bharat programs, which support domestic production of ballistic gear, technological transfers, and PLI programs for technical textiles and defense. China's "Made in China 2025" initiative encourages modernization and subsidies for sophisticated textiles.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the ballistic fabrics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Avient Corporation

- Bally Ribbon Mills

- DuPont de Nemours, Inc.

- FMS Enterprises Migun Ltd.

- Honeywell International Inc.

- Hyosung Corporation

- Sigmatex

- Solvay S.A.

- Teijin Limited

- Toray Industries, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Avient Corporation announced that Dyneema launched its latest ultra-high molecular weight polyethylene fiber solutions at Enforce Tac 2025, unveiling HB330 and HB332, its lightest hard ballistic materials for advanced body armor, helmets, and hard armor panels across defense and law enforcement applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the ballistic fabrics market based on the below-mentioned segments:

Global Ballistic Fabrics Market, By Material

- Glass Fibers

- Aramid Fibers

- Hybrid Fibers

Global Ballistic Fabrics Market, By Application

- Security Equipment

- Helmet

- Body Armor

- Aerospace

Global Ballistic Fabrics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the ballistic fabrics market over the forecast period?The global ballistic fabrics market is projected to expand at a CAGR of 2.95% during the forecast period.

-

2. What is the market size of the ballistic fabrics market?The global ballistic fabrics market size is expected to grow from USD 3.21 Billion in 2024 to USD 4.42 Billion by 2035, at a CAGR of 2.95 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the ballistic fabrics market?North America is anticipated to hold the largest share of the ballistic fabrics market over the predicted timeframe.

-

4. Who are the top companies operating in the global ballistic fabrics market?Avient Corporation, Bally Ribbon Mills, DuPont de Nemours, Inc., FMS Enterprises Migun Ltd., Honeywell International Inc., Hyosung Corporation, Sigmatex, Solvay S.A., Teijin Limited, Toray Industries, Inc., and Others.

-

5. What factors are driving the growth of the ballistic fabrics market?Growth is driven by rising defense expenditures, increasing homeland security concerns, military modernization programs, technological advancements in lightweight high-strength fibers, expanding law enforcement procurement, and growing demand for advanced personal protective equipment.

-

6. What are the market trends in the ballistic fabrics market?The creation of flexible and lightweight materials, the use of ultra-high molecular weight polyethylene fibers, the incorporation of sophisticated composites, the emphasis on improved comfort and mobility, and rising R&D expenditures are some of the major trends.

-

7. What are the main challenges restricting the wider adoption of the ballistic fabrics market?High production and procurement costs, volatile raw material prices, strict regulations, intricate manufacturing procedures, little product differentiation, and financial limitations in the defense and law enforcement sectors are some of the major obstacles.

Need help to buy this report?