Global Ball Valves Market Size, Share, and COVID-19 Impact Analysis, By Valve Type (Floating, Trunnion-Mounted, Rising-Stem, Top-Entry, Fully-Welded, and Cryogenic), By Material (Carbon Steel, Stainless Steel, Cast Iron, and More), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Construction & ManufacturingGlobal Ball Valves Market Insights Forecasts To 2035

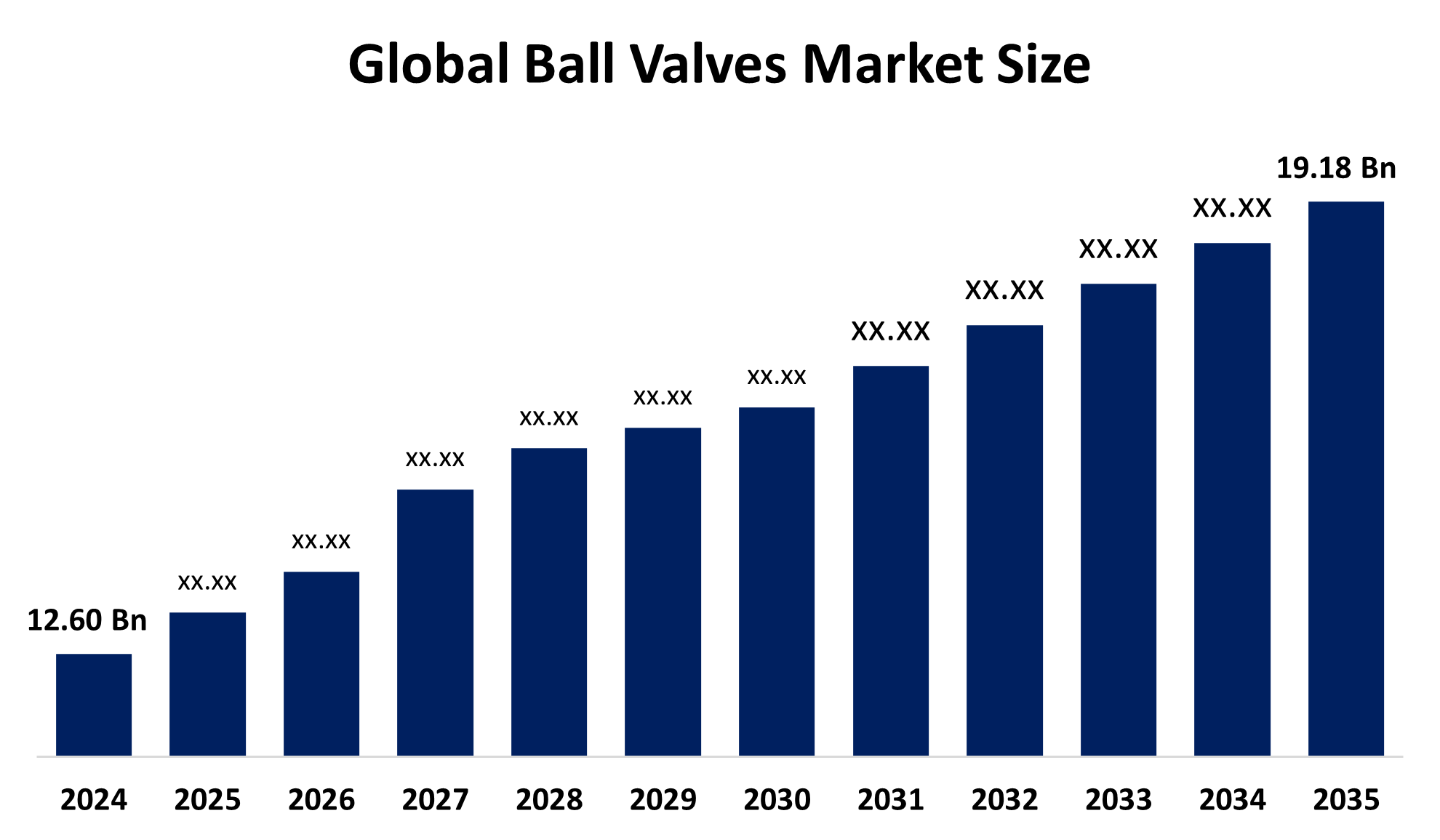

- The Global Ball Valves Market Size Was Estimated at USD 12.60 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.89% from 2025 to 2035

- The Worldwide Ball Valves Market Size is Expected to Reach USD 19.18 Billion by 2035

- Europe is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Ball Valves Market Size was worth around USD 12.60 Billion in 2024 and is Predicted to grow to around USD 19.18 Billion by 2035 with a compound annual growth rate (CAGR) of 3.89% from 2025 and 2035. The market for ball valves has a number of opportunities to grow due to developments in AR and VR, growing demand in the Construction & Manufacturing, education, and entertainment sectors, as well as rising investments in wearable technology and the integration of smart assistants.

Market Overview

A ball valve is a device that uses a hollow, perforated sphere inside its body to control flow by a quarter turn Asian countries view liquefied natural gas as a rapid measure to diversify away from coal dependency and boost energy security. The need for cryogenic ball valves rated for 162 °C increases as global LNG export capacity is set to increase by 18% in 2025, mainly for Asian import terminals. Suppliers with extensive metallurgical backgrounds and documented low temperature testing are preferably considered because these devices must achieve methane tight sealing capabilities while under liquefaction, shipping, and regasifying services. In supporting suppliers towards better buy protection and higher average selling prices, this prequality can lead to further expansion in the ball valve sector. Pipeline and storage systems must be designed to withstand pressures greater than 700 bar without risk of hydrogen induced cracking to achieve the EU's stated target of 10 billion tons of renewable hydrogen by 2030. Duplex and super duplex alloys are increasingly manufactured to meet such mechanical specifications with the carbon capture and storage line segments to address the corrosion issues associated with supercritical CO,. Internet of Things retrofits are being used by Nordic utilities to control distribution losses. The value proposition for connected valves is validated by Scandinavian pilot studies, which show that leakage ratios decrease from 30% to 10% following complete automation

India is promoting the local production of valves, particularly ball valves, through initiatives like the Smart Cities Mission, Atmanirbhar Bharat, and the Production Linked Incentive Scheme This is boosting modernization, exports, and domestic manufacturing. The focus on regulatory compliance and green certifications is forcing manufacturers to develop high performance, ecofriendly valves

India is promoting the local production of valves, particularly ball valves, through initiatives like the Smart Cities Mission, Atmanirbhar Bharat, and the Production Linked Incentive Scheme. This is boosting modernization, exports, and domestic manufacturing. The focus on regulatory compliance and green certifications is forcing manufacturers to develop high performance, ecofriendly valves.

Report Coverage

This research report categorizes the ball valves market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the ball valves market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the ball valves market.

Global Ball Valves Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12.60 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.89% |

| 2035 Value Projection: | USD 19.18 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Valve Type, By Material, By Region |

| Companies covered:: | Emerson Electric Co., Flowserve Corporation, Cameron International Corporation, KITZ Corporation, Crane Co., IMI plc, Velan Inc., Metso Corporation, Weir Group plc, Spirax Sarco Engineering plc, Apollo Valves, Swagelok Company, Curtiss Wright Corporation, AVK Group, Bonney Forge Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ball valves market is driven by countries such as the United States, which have extensive networks of outdated pipeline systems, including deteriorating infrastructure in several critical industries, including water and wastewater treatment, oil and gas, and more in the same condition inhibits the potential of ball valves, and many other valves in this aging system, and creates liability and safety concerns. These valves will have to be replaced to mitigate these concerns and enhance performance. The need to replace or upgrade outdated infrastructure is pushing the demand for more sophisticated and technologically advanced ball valves. In regard to maintenance issues caused by outdated infrastructure, end users across various industries are prioritizing the introduction of highly reliable, integrated, and innovative solutions.

Restraining Factors

The ball valves market is restricted by factors like strict quality standards and environmental regulations increase manufacturing costs due to additional expenditures for quality control practices and ecosystem friendly processes. The total cost of production also includes labor costs that vary by location and vary by prevailing wages.

Market Segmentation

The ball valves market share is classified into valve type and material.

- The floating segment dominated the market in 2024, accounting for approximately 27% and is projected to grow at a substantial CAGR during the forecast period.

Based on the valve type, the ball valves market is divided into floating, trunnion-mounted, rising-stem, top-entry, fully-welded, and cryogenic. Among these, the floating segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven due to its broad applicability in general purpose, water, and refinery activities. While these valves are specific in their application, the cryogenic ball valve sector is expanding at a 6.4% CAGR due to the reliance on dependable sealing down to -162 °C from LNG terminals and hydrogen export facilities. Therefore, end users are willing to select and pay for zero leakage seats and blow out proof stems certified through helium mass spectrometer methods in order to provide a sustainable realization of pricing and increased barriers to entry.

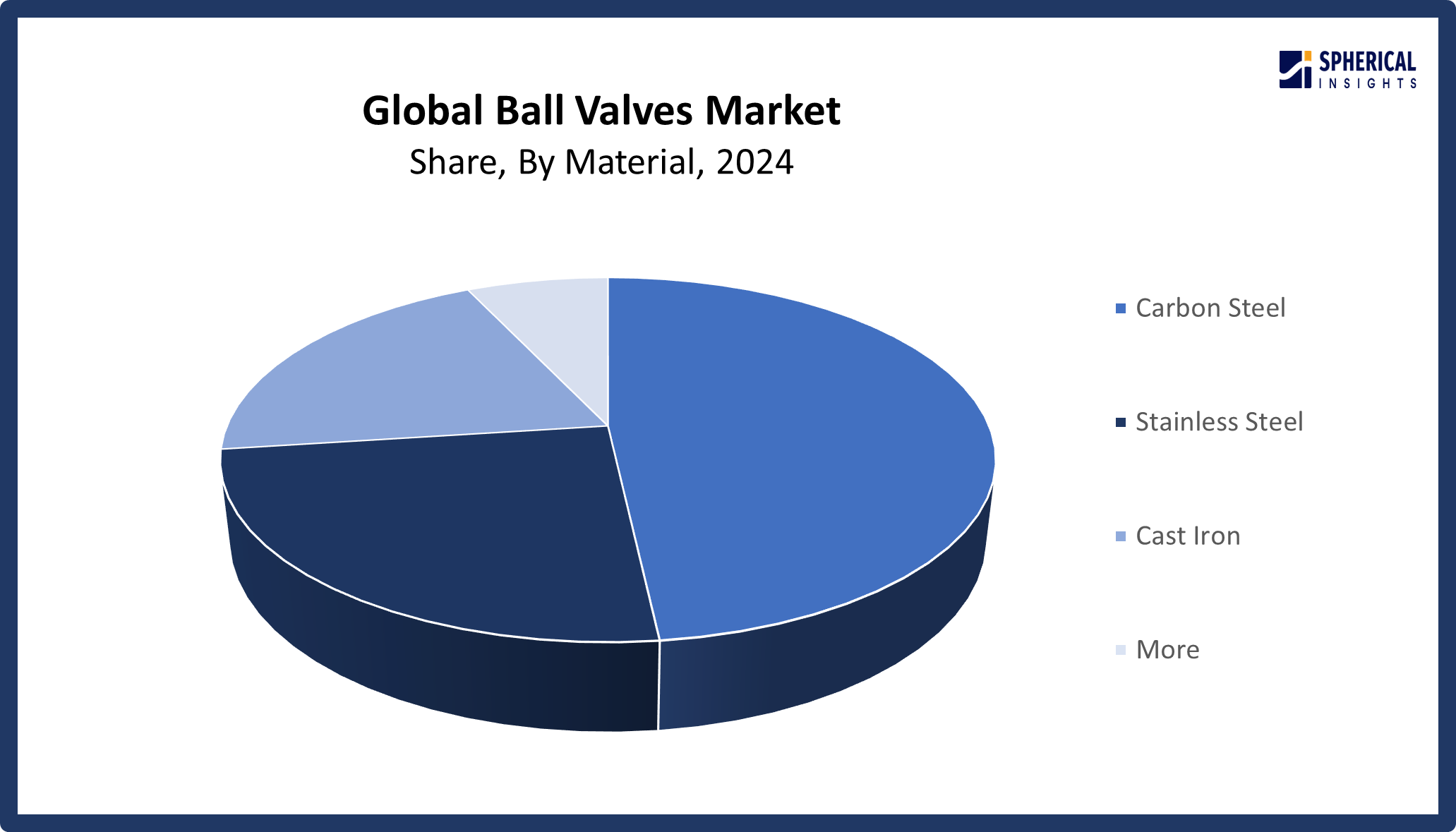

- The carbon steel segment accounted for the largest share in 2024, accounting for approximately 32% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the material, the ball valves market is divided into carbon steel, stainless steel, cast iron, and more. Among these, the carbon steel segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to its favorable strength to cost balance in applications with industrial utilities and pipelines. As a result of the embrittlement issue, the hydrogen project presents a solder metal body that is becoming more prevalently alloy based with super duplex or austenitic grades that support an increase in alloy demand of 5.2% CAGR. The access to duplex grades even provides pipeline engineers a higher allowable pressure ratings that reduce capital costs and schedules.

Get more details on this report -

Regional Segment Analysis of the Ball Valves Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share, representing nearly 40% of the ball valves market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share, representing nearly 40% of the ball valves market over the predicted timeframe. In the Asia Pacific market, the is rising due to the demand for ball valves has been growing across multiple sectors, such as oil and gas, chemicals, water treatment, and power generation, due to rapid urbanization and population growth, particularly in countries such as India and China. With these industries needing reliable and efficient flow control solutions, the usage of ball valves has increased significantly. The demand for ball valves has also increased due to favorable government programs to promote industrial growth. The presence of important market players in the region regarding ball valves and growing investments in infrastructure development projects also helped support market growth in the region.

China is the market leader for ball valves in the Asia Pacific region due to its big manufacturing base, substantial investments in water, oil, and gas, and energy infrastructure projects, lower production costs, and robust government backing for infrastructure and industrial growth.

Europe is expected to grow at a rapid CAGR, representing nearly 5.7% in the ball valves market during the forecast period. The European area has a thriving market for Ball Valves due to increasingly more long term nuclear and fusion research programs that have increased the demand for specialized components, such as ball valves, that are used for high precision fluid control applications. The demand for ball valves has also increased due to the emergence of new particle accelerator projects. The presence of top research institutes and highly qualified physics personnel in Europe is a further driver in increasing demand for ball valves. Further, the increasing R&D budget allocation, along with the emphasis on innovation and technical advancement in Europe, continues to drive the European ball valve market.

The United States leads because of its extensive use of automation and smart valves, robust investments in oil and gas, water and wastewater infrastructure, strict safety and environmental regulations, and a large, advanced industrial and construction sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the ball valves market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Emerson Electric Co.

- Flowserve Corporation

- Cameron International Corporation

- KITZ Corporation

- Crane Co.

- IMI plc

- Velan Inc.

- Metso Corporation

- Weir Group plc

- Spirax Sarco Engineering plc

- Apollo Valves

- Swagelok Company

- Curtiss Wright Corporation

- AVK Group

- Bonney Forge Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, the American Petroleum Institute released the 2025 API Standards International Usage Report, highlighting a 20% increase in global regulatory references to API standards, with 1,395 total references identified across international laws and regulations. This expansion indicates growing standardization in valve specifications and quality requirements across global markets.

- In December 2024, Salvalco declared it would extend its Eco-Valve family further with its Eco Inverted ball valve. Designed specifically for use with inert gas propellants such as nitrogen, the new valve will deliver all the great benefits of Eco-Valve, including superior performance while minimizing environmental impact.

- In November 2024, Emerson Electric reported a 13% increase in net sales to USD 4,619 million for Q4 2024, with strong performance in the Final Control segment that includes ball valve products. The company anticipates net sales growth of 3.5% to 5.5% for the full year 2025, indicating continued momentum in automation solutions.

- In February 2024, the Neles XH metal seated ball valve is designed for safety, high cycle shut off, and throttling services with high pressure differentials. It aims at various industries, like chemical and petrochemical plants, power plants, natural gas, hydrocarbons, oil and gas refining, polymers, catalyst handling, high temperature services, and more.

- In November 2023, Heap and Partners designed and manufactured 12 of its Phase trunnion ball valves for a Serica Energy maintenance campaign this year at the Bruce Field facilities in the UK North Sea. The 16 inch valves were the largest produced by the company, weighing under four metric tons.

- In July 2023, Flomatic released a new swing check valve that meets AWWA C508 requirements and AIS provisions, ensuring superior performance and reliability.

- In July 2023, Valmet and ThyssenKrupp Industries India recently established a cooperative agreement to enhance their collaboration in the field of process automation.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the ball valves market based on the below-mentioned segments:

Global Ball Valves Market, By Valve Type

- Floating,

- Trunnion-Mounted

- Rising-Stem

- Top-Entry

- Fully-Welded

- Cryogenic

Global Ball Valves Market, By Material

- Carbon Steel

- Stainless Steel

- Cast Iron

- More

Global Ball Valves Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the ball valves market over the forecast period?The global ball valves market is projected to expand at a CAGR of 3.89% during the forecast period.

-

2. What is the market size of the ball valves market?The global ball valves market size is expected to grow from USD 12.60 billion in 2024 to USD 19.18 billion by 2035, at a CAGR of 3.89% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the ball valves market?Asia Pacific is anticipated to hold the largest share of the ball valves market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global ball valves market?Emerson Electric Co., Flowserve Corporation, Cameron International Corporation, KITZ Corporation, Crane Co., IMI plc, Velan Inc., Metso Corporation, Weir Group plc, Spirax Sarco Engineering plc, Apollo Valves, Swagelok Company, Curtiss Wright Corporation, AVK Group, Bonney Forge Corporation, and Others.

-

5. What factors are driving the growth of the ball valves market?The ball valves market growth is driven by the need for effective flow control systems in industries including water treatment, power generation, and oil and gas has grown due to rapid industrial expansion, especially in emerging economies.

-

6. What are the market trends in the ball valves market?The Ball Valves market trends include integration of smart technologies, shift towards high performance materials, expansion in oil and gas infrastructure, emergence of renewable energy applications, and advancements in additive manufacturing.

-

7. What are the main challenges restricting wider adoption of the ball valves market?The ball valves market trends include high upfront costs, particularly for cutting-edge materials like Inconel and titanium. Furthermore, 36% of worldwide manufacturers are impacted by changing raw material prices, such as those for brass and stainless steel, which can result in delays and higher expenses.

Need help to buy this report?