Global Aviation Software Market Size, Share, and COVID-19 Impact Analysis, By Software Type (Management Software, Analysis Software, Design Software, Simulation Software, and MRO Software), By Application (Airport, and Airlines), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Aerospace & DefenseGlobal Aviation Software Market Insights Forecasts to 2035

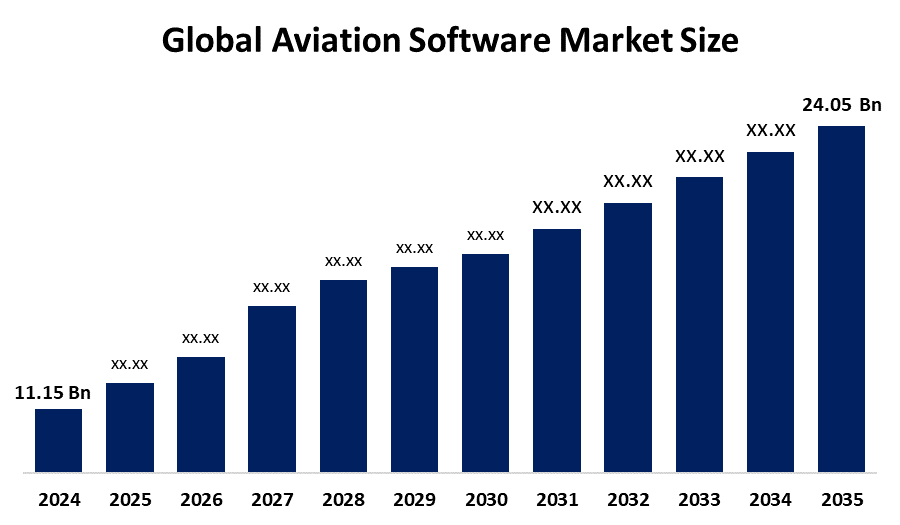

- The Global Aviation Software Market Size Was Estimated at USD 11.15 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.24 % from 2025 to 2035

- The Worldwide Aviation Software Market Size is Expected to Reach USD 24.05 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global aviation software market size was worth around USD 11.15 billion in 2024, growing to USD 11.95 billion in 2025, and is predicted to grow to around USD 24.05 billion by 2035 with a compound annual growth rate (CAGR) of 7.24 % from 2025 to 2035. The growing need for advanced analytics, automation, and cloud-based solutions, which improve operational effectiveness, safety, maintenance, and regulatory compliance while fostering digital transformation and sustainable growth across international aviation sectors, creates opportunities for the aviation software market.

Global Aviation Software Market Forecast and Revenue Size

- 2024 Market Size: USD 11.15 Billion

- 2025 Market Size: USD 11.95 Billion

- 2035 Projected Market Size: USD 24.05 Billion

- CAGR (2025-2035): 7.24 %

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The ecosystem of specialized digital solutions intended to improve operational effectiveness, safety, and compliance within the aviation industry is referred to as the aviation software market. In order to optimize airline operations, airport logistics, and air traffic control, it incorporates artificial intelligence (AI), cloud computing, and data analytics. These software include flight management applications, repair, maintenance, and overhaul (MRO) programs, simulation tools, safety analytics, and compliance monitoring systems. For instance, in September 2024, Ramco Systems launched Aviation Software 6.0, a ground-breaking release set to transform M&E and MRO operations. The integrated system offers AI-driven insights, enhanced automation, seamless integration, and modules for Contracts, Engineering, Planning, Maintenance, Logistics, Finance, ePUBS, and mobility. The growing need for sophisticated flight management systems, integrated aircraft communication systems, and real-time data analytics tools is driving the expansion of the aviation software market. The aviation software market is expanding as a result of the creation of mobile applications and cloud-based solutions for pilots and ground personnel. The demand for aviation software is driven by the increasing trend of digital transformation in the aviation sector, as well as the necessity of fuel efficiency optimization and predictive maintenance.

Key Market Insights

- North America is expected to account for the largest share in the aviation software market during the forecast period.

- In terms of software type, the management software segment is projected to lead the aviation software market throughout the forecast period

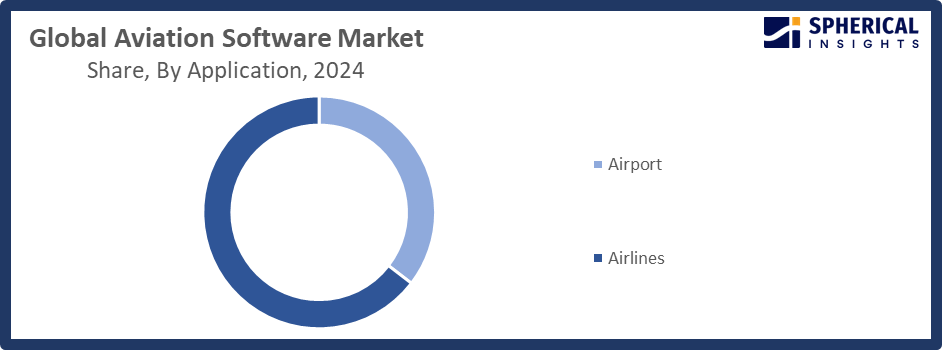

- In terms of application, the airlines segment captured the largest portion of the market

Aviation Software Market Trends

- Cloud-based aviation management solutions are becoming more widely used for scalable and effective operations.

- The increasing use of machine learning (ML) and artificial intelligence (AI) for decision-making and predictive maintenance.

- The growing use of the Internet of Things (IoT) for performance analytics and real-time aircraft monitoring.

- utilizing software-driven optimization to increase attention to sustainability and reduce carbon emissions.

- The increasing need for remote and mobile access solutions for ground and airline employees.

Report Coverage

This research report categorizes the aviation software market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the aviation software market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the aviation software market.

Global Aviation Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Forecast Period: | 2024 – 2035 |

| Forecast Period CAGR 2024 – 2035 : | CAGR of 7.24 % |

| 024 – 2035 Value Projection: | USD 24.05 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Software Type, By Application |

| Companies covered:: | IFS, SITA, Veryon, Airbus SE, Thales Group, Leonardo S.p.A., RTX Corporation, Indra Avitech GmbH, The Boeing Company, CHAMP Cargosystems, Ramco Systems Limited, General Electric Company, Honeywell International Inc., Bigscal Technologies Pvt. Ltd., And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving factors:

The industry is expanding as a result of regulatory agencies implementing frameworks and regulations to guarantee the security and safety of aviation software. The industry's growing need for improved safety procedures and operational efficiency seems to be the driving force behind the continuous development of aviation software solutions. The aviation software market manufacturers are concentrating more on creating cutting-edge solutions to meet the changing demands of the sector. AI-adjacent functionality is currently given top priority in platform roadmaps by both investors and OEMs, contributing to the aviation software market's continued growth.

Restraining Factors:

High implementation and maintenance costs, data security issues, integration challenges with legacy systems, and a lack of technical know-how all restrict widespread adoption and slow digital transformation in the aviation software market.

Market Segmentation

The global aviation software market is divided into software type and application.

Global Aviation Software Market, By Software Type:

What procedures does management software streamline to reduce expenses and boost efficiency?

The management software segment led the aviation software market, generating the largest revenue share. Management software reduces expenses and boosts overall operational efficiency by streamlining a number of procedures, including flight scheduling, crew management, maintenance operations, ticketing, and customer support. The management software segment has acquired an important proportion of the aviation software market due to the strong demand for such all-inclusive and integrated solutions.

The simulation software segment in the aviation software market is expected to grow at the fastest CAGR over the forecast period. The growing demand for sophisticated training solutions and operational planning is driving the simulation software market. A crucial component of pilot training is simulation software, which provides realistic, risk-free settings for practicing and honing abilities.

Global Aviation Software Market, By Application:

What factors contribute to the development of the aviation industry?

The airlines segment held the largest market share in the aviation software market. The aviation industry is a result of its wide range of operational requirements and the vital role that software plays in guaranteeing customer happiness, efficiency, and safety. The use of modern software systems by airlines has been further accelerated by the increased demand for predictive maintenance, real-time data analytics, and improved passenger experience.

Get more details on this report -

The airport segment in the aviation software market is expected to grow at the fastest CAGR over the forecast period. The demand for increased efficiency and security, as well as the growing complexity of airport operations, is driving the airport segment. Airports are developing into complex centers that need integrated software solutions to handle passenger processing, baggage handling, air traffic control, and facility management.

Regional Segment Analysis of the Global Aviation Software Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Aviation Software Market Trends

What factors are boosting the North American aviation software market?

Consistent investments in automation, cybersecurity, and next-generation flight analytics platforms further boost the North American aviation software market. The market is expanding rapidly due to the growing use of cutting-edge technologies like artificial intelligence, the Internet of Things, and big data analytics. Demand for cutting-edge software solutions is being driven by the region's focus on increasing operational effectiveness, improving passenger experience, and guaranteeing safety. The market is further influenced by the existence of significant aviation software firms and robust aviation infrastructure in the US and Canada. In May 2025, the U.S. Department of Transportation announced its Air Traffic Control Modernization Plan, expanding Surface Awareness Initiative software deployment to 200 additional airports to enhance safety and operational efficiency.

U.S Aviation Software Market Trends

What efforts has the U.S. government made to improve air traffic control?

The industry is growing quickly as a result of the U.S. government's efforts to improve air traffic control and update the National Airspace System (NAS). Aviation software is becoming more and more popular in commercial airlines and airports due to the growing need for real-time data analytics, predictive maintenance, and effective flight control systems. Additionally, a strong aerospace industry and the existence of top aviation software suppliers are important elements supporting the market's expansion in the US.

Canada Aviation Software Market Trends

Which aspects of aviation safety influence the Canadian aviation software industry?

The country's increasing focus on digital transformation, operational efficiency, and aviation safety is driving the quickly changing Canada Aviation Software Market. For flight management, air traffic control, predictive maintenance, and passenger services, Canadian airlines, airports, and maintenance companies are rapidly implementing cutting-edge software solutions. Artificial intelligence (AI), cloud computing, and data analytics are integrated to improve resource optimization and decision-making in airline operations.

Asia Pacific Aviation Software Market Trends

Why is the Asia-Pacific aviation software industry expected to continue expanding?

The region's fast-growing air transport and aviation industry, the Asia Pacific aviation software market accounts for a sizeable portion of the global market. The Asia-Pacific aviation software industry is expected to continue expanding as governments support innovations related to sustainability and digital aviation ecosystems. Additionally, the region's emphasis on modernizing airports and the use of cutting-edge technologies in aviation operations are driving rising demand for aviation software. In 2025, India’s Ministry of Civil Aviation accelerated airport modernization and air traffic management (ATM) initiatives, deploying advanced aviation software to enhance operational efficiency, safety, and passenger experience, marking a pivotal step in the nation’s aviation digital transformation.

China Aviation Software Market Trends

Why is China implementing cutting-edge technologies in flight operations and air traffic control?

The market is being driven by China's focus on updating its airports, growing its airline fleets, and implementing cutting-edge technologies for flight operations and air traffic control. Although localization needs are shaped by legal subtleties, China's modernization drive creates an opportunity for predictive maintenance and air traffic optimization platforms. The digitization of Korean operations by Ramco Systems and Hanjin Information Systems is an example of a region-specific partnership that expands the reach of the aviation software market.

India Aviation Software Market Trends

Which factors contribute most to the notable growth of the Indian aviation software market?

The use of cutting-edge aviation software solutions is being fueled by government attempts to build new airports, update existing ones, and improve air traffic control systems. The rapid digital revolution and rising investments in aviation infrastructure are driving the notable expansion of the Indian aviation software market. India's focus on enhancing passenger satisfaction, safety, and operational effectiveness is also driving the market's expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global aviation software market, along with a comparative evaluation primarily based on their Form of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes Form development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The Aviation Software Market Include

- IFS

- SITA

- Veryon

- Airbus SE

- Thales Group

- Leonardo S.p.A.

- RTX Corporation

- Indra Avitech GmbH

- The Boeing Company

- CHAMP Cargosystems

- Ramco Systems Limited

- General Electric Company

- Honeywell International Inc.

- Bigscal Technologies Pvt. Ltd.

- Others

Recent Development

- In July 2025, Ramco Systems launched its Aviation Software implementation at Indamer Technics Private Limited, enhancing technical, operational, and financial efficiency for India’s commercial aviation and government sectors.

- In February 2025, the Civil Aviation Authority of the Philippines (CAAP) launched a contract with Metron Aviation to implement air traffic flow management software, boosting regional situational awareness and enhancing air traffic management across Southeast Asia.

- In August 2024, Surf Air Technologies, a subsidiary that provides solutions for electric and hybrid aircraft, was introduced by Surf Air Mobility. Palantir Technologies and the subsidiary firm will collaborate to create software solutions for new aircraft operators and manufacturers.

- In May 2024, the new Aviary modeling tool, which simulates innovative aircraft designs, was announced by NASA. The tool eliminates the expense of flight testing by digitally testing the aircraft concepts before their introduction into the actual world.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the aviation software market based on the following segments:

Global Aviation Software Market, By Software Type

- Management Software

- Analysis Software

- Design Software

- Simulation Software

- MRO Software

Global Aviation Software Market, By Application

- Airport

- Airlines

Global Aviation Software Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the aviation software market over the forecast period?The global aviation software market is projected to expand at a CAGR of 7.24 % during the forecast period.

-

2. What is the market size of the aviation software market?The global aviation software market size is expected to grow from USD 11.15 billion in 2024 to USD 24.05 billion by 2035, at a CAGR 7.24 % of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the aviation software market?North America is anticipated to hold the largest share of the aviation software market over the predicted timeframe.

-

4. Who are the top companies operating in the global aviation software market?IFS, SITA, Veryon, Airbus SE, Thales Group, Leonardo S.p.A., RTX Corporation, Indra Avitech GmbH, The Boeing Company, CHAMP Cargosystems, Ramco Systems Limited, General Electric, Honeywell, Bigscal Technologies, and others.

-

5. What factors are driving the growth of the aviation software market?Growing air traffic, the need for operational efficiency, predictive maintenance, the adoption of AI and IoT, digital transformation projects, increased safety, cost optimization, and better passenger experiences all drive growth.

-

6. What are market trends in the aviation software market?Trends include cloud-based platforms, AI and machine learning for analytics, IoT integration, automation, cybersecurity solutions, mobile accessibility, blockchain adoption, big data utilization, and sustainability-focused operational optimization.

-

7. What are the main challenges restricting wider adoption of the aviation software market?High implementation costs, legacy system integration complexity, cybersecurity risks, limited technical expertise, regulatory compliance, and resistance to organizational change hinder broader adoption across aviation stakeholders.

Need help to buy this report?