Global Aviation MRO Market Size, Share, and Global Demand Statistics, By Organization (Airline/ Operator MRO, Independent MRO, Original Equipment Manufacturer (OEM) MRO), By Aircraft Type (Narrow Body, Wide Body, Regional Jet, Others), By Service Type (Engine Overhaul, Airframe Maintenance, Line Maintenance, Modification, Others), Aircraft Generation (Old Generation, Mid Generation, New Generation), By Region (North America, Europe, Asia Pacific, Middle East & Africa, and South America) - Market Size & Forecasting To 2030

Industry: Aerospace & DefenseWorldwide Report Summary:

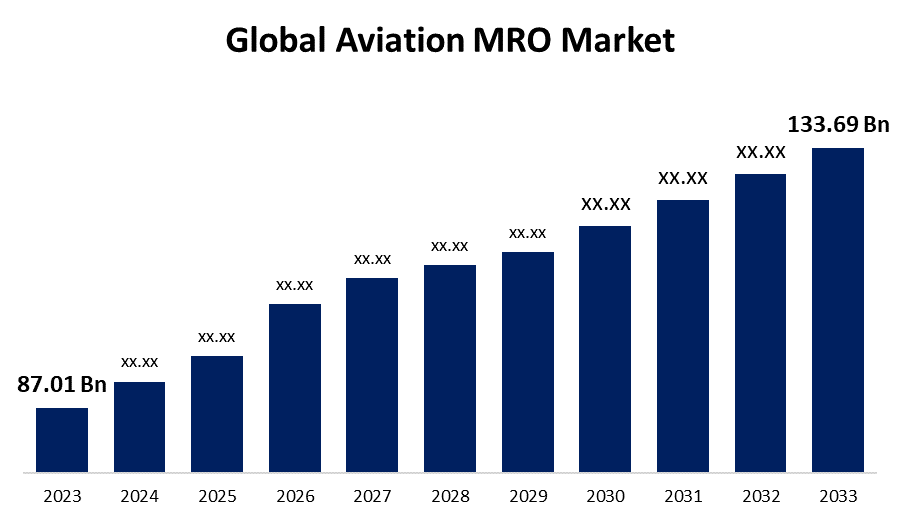

The Global Aviation MRO Market Size was valued at USD 87.01 billion in 2021 and is expected to reach at a CAGR of 5.27% from 2022 to 2030. The worldwide market is expected to reach USD 133.69 Billion by 2030.

Get more details on this report -

The market is anticipated to expand faster due to rising economic growth in emerging nations, rapid urbanisation, and increased business and tourist travel. The market is anticipated to be highly impacted by a number of external factors, including air traffic volumes, the size of the worldwide fleet, and aircraft utilisation. Additionally, more aircraft are anticipated to be produced as a result of the growing air travel by people for both personal and professional reasons, which will have a significant impact on the industry.

Increased spending on aviation MRO software is also anticipated to open up new business opportunities. The maintenance tracking, logbook tracking, flying time monitoring, administration of service bulletins, maintenance scheduling, budget forecasting, electronic task card management, and work order management components of aircraft MRO software. For instance, in May 2021, India saw large foreign direct investments across a range of industries, including the maintenance, repair, and overhaul (MRO) of aeroplanes. This occurred as foreign businesses concentrated on acquiring billions of dollars’ worth of aircraft MRO services. As a result, it is anticipated that investments and acquisitions will produce profitable market prospects.

Worldwide Aviation MRO Market Driving Factors

In the air transportation sector, maintenance expenses now outpace fuel expenses. Airlines must now rely on digital solutions to track physical assets like engines and cockpit controls in real-time, which will help them better plan maintenance protocols due to the rapid increase in maintenance expenses.

Similar to cloud services and connected technologies, mobile solutions are making their way into airline control rooms. In order to allow users to access aircraft management remotely, air transport MRO players are becoming more focused on building software as a service (SaaS) and other efficient tightly connected mobile solutions.

In the air transportation sector, maintenance expenses now outpace fuel expenses. Airlines must now rely on digital solutions to track physical assets like engines and cockpit controls in real-time, which will help them better plan maintenance protocols due to the rapid increase in maintenance expenses. Similar to cloud services and connected technologies, mobile solutions are making their way into airline control rooms. In order to allow users to access aircraft management remotely, air transport MRO players are becoming more focused on building software as a service (SaaS) and other efficient tightly connected mobile solutions.

Worldwide Aviation MRO Market Restraining Factors

As airlines' operations ceased, more of them turned to MRO to keep their fleets operating efficiently. Additionally, a wide range of government initiatives have been created to encourage airports to adopt MRO as a strategic endeavour. In order to ensure that there is enough room for MRO at different airports around the nation, governments are now pursuing a variety of comprehensive initiatives, which could increase aircraft MRO activity during the anticipated time. Due to a lack of skilled labour, rising labour prices, a lack of experienced labour, and declining interest among newly graduated engineers in technical maintenance occupations, the MRO industry is experiencing problems.

Without any modification, this has an impact on the MRO (maintenance, repair, and overhaul) sector of the aviation business. Right-sourcing and outsourcing are two solutions that are more pertinent to MRO service providers for MRO operators. The expansion of the aircraft MRO sector is becoming significantly impacted by rising material costs. As a result, MRO service providers are aiming to form strategic partnerships with OEMs in order to obtain assistance with the procurement of aircraft parts and components.

Worldwide Aviation MRO Market - Covid 19 Impact

The COVID-19 pandemic has slowed practically every country's economic expansion. This economic slump has had a significant influence on the airline industry. Additionally, the hampered economic expansion of nations has resulted in the closure of small airline firms in 2020. All the major nations in Europe, Asia, and North America have put severe limitations on economic operations and the movement of people and products due to the ongoing COVID-19 pandemic. All of these elements are limiting the availability and demand for aeroplane maintenance services, which is impeding the expansion of the worldwide aircraft MRO market's revenue. Additionally, the second COVID-19 epidemic wave in nations like India, France, and the US would have a negative effect on market growth in the first half of 2021.

Global Aviation MRO Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 87.01 billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.27% |

| 2033 Value Projection: | USD 133.69 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | Service type, organization type, aircraft type, aircraft generation, region |

| Companies covered:: | AAR Corp.; Airbus SE; Delta Airlines, Inc. (Delta TechOps); Hong Kong Aircraft Engineering Company Limited; KLM UK Engineering Limited; Lufthansa Technik; MTU Aero Engines AG; Raytheon Technologies Corporation (Previously United Technologies Corporation); Singapore Technologies Engineering Ltd; TAP Maintenance & Engineering (TAP Air Portugal) |

| Growth Drivers: | In the air transportation sector, maintenance expenses now outpace fuel expenses. |

| Pitfalls & Challenges: | As airlines operations ceased, more of them turned to MRO to keep their fleets operating efficiently. |

Get more details on this report -

Worldwide Aviation MRO Market - Segmentation

The global Aviation MRO market is segmented into Organization, Aircraft Type, Air Generation, Service Type, and Region.

By Organization

Independent MRO is anticipated to hold the greatest market share in 2021 and grow to a value of USD 38.31 billion by 2030. OEMs are increasingly outsourcing their auxiliary tasks to MRO service providers and specialised ESPs, which is fuelling the growth of the aviation MRO industry. For instance, ARR, a top provider of MRO services for the aviation industry, and Collins Aerospace's Goodrich De-icing and specialised heating System company struck a comprehensive distribution deal in March 2022. The de-icers and heating systems will be made available under the contract to MROs and other aircraft all around the world.

By Aircraft Type

In the commercial aviation MRO industry, narrow body aircraft are expected to bring in USD 44.10 billion in 2030. Smaller aircraft known as narrow-body aircraft are utilised for short-haul international and domestic flights. Due to its tiny size and short distance, a narrow-body aircraft may carry over 295 passengers. The fleet of narrow-body aircraft is crucial to the aircraft MRO sector. For instance, in March 2018, Jet Airway's fleet of 80 narrow-body Boeing 737NG aircraft entered into a whole component maintenance agreement with Lufthansa Technik AG. The goal is to offer flat-rate, closed-loop repair services for single parts.

By Service Type

Engine MRO overhaul services are predicted to expand and will hold the largest market share in 2021 (40.1%). One important element contributing to the expansion of the aviation MRO sector is OEM involvement in engine repair activities. Field maintenance and depot maintenance are also included in engine MRO. Engines, parts, and subassemblies are all thoroughly maintained, repaired, and rebuilt as part of depot-level maintenance. As opposed to shop-style work and on-equipment repair activities at the field level.

Over the anticipated time, the engine segment in aeroplane MRO is anticipated to rule the market. Additionally, in the approaching years, the Engine segment will get more active and competitive. For instance, AAR stated in April 2019 that it had extended its PW2000 engine support contract with MTU maintenance by an additional five years. MTU, a significant global provider of engine overhauls, received engine components from AAR.

By Air Generation

Over the projected period, it is anticipated that the new-generation segment's revenue share will increase significantly. The latest generation of aircraft uses sustainable fuel since they are more fuel-efficient. In contrast to the present 13%, many operational commercial aircraft will be replaced by a new generation, according to the Airbus research. The main issue with this massive replacement procedure is that CO2-related efficiency would have to significantly improve.

Global Aviation MRO Market, By Region

By 2030, Asia Pacific is anticipated to maintain its dominance as the region with the greatest CAGR, holding the largest market share. A third of all aircraft are operated globally, and this number is projected to rise during the forecast period. Due to sophisticated and widely accessible MRO alternatives, airlines operating in this industry can extend the life of their aircraft fleets. MRO providers frequently focus on the Asia Pacific region since it provides them with more clients, exciting business options, and less expensive labour.

Recent Developments in Global Aviation MRO Market

- February 2021: For advanced aviation engine servicing, repairs, wing testing, and other tasks, SIA Engineering Company Ltd. invested in a new branch called the Engine Services Division. Artificial intelligence, drones, and robots are being used by modern MRO businesses to significantly cut down on the time needed for maintenance and repairs.

- December 2021: With just four drones, Korean Air demonstrated the use of drone swarms to undertake a full-body aeroplane examination. As a result, the projected period for the aviation MRO market is anticipated to benefit from the rising usage of automation techniques.

List of Key Market Players

- Delta Airlines, Inc.

- AAR Corp.

- Hong Kong Aircraft Engineering Company Limited

- Airbus SE

- Singapore Technologies Engineering Limited

- KLM UK Engineering Limited

- Lufthansa Technik

- MTU Aero Engines AG

- Raytheon Technologies Corporation (Previously United Technologies Corporation)

- Singapore Technologies Engineering Ltd

- TAP Maintenance & Engineering (TAP Air Portugal)

Segmentation

By Organization

- Airline/ Operator MRO

- Independent MRO

- Original Equipment Manufacturer (OEM) MRO

By Aircraft Type

- Narrow Body

- Wide Body

- Regional Jet

- Others

By Air Generation

- Old Generation

- Mid Generation

- New Generation

By Service Type

- Engine Overhaul

- Airframe Maintenance

- Line Maintenance

- Modification

- Others

By Region:

North America

- North America, by Country

- U.S.

- Canada

- Mexico

- North America, by Organization

- North America, by Aircraft Type

- North America, by Air Generation

- North America, Service Type

Europe

- Europe, by Country

- Germany

- Russia

- U.K.

- France

- Italy

- Spain

- The Netherlands

- Rest of Europe

- Europe, by Organization

- Europe, by Aircraft Type

- Europe, by Air Generation

- Europe, by Service Type

Asia Pacific

- Asia Pacific, by Country

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Rest of Asia Pacific

- Asia Pacific, by Organization

- Asia Pacific, by Aircraft Type

- Asia Pacific, by Air Generation

- Asia Pacific, by Service Type

Middle East & Africa

- Middle East & Africa, by Country

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

- Middle East & Africa, by Organization

- Middle East & Africa, by Aircraft Type

- Middle East & Africa, by Air Generation

- Middle East & Africa, by Service Type

South America

- South America, by Country

- Brazil

- Argentina

- Colombia

- Rest of South America

- South America, by Organization

- South America, by Aircraft Type

- South America, by Air Generation

- South America, by Service Type

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the tooth regeneration market over the forecast period?The tooth regeneration market is projected to expand at a CAGR of 6.18% during the forecast period.

-

2. What is the market size of the tooth regeneration market?The Global Tooth Regeneration Market Size is Expected to Grow from USD 4.50 Billion in 2023 to USD 8.20 Billion by 2033, at a CAGR of 6.18% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the tooth regeneration market?North America is anticipated to hold the largest share of the tooth regeneration market over the predicted timeframe.

Need help to buy this report?