Global Aviation Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage (Hull and liability insurance, War and terrorism insurance, Passenger liability insurance, and Aircraft damage coverage), By Policy Type (Third-party liability insurance, First-party insurance, and Hull & liability insurance), By Aircraft Type (Commercial aircraft, General aviation aircraft, Military aircraft, and Unmanned aerial vehicles (UAVs)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Banking & FinancialGlobal Aviation Insurance Market Size Forecasts to 2035

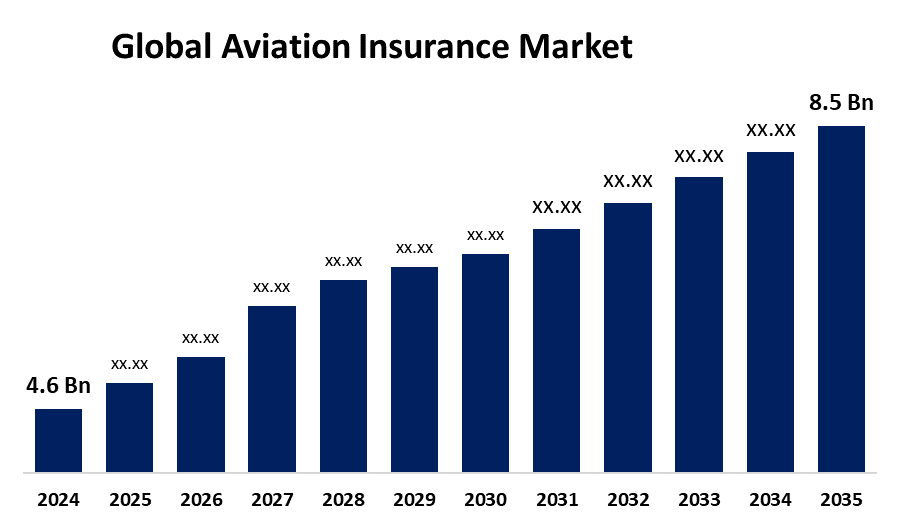

- The Global Aviation Insurance Market Size Was Estimated at USD 4.6 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.74% from 2025 to 2035

- The Worldwide Aviation Insurance Market Size is Expected to Reach USD 8.5 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global aviation insurance market size was worth around USD 4.6 billion in 2024 and is predicted to grow to around USD 8.5 billion by 2035 with a compound annual growth rate (CAGR) of 5.74% from 2025 to 2035. Regulatory compliance and risk management awareness are driving the aviation insurance market globally.

Market Overview

The aviation insurance market refers to the industry providing financial protection to aircraft owners, operators, and other stakeholders against various risks associated with the aviation industry. Aviation insurance is insurance coverage geared specifically to the operation of aircraft and the risks involved in aviation. The policies are distinctly different from those for other areas of transportation and tend to incorporate aviation terminology, as well as terminology, limits, and clauses specific to aviation insurance. Complexity and the specialized nature of aviation insurance are driving the need for insurers to have a deep understanding of aviation operations, regulatory requirements, and industry standards. Evolution and expansion of the aviation industry are driving the demand for innovative and comprehensive insurance products and services, ultimately bolstering the market growth opportunities. Further, the growing expenditure on international airlines is anticipated to provide opportunities for market expansion.

Report Coverage

This research report categorizes the aviation insurance market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the aviation insurance market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the aviation insurance market.

Aviation Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.6 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.74% |

| 2035 Value Projection: | USD 8.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Coverage, By Policy Type, By Aircraft Type and By Region and COVID-19 Impact Analysis |

| Companies covered:: | AIG, Mitsui Sumitomo Insurance Group, General Re (Berkshire Hathaway), Tokio Marine Holdings, Chubb, Allianz SE, AXA, Sompo Holdings, HDI Global, Munich Re, Everest Re Group, Bermudan re insurers, Swiss Re, Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expanding aviation industry, technological advancements in aircraft, and heightened regulatory compliance are driving the aviation insurance market. An increasing economy and middle class, as well as substantial infrastructure investments, are contributing to propel the market growth. The adoption of digital technologies, the use of data analytics to assess risks & set premiums, and the emphasis on sustainability and environmental protection are propelling the market growth. In addition, the need for air travel, rising air traffic volumes, and concerns regarding aviation safety and liability are several factors responsible for driving the market for aviation insurance.

Restraining Factors

Volatility in the economic conditions, exchange rates, and rising frequency & severity of natural disasters are challenging the aviation insurance market. High cost of premium, as well as legal & compliance challenges, are restraining the market

Market Segmentation

The aviation insurance market share is classified into coverage, policy type, and aircraft type.

- The hull and liability insurance segment dominated the market with the largest share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the coverage, the aviation insurance market is divided into hull and liability insurance, war and terrorism insurance, passenger liability insurance, and aircraft damage coverage. Among these, the hull and liability insurance segment dominated the market with the largest share in 2024 and is projected to grow at a substantial CAGR during the forecast period. It covers physical loss or damage to the aircraft itself (hull) or persons or other property (liability), which can be purchased separately or together in the same policy.

- The third-party liability insurance segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the policy type, the aviation insurance market is divided into third-party liability insurance, first-party insurance, and hull & liability insurance. Among these, the third-party liability insurance segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Third-party liability insurance is a policy purchased from an insurance company, protecting the policyholder against claims made by a third party for damages due to the policyholder’s actions. Aircraft owners and operators need to purchase third-party aviation liability insurance, as standard law is driving the market in the third-party liability insurance segment.

- The commercial aircraft segment accounted for a significant share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the aircraft type, the aviation insurance market is divided into commercial aircraft, general aviation aircraft, military aircraft, and unmanned aerial vehicles (UAVs). Among these, the commercial aircraft segment accounted for a significant share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Commercial aircraft aviation insurance aids in mitigating risk as a commercial operator. It includes aircraft manufacturers, flight schools, agricultural aviators, air cargo, aircraft maintenance facilities, and charter aircraft-on-demand services. A wide range of risks, including mechanical failures and accidents, to emerging threats faced by the commercial aviation sector are driving the market expansion in the commercial aircraft segment.

Regional Segment Analysis of the Aviation Insurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the aviation insurance market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the aviation insurance market over the predicted timeframe. Commercial aviation, comprising airlines operating passenger and freight flights, as well as the demand for insurance solutions covering risks such as aircraft damage, liability, and passenger injuries, is driving the aviation insurance market. The presence of major aviation hubs, a well-established insurance industry, and demand for aviation insurance coverage are contributing to the market growth.

Asia Pacific is expected to grow at a rapid CAGR in the aviation insurance market during the forecast period. The strict regulatory requirements, enhanced risk management protocols, and upsurge in airline fleet expansions enable insurers to expand policy coverage options is driving the aviation insurance market growth. Further, the prioritizing investment in aviation infrastructure for the growth in tourism and trade is supporting the aviation insurance market.

Europe is anticipated to hold a significant share of the aviation insurance market during the projected timeframe. The robust aviation sector, including commercial airlines, general aviation, aerospace manufacturing, airports, and other related industries, is contributing to driving the aviation insurance market. The presence of leading aviation insurance providers, as well as an increasing aerospace industry in the region, is responsible for propelling the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the aviation insurance market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AIG

- Mitsui Sumitomo Insurance Group

- General Re (Berkshire Hathaway)

- Tokio Marine Holdings

- Chubb

- Allianz SE

- AXA

- Sompo Holdings

- HDI Global

- Munich Re

- Everest Re Group

- Bermudan re insurers

- Swiss Re

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2023, KKR, a leading global investment firm, and Altavair L.P., a leader in commercial aviation finance, announced that KKR is making an additional $1.15 billion commitment to expand its global portfolio of leased commercial aircraft in partnership with Altavair.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the aviation insurance market based on the below-mentioned segments:

Global Aviation Insurance Market, By Coverage

- Hull and liability insurance

- War and terrorism insurance

- Passenger liability insurance

- Aircraft damage coverage

Global Aviation Insurance Market, By Policy Type

- Third-party liability insurance

- First-party insurance

- Hull & liability insurance

Global Aviation Insurance Market, By Aircraft Type

- Commercial aircraft

- General aviation aircraft

- Military aircraft

- Unmanned aerial vehicles (UAVs)

Global Aviation Insurance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the aviation insurance market over the forecast period?The global aviation insurance market is projected to expand at a CAGR of 5.74% during the forecast period.

-

2. What is the market size of the aviation insurance market?The global aviation insurance market size is expected to grow from USD 4.6 Billion in 2024 to USD 8.5 Billion by 2035, at a CAGR of 5.74% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the aviation insurance market?North America is anticipated to hold the largest share of the aviation insurance market over the predicted timeframe.

Need help to buy this report?