Global Automotive Wheel Speed Sensor Market Size, Share, and COVID-19 Impact Analysis, By Sensor Type (Active Sensors and Passive Sensors), By Vehicle Type (Passenger Vehicles and Commercial Vehicles), By Application Type (Anti-lock Braking System, Traction Control System, Electronic Stability Control, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Automotive & TransportationGlobal Automotive Wheel Speed Sensor Market Insights Forecasts to 2035

- The Global Automotive Wheel Speed Sensor Market Size Was Estimated at USD 8.06 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.1% from 2025 to 2035

- The Worldwide Automotive Wheel Speed Sensor Market Size is Expected to Reach USD 12.54 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global automotive wheel speed sensor market size was worth around USD 8.06 billion in 2024 and is predicted to grow to around USD 12.54 billion by 2035 with a compound annual growth rate (CAGR) of 4.1% from 2025 to 2035. The automotive wheel speed sensor market is growing primarily due to increasing government mandates for vehicle safety features and the widespread adoption of Advanced Driver Assistance Systems (ADAS). These sensors are essential for critical safety functions such as Anti-lock Braking Systems (ABS), Electronic Stability Control (ESC), and traction control.

Market Overview

The global automotive wheel speed sensor market encompasses devices that detect and transmit the rotational speed of vehicle wheels, supporting critical safety and control systems. These sensors play an essential role in Anti-lock Braking Systems (ABS), Electronic Stability Control (ESC), traction control, and advanced driver-assistance systems (ADAS), helping enhance braking efficiency, improve vehicle stability, and strengthen overall road safety.

Market growth is driven by rising vehicle production, stringent safety regulations, and the expanding adoption of electronic and autonomous technologies. Additional opportunities are emerging from the accelerating electric vehicle (EV) segment, ongoing sensor miniaturization, and rising demand for high-precision sensing to support higher levels of autonomous driving.

In December 2024, the U.S. NHTSA proposed a voluntary framework for automated driving systems, emphasizing transparency in sensor performance, including wheel-speed data for maintaining stability in Level 3 and higher autonomous vehicles. This development follows the 2024 FMVSS 108 amendments on adaptive headlights, which incorporate sensor-based perception technologies to improve safety and enable advanced autonomous functionalities.

Technological advances—such as enhanced durability, integrated electronics, and smart sensing capabilities—continue to broaden adoption across the automotive sector. Major industry players include Bosch, Continental AG, Denso Corporation, Aptiv, and ZF Friedrichshafen, all of which are actively focusing on performance improvements and cost-efficient sensor solutions.

Furthermore, a new UNECE regulation on Acceleration Control for Pedal Error (ACPE), slated to take effect in June 2025, will require systems capable of detecting unintended acceleration and intervening through braking. This regulation further underscores the importance of accurate wheel speed sensors for safe and reliable vehicle operation.

Report Coverage

This research report categorizes the automotive wheel speed sensor market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive wheel speed sensor market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the automotive wheel speed sensor market.

Global Automotive Wheel Speed Sensor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8.06 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.1% |

| 2035 Value Projection: | USD 12.54 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Sensor Type, By Application Type |

| Companies covered:: | Continental AG Robert Bosch GmbH ZF Friedrichshafen AG Denso Corporation TE Connectivity plc Astemo PHINIA Inc. Allegro MicroSystems, Inc. NXP Semiconductors N.V. HELLA GmbH & Co. KGaA MELEXIS group Sensata Technologies, Inc. VBOX Automotive Sumitomo Wiring Systems, Ltd. and others key palyers |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Some key factors driving the wheel speed sensor market include increasing vehicle production, especially in emerging economies, along with growing penetration of advanced safety features such as ABS, ESC, and ADAS. This increasingly stringent government mandate for safety features accelerates sensor adoption across all vehicle segments. Growing demand for high-accuracy sensing solutions is also driven by electrification and the trend towards autonomous driving. In addition, consumer demand for improved driving stability and performance propels the growth of the market. Continuous sensor technology development, including miniaturization, durability, and cost efficiency-drives this market through increased enablement across a wide range of passenger and commercial vehicle applications.

Restraining Factors

Key restraints include the high cost of sensors for advanced systems, which limits adoption in price-sensitive markets. Severe operating conditions can cause reliability issues, raising maintenance concerns. Complex integration with modern electronic architectures also increases development time. Additionally, fluctuating raw material prices and supply-chain disruptions hinder consistent production and market growth.

Market Segmentation

The automotive wheel speed sensor market share is classified into sensor type, vehicle type, and application type.

- The active sensors segment dominated the market in 2024, approximately 70% and is projected to grow at a substantial CAGR during the forecast period.

Based on the sensor type, the automotive wheel speed sensor market is divided into active sensors and passive sensors. Among these, the active sensors segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Active sensors dominate the market, owing to the rising demand for vehicle safety and ADAS. As manufacturers enhance ABS, ESC, and traction control, the need for accurate sensors grows. Adoption of EVs, autonomous driving, and stricter safety regulations further fuel demand, making reliable active wheel-speed sensors essential for modern vehicles.

- The passenger vehicles segment accounted for the largest share in 2024, approximately 67% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the vehicle type, the automotive wheel speed sensor market is divided into passenger vehicles and commercial vehicles. Among these, the passenger vehicles segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Passenger cars dominate the automotive wheel speed sensor market, due to high production volumes and rising demand for safety and comfort. Automakers equip vehicles with ABS, ESC, and traction control to meet regulations and consumer expectations. Growing interest in semi-autonomous features, such as adaptive cruise control and lane keeping assistance, further increases demand for precise wheel-speed sensing in passenger vehicles.

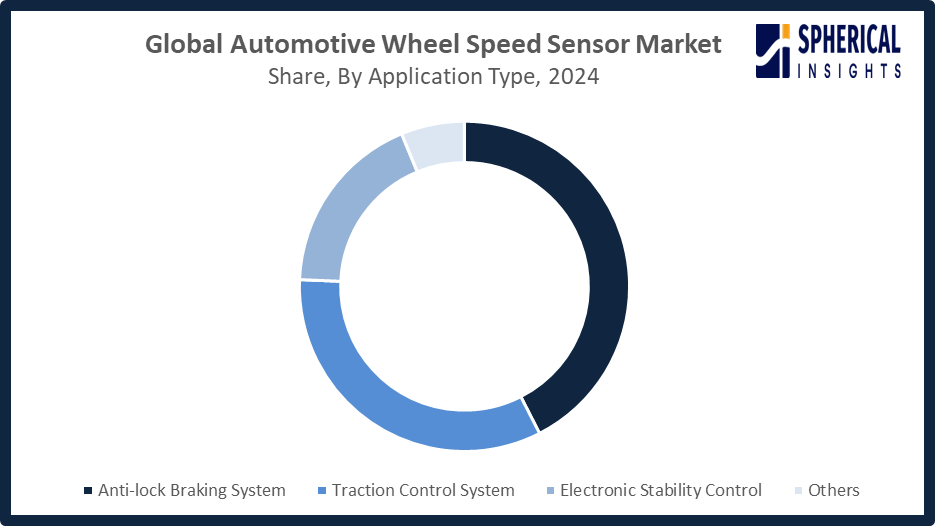

- The anti-lock braking system segment accounted for the highest market revenue in 2024, approximately 42% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application type, the automotive wheel speed sensor market is divided into anti-lock braking system, traction control system, electronic stability control, and others. Among these, the anti-lock braking system segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The anti-lock braking system (ABS) segment market growth, attributed to widespread adoption in passenger and commercial vehicles. Increasing safety regulations, consumer demand for enhanced braking performance, and the integration of ABS with electronic stability control and traction control systems have significantly boosted the need for reliable wheel speed sensors in this application.

Get more details on this report -

Regional Segment Analysis of the Automotive Wheel Speed Sensor Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the automotive wheel speed sensor market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the automotive wheel speed sensor market over the predicted timeframe. Asia Pacific is expected to have a 42% share in the automotive wheel speed sensor market, driven by rapid vehicle production, rising disposable incomes, and higher consumer demand for safer vehicles. The main contributors are countries such as China, India, and Japan. China, which has massive passenger car and commercial vehicle output, leads the way. In India, the growing automotive industry, along with the government's safety mandates, acts as a catalyst for sensor adoption. Japan focuses on the advanced technology integration in vehicles, including ADAS and EVs. The expanding segment of electric and autonomous vehicles further creates demand in the region for highly accurate wheel-speed sensors.

North America is expected to grow at a rapid CAGR in the automotive wheel speed sensor market during the forecast period. The North America region is rapidly growing in CAGR in the automotive wheel speed sensor market, with approximately 28% market share, driven by the implementation of strict safety regulations and the rising adoption of ADAS. The United States is the major contributor, supported by mandates from NHTSA for ABS, ESC, and AEB systems. Increasing production of electric vehicles, rising consumer demand for vehicle safety, and integration of semi-autonomous driving technologies further accelerate the market growth, thereby making North America a key region for wheel-speed sensor adoption.

Europe’s automotive wheel speed sensor market is growing due to strict safety regulations and the rising adoption of ADAS. Germany, as a major automotive hub, drives demand with automakers integrating ABS, ESC, and traction control systems. EU regulations such as GSR2 and increasing production of electric and semi-autonomous vehicles further boost the need for accurate wheel-speed sensors, supporting overall market growth in the region. In July 2024, the EU’s New Vehicle General Safety Regulation (GSR2) came into force, mandating advanced driver-assistance systems in all new vehicles. Key requirements include intelligent speed assist, autonomous emergency braking, driver drowsiness and attention warnings, and emergency lane-keeping systems to enhance road safety across the European Union.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the automotive wheel speed sensor market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Continental AG

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Denso Corporation

- TE Connectivity plc

- Astemo

- PHINIA Inc.

- Allegro MicroSystems, Inc.

- NXP Semiconductors N.V.

- HELLA GmbH & Co. KGaA

- MELEXIS group

- Sensata Technologies, Inc.

- VBOX Automotive

- Sumitomo Wiring Systems, Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, ZF introduced the next generation of its intelligent chassis sensor in Friedrichshafen, Germany. Building on the Smart Chassis Sensor, the new version measures wheel height and captures three-dimensional acceleration for enhanced vehicle dynamics and control.

- In May 2025, Zipp introduced its first smart wheels, the 353 NSW and 303 SW, equipped with integrated live tire-pressure sensors. Connected to SRAM’s AXS ecosystem, they provide real-time pressure monitoring through Hammerhead, Wahoo, and Garmin devices, improving cycling performance and convenience.

- In September 2024, Sumitomo Electric Industries developed a sensor that accurately detects approaching pedestrians and bicyclists. Using proprietary AI image processing, it extends pedestrian detection up to five meters behind, enhancing situational awareness and road safety.

- In March 2024, Sumitomo Rubber Industries developed a sensing technology capable of detecting wheel nuts loosened by as little as 1 mm. Integrated into the SENSING CORE sensor-less monitoring platform, this innovation enhances vehicle safety by identifying potential wheel detachment risks with high accuracy.

- In November 2022, Sensata Technologies introduced its new Tire Mounted Sensor for vehicle and tire OEMs. The advanced sensor enhances safety, performance, and data insights by leveraging the tire’s contact with the road, providing information far beyond traditional pressure and temperature measurements.

- In July 2022, Allegro Microsystems launched A33110 and A33115 magnetic position sensors, targeting autonomous vehicle and motorsport applications. Combining vertical Hall technology (VHT) with tunneling magnetoresistance (TMR) in a single package, these sensors provide excellent redundancy and are the first to integrate both technologies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the automotive wheel speed sensor market based on the below-mentioned segments:

Global Automotive Wheel Speed Sensor Market, By Sensor Type

- Active Sensors

- Passive Sensors

Global Automotive Wheel Speed Sensor Market, By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

Global Automotive Wheel Speed Sensor Market, By Application Type

- Anti-lock Braking System

- Traction Control System

- Electronic Stability Control

- Others

Global Automotive Wheel Speed Sensor Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the automotive wheel speed sensor market over the forecast period?The global automotive wheel speed sensor market is projected to expand at a CAGR of 4.1% during the forecast period.

-

2. What is the automotive wheel speed sensor market?The automotive wheel speed sensor market refers to the global industry for the production, sale, and development of sensors that measure the rotational speed of each vehicle wheel.

-

3. What is the market size of the automotive wheel speed sensor market?The global Automotive Wheel Speed Sensor market size is expected to grow from USD 8.06 billion in 2024 to USD 12.54 billion by 2035, at a CAGR of 4.1% during the forecast period 2025-2035

-

4. Which region holds the largest share of the automotive wheel speed sensor market?Asia Pacific is anticipated to hold the largest share of the automotive wheel speed sensor market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global automotive wheel speed sensor market?Continental AG, Robert Bosch GmbH, ZF Friedrichshafen AG, Denso Corporation, TE Connectivity plc, Astemo, PHINIA Inc., Allegro MicroSystems, Inc., NXP, Semiconductors N.V., HELLA GmbH & Co. KGaA, and Others.

-

6. What factors are driving the growth of the automotive wheel speed sensor market?The growth of the automotive wheel speed sensor market is driven by the increasing adoption of advanced driver-assistance systems (ADAS) and electronic stability control (ESC), stricter vehicle safety regulations, the rise of electric and hybrid vehicles, and the expansion of the automotive aftermarket.

-

7. What are the market trends in the automotive wheel speed sensor market?Key market trends for automotive wheel speed sensors include the rising adoption of electric vehicles (EVs), a growing demand for advanced driver-assistance systems (ADAS), and the integration of sensors into connected vehicle technologies.

-

8. What are the main challenges restricting wider adoption of the automotive wheel speed sensor market?The main challenges restricting the wider adoption of automotive wheel speed sensors are high cost, the need for durability in harsh conditions, complex integration with existing electronics, and supply chain disruptions.

Need help to buy this report?