Global Automotive Upholstery Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Fabric, Leather, Vinyl, Synthetic Leather), By Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles, Luxury Cars), By Application (Seats, Door Panels, Headliners, Dashboard), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Upholstery Market Insights Forecasts to 2033

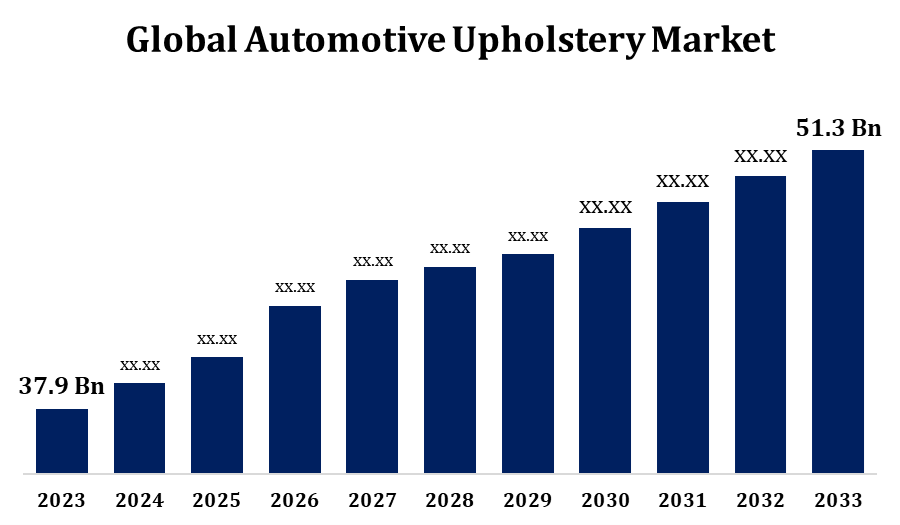

- The Global Automotive Upholstery Market Size was Valued at USD 37.9 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.07% from 2023 to 2033.

- The worldwide Automotive Upholstery Market Size is Expected to Reach USD 51.3 Billion by 2033.

- Asia Pacific is Expected to Grow the Fastest during the Forecast Period.

Get more details on this report -

The Global Automotive Upholstery Market Size is Expected to Reach USD 51.3 Billion by 2033, at a CAGR of 3.07% during the Forecast Period 2023 to 2033.

The automotive upholstery market is experiencing steady growth, driven by rising consumer demand for enhanced vehicle comfort, aesthetics, and customization. Increasing automotive production and the shift toward premium and electric vehicles have significantly influenced the need for high-quality interior materials. Advancements in fabric technology, such as stain resistance and eco-friendly materials, are reshaping design preferences. OEMs and aftermarket players are focusing on innovative designs and sustainable solutions to meet evolving regulatory standards and consumer expectations. Leather, synthetic fabrics, and advanced textiles continue to dominate the material choices. Additionally, growing interest in personalization and interior upgrades supports market expansion. Asia-Pacific, with its robust automotive manufacturing base, plays a vital role in market dynamics, while North America and Europe follow closely with strong demand for luxury and comfort-focused interiors.

Automotive Upholstery Market Value Chain Analysis

The automotive upholstery market value chain involves several interconnected stages, starting with raw material suppliers providing fabrics, leather, synthetics, foams, and adhesives. These materials are then processed by component manufacturers who produce seat covers, cushions, headliners, and other interior trims. Tier 1 suppliers integrate these components into complete upholstery systems and supply them to automotive OEMs. OEMs incorporate these systems during vehicle assembly, aligning with design specifications and comfort standards. Post-manufacturing, the aftermarket segment supports repairs, replacements, and customization services. Design and R&D play a critical role across the chain, focusing on comfort, durability, and sustainability. Logistics and distribution channels ensure timely delivery to manufacturers and service providers. Overall, coordination across the value chain is vital for innovation, quality control, cost efficiency, and meeting evolving consumer preferences.

Automotive Upholstery Market Opportunity Analysis

The automotive upholstery market offers strong growth opportunities driven by evolving consumer preferences, rising demand for luxury vehicles, and advancements in vehicle design. With increasing focus on comfort and personalization, consumers are seeking premium interior materials and customizable options. The shift toward electric and autonomous vehicles is opening new possibilities for innovative and tech-integrated upholstery solutions. Sustainability is also a key opportunity, as manufacturers adopt eco-friendly and recycled materials to meet rising environmental awareness. The integration of smart features such as climate control and health-monitoring sensors into seats and trims adds further value. Emerging markets, particularly in Asia-Pacific, present substantial potential due to growing disposable incomes and expanding automotive production. These trends collectively create favorable conditions for upholstery manufacturers to innovate and expand their global market presence.

Global Automotive Upholstery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 37.9 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.07% |

| 2033 Value Projection: | USD 51.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Material Type, By Vehicle Type, By Application, By Region. |

| Companies covered:: | Textron, SABIC, TStech, Mitsubishi Chemical, Toyota Boshoku, Faurecia, Groupe PSA, Adient, Tandus Centiva, Lear Corporation, BASF, Hermann GmbH, Continental AG, Seiren, Nitchi, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Automotive Upholstery Market Dynamics

Increasing Preference for Personalized Vehicle Interiors

The increasing preference for personalized vehicle interiors is a key driver of growth in the automotive upholstery market. Consumers are seeking unique and customized cabin experiences that reflect their individual tastes and lifestyles, prompting automakers and upholstery manufacturers to offer a wider range of materials, colors, textures, and stitching patterns. This trend is particularly strong among younger buyers and luxury vehicle owners, who value exclusivity and premium aesthetics. Advanced manufacturing technologies, such as digital cutting and automated stitching, are enabling greater design flexibility and cost-effective customization. Additionally, the rise of electric and high-end vehicles has amplified the demand for innovative and luxurious interior solutions. As personalization becomes a standard expectation rather than a luxury, the automotive upholstery market is evolving to meet diverse consumer preferences and enhance overall vehicle appeal.

Restraints & Challenges

Fluctuating prices of raw materials like leather, foam, and synthetic fabrics increase production costs and create pricing uncertainties. Intense competition from low-cost manufacturers, especially in developing regions, pressures established players to balance quality with affordability. Environmental regulations concerning chemical usage and emissions demand continuous compliance and investment in sustainable materials. Additionally, the shortage of skilled labor affects the ability to deliver high-quality, customized upholstery solutions. Rapidly changing consumer preferences and the demand for smart, tech-integrated interiors further require significant research and development efforts. These evolving expectations, combined with rising costs and regulatory pressures, make it essential for companies to innovate, streamline operations, and adopt flexible strategies to stay competitive in the dynamic automotive upholstery market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Automotive Upholstery Market from 2023 to 2033. The North American automotive upholstery market is witnessing steady growth, driven by increasing demand for premium, comfortable, and personalized vehicle interiors. Consumers in the region, particularly in the U.S. and Canada, are showing a strong preference for high-quality materials such as leather, suede, and eco-friendly fabrics. Advancements in upholstery technology, including climate-controlled seating and stain-resistant textiles, are enhancing customer appeal. Automakers and suppliers are focusing on innovation and sustainability, integrating recycled and bio-based materials to meet environmental standards. The rise in electric and luxury vehicles is also boosting demand for modern, feature-rich upholstery solutions. Additionally, a growing aftermarket for interior customization supports market expansion. With a mature automotive industry and rising interest in smart, sustainable interiors, North America remains a key region in the global automotive upholstery landscape.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific automotive upholstery market is experiencing strong growth, driven by rising demand for premium and customized vehicle interiors. This trend is particularly prominent in countries such as China, India, and Japan, where increasing disposable incomes and urbanization are boosting the adoption of luxury and electric vehicles. Leather remains a popular choice due to its premium appeal and durability, while alternatives like vinyl are gaining traction for their affordability and low maintenance. The seats segment dominates the market, reflecting their importance in vehicle comfort and safety. Additionally, there is a noticeable shift towards sustainable and eco-friendly materials, aligning with growing environmental awareness among consumers. The aftermarket for automotive upholstery is expanding as more consumers seek to personalize and upgrade their vehicle interiors, presenting further growth opportunities in the region.

Segmentation Analysis

Insights by Material Type

The fabric segment accounted for the largest market share over the forecast period 2023 to 2033. The automotive upholstery fabric segment is witnessing strong growth, driven by innovations in material technology, rising consumer demand for comfort and aesthetics, and a growing focus on sustainability. Advanced fabric technologies like 3D weaving and nanotechnology are enhancing durability, stain resistance, and breathability, making fabrics more resilient and long-lasting. Additionally, the increasing preference for eco-friendly materials is encouraging the use of recycled fabrics and plant-based alternatives, aligning with consumer desires for sustainable products. The demand for personalized vehicle interiors is also fueling the segment's growth, as consumers seek a variety of colors, textures, and patterns for customization. These factors collectively contribute to the expansion of the automotive upholstery fabric market, meeting both industry needs and evolving consumer expectations.

Insights by Vehicle Type

The passenger cars segment accounted for the largest market share over the forecast period 2023 to 2033. This dominance is supported by high production rates of passenger vehicles, particularly in emerging markets like China and India, where urbanization and rising incomes are boosting growth. Consumers are increasingly opting for premium materials such as leather, synthetic leather, and sustainable alternatives, alongside features like heated and ventilated seats. The transition to electric vehicles (EVs) and autonomous cars is also fueling demand for innovative interior designs and advanced upholstery technologies. As a result, the passenger car segment is expected to maintain its position as the market leader, driving continued innovation and expansion in the automotive upholstery sector.

Insights by Application

The door panels segment accounted for the largest market share over the forecast period 2023 to 2033. Manufacturers are increasingly using lightweight materials like composites and recycled plastics to reduce vehicle weight, improve fuel efficiency, and comply with stricter environmental standards. These sustainable practices are gaining traction in the market. Technological advancements have also led to the integration of smart features in door panels, such as touch-sensitive controls, ambient lighting, and improved insulation materials, enhancing comfort and safety. Additionally, the rise of electric vehicles is driving the need for specialized door panels that can accommodate advanced sensors and controls. These factors combined are fueling the continued growth of the door panel segment within the automotive upholstery market.

Recent Market Developments

- In April 2024, Adient has partnered with a leading supplier to create lightweight seat structures for electric vehicles, a collaboration that could influence the future demand for upholstery solutions.

Competitive Landscape

Major players in the market

- Textron

- SABIC

- TStech

- Mitsubishi Chemical

- Toyota Boshoku

- Faurecia

- Groupe PSA

- Adient

- Tandus Centiva

- Lear Corporation

- BASF

- Hermann GmbH

- Continental AG

- Seiren

- Nitchi

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Upholstery Market, Material Type Analysis

- Fabric

- Leather

- Vinyl

- Synthetic Leather

Automotive Upholstery Market, Vehicle Type Analysis

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles

- Luxury Cars

Automotive Upholstery Market, Application Analysis

- Seats

- Door Panels

- Headliners

- Dashboard

Automotive Upholstery Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automotive Upholstery Market?The global Automotive Upholstery Market is expected to grow from USD 37.9 billion in 2023 to USD 51.3 billion by 2033, at a CAGR of 3.07% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automotive Upholstery Market?Some of the key market players of the market are Textron, SABIC, TStech, Mitsubishi Chemical, Toyota Boshoku, Faurecia, Groupe PSA, Adient, Tandus Centiva, Lear Corporation, BASF, Hermann GmbH, Continental AG, Seiren, Nitchi.

-

3. Which segment holds the largest market share?The door panels segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?