Global Automotive Radar Market Size, Share, and COVID-19 Impact Analysis, By Range (Long-Range Radar (LRR), Medium-Range Radar (MRR), Short-Range Radar (SRR)), By Frequency (79 GHz, 77 GHz, 24 GHz), By Application (Blind Spot Detection (BSD), Autonomous Emergency Braking (AEB), Forward Collision Warning System, Adaptive Cruise Control (ACC), Intelligent Park Assist, Other Advanced Driver Assistance System (ADAS)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Industry: Automotive & TransportationGlobal Automotive Radar Market Insights Forecasts to 2033

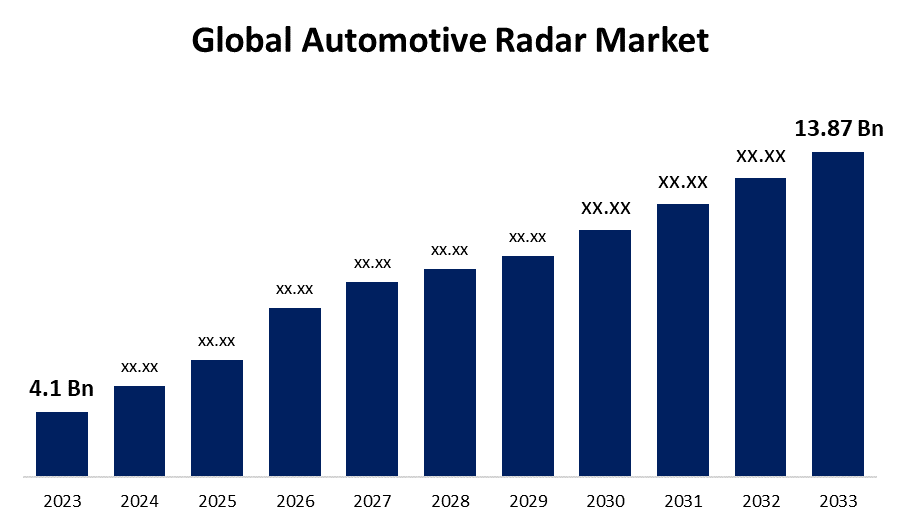

- The Global Automotive Radar Market Size was Valued at USD 4.1 Billion in 2023.

- The Market Size is Growing at a CAGR of 12.96% from 2023 to 2033.

- The Worldwide Automotive Radar Market Size is Expected to Reach USD 13.87 Billion by 2033.

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Radar Market Size is Anticipated to Exceed USD 13.87 Billion by 2033, Growing at a CAGR of 12.96% from 2023 to 2033.

Market Overview

Automotive Radar refers to radar systems that are specifically designed and implemented for use in vehicles, primarily for advanced driver assistance systems (ADAS) and autonomous driving applications. Radar (Radio Detection and Ranging) is a technology that uses radio waves to detect the presence, distance, speed, and direction of objects in the surrounding environment. Automotive Radar is a critical sensor for accident avoidance, vehicle and pedestrian avoidance, and other purposes. Vehicles use higher frequency radar systems with frequencies ranging from 77 GHz to 81 GHz (79 GHz band) for the detection of pedestrians and brake assistance systems. The increasing acceptance of autonomous vehicles and self-driving cars is predicted to generate several potential prospects for the market. The automotive radar market is expected to grow at a rapid pace during the forecast period, driven by an increase in consumer preference for vehicles with protection features. Furthermore, when compared to many other alternative sensors, particularly visual sensors, automobile RADAR is one of the leading technologies due to its high precision and accuracy of information content, such as speed and range detection. Automotive radar systems are the primary sensors utilized by adaptive speed control and are a key component of advanced driver assistance systems.

Report Coverage

This research report categorizes the market for the global automotive radar market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global automotive radar market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global automotive radar market.

Global Automotive Radar Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.1 Billion |

| Forecast Period: | 2023-2033 |

| 2033 Value Projection: | USD 13.87 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Range, By Frequency, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Infineon Technologies AG, NXP Semiconductors NV, Aptiv, Texas Instruments Incorporated, Robert Bosch GmbH, Continental AG, Denso Corporation, Autoliv Inc., Veoneer, HELLA KGaA, Valeo SA, Magna International, ZF Friedrichshafen AG, Renesas Electronics Corporation and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Automotive radar sensors play a major role in the development and deployment of autonomous driving technologies such as automatic emergency braking (AEB) and adaptive cruise control (ACC), as they provide precise monitoring and perception of the vehicle's surroundings. Furthermore, Road accidents are the main cause of mortality globally; the rising number of fatalities has forced governments to put stringent regulations on the vehicle industry. As a result, governments around the world have implemented strict laws to reduce the number of traffic accidents and fatalities. Also, firms must now design vehicles with safety measures included. Many automakers are working on building a technologically improved RADAR system to improve driving safety. As an outcome of continual developments in semiconductor technology and economies of scale, the expense of radar sensors and related equipment is reducing, lowering the cost of automobile radar systems and increasing their affordability for automakers.

Restraining Factors

Electronic devices or other radar systems could interfere with the functioning of vehicle radar systems, leading to false alerts or malfunctions. Market adoption is dependent on eliminating interference issues and ensuring consistent performance in a variety of environments. Moreover, environmental conditions such as bad weather, uneven roads, and electromagnetic interference can have an impact on the performance of radar systems in automobiles. The development of reliable radar systems that perform well in a variety of environmental conditions is critical for market adoption.

Market Segmentation

The global automotive radar market share is classified into range, frequency, and distribution channel.

- The medium-range radar segment is expected to hold the largest share of the global automotive radar market during the forecast period.

Based on the range, the global automotive radar market is categorized into long-range radar (LRR), medium-range radar (MRR), and short-range radar (SRR). Among these, the medium-range radar segment is expected to hold the largest share of the global automotive radar market during the forecast period. The consumer's shift towards technology such as heading distance indicators, autonomous emergency braking (AEB), and rear cross-traffic alert and adaptive cruise control (ACC) supports the segment’s growth. The medium-range radar has digital beamforming (DBF) and three to four receiving channels. This allows medium-range radar to be configured with distinct receive channels for different directions, increasing the measurement accuracy of MRR.

- The 77 GHz segment is expected to grow at the fastest CAGR during the forecast period.

Based on the frequency, the global automotive radar market is categorized into 79 GHz, 77 GHz, and 24 GHz. Among these, the 77 GHz segment is expected to grow at the fastest CAGR during the forecast period. The 77 GHz provides high precision and resolution; however, it is susceptible to influence from other electrical components in the car. Because of its ability to detect objects with high accuracy and function in a variety of weather situations, 77 GHz radar has grown more popular in the automotive industry. The 77 GHz radar operates at a frequency range of 76-81 GHz and is used for short-range applications like as collision warning, adaptive cruise control, and lane departure warning.

- The intelligent park assist segment is expected to hold a significant share of the global automotive radar market during the forecast period.

Based on the application, the global automotive radar market is categorized into blind spot detection (BSD), autonomous emergency braking (AEB), forward collision warning system, adaptive cruise control (ACC), intelligent park assist, and other advanced driver assistance systems (ADAS). Among these, the intelligent park assist segment is expected to hold a significant share of the global automotive radar market during the forecast period. The public's desire for driving assistance to minimize backside crashes and accidents is the primary element driving the rising demand for intelligent park assist solutions. Additionally, the demand for luxury vehicles, sports cars, and advanced vehicles necessitates intelligent park assist technologies to increase safety. Another aspect helping to the segmental growth is the introduction of intelligent park assistance in electric automobiles.

Regional Segment Analysis of the Global Automotive Radar Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global automotive radar market over the predicted timeframe.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global automotive radar market over the forecast period. A boost in automobile sales across the region is projected to drive up demand for vehicle sensors. The increase of interest in electric vehicles across this region also drives market growth. The significant importance of manufacturing industries in China, India, and Japan is driving market growth. In addition, as consumers' safety concerns grow in India and the ASEAN countries, automotive manufacturers are adding more sensors to low-cost automobiles. It is projected to increase demand for vehicle sensors shortly. Original Equipment Manufacturers (OEMs) in this region have played an important part in fueling this expansion by offering innovative technologies focused on reducing traffic jams and improving the general accessibility of transportation systems.

North America is expected to grow at the fastest CAGR growth of the global automotive radar market during the forecast period. The widespread use of automobile radar technology in North America is mainly driven by severe safety requirements, rising demand from consumers for advanced driver assistance systems (ADAS), and an increased focus on automotive radar applications. These applications include vital features like collision prevention and adaptive cruise control. In addition, the focus on developing and incorporating radar-based technology has increased the automotive radar industry analysis in this region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global automotive radar market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Infineon Technologies AG

- NXP Semiconductors NV

- Aptiv

- Texas Instruments Incorporated

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Autoliv Inc.

- Veoneer

- HELLA KGaA

- Valeo SA

- Magna International

- ZF Friedrichshafen AG

- Renesas Electronics Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Infineon Technologies AG and Aurora Labs introduced a new range of AI-powered solutions to enhance the durability and safety of vital car parts like steering, brakes, and airbags. The partnership will provide solutions incorporating Aurora Labs' Line-of-Code Intelligence (LOCI) AI technology on Infineon's 32-bit TriCore AURIX TC4x family of microcontrollers (MCUs) to help automotive manufacturers improve vehicle safety, reliability, and performance throughout the vehicle's lifespan.

- In January 2024, NXP Semiconductors N.V. revealed an expansion of its single-chip family for automotive radar. The SAF86xx integrates a radar transceiver, radar processor, and MACsec hardware engine for secure communication over Automotive Ethernet. Paired with NXP's S32 high-performance processors, connectivity for vehicle networks, and power management, the complete system solution enables the development of advanced radar defined by software.

- In May 2023, Arbe Robotics Limited attended the IWPC Automotive Sensor Architecture Conference to discuss the innovative radar-camera fusion technology and its ability to improve environmental awareness, increasing safety for drivers in various conditions. Arbe's sophisticated AI algorithms enable the simultaneous integration of radar and camera data in real time, enhancing vehicles' abilities to detect and track objects at high speeds and long distances. This groundbreaking solution has been created to excel in identifying various objects to help create clear paths on highways and in urban areas, ultimately ensuring safety for both drivers and pedestrians.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global automotive radar market based on the below-mentioned segments:

Global Automotive Radar Market, By Range

- Long-Range Radar (LRR)

- Medium-Range Radar (MRR)

- Short-Range Radar (SRR)

Global Automotive Radar Market, By Frequency

- 79 GHz

- 77 GHz

- 24 GHz

Global Automotive Radar Market, By Distribution Channel

- Blind Spot Detection (BSD)

- Autonomous Emergency Braking (AEB)

- Forward Collision Warning System

- Adaptive Cruise Control (ACC)

- Intelligent Park Assist

- Other Advanced Driver Assistance System (ADAS)

Global Automotive Radar Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global automotive radar market over the forecast period?The global automotive radar market is projected to expand at a CAGR of 12.96% during the forecast period.

-

2. What is the projected market size and growth rate of the global automotive radar market?The global automotive radar market was valued at USD 4.1 Billion in 2023 and is projected to reach USD 13.87 Billion by 2033, growing at a CAGR of 12.96% from 2023 to 2033.

-

3. Which region is expected to hold the highest share in the global automotive radar market?The Asia Pacific region is expected to hold the highest share of the global automotive radar market.

Need help to buy this report?