Global Automotive Powder Metallurgy Components Market Size, Share, and COVID-19 Impact Analysis, By Component Type (Steel Powder Components, Aluminum Powder Components, Copper Powder Components, Nickel Powder Components, Magnetic Powders, Graphite-Mixed Powders, and Others), Vehicle Type (Passenger Cars, Commercial Vehicles, and Electric Vehicles), Manufacturing Process (Press and Sintering, Metal Injection Molding (MIM), Additive Manufacturing, Hot Isostatic Pressing (HIP), and Cold Isostatic Pressing), By Application (Engine Components, Transmission Components, Brake Components, Starter & Alternator Components, Fuel System Components, Exhaust System Components, Steering & Suspension Components, Chassis & Body Parts, and Others), By End User (Original Equipment Manufacturers (OEMs), and Aftermarket Suppliers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Automotive & TransportationGlobal Automotive Powder Metallurgy Components Market Insights Forecasts to 2035

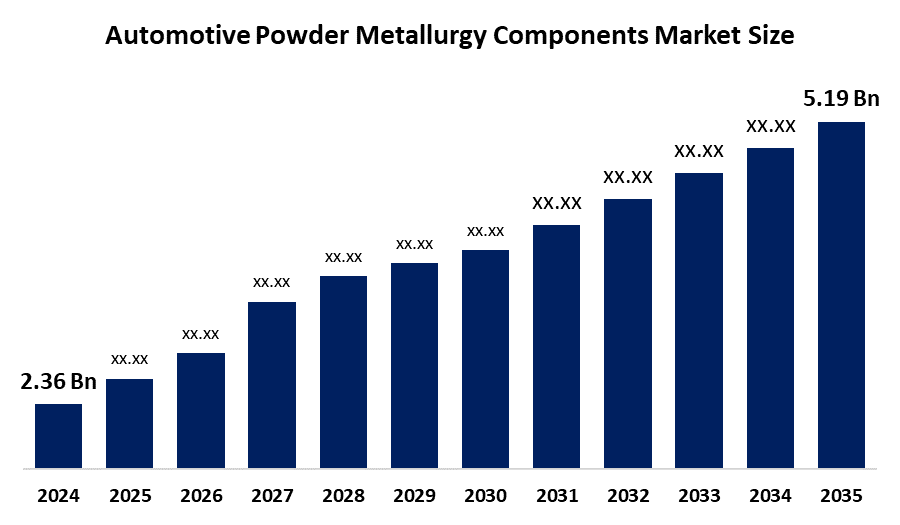

- The Global Automotive Powder Metallurgy Components Market Size Was Estimated at USD 2.36 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.43% from 2025 to 2035

- The Worldwide Automotive Powder Metallurgy Components Market Size is Expected to Reach USD 5.19 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Powder Metallurgy Components Market Size was worth around USD 2.36 Billion in 2024 and is Predicted to Grow to around USD 5.19 Billion by 2035 with a compound annual growth rate (CAGR) of 7.43% from 2025 and 2035. The growing demand for lightweight, fuel-efficient automobiles, improvements in material technology, affordable production, and the growing global usage of electric and hybrid vehicles provide opportunities for the automotive powder metallurgy components market.

Market Overview

The automotive powder metallurgy components market indicates the global industry that produces, distributes, and uses components made from powder metallurgy processes for the automobile industry. Powder metallurgy is a process used to make metal parts by compacting powdered metals and subsequently sintering them. The automotive powder metallurgy components processes tend to be efficient in the use of materials, allow for design flexibility, and lower cost. The components produced in the automotive powder metallurgy components market include gears, bearings, bushings, and structural components that are used in automotive engines, transmissions, trailers, and brakes.

One of the main factors fueling growth in the automotive powder metallurgy components market is the increasing demand for fuel-efficient vehicles. The PM technology is being used in the development of fuel-efficient vehicles; it is expected to sustain growth in the automotive powder metallurgy components market. In addition, growth in the automotive powder metallurgy components is fueled by increasing demands for lightweight, high-performance automotive parts, technological advances using powder metallurgy processes, and mandates for energy-efficient vehicles.

Report Coverage

This research report categorizes the automotive powder metallurgy components market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive powder metallurgy components market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the automotive powder metallurgy components market.

Automotive Powder Metallurgy Components Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.36 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.43% |

| 2035 Value Projection: | USD 5.19 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | Vehicle Type, By Component Type, By Application and By Region. |

| Companies covered:: | TRIS Inc., DIAMET CORPORATION, PORITE CORPORATION, Sumitomo Electric Sintered Alloy, Ltd., Hitachi Chemical Co., Ltd., GKN Powder Metallurgy, Johnson Electric, Miba, Mahle Behr, Kurabe Industries, PMG Holding GmbH, Fine Sinter Co., Ltd and Others. |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Increased sustainability, less machining needed, and cost-effective mass production all contribute to the automotive powder metallurgy components market expansion. Growing need for lightweight, fuel-efficient automobiles, developments in powder metallurgy technology, affordable mass production, and expanding use in electric vehicles are the main factors propelling the automotive powder metallurgy components market. The increasing use of PM components is anticipated to be a major factor in the growth of the market for automotive powder metallurgy components. Additionally, rising global car production and stricter emissions standards are promoting the usage of cutting-edge manufacturing techniques like powder metallurgy in a variety of vehicle segments.

Restraining Factors

High initial tooling costs, production constraints for large, complicated parts, volatile raw material prices, and competition from other manufacturing processes are the main factors restricting the market for automotive powder metallurgy components market.

Market Segmentation

The automotive powder metallurgy components market share is classified into component type, vehicle type, manufacturing process, application, and end user

- The steel powder components segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the component type, the automotive powder metallurgy components market is divided into steel powder components, aluminum powder components, copper powder components, nickel powder components, magnetic powders, graphite-mixed powders, and others. Among these, the steel powder components segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Steel's incredible mechanical strength, longevity, and affordability make it an excellent choice for producing vital automobile parts like gears, bearings, and structural elements, which is the main factor driving the steel powder components market.

- The passenger cars segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the vehicle type, the automotive powder metallurgy components market is divided into passenger cars, commercial vehicles, and electric vehicles. Among these, the passenger cars segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The significant volume of passenger cars produced worldwide and the growing focus on producing lightweight, fuel-efficient components to meet strict environmental rules are the main drivers of the passenger car market.

- The press and sintering segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the manufacturing process, the automotive powder metallurgy components market is divided into press and sintering, metal injection molding (MIM), additive manufacturing, hot isostatic pressing (HIP), and cold isostatic pressing. Among these, the press and sintering segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The cost-effectiveness, efficiency, and capacity to create components with outstanding mechanical qualities and dimensional accuracy are the main reasons for the press and sintering segment. Demand is still being driven, and continued market expansion is supported by the process's scalability and appropriateness for mass manufacturing.

- The engine components segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the automotive powder metallurgy components market is divided into engine components, transmission components, brake components, starter & alternator components, fuel system components, exhaust system components, steering & suspension components, chassis & body parts, and others. Among these, the engine components segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growing need for high-performance, lightweight, and long-lasting engine parts that improve fuel economy and lower emissions is the main driver of the engine components market.

- The original equipment manufacturers segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the automotive powder metallurgy components market is divided into original equipment manufacturers (OEMs), and aftermarket suppliers. Among these, the original equipment manufacturers segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. OEMs' inclination to use premium, lightweight, and reasonably priced powder metallurgy components in the manufacturing of new vehicles in order to improve performance, fuel efficiency, and compliance with strict regulatory standards is the main driver of the original equipment manufacturers (OEMs) segment.

Regional Segment Analysis of the Automotive Powder Metallurgy Components Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the automotive powder metallurgy components market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the automotive powder metallurgy components market over the predicted timeframe. Asia-Pacific is propelled by thriving automotive manufacturing and rising regional demand for lightweight, fuel-efficient automobiles. China, Japan, South Korea, and India are among the major suppliers because of their robust industrial bases, well-established supply chains, and increasing investments in cutting-edge automotive technologies. Adoption of powder metallurgy technology is further aided by advantageous government policies that foster regional manufacturing and environmental sustainability. The region's dominant position in the market is also largely attributed to ongoing technological developments and reasonably priced labor.

North America is expected to grow at a rapid CAGR in the automotive powder metallurgy components market during the forecast period. The growing demand for lightweight, high-performance automotive components and the growing use of modern manufacturing methods are driving North America. The area benefits from a large number of top automakers and tier-1 suppliers as well as active R&D efforts centered on efficient and innovative materials. Investments in clean automotive technologies and government incentives help fuel market expansion. Through ongoing technological developments, the United States and Canada are anticipated to take the lead in regional expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the automotive powder metallurgy components market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TRIS Inc.

- DIAMET CORPORATION

- PORITE CORPORATION

- Sumitomo Electric Sintered Alloy, Ltd.

- Hitachi Chemical Co., Ltd.

- GKN Powder Metallurgy

- Johnson Electric

- Miba

- Mahle Behr

- Kurabe Industries

- PMG Holding GmbH

- Fine Sinter Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, Porous Transport Layers (PTL) for proton exchange membrane (PEM) electrolysis was launched by GKN Powder Metallurgy, a world leader in powder metallurgy and creative, sustainable solutions for industrial and automotive applications. The solution's goal is to transform hydrogen production by lowering its total environmental effect and boosting efficiency.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the automotive powder metallurgy components market based on the below-mentioned segments:

Global Automotive Powder Metallurgy Components Market, By Component Type

- Steel Powder Components

- Aluminum Powder Components

- Copper Powder Components

- Nickel Powder Components

- Magnetic Powders (for EV motors & sensors)

- Graphite-Mixed Powders

- Others

Global Automotive Powder Metallurgy Components Market, By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles

Global Automotive Powder Metallurgy Components Market, By Manufacturing Process

- Press and Sintering

- Metal Injection Molding (MIM)

- Additive Manufacturing

- Hot Isostatic Pressing (HIP)

- Cold Isostatic Pressing

Global Automotive Powder Metallurgy Components Market, By Application

- Engine Components

- Transmission Components

- Brake Components

- Starter & Alternator Components

- Fuel System Components

- Exhaust System Components

- Steering & Suspension Components

- Chassis & Body Parts

- Others

Global Automotive Powder Metallurgy Components Market, By End User

- Original Equipment Manufacturers (OEMs)

- Aftermarket Suppliers

Global Automotive Powder Metallurgy Components Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the automotive powder metallurgy components market over the forecast period?The global automotive powder metallurgy components market is projected to expand at a CAGR of 7.43% during the forecast period.

-

2. What is the market size of the automotive powder metallurgy components market?The global automotive powder metallurgy components market size is expected to grow from USD 2.36 billion in 2024 to USD 5.19 billion by 2035, at a CAGR of 7.43% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the automotive powder metallurgy components market?Asia Pacific is anticipated to hold the largest share of the automotive powder metallurgy components market over the predicted timeframe.

-

4. What is the market size of the global automotive powder metallurgy components Market in 2025?The global automotive powder metallurgy components Market size was estimated USD 2.53 billion in 2025.

-

5. Who are the top 10 companies operating in the global automotive powder metallurgy components market?Key players include TRIS Inc., DIAMET CORPORATION, PORITE CORPORATION, Sumitomo Electric Sintered Alloy, Ltd., Hitachi Chemical Co., Ltd., GKN Powder Metallurgy, Johnson Electric, Miba, Mahle Behr, Kurabe Industries, PMG Holding GmbH, Fine Sinter Co., Ltd., and Others.

-

6. What are the main drivers of growth in the automotive powder metallurgy components market?The main drivers of growth in the automotive powder metallurgy components market include increasing demand for lightweight vehicles, technological advancements, cost-efficient manufacturing, rising electric vehicle adoption, and stringent environmental regulations.

-

7. What are the latest trends in the automotive powder metallurgy components market?The latest trends in the automotive powder metallurgy components market include the integration of additive manufacturing, development of advanced powder materials, increasing use in electric vehicles, and adoption of sustainable, energy-efficient production processes.

-

8. What are the top investment opportunities in the global automotive powder metallurgy components market?The opportunities in the global automotive powder metallurgy components market include advancements in electric vehicle components, expansion of additive manufacturing technologies, development of lightweight materials, and strategic partnerships for sustainable and cost-effective production solutions.

-

9. What challenges are limiting the adoption of automotive powder metallurgy components market?High initial tooling costs, production restrictions for big, complicated parts, variable raw material prices, and competition from well-established alternative manufacturing processes are some of the obstacles impeding the adoption of automotive powder metallurgy components.

-

10. What is the long-term outlook (2025–2035) for the automotive powder metallurgy components market?The long-term outlook for the automotive powder metallurgy components market is positive, driven by growing demand for lightweight, fuel-efficient vehicles, technological advancements, increased electric vehicle production, and stricter environmental regulations globally.

Need help to buy this report?