Global Automotive Lead Acid Battery Separator Market Size, Share, and COVID-19 Impact Analysis, By Types (0.5mm and 0.3mm), By Applications (Conventional Wet Cell Batteries, EFB Batteries, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Automotive Lead Acid Battery Separator Market Size Insights Forecasts to 2035

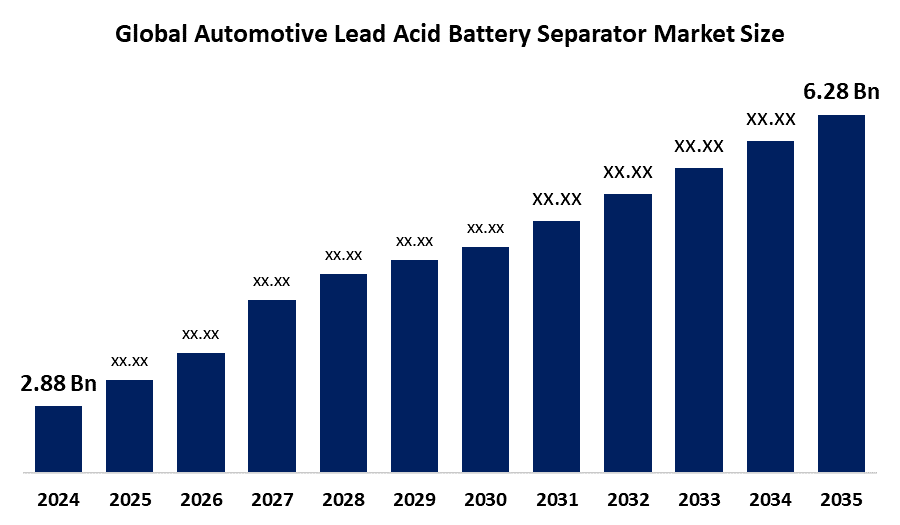

- The Global Automotive Lead Acid Battery Separator Market Size Was Estimated at USD 2.88 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.34% from 2025 to 2035

- The Worldwide Automotive Lead Acid Battery Separator Market Size is Expected to Reach USD 6.28 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Automotive Lead Acid Battery Separator Market Size was worth around USD 2.88 Billion in 2024 and is predicted to Grow to around USD 6.28 Billion by 2035 with a compound annual growth rate (CAGR) of 7.34% from 2025 and 2035. The market for automotive lead acid battery separator has a number of opportunities to grow because of government incentives and ecological programs. The demand for effective battery separators has increased due to the growing global usage of electric vehicles. Further increasing the demand for sophisticated battery separators is the necessity for dependable energy storage solutions brought on by the growth of renewable energy sources like solar and wind power, of smart assistants.

Market Overview

An automotive lead acid battery separator is a nonconductive, porous substance that is positioned between the battery's positive and negative plates. India is one of the largest automobile markets in the world, driving demand for passenger cars, commercial vehicles, and two wheelers. As automobile demand has increased, SLI batteries are also becoming more in demand. Separators play a key role in defining the efficiency, reliability, and safety associated with SLI batteries, which are critical components in ICE vehicles. According to the Society of Indian Automobile Manufacturers, overall automobile production in India for FY 2022-2023 is 28.43 million units, a growth of 7.89% compared to the FY 2019-2020 period and 9.59% compared to the FY 2022-2023 period. Auto manufacturing is poised for further growth as major companies launch significant programs and projects to meet the growing country's demand for vehicles. For instance, in February 2024, Toyota Kirloskar Motor launched its Awesome New Car Delivery Solution. The project aims to streamline vehicle logistics by eliminating the need for dealer staff to drive new vehicles to delivery locations. The program provides consumers access to 130 dealer locations in 26 states around the country in the first phase of the project to respond to regional demand for vehicles.

Governments globally are encouraging the automotive lead-acid battery separator market to expand by enforcing recycling laws, environmental restrictions, and policies promoting sustainable materials. Extended Producer Responsibility, for instance, was adopted by India's Battery Waste Management Rules (2022) and requires producers to collect and recover spent batteries. This increases demand for long-lasting and recyclable separators.

Report Coverage

This research report categorizes the automotive lead acid battery separator market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive lead acid battery separator market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the automotive lead acid battery separator market.

Global Automotive Lead Acid Battery Separator Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.88 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.34% |

| 2035 Value Projection: | USD 6.28 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 173 |

| Tables, Charts & Figures: | 139 |

| Segments covered: | By Types, By Applications and COVID-19 Impact Analysis |

| Companies covered:: | Entek International LLC, Daramic LLC, Toray Industries, Inc., Freudenberg Performance Materials, SK ie Technology Corporation Ltd, Ube Corporation, Hollingsworth & Vose Company, Microporous LLC, Sumitomo Chemical Co., Ltd., Exide Technologies, East Penn Manufacturing Co., GS Yuasa Corporation, Amara Raja Batteries Ltd., Leoch International Technology Ltd., HBL Power Systems Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The automotive lead acid battery separator market is driven by the ongoing need for lead acid batteries in a variety of automotive applications, especially in developing economies and the market for older car replacements. Lead acid batteries are still affordable and widely accessible, therefore there will continue to be a need for separators for some time to come, even though the switch to other battery technologies like lithium ion is already under way. The market is divided into segments according to battery type, geographic location, and separator material type, e.g., microporous polyethylene, microporous polypropylene. In order to improve separator performance in terms of thermal stability, leak resistance, and overall battery longevity, key manufacturers are concentrating on material science innovation.

Restraining Factors

The automotive lead acid battery separator market is restricted by factors like the competition from other battery technologies, especially lithium-ion batteries, which need less weight and have a higher energy density. As producers shift their focus more and more to these substitutes, the market share of conventional lead acid batteries can decrease.

Market Segmentation

The automotive lead acid battery separator market share is classified into types and applications.

- The 0.5mm segment dominated the market in 2024, accounting for approximately 64.7%, and is projected to grow at a substantial CAGR during the forecast period.

Based on the types, the automotive lead acid battery separator market is divided into 0.5mm and 0.3mm. Among these, the 0.5mm segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is because of its suitability for high performance battery applications and its unique mechanical strength and durability. It is the recommended choice for most conventional and heavy-duty vehicles because of its superior puncture resistance and longer battery life.

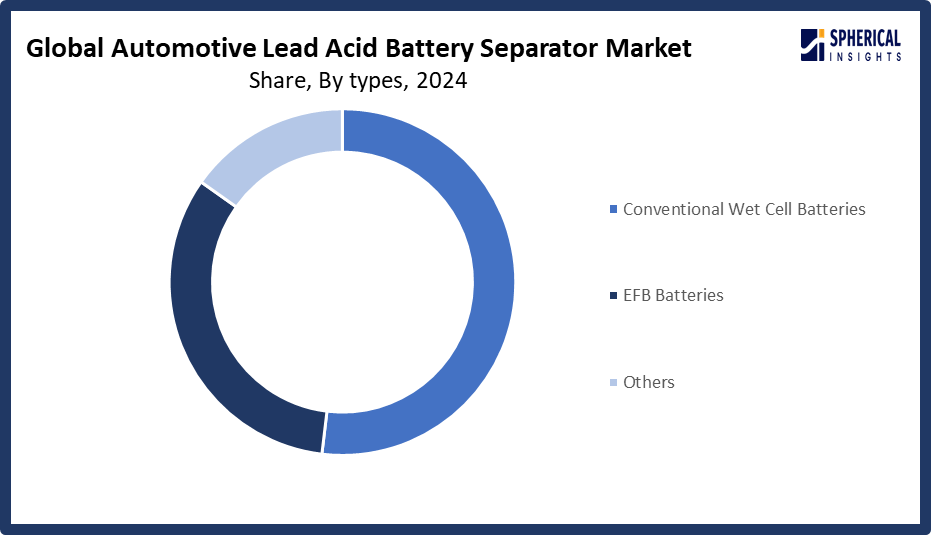

- The conventional wet cell batteries segment accounted for the largest share in 2024, accounting for approximately 52% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the automotive lead acid battery separator market is divided into conventional wet cell batteries, EFB batteries, and others. Among these, the conventional wet cell batteries segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to their widespread use in entry level and mid range cars, low price, existing infrastructure, and significant demand for spare parts, particularly in developing countries where reliability and low price are still paramount.

Get more details on this report -

Regional Segment Analysis of the Automotive Lead Acid Battery Separator Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share, representing nearly 40% of the automotive lead acid battery separator market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share, representing nearly 7.53% of the automotive lead acid battery separator market over the predicted timeframe. In the Asia Pacific market, the is rising due to the rising need for affordable energy storage solutions, the expansion of the automotive aftermarket, and the growth in vehicle production. The developing economies, including China, India, and Southeast Asia, continue to exhibit especially strong growth.

China's large automotive manufacturing base, high vehicle sales, robust battery recycling infrastructure, and government backing for energy storage and battery production in both domestic and export markets have made it the market leader in the APAC automotive lead acid battery separator.

North America is expected to grow at a rapid CAGR, representing nearly 25% in the automotive lead acid battery separator market during the forecast period. The North American area has a thriving market for automotive lead acid battery separators due to its strong demand for replacement batteries, high vehicle ownership rates, and a mature automotive industry. In addition, environmental regulations and technology advancements ensure that lead acid battery systems will be sustained over time.

The United States leads the automotive lead acid battery separator market because of its extensive fleet of vehicles, high need for replacement batteries, sophisticated infrastructure for battery manufacturing, and continuous expenditures in energy storage and automotive technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the automotive lead acid battery separator market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Entek International LLC

- Daramic LLC

- Toray Industries, Inc.

- Freudenberg Performance Materials

- SK ie Technology Corporation Ltd

- Ube Corporation

- Hollingsworth & Vose Company

- Microporous LLC

- Sumitomo Chemical Co., Ltd.

- Exide Technologies

- East Penn Manufacturing Co.

- GS Yuasa Corporation

- Amara Raja Batteries Ltd.

- Leoch International Technology Ltd.

- HBL Power Systems Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Entek announces a significant investment in its manufacturing capacity.

- In July 2025, Diversified global manufacturer Asahi Kasei and Toyota Tsusho established a strategic partnership for the supply of automotive lithium ion battery separators in North America.

- In April 2024, Honda Motor Co. Ltd announced a significant partnership with Asahi Kasei Corporation to manufacture lead acid battery separators specifically designed for automobile SLI (Starting, Lighting, and Ignition) batteries in Canada. The companies are preparing to establish a joint venture by the end of 2024.

- In July 2024, Exide unveiled its advanced SLI-AGM battery, which targets the automotive sector. The AGM technology based lead acid battery is now recognized as a premium choice, offering dependable starting power, enhanced durability, and a longer lifespan than traditional lead-acid counterparts. Such innovations are anticipated to boost the demand for battery separators in the market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the automotive lead acid battery separator market based on the below-mentioned segments:

Global Automotive Lead Acid Battery Separator Market, By Types

- 0.5mm

- 0.3mm

Global Automotive Lead Acid Battery Separator Market, By Application

- Conventional Wet Cell Batteries

- EFB Batteries

- Others

Global Automotive Lead Acid Battery Separator Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the automotive lead acid battery separator market over the forecast period?The global automotive lead acid battery separator market is projected to expand at a CAGR of 7.34% during the forecast period.

-

2. What is the market size of the automotive lead acid battery separator market?The global automotive lead acid battery separator market size is expected to grow from USD 2.88 Billion in 2024 to USD 6.28 Billion by 2035, at a CAGR of 7.34% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the automotive lead acid battery separator market?Asia Pacific is anticipated to hold the largest share of the automotive lead acid battery separator market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global automotive lead acid battery separator market?Entek International LLC, Daramic LLC, Toray Industries, Inc., Freudenberg Performance Materials, SK ie Technology Corporation Ltd, Ube Corporation, Hollingsworth & Vose Company, Microporous LLC, Sumitomo Chemical Co., Ltd., Exide Technologies, East Penn Manufacturing Co., GS Yuasa Corporation, Amara Raja Batteries Ltd., Leoch International Technology Ltd., HBL Power Systems Ltd., and Others.

-

5. What factors are driving the growth of the automotive lead acid battery separator market?The automotive lead acid battery separator market growth is driven due to the growing global use of electric vehicles, which is being fueled by government incentives and sustainability programs. Advanced battery separators are also becoming more and more necessary as a result of the growth of renewable energy sources like solar and wind power, which call for dependable energy storage solutions.

-

6. What are the market trends in the automotive lead acid battery separator market?The automotive lead acid battery separator market trends include advancements in separator materials, rising demand for enhanced flooded batteries, shift towards lightweight and high performance separators, growth in renewable energy storage, and regulatory support for sustainable practices.

-

7. What are the main challenges restricting wider adoption of the automotive lead acid battery separator market?The automotive lead acid battery separator market trends include price fluctuations for raw materials affect production stability and profit margins, especially for polyethylene and lead. Investment in lead acid batteries is being redirected into solid state and lithium ion battery technologies.

Need help to buy this report?