Global Automotive In-Cabin Sensing Technology Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Camera‑based Systems, Infrared Sensors, Ultrasonic Sensors, Capacitive Sensors, and Radar/TOF (Time‑of‑Flight)), By Application (Driver Monitoring Systems (DMS), Occupant Monitoring Systems (OMS), Child Presence Detection, Gesture Recognition/Interaction, Environmental/Cabin Condition Sensing, and Voice/Conversation Assistance), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Automotive & TransportationGlobal Automotive In-Cabin Sensing Technology Market Size Insights Forecasts to 2035

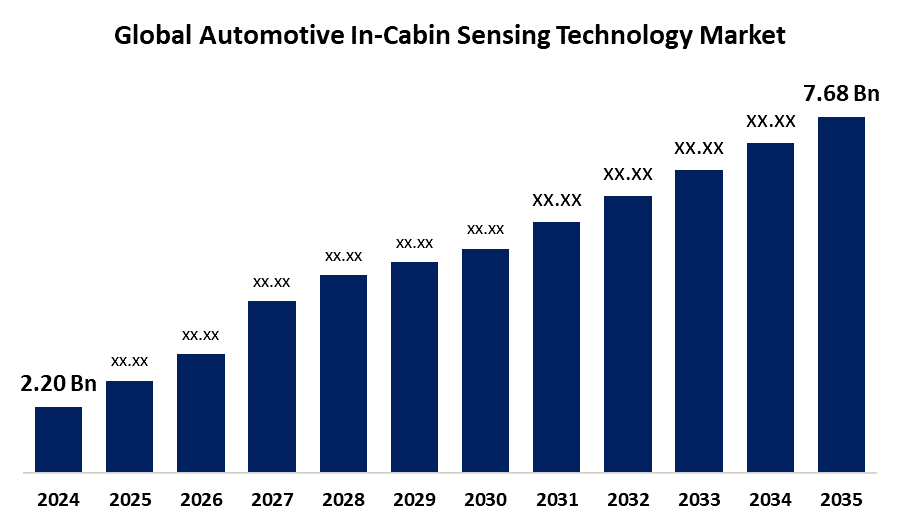

- The Global Automotive In-Cabin Sensing Technology Market Size Was Estimated at USD 2.20 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.04% from 2025 to 2035

- The Worldwide Automotive In-Cabin Sensing Technology Market Size is Expected to Reach USD 7.68 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Automotive In Cabin Sensing Technology Market Size was worth around USD 2.20 Billion in 2024 and is predicted to Grow to around USD 7.68 Billion by 2035 with a compound annual growth rate (CAGR) of 12.04% from 2025 to 2035. The market for automotive in-cabin sensing technology is being driven by strict international safety standards, ADAS adoption, and the growing desire for improved vehicle safety. Government regulations and an increase in traffic accidents encourage the use of occupant detection and driver monitoring devices.

Market Overview

The global automotive in-cabin sensing technology market refers to the systems that use sensors and cameras to monitor car passengers and interior conditions, improving safety, comfort, and convenience with features such as driver monitoring and occupant detection. The increased need for improved safety, comfort, and customised in car experiences is driving the market for automotive in-cabin sensing technology. These systems keep an eye on passenger conditions, driver behaviour, and the environment around the car using sophisticated sensors, cameras, and AI analytics. Key features that increase convenience and safety include gesture control, occupant detection, driver monitoring, facial recognition, and mood recognition. Adoption is being fuelled by improved autonomous driving capabilities, stricter safety laws, and increased awareness of driver attention and exhaustion. AI enables real-time analysis and reactions for Driver Monitoring Systems (DMS), which detect attentiveness, head posture, and eye movements. Passenger comfort is further improved by amenities like customised seating and climate control.

Innovations in AI, radar, 3D cameras, and sensor fusion are propelling the market for automotive in-cabin sensing technologies in 2025. Vehicle safety, customisation, and adherence to changing rules are all being improved by this technology. At CES 2025 in 2024, LG Electronics showcased its AI powered in cabin sensing system, focusing on occupant comfort and safety with cutting edge Vision AI technology. Furthermore, Seeing Machines and Airy3D introduced next-generation 3D camera technology that combines 5MP RGB and infrared images into a single sensor for accurate eye tracking and in cabin monitoring.

Report Coverage

This research report categorizes the automotive in-cabin sensing technology market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive in-cabin sensing technology market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the automotive in cabin sensing technology market.

Global Automotive In-Cabin Sensing Technology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.20 Billion |

| Forecast Period: | 2025-2035 |

| 2035 Value Projection: | USD 7.68 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 175 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Valeo, Robert Bosch GmbH, Continental AG, Denso Corporation, Magna International Inc., Aptiv PLC, ZF Friedrichshafen AG, Faurecia S.A., Gentex Corporation, Hyundai Mobis, Visteon Corporation, Panasonic Corporation, Harman International Industries, Inc., NXP Semiconductors N.V., Analog Devices, Inc., OmniVision Technologies, Inc., Smart Eye AB, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing production and use of autonomous vehicles are a major factor propelling the growth of the automotive in-cabin sensing market. For the safety, comfort, and privacy of the driver and passengers, these cars rely on cutting-edge sensing technologies. The increasing focus on vehicle safety requirements and partnerships among technology providers is a major driver of the automotive in-cabin sensor technology industry. Advanced driver assistance systems (ADAS), many of which rely on in-cabin sensing technology, were to be integrated by July 2024 to comply with the EU's New Vehicle General Safety Regulation (GSR2). Furthermore, alliances like the one between LG Electronics and Ambarella to include its CV25 AI SoC into Driver Monitoring Systems (DMS) are helping automakers produce safer, smarter cars, which is driving market expansion.

Restraining Factors

The market for automotive in-cabin sensing is constrained by issues like a lack of standardization, privacy concerns, and expensive integration costs. Adoption is further complicated by increased cybersecurity dangers, sensor dependability in a variety of situations, and technical difficulties in system integration. Despite growing demand for sophisticated safety and monitoring technologies, these limitations restrict widespread adoption across vehicle categories, delaying market growth.

Market Segmentation

The Automotive In Cabin Sensing Technology market share is classified into product type and application.

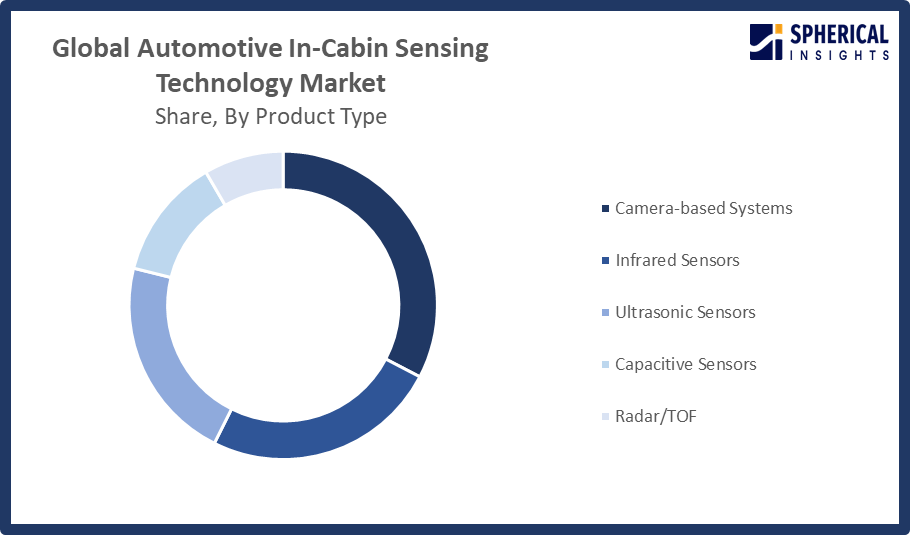

- The camer based systems segment dominated the market in 2024, and is projected to grow at a substantial CAGR of around 9.7% during the forecast period.

Based on the product type, the automotive in-cabin sensing technology market is divided into camera based systems, infrared sensors, ultrasonic sensors, capacitive sensors, and radar/TOF. Among these, the camera based systems segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Their great accuracy in occupant detection, facial recognition, and driver behaviour monitoring, all essential for ADAS integration and safety compliance, is the reason for their supremacy. Demand is further accelerated by growing use in both luxury and mass market automobiles, as well as by laws like the EUs GSR2, which requires driver monitoring devices.

Get more details on this report -

- The driver monitoring systems segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR of around 8.6% during the forecast period.

Based on the application, the automotive in-cabin sensing technology market is divided into driver monitoring systems, occupant monitoring systems, child presence detection, gesture recognition/interaction, environmental/cabin condition sensing, and voice/conversation assistance. Among these, the driver monitoring systems segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The most important use is driver monitoring systems, which strive to improve vehicle safety by tracking the condition of the driver. These devices employ a mix of sensors and cameras to identify indications of weariness, inattention, or other potentially harmful behaviours. One of the main areas of market growth is driver monitoring systems, which are being used as a result of growing awareness of the risks associated with distracted and sleepy driving. The EUs GSR2 requirement, which mandates the inclusion of advanced driver monitoring systems to identify fatigue, attention, and sleepiness, is one of the strict safety laws that are largely responsible for this supremacy. Further driving the need are an increase in traffic accidents and the expanding use of ADAS.

Regional Segment Analysis of the Automotive In-Cabin Sensing Technology Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share with approximately 42.5% of the Automotive In-Cabin Sensing Technology market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the automotive in-cabin sensing technology market over the predicted timeframe. Driven by strict safety laws and a strong desire among consumers for cutting-edge car amenities. The area is home to several top automakers and tech companies, which have accelerated the uptake of in-cabin sensing systems. One significant market that places a high priority on improving vehicle comfort and safety is the United States. It is anticipated that the North American market will continue to rise due to the presence of a strong automotive sector and constant research and development efforts. In the US, the automotive in-cabin sensing market is expanding due to strict safety regulations and growing consumer demand for advanced driver monitoring and personalized in-car experiences.

Asia Pacific is expected to grow market share at a rapid CAGR of around 9.1% in the automotive in-cabin sensing technology market during the forecast period. This is mostly because increasing attention is being paid to enhancing vehicle safety. The need for personalised in-car experiences is very high. Regional market growth is facilitated by the automotive industry's explosive growth, the growing demand for smart and connected car technologies, safe and supportive government regulations, and increased automotive production. Furthermore, the growing use of cutting-edge technology to improve vehicle safety is anticipated to accelerate the expansion of the Asia Pacific in-cabin sensing market. The market for automotive in-cabin sensing is expanding quickly in India as a result of increased ADAS use, growing vehicle production, and government programs that support smart mobility and vehicle safety. The extensive use of connected vehicle technology, significant investments in autonomous vehicle development, and strong customer demand for cutting-edge in-car comfort and safety features are driving market expansion in China.

Europe is expected to grow at a rapid CAGR in the automotive in-cabin sensing technology market during the forecast period. Government rules and safety standards, the growing use of sophisticated technologies with high sensing capabilities, the growing demand for driver monitoring systems (DMS), and the growing desire for autonomous vehicles are all factors contributing to the expansion of the European in-cabin sensing market. Market expansion is supported by the rising demand for cutting-edge safety features in automobiles. To increase automation and boost vehicle safety, European automakers are concentrating on the development of advanced driver assistance systems (ADAS). Furthermore, strict laws promoting ADAS help the business expand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the automotive in-cabin sensing technology market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Valeo

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Magna International Inc.

- Aptiv PLC

- ZF Friedrichshafen AG

- Faurecia S.A.

- Gentex Corporation

- Hyundai Mobis

- Visteon Corporation

- Panasonic Corporation

- Harman International Industries, Inc.

- NXP Semiconductors N.V.

- Analog Devices, Inc.

- OmniVision Technologies, Inc.

- Smart Eye AB

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, Seeing Machines and Airy3D launched a next generation 3D camera for in cabin monitoring. It combines 3D depth, 5MP RGB, and infrared imaging, supporting eye tracking across the full cabin field of view

- In January 2025, Hyundai Mobis unveiled a behaviour-aware in-cabin monitoring system that tracks front/rear seat posture, detects mobile usage, checks seat belts, and helps prevent unsafe actions (e.g. driver distraction, children unbuckled) across seats.

- In December 2024, LG Electronics introduced its AI In Vehicle Experience an in cabin sensing solution at CES 2025. It includes Driver Monitoring (DMS) & Driver Interior Monitoring (DIMS) systems using Vision AI to assess occupant safety, health, and emotional state.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the automotive in cabin sensing technology market based on the below mentioned segments:

Global Automotive In Cabin Sensing Technology Market, By Product Type

- Camera based Systems

- Infrared Sensors

- Ultrasonic Sensors

- Capacitive Sensors

- Radar/TOF

Global Automotive In-Cabin Sensing Technology Market, By Application

- Driver Monitoring Systems (DMS)

- Occupant Monitoring Systems (OMS)

- Child Presence Detection

- Gesture Recognition/Interaction

- Environmental/Cabin Condition Sensing

- Voice/Conversation Assistance

Global Automotive In Cabin Sensing Technology Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Automotive In-Cabin Sensing Technology market over the forecast period?The global Automotive In-Cabin Sensing Technology market is projected to expand at a CAGR of 12.04% during the forecast period.

-

2. What is the market size of the Automotive In-Cabin Sensing Technology market?The global Automotive In-Cabin Sensing Technology market size is expected to grow from USD 2.20 Billion in 2024 to USD 7.68 Billion by 2035, at a CAGR of 12.04% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Automotive In-Cabin Sensing Technology market?North America is anticipated to hold the largest share of the Automotive In-Cabin Sensing Technology market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global Automotive In-Cabin Sensing Technology market?Valeo, Robert Bosch GmbH, Continental AG, Denso Corporation, Magna International Inc., Aptiv PLC, ZF Friedrichshafen AG, Faurecia S.A., Gentex Corporation, and Hyundai Mobis.

-

5. What factors are driving the growth of the Automotive In-Cabin Sensing Technology market?Stricter government safety regulations, growing emphasis on personalised in-car experiences, growing demand for improved vehicle safety, growing adoption of advanced driver-assistance systems (ADAS), and quick developments in artificial intelligence (AI), sensor technologies, and connected vehicle systems are all factors propelling the growth of the automotive in-cabin sensing technology market.

-

6. What are the market trends in the Automotive In-Cabin Sensing Technology market?The use of AI-powered driver monitoring, the combination of 3D cameras and sensor fusion, the increasing emphasis on occupant comfort, gesture recognition, voice assistance, and the growing integration in connected and autonomous vehicles are some of the major trends in the automotive in-cabin sensing technology market.

-

7. What are the main challenges restricting wider adoption of the Automotive In-Cabin Sensing Technology market?The primary obstacles that prevent widespread use across all vehicle segments include high integration costs, privacy issues over monitoring, difficult system compatibility, lack of standardisation, sensor reliability under various situations, and cybersecurity dangers.

Need help to buy this report?