Global Automotive Gearbox Market Size, Share, and COVID-19 Impact Analysis, By Gearbox Type (Manual Transmission (MT), Intelligent Manual Transmission (IMT), Automated Manual Transmission (AMT), Automatic Transmission (AT), Continuously Variable Transmission (CVT), and Dual Clutch Transmission (DCT)), By Fuel Type (IC, HEV, and BEV), By Vehicle Type (Hatchback/Sedan, SUVs, LCV, and HCV), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Gearbox Market Insights Forecasts to 2033

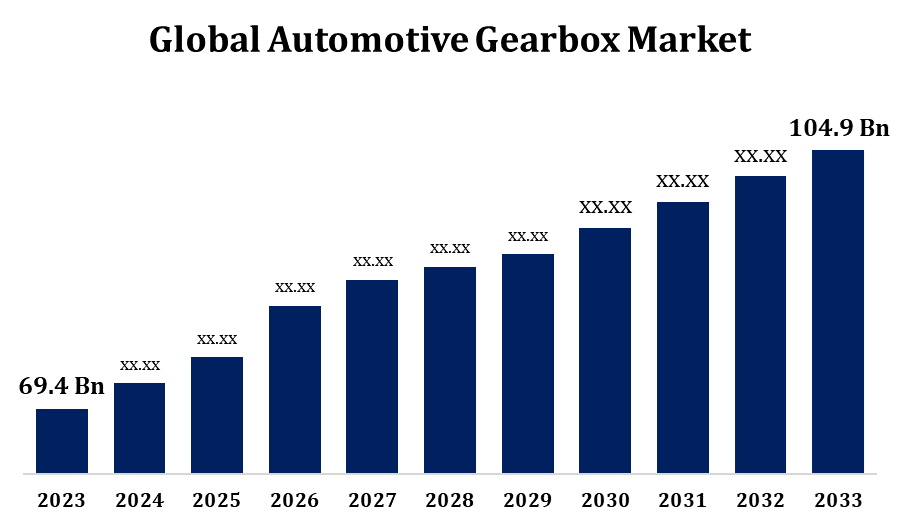

- The Automotive Gearbox Market Size Was Valued at USD 69.4 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.22% from 2023 to 2033.

- The Global Automotive Gearbox Market Size is Expected to reach USD 104.9 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the Forecast period.

Get more details on this report -

The Global Automotive Gearbox Market Size is Expected to reach USD 104.9 Billion by 2033, at a CAGR of 4.22% during the Forecast period 2023 to 2033.

The automotive gearbox market is experiencing steady growth, driven by increasing vehicle production and the rising demand for enhanced driving experiences. Gearboxes, essential for transmitting power from the engine to the wheels, are evolving with advancements in technology, such as automated manual transmissions (AMTs) and continuously variable transmissions (CVTs). Rising consumer preference for fuel-efficient and high-performance vehicles is boosting demand for sophisticated gearbox systems. Electric vehicles (EVs) are also influencing market dynamics, leading to innovations in single-speed and multi-speed transmissions. Asia-Pacific dominates the market due to high automotive production in countries like China, Japan, and India, while Europe and North America continue to invest heavily in advanced gearbox technologies. Key players are focusing on lightweight materials, improved durability, and smarter integration to meet stricter emission norms and changing consumer expectations.

Automotive Gearbox Market Value Chain Analysis

The automotive gearbox market value chain involves several critical stages, starting with raw material suppliers providing metals, alloys, and electronic components. Manufacturers then design and produce gearbox components such as gears, shafts, and casings, integrating advanced technologies for better performance. These components are assembled into complete gearbox units by OEMs (Original Equipment Manufacturers) or specialized suppliers. System integrators ensure that gearboxes align with vehicle designs and performance requirements. Distribution channels, including authorized dealers and aftermarket suppliers, deliver gearboxes to automakers and end-users. Aftermarket services, such as maintenance, repairs, and upgrades, also play a key role in the value chain. Research and development activities by technology providers and manufacturers are crucial for innovation, focusing on efficiency, lightweight materials, and sustainability to meet evolving automotive industry trends and regulatory standards.

Automotive Gearbox Market Opportunity Analysis

The automotive gearbox market presents significant opportunities fueled by technological advancements and shifting industry trends. The growing adoption of electric and hybrid vehicles is creating demand for innovative gearbox solutions, such as multi-speed transmissions tailored for electric drivetrains. Increasing consumer preference for vehicles offering smoother performance, better fuel efficiency, and reduced emissions is driving the need for advanced gearbox systems like dual-clutch and automated manual transmissions. Emerging markets, particularly in Asia-Pacific, are experiencing rapid vehicle production growth, providing further expansion prospects. Additionally, the trend toward lightweight materials and smart, electronically controlled gearboxes aligns with global efforts to improve energy efficiency and meet stricter emission regulations. Companies investing in research and development, as well as strategic partnerships, are well-positioned to capitalize on the evolving needs of the automotive sector.

Global Automotive Gearbox Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 69.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.22% |

| 2033 Value Projection: | USD 104.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Gearbox Type, By Fuel Type, By Vehicle Type, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Getrag, Hyundai Powertech, BorgWarner, Driveline Systems International, Allison Transmission, Jatco, Dana, Aisin Seiki, Eaton, Ricardo, Oerlikon Graziano, ZF, Magna, Schaeffler, AVL List GmbH, and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Automotive Gearbox Market Dynamics

The growing adoption of EVs equipped with advanced transmission systems

The growing adoption of electric vehicles (EVs) equipped with advanced transmission systems is significantly driving the expansion of the automotive gearbox market. As EV technology evolves, manufacturers are increasingly integrating multi-speed transmissions and innovative drive systems to enhance vehicle efficiency, performance, and range. Traditional single-speed setups are being supplemented with advanced gear mechanisms to meet the diverse requirements of high-performance and commercial electric vehicles. This shift is creating new demand for specialized gearbox designs that are lightweight, compact, and highly efficient. Additionally, the push for greater energy efficiency and improved driving dynamics is encouraging continuous research and development in transmission technologies. With governments worldwide promoting electric mobility and stricter emission regulations coming into force, the automotive gearbox sector is witnessing a surge in opportunities to develop next-generation solutions tailored for the electric mobility era.

Restraints & Challenges

The automotive gearbox market faces several challenges that could impact its growth. The rise of electric vehicles, which often require simpler transmission systems, is reducing the demand for traditional gearboxes. High production and maintenance costs of advanced gear systems can also deter adoption, especially in price-sensitive markets. Integrating modern, high-performance gearboxes into vehicles demands complex engineering and advanced manufacturing capabilities, leading to higher development costs. Fluctuations in raw material prices and ongoing supply chain disruptions further strain production processes and profitability. Additionally, strict environmental regulations push manufacturers to develop lightweight and energy-efficient gearbox solutions, increasing pressure on innovation. The emergence of alternative propulsion technologies, such as direct drive systems, also poses a threat to traditional gearbox designs. Addressing these challenges is crucial for sustaining competitiveness in the evolving automotive industry landscape.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Automotive Gearbox Market from 2023 to 2033. The increasing adoption of automatic, dual-clutch, and continuously variable transmissions reflects consumer preferences for enhanced driving comfort and fuel efficiency. Technological advancements, such as the integration of electronic controls and lightweight materials, are further propelling market expansion. However, the market faces challenges, including supply chain disruptions and trade uncertainties, which can impact production and profitability. Despite these hurdles, the presence of major automotive manufacturers and ongoing investments in research and development position North America as a significant player in the global automotive gearbox industry.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific automotive gearbox market is experiencing robust growth, driven by increasing vehicle production, rising demand for fuel-efficient transmissions, and the rapid adoption of electric and hybrid vehicles. Countries like China, India, Japan, and South Korea are central to this expansion, supported by strong manufacturing infrastructure and favorable government policies promoting cleaner mobility solutions. Consumers are increasingly favoring automatic, dual-clutch, and continuously variable transmissions (CVTs) for their enhanced comfort and efficiency. Technological advancements, including lightweight materials and smart electronic controls, are further propelling the market.

Segmentation Analysis

Insights by Gearbox Type

The automatic transmission (AT) segment accounted for the largest market share over the forecast period 2023 to 2033. This preference is particularly evident in urban areas, where stop-and-go traffic makes manual gear shifting less desirable. Technological advancements, such as the integration of electronic controls and lightweight materials, have further enhanced the performance and appeal of automatic transmissions. Additionally, the rise of electric and hybrid vehicles has led to the development of specialized automatic transmission systems, including single-speed and dual-clutch transmissions, to meet the unique requirements of these powertrains. As a result, the AT segment is expected to maintain its leading position in the automotive gearbox market in the coming years.

Insights by Fuel Type

The ICE segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is due to their established infrastructure, affordability, and consumer familiarity. Manufacturers are focusing on improving ICE efficiency with innovations such as smaller, more fuel-efficient engines and hybrid systems. Companies like Toyota are developing engines capable of running on multiple fuels, including carbon-neutral options, while major automakers like General Motors are ramping up production of ICE transmission components. This demonstrates sustained demand for traditional gearbox systems, especially in specific markets and vehicle categories where EV adoption is slower. As a result, the ICE segment remains crucial in the automotive gearbox industry, even as electric mobility gains momentum.

Insights by Vehicle Type

The SUV segment accounted for the largest market share over the forecast period 2023 to 2033. SUVs are becoming a preferred choice due to their higher ground clearance, larger cabin space, and enhanced performance capabilities. As more consumers shift toward SUVs, the demand for advanced gearbox solutions has risen, particularly for automatic and dual-clutch transmissions that can handle the increased power and weight of these vehicles. The growing popularity of SUVs is encouraging manufacturers to innovate and integrate specialized transmission systems to meet the unique requirements of this segment. Additionally, the trend toward more fuel-efficient and performance-oriented SUVs is further propelling the demand for sophisticated gearbox technologies tailored to enhance driving experiences.

Recent Market Developments

- In April 2024, Stellantis introduced its new electrified dual-clutch transmission (eDCT) at the Mirafiori Automotive Park in Italy. The company also announced plans to invest around USD 267 million in the site and the Italian automotive industry, aiming to develop the Mirafiori Automotive Park 2030.

Competitive Landscape

Major players in the market

- Getrag

- Hyundai Powertech

- BorgWarner

- Driveline Systems International

- Allison Transmission

- Jatco

- Dana

- Aisin Seiki

- Eaton

- Ricardo

- Oerlikon Graziano

- ZF

- Magna

- Schaeffler

- AVL List GmbH

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Gearbox Market, Gearbox Type Analysis

- Manual Transmission (MT)

- Intelligent Manual Transmission (IMT)

- Automated Manual Transmission (AMT)

- Automatic Transmission (AT)

- Continuously Variable Transmission (CVT)

- Dual Clutch Transmission (DCT)

Automotive Gearbox Market, Fuel Type Analysis

- IC

- HEV

- BEV

Automotive Gearbox Market, Vehicle Type Analysis

- Hatchback/Sedan

- SUVs

- LCV

- HCV

Automotive Gearbox Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automotive Gearbox Market?The global Automotive Gearbox Market is expected to grow from USD 69.4 billion in 2023 to USD 104.9 billion by 2033, at a CAGR of 4.22% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automotive Gearbox Market?Some of the key market players of the market are Getrag, Hyundai Powertech, BorgWarner, Driveline Systems International, Allison Transmission, Jatco, Dana, Aisin Seiki, Eaton, Ricardo, Oerlikon Graziano, ZF, Magna, Schaeffler, AVL List GmbH.

-

3. Which segment holds the largest market share?The SUVs segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?