Global Automotive Gear Oil Market Size, Share, and COVID-19 Impact Analysis, By Base Oil Type (Mineral Oil, Synthetic Oil, and Semi-Synthetic Oil), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), By Application (Standard, Heavy Duty, Racing, and Off-Highway), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Automotive Gear Oil Market Insights Forecasts to 2035

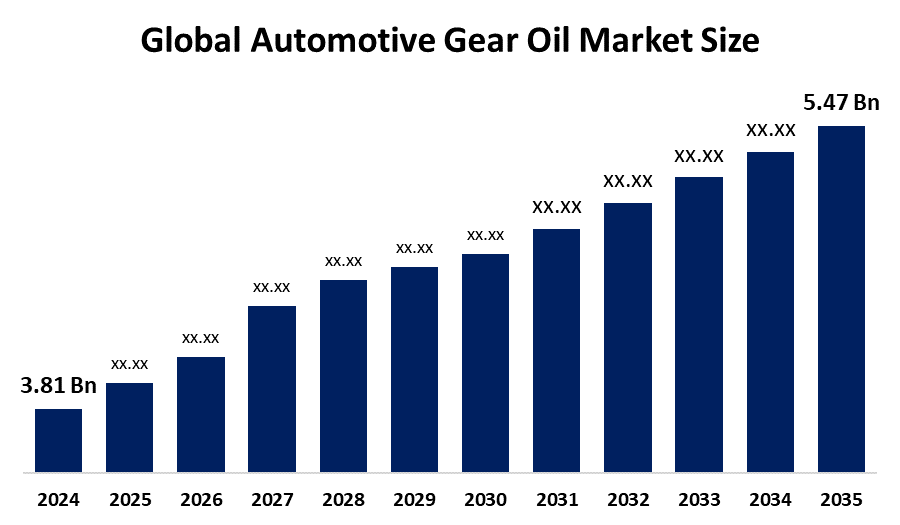

- The Global Automotive Gear Oil Market Size Was Estimated at USD 3.81 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.34% from 2025 to 2035

- The Worldwide Automotive Gear Oil Market Size is Expected to Reach USD 5.47 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global automotive gear oil market size was worth around USD 3.81 billion in 2024 and is predicted to grow to around USD 5.47 billion by 2035 with a compound annual growth rate (CAGR) of 3.34% from 2025 to 2035. The development of the automotive gear oil market is fueled by the expansion of vehicle manufacturing, growth in demand for commercial vehicles, technological developments in gear system technologies, and the demand for effective lubrication for improving performance, minimizing wear, and maximizing vehicle lifespan.

Market Overview

The global automotive gear oil market refers to the industry of producing and selling specialized lubrication for car gear systems, including manual transmissions, differentials, and transfer cases. Gear oil plays a key role in reducing friction, preventing wear, and ensuring smooth gear shifting under high-pressure and temperature conditions. It plays a crucial role in the performance and durability of commercial and passenger cars. The market is subject to steady growth due to increased vehicle production, particularly in the developing economies, and greater demand for fuel-efficient and durable vehicles. Progress of the transportation and logistics sectors, coupled with a greater preference for personal transport, also has its role to play in the greater consumption of gear oil. Technological innovations such as synthetic and semi-synthetic gear oils, which are superior in quality and have longer oil change intervals, are changing the character of the market.

Opportunities lie in the growth of electric and hybrid vehicles, while those vehicles, despite requiring less traditional gear oil, are driving the development of new types of lubricants. Major industry players such as ExxonMobil, Shell, Chevron, BP, and TotalEnergies are investing in R&D to develop sophisticated formulas that meet the requirements of modern high-performance transmissions. These developments are supported by the evolving OEM specifications and the shift to environmentally friendly lubricants. On 21 January 2025, the European Automobile Manufacturers' Association (ACEA) published new lubricant specifications for cars and heavy-duty machinery engines. The new oil specifications, which go into effect towards the end of 2025, are intended to ensure the quality, performance, and compatibility of lubricants in trucks, buses, tractors, and other equipment. The standards are revised over a period of time to make them industry-specific.

Report Coverage

This research report categorizes the automotive gear oil market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive gear oil market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the automotive gear oil market.

Global Automotive Gear Oil Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.81 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.34% |

| 2035 Value Projection: | USD 5.47 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 122 |

| Companies covered:: | ExxonMobil, Chevron Corporation, TotalEnergies, Shell, Valvoline Inc., BP p.l.c., Idemitsu Kosan Co., Ltd., Gazprom Energoholding LLC, Fuchs Petrolub SE, LUKOIL, Indian Oil Corporation Limited, ENEOS Corporation, Gulf Oil Corporation Limited, Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The automotive gear oil market is spurred by rising global vehicle manufacturing, particularly in emerging markets, which increases demand for performance lubricants. Increased demand for efficient and long-lasting cars urges the adoption of high-tech gear oils such as semi-synthetic and synthetic ones. Expanding transportation and logistics industries also drive consumption. Advances in technology, enhancing the efficiency of gear oils, and increasing the service life of oils also aid in market development. Moreover, government regulations imposing stricter standards for lubricant quality and emissions contribute to driving innovation and adoption. Growing demand for electric and hybrid vehicles, requiring specialized lubricants, presents new opportunities, collectively propelling the automotive gear oil market forward.

Restraining Factors

The automotive gear oil market is confronted with constraints from volatile raw materials and petroleum prices, rising costs of production, and environmental issues with chemical additives. Over-regulation of lubricant formulations and waste disposal, coupled with competition from substitute technologies and electric vehicles that need less conventional gear oil, constrain market growth and adoption levels.

Market Segmentation

The automotive gear oil market share is classified into base oil type, vehicle type, and application.

- The synthetic oil segment dominated the market in 2024, approximately 48% and is projected to grow at a substantial CAGR during the forecast period.

Based on the base oil type, the automotive gear oil market is divided into mineral oil, synthetic oil, and semi-synthetic oil. Among these, the synthetic oil segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. This segment is dominated owing to its better characteristics, such as improved thermal stability, oxidation resistance, and lubrication efficiency. These characteristics result in improved oil life, less engine wear, and improved fuel efficiency. Moreover, stringent environmental regulations and the rising demand for electric and high-performance vehicles also contribute to the use of synthetic gear oils across the world.

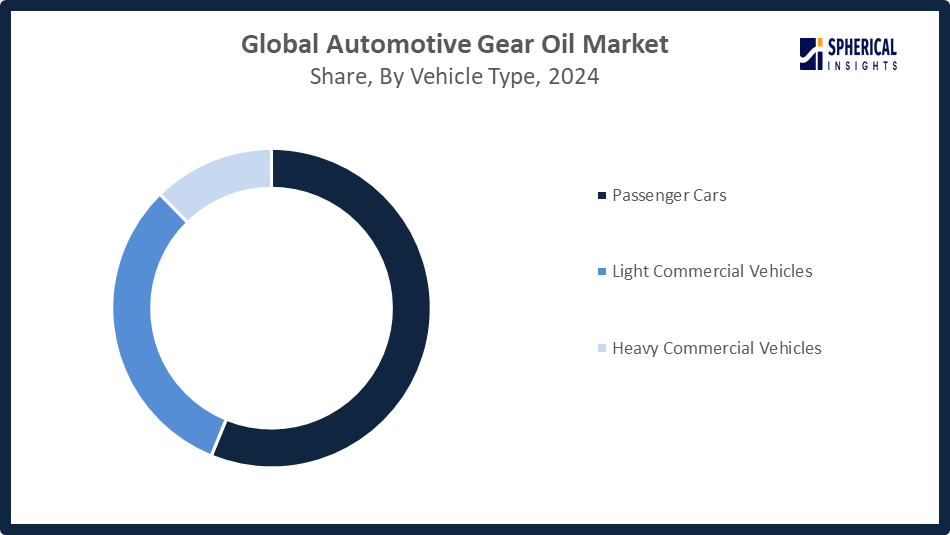

- The passenger cars segment accounted for the largest share in 2024, approximately 56% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the vehicle type, the automotive gear oil market is divided into passenger cars, light commercial vehicles, and heavy commercial vehicles. Among these, the passenger cars segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The passenger cars segment dominated with increasing vehicle manufacturing, enhancing consumer demand for personal mobility, and technological upgrades in cars necessitating good-quality gear oils. Moreover, increasing urbanization, disposable incomes, and regulatory pressures are leading to fuel-efficient lubricants, driving demand further to propel growth in the segment.

Get more details on this report -

- The standard segment accounted for the highest market revenue in 2024, approximately 50% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the automotive gear oil market is divided into standard, heavy duty, racing, and off-highway. Among these, the standard segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The standard segment is growing due to its extensive application in daily vehicles, affordability, and applicability in a wide variety of automotive gear systems. Rising demand for dependable, cheap lubricants in passenger and commercial vehicles further propels growth in this segment.

- Regional Segment Analysis of the Automotive Gear Oil Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the automotive gear oil market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the automotive gear oil market over the predicted timeframe. North America dominates the automotive gear oil market, with an approximate market share of around 35%, due to its well-established automotive industry, high vehicle ownership rates, and growing demand for advanced lubricants that enhance engine performance and fuel efficiency. The region’s stringent environmental regulations and focus on reducing emissions drive the adoption of high-quality synthetic and semi-synthetic gear oils. The United States, being the largest market within North America, leads due to its extensive vehicle fleet, technological advancements, and strong aftermarket maintenance culture supporting steady gear oil demand.

Asia Pacific is expected to grow at a rapid CAGR in the automotive gear oil market during the forecast period. Asia Pacific is a region that holds an approximate market share of around 28% in the automotive gear oil market during the forecast period due to rapid industrialization, increasing vehicle production, and rising disposable incomes in emerging economies such as China and India. The expanding middle class and growing demand for personal and commercial vehicles fuel market growth. Additionally, government initiatives promoting better fuel efficiency and stringent emission norms encourage the use of advanced gear oils. China leads the region with its vast automotive manufacturing base and increasing adoption of high-performance lubricants, driving the market’s robust expansion.

On March 28, 2025, a FICCI, RECEIC, and Deloitte report urged India to overhaul its informal used oil recycling through regulatory reforms and technology upgrades. The government’s Extended Producer Responsibility mandates recycling from 5% in FY2025 to 50% by FY2031, increasing required EPR certificates from 0.08 to 1 million metric tonnes.

Europe’s automotive gear oil market is growing due to stringent environmental regulations, increasing demand for high-performance lubricants, and a strong focus on sustainability. Countries such as Germany and France lead the region with advanced automotive manufacturing and the adoption of synthetic gear oils to improve fuel efficiency and reduce emissions. Additionally, the rise of electric and hybrid vehicles is driving innovation in gear oil formulations, further boosting market growth across Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the automotive gear oil market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ExxonMobil

- Chevron Corporation

- TotalEnergies

- Shell

- Valvoline Inc.

- BP p.l.c.

- Idemitsu Kosan Co., Ltd.

- Gazprom Energoholding LLC

- Fuchs Petrolub SE

- LUKOIL

- Indian Oil Corporation Limited

- ENEOS Corporation

- Gulf Oil Corporation Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, Chevron announced the start of oil and gas production from the Ballymore subsea tieback in the Gulf of Mexico. Expected to produce up to 75,000 barrels per day, Ballymore supports Chevron’s goal of reaching 300,000 barrels per day from the Gulf by 2026.

- In August 2025, TotalEnergies Marketing India launched its upgraded Quartz car engine oils in India, meeting the latest API SP and ILSAC GF-7 standards. These advanced lubricants enhance fuel efficiency, engine protection, and performance, showcasing TotalEnergies’ commitment to innovation and advancement in automotive lubricant technology.

- In November 2024, Valvoline Global Operations launched its first super premium full synthetic gear oil, Valvoline Extended Protection. This new product delivers four times better gear wear protection than Valvoline Daily Protection Gear Oil, aiming to maximize differential life and expand Valvoline’s advanced automotive solutions portfolio.

- In November 2021, Chevron Products Company launched Havoline PRO-RS Renewable Full Synthetic Motor Oil, its first renewable and ultra-premium motor oil. Made with 25% plant-based oils from Novvi LLC, this product supports Chevron’s commitment to advancing a lower-carbon future through sustainable innovation in automotive lubricants.

- In January 2021, Valvoline Inc. announced the retail launch of FlexFill, a patented gear oil packaging innovation. Designed for synthetic gear oil, FlexFill offers a more convenient, flexible, and less wasteful solution for automotive DIY users during oil changes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the automotive gear oil market based on the below-mentioned segments:

Global Automotive Gear Oil Market, By Base Oil Type

- Mineral Oil

- Synthetic Oil

- Semi-Synthetic Oil

Global Automotive Gear Oil Market, By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Global Automotive Gear Oil Market, By Application

- Standard

- Heavy Duty

- Racing

- Off-Highway

Global Automotive Gear Oil Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the automotive gear oil market over the forecast period?The global automotive gear oil market is projected to expand at a CAGR of 3.34% during the forecast period.

-

2. What is the automotive gear oil market?The automotive gear oil market is a global industry focused on the production and sale of lubricants for vehicle gear systems such as transmissions and differentials.

-

3. What is the market size of the automotive gear oil market?The global automotive gear oil market size is expected to grow from USD 3.81 billion in 2024 to USD 5.47 billion by 2035, at a CAGR of 3.34% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the automotive gear oil market?North America is anticipated to hold the largest share of the automotive gear oil market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global automotive gear oil market?The major players operating in the automotive gear oil market are ExxonMobil, Chevron Corporation, TotalEnergies, Shell, Valvoline Inc., BP p.l.c., Idemitsu Kosan Co., Ltd., Gazprom Energoholding LLC, Fuchs Petrolub SE, LUKOIL, Indian Oil Corporation Limited, ENEOS Corporation, Gulf Oil Corporation Limited, and Others.

-

6. What factors are driving the growth of the automotive gear oil market?The automotive gear oil market is driven by increased vehicle production globally, especially in developing nations, and a rising demand for better fuel economy and performance. Factors like the adoption of advanced transmission systems, growing middle-class populations, and consumer awareness of regular maintenance also contribute to growth

-

7. What are the market trends in the automotive gear oil market?Key trends in the automotive gear oil market include the increasing demand for high-performance synthetic oils, the development of specialized lubricants for electric vehicles, and a focus on eco-friendly and fuel-efficient formulations to meet stricter regulations.

-

8. What are the main challenges restricting wider adoption of the automotive gear oil market?The automotive gear oil market faces several challenges that restrict its wider adoption, primarily driven by the transition toward electric vehicles, advancements in lubricant technology, and growing environmental regulations.

Need help to buy this report?