Global Automotive Engine Encapsulation Market Size, Share, and COVID-19 Impact Analysis, By Material (Carbon Fiber, Polyurethane, Polyamide), By Fuel Type (Gasoline, Diesel), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Engine Encapsulation Market Insights Forecasts to 2033

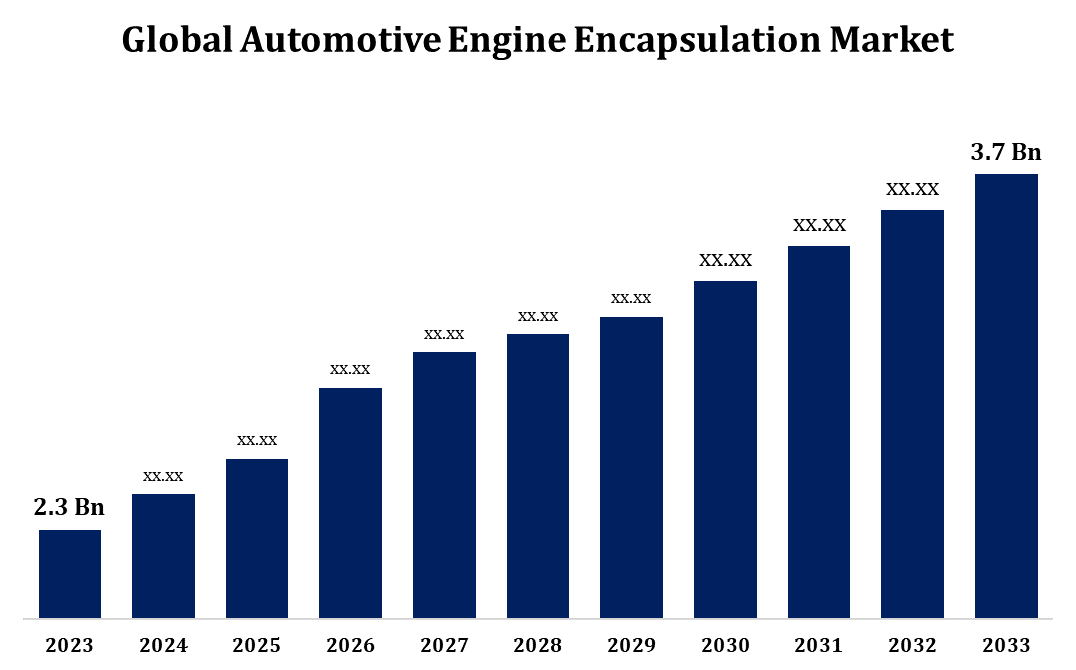

- The Automotive Engine Encapsulation Market was valued at USD 2.3 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.87% from 2023 to 2033.

- The Worldwide Automotive Engine Encapsulation Market Size is Expected to reach USD 3.7 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Automotive Engine Encapsulation Market Size Expected to reach USD 3.7 Billion by 2033, at a CAGR of 4.87% during the forecast period 2023 to 2033.

The global automotive engine encapsulation market is experiencing significant growth, driven by increasing demand for fuel-efficient, low-emission, and quieter vehicles. This technology involves enclosing engine components with insulating materials to enhance thermal management, reduce noise, and improve fuel efficiency. Stringent emission regulations and consumer preferences for quieter driving experiences are key drivers of this market. Materials such as polyamide and polypropylene are commonly used due to their durability and cost-effectiveness. The Asia-Pacific region leads in market share, followed by North America and Europe. Major players in the industry include BASF SE, Hennecke GmbH, and Roechling Group, among others. Despite challenges like material cost fluctuations, the market is poised for continued expansion as automakers strive to meet evolving environmental standards.

Automotive Engine Encapsulation Market Value Chain Analysis

The automotive engine encapsulation market value chain encompasses several key stages, from raw material sourcing to end-product delivery. It begins with the procurement of materials such as polypropylene, polyamide, and other insulating compounds. These materials are then processed and manufactured by component suppliers into engine encapsulation systems that meet specific performance requirements. Original equipment manufacturers (OEMs) work with suppliers to integrate these encapsulation systems into vehicle designs, ensuring they meet regulatory and consumer demand for noise reduction and thermal management. The next step involves distribution to automotive manufacturers and assemblers who incorporate the components into vehicles. Finally, the encapsulation systems are tested for durability, thermal insulation, and noise reduction before reaching the consumer market. Throughout the chain, collaboration between material suppliers, manufacturers, and OEMs is essential for ensuring efficiency and compliance with environmental standards.

Automotive Engine Encapsulation Market Opportunity Analysis

The automotive engine encapsulation market offers substantial growth opportunities due to several driving factors. Increasing global emission and fuel efficiency regulations are pushing automakers to adopt technologies that improve engine performance and reduce environmental impact. Engine encapsulation helps meet these standards by enhancing thermal management, reducing noise, and boosting fuel efficiency. The development of lightweight materials, like polypropylene and carbon fiber, is enabling more efficient and cost-effective encapsulation solutions. Moreover, the rise of electric and hybrid vehicles presents new prospects for encapsulation technologies to manage heat and improve performance. The Asia-Pacific region, particularly China and India, is witnessing rapid automotive growth, presenting a large market potential.

Automotive Engine Encapsulation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 2.3 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.87% |

| 2033 Value Projection: | USD 3.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material, By Fuel Type, By Vehicle Type and COVID-19 Impact Analysis |

| Companies covered:: | General Motors, Mann+Hummel, Edelbrock, Daimler, Continental, Johnson Controls, Summit Plastics, Volkswagen, Ford, Faurecia, Plastic Omnium, Toyota Industries, Trelleborg, Nissan, BorgWarner, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Automotive Engine Encapsulation Market Dynamics

Increasing environmental regulations and emission requirements

The growth of the automotive engine encapsulation market is strongly influenced by tightening environmental regulations and emission standards. Governments worldwide are enforcing stricter emission norms to reduce vehicle pollution, urging automakers to adopt solutions that enhance engine efficiency and minimize environmental impact. Engine encapsulation helps achieve these goals by improving thermal management, which in turn boosts fuel efficiency and reduces Carbon dioxide emissions. Regulatory initiatives, such as the European Unions 2035 ban on new internal combustion engine vehicles and the U.S. EPAs emission targets, are accelerating the shift towards sustainable automotive technologies. These pressures are driving the adoption of advanced encapsulation solutions, including lightweight materials like polypropylene and carbon fiber, to ensure compliance with global environmental regulations. Consequently, the demand for innovative encapsulation technologies is increasing across the industry.

Restraints & Challenges

High initial investment costs for research, development, and technology integration can discourage manufacturers, especially smaller companies, from entering the market. Additionally, the complexity of integrating encapsulation solutions into existing vehicle designs requires substantial modifications, adding to the difficulty. Fluctuating raw material prices also pose a challenge, complicating long-term cost management and planning for manufacturers. Retrofitting encapsulation systems into older vehicle models is another obstacle, as it can be expensive and technically challenging, limiting wider adoption. Moreover, the fast pace of technological advancements demands continuous innovation, which can strain resources and extend development timelines. These factors combined create barriers to the market's rapid expansion.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Automotive Engine Encapsulation Market from 2023 to 2033. The North American automotive engine encapsulation market is experiencing steady growth, driven by stringent environmental regulations and increasing consumer demand for fuel-efficient and quieter vehicles. This growth is fueled by the adoption of advanced encapsulation technologies that enhance thermal management, reduce noise, and improve fuel efficiency. The United States, Canada, and Mexico play significant roles in this market, each focusing on integrating encapsulation solutions tailored to their specific automotive manufacturing needs and regulatory standards. Key players in the region, including major automotive manufacturers, are investing in innovative encapsulation technologies to meet evolving environmental and consumer expectations.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The growth is fueled by stringent emission regulations, a rising demand for fuel-efficient vehicles, and advancements in lightweight materials. The region’s automotive sector is increasingly adopting engine encapsulation technologies to enhance thermal management, reduce noise, and improve fuel efficiency. China dominates the market, with India emerging as the fastest-growing market. The use of lightweight materials like polypropylene and polyamide is gaining momentum, enabling the development of more efficient and cost-effective encapsulation solutions. The growth of electric and hybrid vehicle production further drives the need for innovative thermal management technologies.

Segmentation Analysis

Insights by Material

The polyamide segment accounted for the largest market share over the forecast period 2023 to 2033. The polyamide segment plays a significant role in the automotive engine encapsulation market due to its excellent strength, durability, and resistance to abrasion, making it ideal for applications like engine covers and intake manifolds. Polyamides ability to perform well in high-temperature environments and resist chemical degradation is driving its widespread adoption in the industry. Manufacturers are developing heat-stabilized polyamide variants reinforced with glass fibers to improve thermal aging performance and vibration resistance, making it suitable for internal combustion, hybrid, and electric vehicles. Additionally, polyamide materials are being used for underbody shields due to their high resistance to heat, sound, and chemicals. The growing consumer demand for quieter, more fuel-efficient vehicles and increasing environmental regulations continue to drive the use of polyamide in automotive engine encapsulation.

Insights by Fuel Type

The gasoline segment accounted for the largest market share over the forecast period 2023 to 2033. Gasoline-powered vehicles are more widespread globally, leading to a larger market share compared to diesel engines. This is further supported by government policies that favor gasoline engines for their relatively lower particulate emissions. Engine encapsulation technologies help enhance thermal management, reduce engine noise, and improve fuel efficiency, aligning with consumer demand for quieter and more energy-efficient vehicles. Additionally, the rise of hybrid vehicles, which typically use gasoline engines, is increasing the need for advanced encapsulation solutions. As automakers continue to innovate and meet stricter emission standards, the gasoline segment is expected to maintain strong growth in the automotive engine encapsulation market.

Insights by Vehicle Type

The passenger cars segment accounted for the largest market share over the forecast period 2023 to 2033. This segment holds a significant market share and is expected to continue expanding as consumers and regulatory bodies prioritize noise reduction and fuel efficiency. Engine encapsulation technologies are essential in enhancing thermal management, minimizing noise, and improving overall vehicle performance, all of which are crucial for both conventional and electric vehicles. The increasing popularity of electric and hybrid passenger vehicles is further boosting the demand for advanced encapsulation solutions to manage heat and reduce noise. Additionally, the rising demand for premium and luxury cars, which often require sophisticated noise, vibration, and harshness (NVH) control, is also driving market growth in this segment.

Recent Market Developments

- In October 2023, Freudenberg has created an innovative heat shield tailored for electric vehicle batteries. This shield offers exceptional heat management and fire resistance, both of which are vital for enhancing EV safety and performance.

Competitive Landscape

Major players in the market

- General Motors

- Mann+Hummel

- Edelbrock

- Daimler

- Continental

- Johnson Controls

- Summit Plastics

- Volkswagen

- Ford

- Faurecia

- Plastic Omnium

- Toyota Industries

- Trelleborg

- Nissan

- BorgWarner

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Engine Encapsulation Market, Material Analysis

- Carbon Fiber

- Polyurethane

- Polyamide

Automotive Engine Encapsulation Market, Fuel Type Analysis

- Gasoline

- Diesel

Automotive Engine Encapsulation Market, Vehicle Type Analysis

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Automotive Engine Encapsulation Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automotive Engine Encapsulation Market?The global Automotive Engine Encapsulation Market is expected to grow from USD 2.3 billion in 2023 to USD 3.7 billion by 2033, at a CAGR of 4.87% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automotive Engine Encapsulation Market?Some of the key market players of the market are General Motors, Mann+Hummel, Edelbrock, Daimler, Continental, Johnson Controls, Summit Plastics, Volkswagen, Ford, Faurecia, Plastic Omnium, Toyota Industries, Trelleborg, Nissan, BorgWarner.

-

3. Which segment holds the largest market share?The passenger cars segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?