Global Automotive Electronic Control Unit Market Size, Share, and COVID-19 Impact Analysis, By Capacity (16-bit ECU, 32-bit ECU, 64-bit ECU), By Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicle), By Application (ADAS And Safety System, Body Control, Infotainment), By Propulsion Type (Battery Powered, Hybrid, Internal Combustion Engine (ICE)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Electronic Control Unit Market Insights Forecasts to 2033

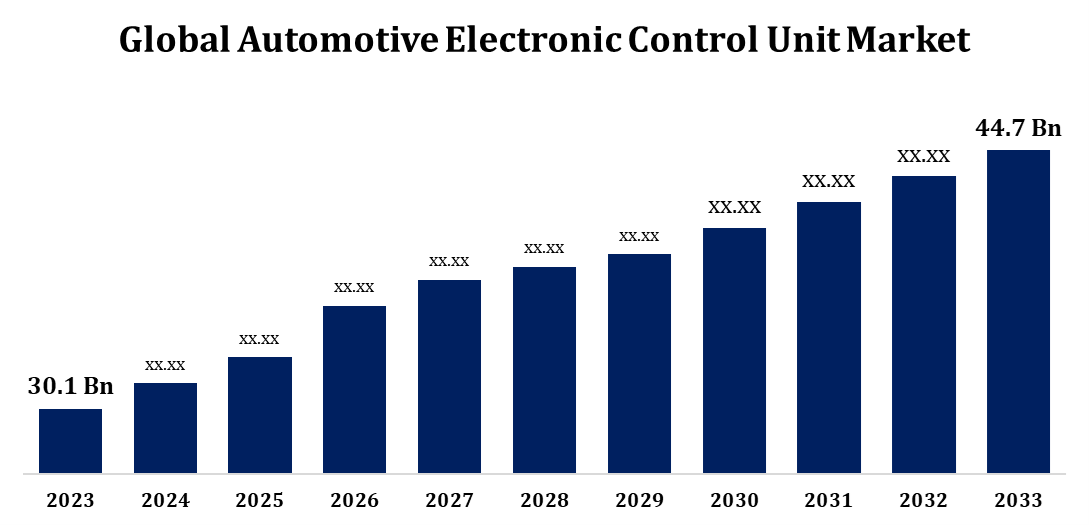

- The Global Automotive Electronic Control Unit Market Size was valued at USD 30.1 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.03% from 2023 to 2033.

- The Worldwide Automotive Electronic Control Unit Market Size is Expected to reach USD 44.7 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Electronic Control Unit Market Size is Expected to reach USD 44.7 Billion by 2033, at a CAGR of 4.03% during the Forecast Period 2023 to 2033.

The Automotive Electronic Control Unit (ECU) market is experiencing significant growth due to increasing demand for advanced safety, comfort, and performance features in modern vehicles. ECUs play a crucial role in controlling various electronic systems such as engine management, infotainment, powertrain, and advanced driver assistance systems (ADAS). The shift toward electric and hybrid vehicles has further accelerated the integration of sophisticated ECUs to manage complex electrical architectures. Automakers are focusing on developing lightweight, efficient, and software-driven ECUs to enhance fuel efficiency and reduce emissions. Moreover, the growing trend of vehicle connectivity and autonomous driving technologies is boosting the need for high-performance computing systems within vehicles. As automotive technology evolves, the role of ECUs continues to expand, making them central to innovation and intelligent vehicle operation.

Automotive Electronic Control Unit Market Value Chain Analysis

The value chain of the Automotive Electronic Control Unit (ECU) market involves several interconnected stages, starting with raw material and component suppliers who provide semiconductors, microcontrollers, and circuit boards. These are followed by ECU manufacturers who design, assemble, and test the units to meet specific automotive requirements. Tier 1 suppliers then integrate these ECUs into broader vehicle systems, often customizing them for automakers’ needs. Original Equipment Manufacturers (OEMs) install the ECUs in vehicles during assembly, ensuring proper calibration and system compatibility. Post-manufacturing, the value chain extends to software developers who offer updates and enhancements, as well as service providers handling diagnostics and maintenance. Additionally, regulatory bodies and certification agencies play a role in ensuring safety and compliance. This integrated value chain supports innovation and efficiency in the evolving automotive sector.

Automotive Electronic Control Unit Market Opportunity Analysis

The Automotive Electronic Control Unit (ECU) market offers strong growth opportunities driven by the increasing shift toward electric and hybrid vehicles, which rely heavily on advanced ECUs for managing powertrains and energy systems. The growing adoption of autonomous driving and advanced driver-assistance systems (ADAS) is fueling demand for high-speed, data-driven ECUs. In addition, the rise of connected vehicles and over-the-air (OTA) software updates is creating a need for ECUs that support seamless communication and integration with smart infrastructure. Emerging markets, especially in the Asia-Pacific region, are witnessing a surge in vehicle production and demand for modern automotive technologies. Moreover, innovations in artificial intelligence and machine learning are enabling the development of intelligent ECUs, enhancing vehicle safety, performance, and user experience, thereby expanding opportunities across the value chain.

Global Automotive Electronic Control Unit Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 30.1 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.03% |

| 2033 Value Projection: | USD 44.7 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Capacity, By Vehicle Type, By Application, By Propulsion Type, By Region. |

| Companies covered:: | Autoliv, Inc., BorgWarner, Inc., Continental AG, Denso Corporation, Hella KGaA Hueck & Co. (Hella), Hitachi Astemo Americas, Inc., Panasonic Holdings Corporation, Robert Bosch GmbH, Valeo S.A., ZF Friedrichshafen AG, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Automotive Electronic Control Unit Market Dynamics

The growing focus of OEMs to provide advanced software features

The growing focus of OEMs on integrating advanced software features into Automotive Electronic Control Units (ECUs) is significantly driving market growth. As vehicles become more reliant on electronics and connectivity, OEMs are prioritizing software capabilities to deliver enhanced safety, comfort, and performance. Features such as adaptive driving assistance, real-time diagnostics, and vehicle-to-everything (V2X) communication are increasingly managed through intelligent ECUs. OEMs are also leveraging over-the-air (OTA) updates to keep vehicle software current without physical servicing, reducing maintenance costs and improving user experience. This software-centric approach supports faster innovation, increased vehicle customization, and alignment with regulatory demands for emissions and safety. As a result, the demand for high-performance, reprogrammable ECUs is rising, positioning software as a key growth driver in the automotive ECU market.

Restraints & Challenges

The Automotive Electronic Control Unit (ECU) market faces several key challenges that may hinder its growth. One major concern is the complexity of integrating advanced ECUs into increasingly interconnected vehicle systems, which raises development costs and extends time-to-market. Additionally, as vehicles become more connected, cybersecurity risks are growing, requiring stronger protective measures that add to design complexity. The rapid pace of technological innovation also pressures manufacturers to continuously upgrade products, increasing the risk of quick obsolescence. Ongoing global semiconductor shortages have further disrupted ECU production, leading to supply chain delays and higher manufacturing costs. Moreover, the absence of standardization across vehicle platforms complicates ECU compatibility and limits scalability. Overcoming these issues is essential for ensuring the continued expansion and technological advancement of the ECU market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Automotive Electronic Control Unit Market from 2023 to 2033. The growing integration of systems such as Advanced Driver-Assistance Systems (ADAS), infotainment, and powertrain control is significantly boosting the demand for high-performance ECUs. These units are essential for real-time data processing and efficient system coordination, particularly in connected and semi-autonomous vehicles. The rising popularity of electric and hybrid vehicles across the region is also contributing to the need for sophisticated ECUs to manage complex energy and drive systems. The U.S. remains a key contributor to regional growth, supported by ongoing investments in automotive innovation and regulatory pushes for safety and emissions compliance. North America continues to be a major hub for ECU development and technological advancement.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The growing preference for enhanced safety features, infotainment systems, and connectivity in passenger vehicles is fueling this demand. Major markets such as China and India are leading the expansion, with China holding the largest share and India emerging as a rapidly growing market. The rise of electric vehicles (EVs) and the integration of advanced driver-assistance systems (ADAS) are further contributing to the demand for sophisticated ECUs. This rapid growth makes Asia Pacific a key region for ECU manufacturers and suppliers, offering substantial opportunities for market players to innovate and expand their presence in the automotive sector.

Segmentation Analysis

Insights by Capacity

The 32-bit ECU segment accounted for the largest market share over the forecast period 2023 to 2033. The 32-bit segment is witnessing significant growth in the Automotive Electronic Control Unit (ECU) market, as these units offer a balanced combination of performance, cost-effectiveness, and energy efficiency. 32-bit ECUs are increasingly favored for mid-range vehicles that require advanced features like Advanced Driver-Assistance Systems (ADAS), infotainment, and powertrain management. With their enhanced processing power, these ECUs can efficiently handle complex algorithms and process data in real-time, making them ideal for modern automotive applications. As vehicles become more connected and feature-rich, the demand for 32-bit ECUs continues to rise due to their ability to manage increased complexity without the higher cost of 64-bit systems. This growth trend is expected to solidify the 32-bit ECU's position as a key standard in the automotive sector.

Insights by Vehicle Type

The passenger car segment accounted for the largest market share over the forecast period 2023 to 2033. This segment holds a significant share, with passenger vehicles, particularly luxury models, requiring a higher number of ECUs to support advanced functionalities. The increasing demand for features like Advanced Driver-Assistance Systems (ADAS), infotainment systems, and connectivity is fueling the need for more sophisticated ECUs. Luxury vehicles, in particular, often incorporate numerous ECUs to manage complex systems. The rise in consumer disposable income and the growing preference for high-end vehicles are also contributing to the expansion of this segment. Additionally, the increasing adoption of electric and hybrid vehicles is further driving the demand for advanced ECUs to efficiently manage powertrains and energy systems, boosting growth in the passenger car segment.

Insights by Application

The ADAS and Safety system segment accounted for the largest market share over the forecast period 2023 to 2033. The Advanced Driver-Assistance Systems (ADAS) and safety systems segment is a major growth driver in the Automotive Electronic Control Unit (ECU) market. As consumers demand enhanced safety and automation, automakers are increasingly integrating advanced ECUs to manage complex ADAS features such as adaptive cruise control, lane-keeping assist, and automatic emergency braking. These systems require real-time data processing from sensors like cameras, radar, and LIDAR, pushing the need for ECUs capable of handling large amounts of data quickly and accurately. Additionally, regulatory requirements in various regions mandating safety technologies in vehicles are fueling the demand for ADAS-related ECUs. This trend highlights the critical role of ADAS and safety systems in shaping the future of automotive electronics and driving the evolution of the ECU market.

Insights by Propulsion Type

The internal combustion engine (ICE) segment accounted for the largest market share over the forecast period 2023 to 2033. The internal combustion engine (ICE) segment remains a key player in the Automotive Electronic Control Unit (ECU) market, driven by the continued global use of ICE vehicles. These vehicles depend on ECUs to manage essential functions like engine control, fuel injection, transmission, and emissions systems. The adoption of advanced technologies, such as turbocharging, direct fuel injection, and variable valve timing, has increased the demand for more sophisticated ECUs to enhance performance and meet stringent environmental regulations. While the rise of electric vehicles (EVs) is influencing the industry, ICE vehicles still dominate due to their established infrastructure, lower production costs, and consumer familiarity. As a result, the ICE segment is expected to retain a significant share of the automotive ECU market despite the ongoing shift towards electrification.

Recent Market Developments

- In October 2021, BorgWarner Inc. announced the acquisition of Delphi Technologies, a move that will enhance its portfolio of power electronics and strengthen its electronic control business.

Competitive Landscape

Major players in the market

- Autoliv, Inc.

- BorgWarner, Inc.

- Continental AG

- Denso Corporation

- Hella KGaA Hueck & Co. (Hella)

- Hitachi Astemo Americas, Inc.

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Valeo S.A.

- ZF Friedrichshafen AG

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Electronic Control Unit Market, Capacity Analysis

- 16-bit ECU

- 32-bit ECU

- 64-bit ECU

Automotive Electronic Control Unit Market, Vehicle Type Analysis

- Passenger Cars

- Commercial Vehicles

- Electric Vehicle

Automotive Electronic Control Unit Market, Application Analysis

- ADAS And Safety System

- Body Control

- Infotainment

Automotive Electronic Control Unit Market, Propulsion Type Analysis

- Battery Powered

- Hybrid

- Internal Combustion Engine (ICE)

Automotive Electronic Control Unit Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automotive Electronic Control Unit Market?The global Automotive Electronic Control Unit Market is expected to grow from USD 30.1 billion in 2023 to USD 44.7 billion by 2033, at a CAGR of 4.03% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automotive Electronic Control Unit Market?Some of the key market players of the market are Autoliv, Inc., BorgWarner, Inc., Continental AG, Denso Corporation, Hella KGaA Hueck & Co. (Hella), Hitachi Astemo Americas, Inc., Panasonic Holdings Corporation, Robert Bosch GmbH, Valeo S.A., ZF Friedrichshafen AG.

-

3. Which segment holds the largest market share?The ADAS and Safety system segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?