Global Automotive Adhesive Market Size, Share, and COVID-19 Impact Analysis, By Adhesive Type (Threadlocks & Retainers, Structural, Tapes & Films, Liquid Gaskets), By Technology (Solvent-Based, Hot-Melt, Water-Based), By Application (Powertrain, Paint Shop, Body-In-White, Assembly, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Automotive & TransportationGlobal Automotive Adhesive Market Insights Forecasts to 2033

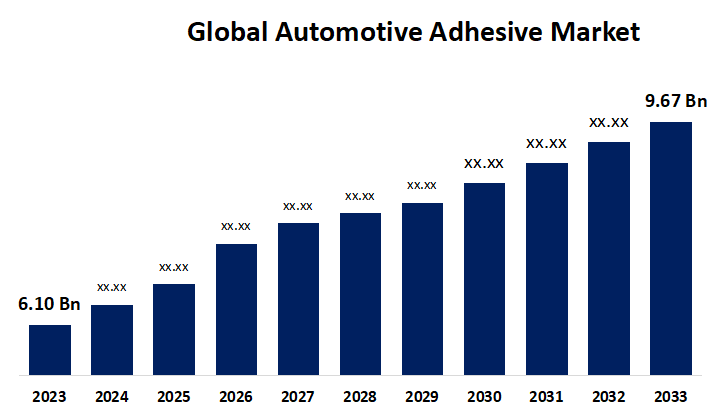

- The Global Automotive Adhesive Market Size was Valued at USD 6.10 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.72% from 2023 to 2033.

- The Worldwide Automotive Adhesive Market Size is Expected to Reach USD 9.67 Billion by 2033.

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Adhesive Market Size is Anticipated to Exceed USD 9.67 Billion by 2033, Growing at a CAGR of 4.72% from 2023 to 2033.

Market Overview

The Bonding agent is specifically designed and formulated for use in automotive applications where these adhesives are used in various parts of vehicles for bonding different materials together, such as metals, plastics, composites, and glass are referred to as automotive adhesives. They play a crucial role in automotive manufacturing and repair processes by providing strong, durable bonds that withstand the stresses and conditions encountered in automotive environments. Automotive adhesives play a role in the manufacturing of more secure, more efficient, and ecological cars. Adhesives are the most flexible bonding agents available today, and manufacturers utilize them to make vehicles lighter and more durable. In addition, these adhesives can enhance crash performance and reduce the vibration, noise, and harshness in automobiles. However, they are composed of exact mixtures of polymer elastomers, resins, and chemicals or additives that enhance specific properties based on the ultimate purpose. Furthermore, adhesive bonding results in the production of new unique vehicle body layouts and hybrid material layouts made of high-strength steels, nonferrous metals, plastics, and composites. Furthermore, adhesives provide excellent bonding strength across a wide range of surfaces. It can be used to secure dashboards, door panels, electronics, light covers, and lenses, as also steel and mixed components.

Report Coverage

This research report categorizes the market for the global automotive adhesive market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global automotive adhesive market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global automotive adhesive market.

Global Automotive Adhesive Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.10 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.72% |

| 2033 Value Projection: | USD 9.67 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Adhesive Type, By Technology, By Application, By Region. |

| Companies covered:: | H.B. Fuller Company, 3M, DuPont, Huntsman International LLC, Henkel AG & Co., KGaA, Arkema S.A., Sika AG, Jowat SE, Dow, Ashland, Franklin International, Bostik S.A., The DOW Chemical Company, PPG Industries, Illinois Tool Works Corporation, Solvay S.A., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Developing countries are experiencing an increase in disposable income and urbanization, which drives demand for automobile ownership. To enhance fuel efficiency, major automakers globally are working to lower vehicle weight. To do this, they are using automotive adhesives and sealants instead of heavier metal frames and joinery components, such as weld joints. Furthermore, the growing demand for autonomous EVs has created exciting market growth opportunities. Automated electric vehicles are both driverless and robotic. It comes with self-driving capabilities that are useful in smart cities. Many nations are locating the use of self-driving automobiles. These vehicles are regarded as being the most dependable and cost-effective modes of transportation. Automated electric vehicles' advanced driver assistance systems provide numerous functions. Modern radar, cameras, and sensors are among the vehicle's most important components. The current adoption rate for these vehicles is 20%. However, the acceptance rate is expected to increase dramatically in the next few years. Automated vehicles require a variety of adhesives.

Restraining Factors

Conflict over politics in raw material-supplying nations is expected to cause significant fluctuation in raw material pricing over the next years, limiting automotive adhesive shipments. However, the enforcement of tight VOC emission standards and laws governing the use of harmful compounds is projected to face long-term obstacles to global automotive adhesive market expansion.

Market Segmentation

The global automotive adhesive market share is classified into adhesive type, technology, and application.

- The structural segment is expected to grow at the fastest pace in the global automotive adhesive market during the forecast period.

Based on adhesive type, the global automotive adhesive market is divided into threadlocks & retainers, structural, tapes & films, and liquid gaskets. Among these, the structural segment is expected to grow at the fastest pace in the global automotive adhesive market during the forecast period. The increasing usage of carbon fiber to construct the core structural body of automobiles is also expected to boost the sale of structural car adhesives and auto body glue over the forecast period. Furthermore, the increasing use of plastics and composite materials in car manufacture to reduce weight and deal with tight emission standards globally is expected to boost demand for auto adhesives in the future.

- The hot-melt segment is expected to grow at the fastest pace in the global automotive adhesive market during the forecast period.

Based on the technology, the global automotive adhesive market is divided into solvent-based, hot-melt, and water-based. Among these, the hot-melt segment is expected to grow at the fastest pace in the global automotive adhesive market during the forecast period. Hot-melt adhesives' (HMAs) growing popularity is driving market growth because it offers a long shelf life, which reduces storage and maintenance costs. Hot melts settle quickly and, when cooled, convert into beads. HMAs are a broad range of thermoplastic adhesives that are adaptable in binding to substrates and are used in a variety of automotive applications. They are used for automobile bonding of many substrate types such as metal, leather, glass, plastics, foam, and rubber.

- The body-in-white segment is expected to hold the largest share of the global automotive adhesive market during the forecast period.

Based on application, the global automotive adhesive market is divided into powertrain, paint shop, body-in-white, assembly, and others. Among these, the body-in-white segment is expected to hold the largest share of the global automotive adhesive market during the forecast period. Automotive adhesives outperform traditional welding procedures in terms of anti-corrosion properties, structural strength, and lightweight. Furthermore, employing adhesives in Body-in-White applications increases productivity and reduces expenses. As aconsequence, the need for Body-in-White adhesives is expected to increase significantly over the forecast period.

Regional Segment Analysis of the Global Automotive Adhesive Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

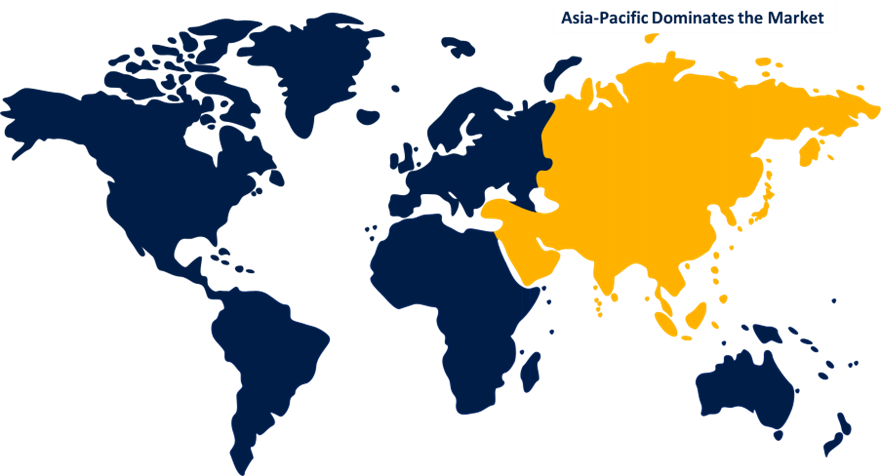

Asia Pacific is anticipated to hold the largest share of the global automotive adhesive market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global automotive adhesive market over the predicted timeframe. The Asia-Pacific automotive adhesives market meets the rising demand for automotive adhesives caused by growing application industries in the automotive sector, which provide vehicle safety, rigidity, and design flexibility. This component is being supported by widespread use and production in China, Japan, Korea, India, and others. The market is being driven by growing industrialization and significant investments in the automotive sector. The primary trends observed in the APAC automotive adhesives market include automobile manufacturers' increased focus on innovations in technology and the adoption of car fuel efficiency policies in various nations. The primary factors highlighted in the APAC automotive adhesives market are the growing use of lightweight materials in automobile manufacturing and increased vehicle production in the region.

North America is expected to grow at the fastest pace in the global automotive adhesive market during the forecast period. This is primarily due to an increase in regional automobile manufacturing driven by a rise in demand for environmentally friendly and fuel-efficient vehicles. Additionally, the region's severe safety and environmental standards have increased the use of adhesives in autos to improve strength while reducing weight. The growth of the region's Automotive Aftermarket is also helping the market for automotive adhesives. The market is growing because of the presence of several major companies in the industry that are dedicated to developing revolutionary adhesive technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global automotive adhesive along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- H.B. Fuller Company

- 3M

- DuPont

- Huntsman International LLC

- Henkel AG & Co., KGaA

- Arkema S.A.

- Sika AG

- Jowat SE

- Dow

- Ashland

- Franklin International

- Bostik S.A.

- The DOW Chemical Company

- PPG Industries

- Illinois Tool Works Corporation

- Solvay S.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, H.B. Fuller, the largest adhesive company focused solely on adhesives globally, revealed that its facilities in Lüneburg and Nienburg, Germany, have been granted the ISCC PLUS certification, emphasizing the company's dedication to a more sustainable future and its compliance with international standards throughout the entire supply chain.

- In July 2023, Berry Global introduced an updated version of its main Formifor insulation compression films, incorporating more than 30% recycled materials. The incorporation of recycled materials in the movie is expected to support sustainability initiatives in car production.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global automotive adhesive market based on the below-mentioned segments:

Global Automotive Adhesive Market, By Adhesive Type

- Threadlocks & Retainers

- Structural

- Tapes & Films

- Liquid Gaskets

Global Automotive Adhesive Market, By Technology

- Solvent-based

- Hot-melt

- Water-based

Global Automotive Adhesive Market, By Application

- Powertrain

- Paint shop

- Body-in-white

- Assembly

- Others

Global Automotive Adhesive Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which region holds the largest share of the global automotive adhesive market?Asia Pacific is anticipated to hold the largest share of the global automotive adhesive market over the predicted timeframe.

-

2.What is the projected market size & growth rate of the global automotive adhesive market?The global automotive adhesive market was valued at USD 6.10 Billion in 2023 and is projected to reach USD 9.67 Billion by 2033, growing at a CAGR of 4.72% from 2023 to 2033.

-

3.Which are the key companies that are currently operating within the global automotive adhesive market?H.B. Fuller Company, 3M, DuPont, Huntsman International LLC, Henkel AG & Co., KGaA, Arkema S.A., Sika AG, Jowat SE, Dow, Ashland, Franklin International, Bostik S.A., The DOW Chemical Company, PPG Industries, Illinois Tool Works Corporation, Solvay S.A., and Others.

Need help to buy this report?