Global Automatic Identification System Market Size, By Class (Class A AIS, Class B AIS, AIS–based stations), By Platform (Vessel-based, On-shore), By Application (Fleet Management, Vessels Tracking, Maritime Security), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Automatic Identification System Market Insights Forecasts to 2033

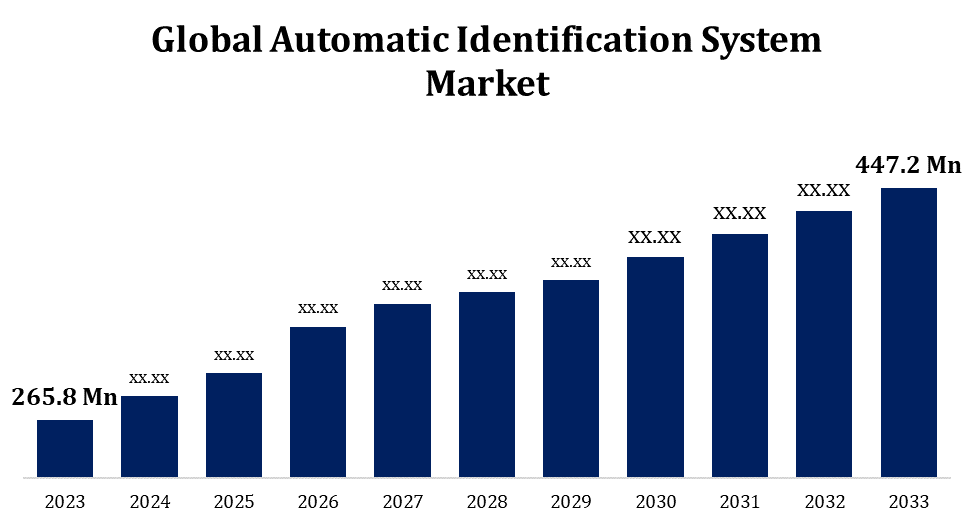

- The Global Automatic Identification System Market Size was valued at USD 265.8 Million in 2023.

- The Market is Growing at a CAGR of 5.34% from 2023 to 2033

- The Worldwide Automatic Identification System Market Size is Expected to reach USD 447.2 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Automatic Identification System Market Size is expected to reach USD 447.2 Million by 2033, at a CAGR of 5.34% during the forecast period 2023 to 2033.

The introduction of Class B AIS, which enables smaller vessels to transmit and receive AIS data, and other advancements in AIS technology are propelling market expansion. Better vessel tracking and management systems are required as a result of the expansion of global trade and the increase in marine traffic. To offer complete marine domain awareness solutions, AIS is rapidly being combined with other maritime systems, like radar and satellite tracking. Increased use of AIS is being driven by worries about threats to maritime security, including terrorism, smuggling, and piracy. This technology improves vessel monitoring and surveillance. The adoption of AIS is being driven by the need for real-time information on vessel movements, particularly for applications like fleet management, port operations, and marine surveillance.

Automatic Identification System Market Value Chain Analysis

Antennas, GPS modules, integrated circuits, microprocessors, and other electronic components suppliers are essential links in the AIS value chain. They provide the necessary parts to AIS equipment manufacturers so that the devices can be assembled. Businesses that specialise in AIS integration with other maritime systems, including radar, satellite communication, navigation systems, and vessel tracking software, are known as system integrators. Ship owners, port authorities, and marine agencies are just a few of the players in the maritime industry for whom they offer tailored solutions. The marketing and distribution of AIS equipment to end customers is mostly dependent on distributors and resellers. They can sell AIS products to ship owners, marine operators, and other clients directly from manufacturers or through approved channels. The marketing and distribution of AIS equipment to end customers is mostly dependent on distributors and resellers. They can sell AIS products to ship owners, marine operators, and other clients directly from manufacturers or through approved channels. Ship owners, operators, captains, maritime authorities, port authorities, coast guards, and other parties involved in marine operations and management are examples of end users of AIS technology.

Automatic Identification System Market Opportunity Analysis

In order to improve predictive analytics for risk assessment and decision-making, automate vessel traffic management, and improve maritime domain awareness, AIS technology can be combined with new technologies like artificial intelligence (AI), machine learning, and the Internet of Things (IoT). There is a growing need for AIS solutions that include strong cybersecurity capabilities to guard against unauthorised access, data breaches, and intentional interference with AIS broadcasts due to the increasing digitization of maritime systems and the growing threat of cyberattacks. AIS technology suppliers have a rare chance to create customised solutions for autonomous navigation, collision avoidance, and situational awareness in unmanned vessel operations thanks to the emergence of autonomous ships and unmanned marine vehicles.

Global Automatic Identification System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 265.8 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.34% |

| 2033 Value Projection: | USD 447.2 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Class, By Platform, By Application, By Region. |

| Companies covered:: | Furuno Electric Co. Ltd, Honeywell International Inc, Japan Radio Co. Ltd., CNS Systems AB, SAAB AB, ExactEarth Ltd, Orbcomm Inc., Garmin International Inc, Kongsberg Gruppen ASA, Raytheon Ltd., ComNav Marine Ltd, True Heading AB, Wartsila OYJ Abp, L-3 Communications Holdings Inc., and other key vendors. |

| Growth Drivers: | Growth of international trade and maritime traffic |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Automatic Identification System Market Dynamics

Growth of international trade and maritime traffic

The number of ships traversing the world's oceans and rivers rises in tandem with the expansion of international trade. More advanced vessel tracking and management systems are required because to the increased vessel density, with AIS being essential in improving navigation safety and preventing collisions. By managing the loading, unloading, and transshipment of commodities between ships and land-based transportation networks, ports play a crucial role as hubs for international trade. By giving port authorities precise information on vessel arrivals, departures, and movements, AIS technology facilitates more effective use of port facilities and resources, hence optimising port operations. Concerns over risks to marine security like terrorism, smuggling, and piracy are further heightened by the increase in maritime traffic.

Restraints & Challenges

AIS system installation and acquisition can come with a hefty upfront cost, especially for smaller operators and vessels. Adoption may be hampered by this expense, particularly in areas where marine operators have little resources. It might be difficult and require technical know-how to integrate AIS technology with current maritime systems, such as radar, navigational aids, and communication networks. Shipbuilders, system integrators, and vessel owners have difficulties in ensuring smooth integration and interoperability. AIS systems are susceptible to cybersecurity risks like malware, spoofing, and hacking, just like any other linked device. It is essential to defend AIS networks and data transmission channels from cyberattacks in order to stop illegal access, data breaches, and interruptions of maritime operations.

Regional Forecasts

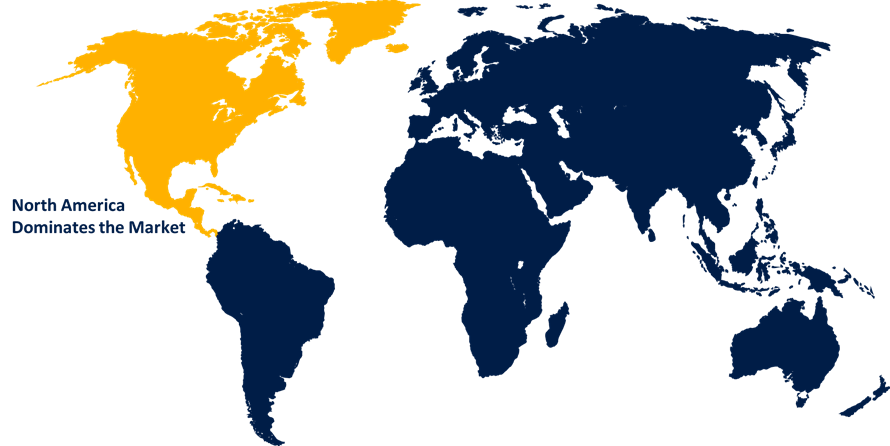

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Automatic Identification System Market from 2023 to 2033. The vast coastline, bustling ports, and navigable waterways of North America highlight the significance of marine security and safety. In North American waterways, AIS technology is essential for improving situational awareness, preventing collisions, and conducting search and rescue missions. North America's ports and waterways handle enormous amounts of freight, making it a major hub for worldwide trade. A significant market for AIS technology is the commercial shipping industry, which is motivated by the need for safe navigation, legal compliance, and effective port operations. In the marine industry, North America is a key centre of technical innovation, with continuous research and development taking place in fields like autonomous vessels, unmanned systems, and satellite-based AIS services.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. As a result of fast economic growth, industrialization, and globalisation, the Asia-Pacific region is home to some of the busiest ports and maritime trade routes in the world. The demand for AIS technology to improve port operations, navigation safety, and vessel tracking is fueled by the region's thriving marine economy. The Exclusive Economic Zones (EEZs) and coastal seas of Asia-Pacific are home to a large number of marine operations, making the region a key hub for commercial fishing and aquaculture. In an effort to prevent illicit, unreported, and unregulated fishing activities and maintain sustainable fisheries, AIS technology is being utilised more and more in fisheries management and monitoring. Satellite-based AIS service providers, which provide worldwide coverage and real-time vessel tracking capabilities, are expanding in the Asia-Pacific area. Applications for satellite-derived automatic identification systems (AIS) include environmental monitoring, maritime intelligence, and maritime surveillance.

Segmentation Analysis

Insights by Class

The Class A AIS segment accounted for the largest market share over the forecast period 2023 to 2033. Class A AIS technology is essential to the commercial shipping industry for improving operational effectiveness, navigation safety, and regulatory compliance. This includes bulk ships, LNG carriers, oil tankers, and container shipping. The increasing volume of global trade is driving up demand for Class A AIS technology since it provides dependable vessel tracking and management capabilities. Class A AIS transponders give authorities access to real-time vessel tracking information, which is essential for maritime security and surveillance operations. Enhanced maritime security and stability are achieved through the use of this data for border security, maritime law enforcement, coastal surveillance, and maritime domain awareness.

Insights by Platform

The vessel-based segment accounted for the largest market share over the forecast period 2023 to 2033. AIS transponders improve navigation and safety for vessel operators by providing real-time tracking and identifying information. AIS helps to enhance situational awareness, lower the danger of collisions, and enable effective vessel traffic management, particularly in crowded waterways and busy shipping lanes, by broadcasting vessel position, course, speed, and other data. One of the main forces behind the expansion of the vessel-based AIS market is the commercial shipping sector. AIS technology is used by a variety of boats, including bulk carriers, LNG carriers, container ships, and oil tankers, to ensure regulatory compliance, track vessel movements, and optimise navigation routes. In the commercial shipping industry, there is still a high need for vessel-based AIS solutions due to the ongoing increase in global trade volumes.

Insights by Application

The maritime security segment accounted for the largest market share over the forecast period 2023 to 2033. The use of AIS technology is essential to the coast guard, navies, and maritime law enforcement agencies' coastal surveillance missions. Authorities are able to monitor maritime traffic, identify unauthorised or suspect activity, and react quickly to security risks around coastlines and maritime borders thanks to the real-time information on vessel movements provided by AIS data. Marine law enforcement agencies use AIS data to enforce maritime rules and regulations and to fight maritime crimes such as smuggling, pirate attacks, and illegal fishing. In order to preserve marine security and uphold maritime governance, authorities can follow vessel activity, identify non-compliant vessels, and coordinate law enforcement actions with the use of AIS technology.

Recent Market Developments

- In August 2022, the Advanced Training Aircraft Fuselage Systems order was secured by Saab AB.

Competitive Landscape

Major players in the market

- Furuno Electric Co. Ltd

- Honeywell International Inc

- Japan Radio Co. Ltd.

- CNS Systems AB

- SAAB AB

- ExactEarth Ltd

- Orbcomm Inc.

- Garmin International Inc

- Kongsberg Gruppen ASA

- Raytheon Ltd.

- ComNav Marine Ltd

- True Heading AB

- Wartsila OYJ Abp

- L-3 Communications Holdings Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automatic Identification System Market, Class Analysis

- Class A AIS

- Class B AIS

- AIS–based stations

Automatic Identification System Market, Platform Analysis

- Vessel-based

- On-shore

Automatic Identification System Market, Application Analysis

- Fleet Management

- Vessels Tracking

- Maritime Security

Automatic Identification System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automatic Identification System Market?The global Automatic Identification System Market is expected to grow from USD 265.8 million in 2023 to USD 447.2 million by 2033, at a CAGR of 5.34% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automatic Identification System Market?Some of the key market players of the market are Furuno Electric Co. Ltd, Honeywell International Inc, Japan Radio Co. Ltd., CNS Systems AB, SAAB AB, ExactEarth Ltd, Orbcomm Inc., Garmin International Inc, Kongsberg Gruppen ASA, Raytheon Ltd., ComNav Marine Ltd, True Heading AB, Wartsila OYJ Abp, and L-3 Communications Holdings Inc.

-

3. Which segment holds the largest market share?The maritime security segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Automatic Identification System Market?North America is dominating the Automatic Identification System Market with the highest market share.

Need help to buy this report?