Global Automated Optical Inspection Market Size, Share, and COVID-19 Impact Analysis, By Type (2D AOI, 3D AOI), By Technology (Inline, Offline), By End-Use Industry (IT & Telecom, Consumer Electronics, Automotive, Industrial Electronics, Aerospace & Defence, Medical, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Semiconductors & ElectronicsGlobal Automated Optical Inspection Market Size Insights Forecasts to 2032

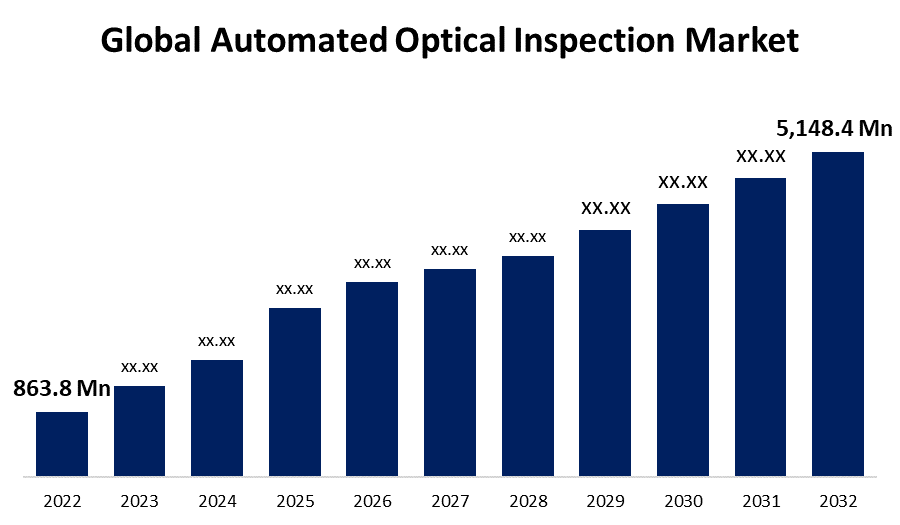

- The Global Automated Optical Inspection Market Size was valued at USD 863.8 Million in 2022.

- The Market Size is Growing at a CAGR of 19.5% from 2022 to 2032.

- The Worldwide Automated Optical Inspection Market Size is expected to reach USD 5,148.4 Million By 2032.

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automated Optical Inspection Market Size is expected to reach USD 5,148.4 Million By 2032, at a CAGR of 19.5% during the forecast period 2022 to 2032.

Automated Optical Inspection (AOI) is an industrial technology that can be utilized in manufacturing lines that demand high levels of accuracy and precision, such as electronics assembly. Visual approaches are used by automated optical inspection systems for monitoring and inspecting numerous sorts of items as well as manufacturing processes. To detect discrepancies or errors with the product, these system uses artificial intelligence, pattern recognition, machine learning, or visual inspection software. It is widely used in industries such as electronics, semiconductor manufacturing, automotive, and others. AOI is a crucial tool for present-day manufacturing, aiding in ensuring product quality, boosting worker efficiency, and decreasing the risk of incorrect items entering the marketplace. It is critical to the functioning of electronic components, PCBs, and other precision-made objects. Automated optical inspection systems are used throughout the manufacturing process, not just at the finish line. The initial identification of problems can assist avert increasing the value of a product that ordinarily contains flaws. This can result in significant reductions in expenses and greater productivity. The automated optical inspection market has been growing rapidly, owing to rising demand in industries such as consumer electronics, automotive, aerospace & defence, medical devices, and telecommunications. Further, the growing popularity of the Internet of Things (IoT), expanding electronic content in the automotive sector, the downsizing of electronic equipment, and increasing consumer demand for high-quality products are significant trends driving the AOI market towards expansion.

Global Automated Optical Inspection Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 863.8 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 19.5% |

| 2032 Value Projection: | USD 5,148.4 Million |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Type, By Technology, By End-Use Industry, By Region |

| Companies covered:: | Saki Corporation, Koh Young, Omron Corporation, Camtek, Viscom AG, GOPEL Electronic GmbH, Nordson Corporation, Daiichi Jitsugyo Asia Pte. Ltd., MIRTEC CO., LTD., CyberOptics, Test Research, Inc., and and Other key Venders. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapid development of gadgets and electronic devices, as well as the ongoing increase in markets such as consumer electronics, automotive electronics, and information technology, have resulted in a stronger need for higher-quality and more effective PCBs, boosting the demand for AOI systems. AOI aids in the reduction of physical inspection expenses and the reduction of human errors, resulting in enhanced capacity utilization and decreased production costs. In addition, the growth of nanotechnology has prompted the shrinking and the usage of high-density PCBs in the production of electronic components. As the overall dimension of the PCB decreases, so does the ball grid array (BGA) gap, resulting in a variety of PCB faults. Manual inspection cannot exactly identify these problems. As a result, there is a growing interest in using AOI devices to detect IC substrate faults. Furthermore, the worldwide drive toward automation and the application of Industry 4.0 techniques in manufacturing facilities have accelerated the use of AOI systems, given that they integrate smoothly into fully automated manufacturing processes and give instantaneous information for optimizing processes.

Restraining Factors

However, with superior inspection technology available as a substitute, these systems are projected to offer competition to the automated optical inspection market. Additionally, numerous call rates impede machine operation and produce inaccurate inspection data.

Market Segmentation

By Type Insights

The 2D automated optical inspection segment is dominating the market with the largest revenue share over the forecast period.

On the basis of type, the global automated optical inspection market is segmented into the 2D automated optical inspection, and 3D automated optical inspection. Among these, the 2D automated optical inspection segment is dominating the market with the largest revenue share of 68.6% over the forecast period, because of the more affordable price and the ease of programming with the 2D AOI system. With years of development, 2D AOI systems have seen several advances in terms of software applications and image processing technologies, resulting in faster image capture and shorter inspection processing cycles. Furthermore, the camera, illumination, and optics utilized in 2D systems facilitate inspection versatility, as large and small parts on a printed circuit board can be viewed at the same time.

By Technology Insights

The inline segment is witnessing significant CAGR growth over the forecast period.

On the basis of technology, the global automated optical inspection market is segmented into inline and offline. Among these, the inline segment is witnessing significant CAGR growth over the forecast period. The inline AOI system can be used at each level of the manufacturing process, allowing for a full examination of the printed circuit board elements for design and flaws. The inline device allows for scanning both sides of the printed circuit boards whilst minimizing the need for manual flipping. The introduction of inline AOI systems provides a reliable inspection procedure that does not disrupt production, which is projected to enhance the use of these devices.

By End-Use Industry Insights

The IT & telecom segment accounted for the largest revenue share of more than 57.2% over the forecast period.

On the basis of end-use industry, the global automated optical inspection market is segmented into IT & telecom, consumer electronics, automotive, industrial electronics, aerospace & defence, medical, and others. Among these, the IT & telecom segment is dominating the market with the largest revenue share of 57.2% over the forecast period. This is due to the widespread utilization of printed circuit boards in systems in the IT industry and the expansion of global telecom networks. Telecom applications such as routers, servers, satellite systems, communication devices, broadcasting systems, telecom towers, and LED displays and indicators necessitate the use of high-quality electronic components, which led to a widespread application of the AOI system in this industry. Additionally, during the projection period, the automobile industry is expected to grow at the fastest CAGR. The segment is being driven by a growing need for high-performance, long-lasting electrical components used to improve vehicle safety.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 46.3% market share over the forecast period. This is due to the existence of numerous semiconductors and printed circuit board companies in the region. Furthermore, the inexpensive nature of labor has proven to be one of the main drives for large electronics manufacturers to relocate operations to this region. In addition, increasing financial resources has raised the demand for luxury electronics and vehicles among nations such as China and India, pushing the market for excellent electronic components and integrating into the market's expansion.

North America, on the contrary, is expected to grow the fastest during the forecast period. This might be ascribed to increased entrepreneurship and technological breakthroughs in the region's manufacturing industries. The growing desire for smaller, thinner, more responsive electronic items and smartphones is also driving the industry in this region.

The Europe market is expected to register a substantial CAGR growth rate during the forecast period, especially with the rising popularity of vehicle manufacturing in this region. Automakers in countries such as Germany and France are focusing on improving car safety systems, which has contributed to an increase in demand for high-quality electronic supplies, hence raising demand for the automated optical inspection market in this region.

List of Key Market Players

- Saki Corporation

- Koh Young

- Omron Corporation

- Camtek

- Viscom AG

- GOPEL Electronic GmbH

- Nordson Corporation

- Daiichi Jitsugyo Asia Pte. Ltd.

- MIRTEC CO., LTD.

- CyberOptics

- Test Research, Inc.

Key Market Developments

- On July 2023, Test Research, Inc. (TRI), the leading producer of test and inspection equipment for the electronics manufacturing sector, announced the release of the TR7700QH SII Ultra-High Speed 3D AOI. The TR7700QH SII is designed for high-throughput production manufacturing in industries such as automotive and telecommunication electronics. It provides precise metrology measurements and complete inspection for large and high-density boards.

- On May 2023, Techman Robot has partnered with NVIDIA's Isaac Sim platform to create a digital twin that will improve the effectiveness of robot production line inspection. This partnership intends to save robot programming time by 70% and cycle time by 20%, saving both time and money. Techman Robot used its own robots for assembly and inspection activities in a recent demonstration displayed in conjunction with NVIDIA, employing AOI (Automated Optical Inspection) technology.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Automated Optical Inspection Market based on the below-mentioned segments:

Automated Optical Inspection Market, Type Analysis

- 2D AOI

- 3D AOI

Automated Optical Inspection Market, Technology Analysis

- Inline

- Offline

Automated Optical Inspection Market, End-Use Industry Analysis

- IT & Telecom

- Consumer Electronics

- Automotive

- Industrial Electronics

- Aerospace & Defence

- Medical

- Others

Automated Optical Inspection Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automated Optical Inspection market?The Global Automated Optical Inspection Market is expected to grow from USD 863.8 million in 2022 to USD 5,148.4 million by 2032, at a CAGR of 19.5% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?Saki Corporation, Koh Young, Omron Corporation, Camtek, Viscom AG, GOPEL Electronic GmbH, Nordson Corporation, Daiichi Jitsugyo Asia Pte. Ltd., MIRTEC CO., LTD., CyberOptics, Test Research, Inc.

-

3. Which segment dominated the Automated Optical Inspection market share?The IT & telecom segment in end-use industry type dominated the Automated Optical Inspection market in 2022 and accounted for a revenue share of over 57.2%.

-

4. Which region is dominating the Automated Optical Inspection market?Asia Pacific is dominating the Automated Optical Inspection market with more than 46.3% market share.

-

5. Which segment holds the largest market share of the Automated Optical Inspection market?The 2D automated optical inspection segment based on type holds the maximum market share of the Automated Optical Inspection market.

Need help to buy this report?