Global Automated Material Handling Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product Type (AMR, AGV, AS/RS, Cranes, Robots, WMS, Sortation & Conveyors Systems, Collaborative Robots, Others), By System (Unit Load Material Handling, Bulk Load Material Handling), By End-Use Industry (3PL, Chemicals, Healthcare, Aviation, Automotive, Food & Beverages, Semiconductor & Electronics, E-Commerce, Metals & Heavy Machinery, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Machinery & EquipmentGlobal Automated Material Handling Equipment Market Size Insights Forecasts to 2032

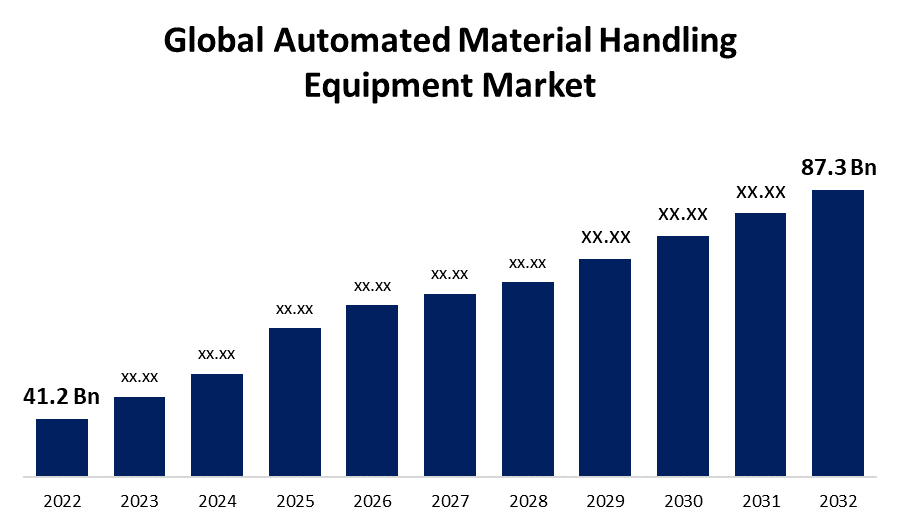

- The Global Automated Material Handling Equipment Market Size was valued at USD 41.2 Billion in 2022.

- The Market Size is Growing at a CAGR of 7.8% from 2022 to 2032

- The Worldwide Automated Material Handling Equipment Market Size is expected to reach USD 87.3 Billion by 2032

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Automated Material Handling Equipment Market Size is expected to reach USD 87.3 Billion by 2032, at a CAGR of 7.8% during the forecast period 2022 to 2032.

The automated material handling systems or AHM systems facilitate effective material delivery from one location to another in the manufacturing space, whether it is within the same division or bay, on the opposite side of the manufacturing floor, or possibly in two independent premises. An AMHS transfers materials utilizing conveyors, vertical elevators, and self-driving machines using itinerary and process cycle details provided by the MES. Automated material handling systems employ carrier and material tracking systems to identify the material set by the operator at a "pick-up" point, process the material identification to locate the next destination, and then convey the contents. The availability of information, efficiency, high-quality control, workplace safety, flexibility in manufacturing, cost-effective utilization of labor, and adherence to legislative requirements are among the many advantages of automated material handling systems. Automated material handling systems are precise and scalable, but they need significant investment and will require a longer to income stream.

Global Automated Material Handling Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 41.2 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.8% |

| 2032 Value Projection: | USD 87.3 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By End-Use Industry, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Hyster-Yale Material Handling, Jungheinrich, Hanwha, JBT, KUKA, Daifuku, KION, SSI Schaffer, Toyota Industries, Honeywell International, Toyota Material Handling, Dematic Group S.A.R.L, Bosch Rexroth, Murata Machinery Ltd., Crown Equipment Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The key drivers propelling the automated material handling equipment market growth around the world include the rising demand for automated material handling equipment in industries like airline management, transportation, food and beverage, semiconductor and electronics, metals and heavy machinery, and e-commerce as well as the need for companies to boost productivity, lower expenses, and further enhance safety in the company's material handling operations. Material handling is a vital part of today's manufacturing systems, in which the transportation, storage, and protection of materials and products are required for the uninterrupted operation of the entire process. An efficient material handling system may decrease finances on labor, lessen equipment costs, and increase product quality. As a result, material handling equipment is indispensable for every manufacturing or production industry striving to improve operations and maximize productivity.

The extensive usage of automated material handling equipment, such as automated guided vehicles (AGV), AS/RS, conveying systems, cranes, and robots, aids in completing material handling objectives such as pick and place, storage, retrieval, and transportation. Just-in-time (JIT) delivery of raw materials, computerized control of received assembled parts, and tracking of goods in factories and storage facilities have all become feasible with automated material handling technology. The growing shift toward smart manufacturing is projected to boost the automated material handling market. Robots have gotten increasingly flexible and accurate as motion control technology has become more sophisticated, enabling them to freely manipulate workpieces or products and execute an extensive variety of jobs. Additionally, modern technologies such as cloud-based applications, IoT, and machine learning allow real-time data monitoring and analysis, identifying inconsistencies, and optimizing processes in the automated material handling solutions. Furthermore, increased industrialization has led to a major investment in emerging economies' infrastructure development. As a result, new and complex warehouse facilities are required to integrate and manage supply chains. The spike in investments in improving the capability of emerging nations' logistics systems has created new growth prospects for automated material handling equipment vendors.

Restraining Factors

The high initial installation cost of automated material handling equipment, on the other hand, constitutes a significant challenge to the automated material handling equipment market. In addition, connecting new automated material handling equipment with previous equipment incurs significant costs for modifying the layout and deploying new software.

Market Segmentation

By Product Type Insights

The AS/RS segment is dominating the market with the largest revenue share over the forecast period.

On the basis of product type, the global automated material handling equipment market is segmented into the AMR, AGV, AS/RS, cranes, robots, WMS, sortation & conveyors systems, collaborative robots, and others. Among these, the AS/RS segment is dominating the market with the largest revenue share of 34.6% over the forecast period. AS/RS provides advantages such as decreased space and labor use, increased supply chain effectiveness and productivity, real-time inventory management at a more affordable price, error-free fulfillment, and quick storage and retrieval of items. AS/RS implementation is growing as these systems assist warehouses and manufacturing organizations in enhancing manufacturing capacity and precision of orders. As a result of these factors, several warehouses and distribution centers began warehouse consolidation to better meet the needs of their clients, a development that is projected to be followed by additional warehouse operators.

By System Insights

The global automated material handling equipment market segment is expected to hold the largest share of the global automated material handling equipment market during the forecast period.

Based on the system, the global automated material handling equipment market is classified into unit-load material handling and bulk-load material handling. Among these, the global automated material handling equipment market segment is expected to hold the largest share of the automated material handling equipment market during the forecast period. The unit load material handling equipment execution entails moving and storing one component, such as pallets and containers. Regardless of the separate components, it carries a single load. When opposed to moving each item individually, unit load equipment carriers are more cost-effective and faster. The growing need for automated material handling equipment in e-commerce businesses is likely to boost the demand for unit load material handling systems for the automated material handling equipment market during the research period.

By End-Use Industry Insights

The e-commerce segment accounted for the largest revenue share of more than 32.7% over the forecast period.

On the basis of end-uses, the global automated material handling equipment market is segmented into 3PL, chemicals, healthcare, aviation, automotive, food & beverages, semiconductor & electronics, e-commerce, metals & heavy machinery, and others. Among these, the e-commerce segment is dominating the market with the largest revenue share of 32.7% over the forecast period. One of the fastest-growing industries, e-commerce relies on AMH equipment to optimize warehouse and fulfillment processes. Additionally, the rise of e-commerce has increased demand for automated material-handling equipment significantly. These technologies can efficiently manage enormous amounts of orders, decreasing the requirement for laborious processes. There is also a rising emphasis on worker safety, and automated material handling technology can increase safety dramatically by lowering the likelihood of serious injuries or accidents.

Regional Insights

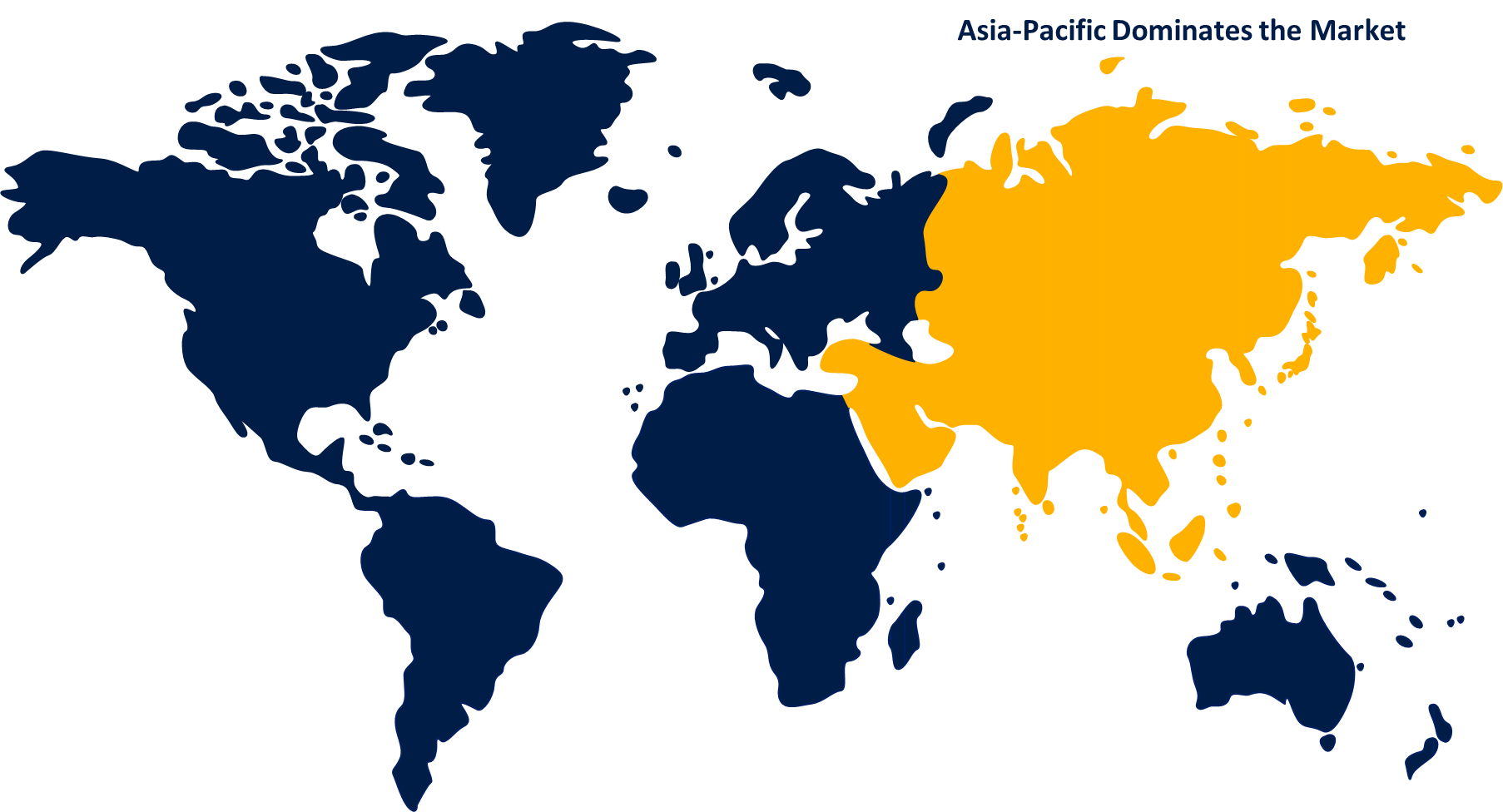

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 38.7% market share over the forecast period. Growing recognition of warehouse automation and the increased emphasis of major economies such as China, Japan, India, and South Korea on automated systems are prominent factors driving to Asia Pacific's significant expansion in the automated material handling equipment market. The rapid expansion of the automotive, e-commerce, food and beverage, and healthcare industries in key markets like China, Japan, India, Singapore, Australia, and Japan is fueling the explosive development of the Asia Pacific market. Furthermore, increased manufacturing capacity and the widespread use of material handling systems to improve production capabilities in several regions, including South Korea, China, and Taiwan, are fueling the automated material handling equipment market expansion.

North America, on the contrary, is expected to grow the fastest during the forecast period. North America is a technological hotspot, propelling the creation of new and sophisticated automated material handling equipment. Manufacturers in the region are heavily investing in R&D to develop less expensive, flexible, and sophisticated technologies. Furthermore, the rise in e-commerce sales, as well as the rise in demand for both durable and non-durable goods, has compelled manufacturing enterprises to invest in vast manufacturing facilities and material handling equipment.

List of Key Market Players

- Hyster-Yale Material Handling

- Jungheinrich

- Hanwha

- JBT

- KUKA

- Daifuku

- KION

- SSI Schaffer

- Toyota Industries

- Honeywell International

- Toyota Material Handling

- Dematic Group S.A.R.L

- Bosch Rexroth

- Murata Machinery Ltd.

- Crown Equipment Corporation

Key Market Developments

- On August 2023, Duravant LLC ("Duravant"), a global provider of engineering equipment and automation solutions to the food processing, packaging, and material handling industries, announced today the acquisition of National Presort, LP ("NPI"), a leading developer of automated parcel sortation systems. NPI has provided innovative turnkey equipment solutions to e-commerce, courier, parcel post, warehouse, and fulfillment operations to boost throughput, improve accuracy, and reduce fulfillment time.

- In October 2022, Vecna Robotics, the industry leader in flexible material handling automation solutions, announced a new software release as well as hardware upgrades for its AFL-class autonomous forklift. The new capabilities broaden the company's reach on warehouse and manufacturing floors by streamlining material transit between other gear and equipment, with a particular emphasis on low-lift operations.

- In September 2022, Ouster, Inc. introduced a 3D industrial lidar sensor suite suited for high-volume material handling applications. The industrial series of high-resolution OS0 and OS1 sensors is designed to fulfill the specific needs of forklifts, port equipment, and autonomous mobile robot (AMR) makers at prices that allow implementation on high-volume production fleets.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Automated Material Handling Equipment Market based on the below-mentioned segments:

Automated Material Handling Equipment Market, Product Type Analysis

- AMR (Autonomous Mobile Robot)

- AGV (Automated Guided Vehicles)

- AS/RS (Automated Storage/Retrieval Systems)

- Cranes

- Robots

- WMS (Warehouse Management System)

- Sortation & Conveyors Systems

- Collaborative Robots

- Others

Automated Material Handling Equipment Market, System Analysis

- Unit Load Material Handling

- Bulk Load Material Handling

Automated Material Handling Equipment Market, End-Use Industry Analysis

- 3PL

- Chemicals

- Healthcare

- Aviation

- Automotive

- Food & Beverages

- Semiconductor & Electronics

- E-Commerce

- Metals & Heavy Machinery

- Others

Automated Material Handling Equipment Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the automated material handling equipment market?The Global Automated Material Handling Equipment Market is expected to grow from USD 41.2 billion in 2022 to USD 87.3 billion by 2032, at a CAGR of 7.8% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?Hyster-Yale Material Handling, Jungheinrich, Hanwha, JBT, KUKA, Daifuku, KION, SSI Schaffer, Toyota Industries, Honeywell International, Toyota Material Handling, Dematic Group S.A.R.L, Bosch Rexroth, Murata Machinery Ltd., Crown Equipment Corporation

-

3. Which segment dominated the automated material handling equipment market share?The e-commerce segment in end-use industry type dominated the automated material handling equipment market in 2022 and accounted for a revenue share of over 32.7%.

-

4. What are the elements driving the growth of the automated material handling equipment market?Some of the primary elements drivers for AMH firms and the automated material handling equipment market include rising demand for automated material handling equipment in the e-commerce industry and significant growth prospects in the healthcare industry.

-

5. Which region is dominating the automated material handling equipment market?Asia Pacific is dominating the automated material handling equipment market with more than 38.7% market share.

-

6. Which segment holds the largest market share of the automated material handling equipment market?The AS/RS segment based on product type holds the maximum market share of the automated material handling equipment market.

Need help to buy this report?