Australia Winter Sports Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product (Ski Equipment, Snowboard Equipment, Ice Hockey Equipment, and Others), By End User (Professional Athletes, and Amateurs), and Australia Winter Sports Equipment Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsAustralia Winter Sports Equipment Market Insights Forecasts to 2035

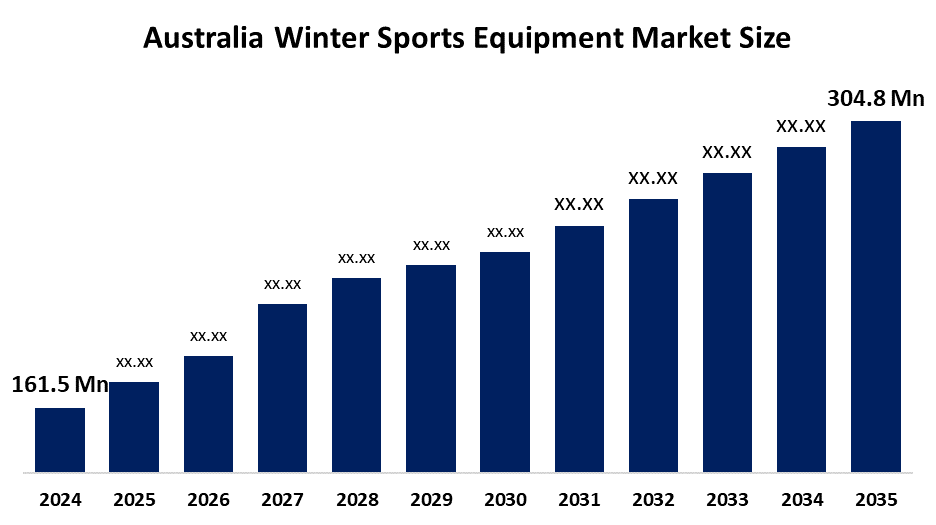

- The Australia Winter Sports Equipment Market Size Was Estimated at USD 161.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.94% from 2025 to 2035

- The Australia Winter Sports Equipment Market Size is Expected to Reach USD 304.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Australia Winter Sports Equipment Market Size Is Anticipated To Reach USD 304.8 Million By 2035, Growing At A CAGR Of 5.94% From 2025 To 2035. The winter sports equipment market in Australia is driven by need for cutting-edge, lightweight, and safety-enhanced sports equipment, growing adventure tourism, rising disposable incomes, the growth of ski resorts, and increased participation in skiing and snowboarding.

Market Overview

The Australia winter sports equipment market includes the production and sale of gear and accessories used for snow-based activities. The market includes skis snowboards boots bindings helmets protective wear and apparel. The applications of the equipment cover recreational skiing professional snow sports training programs and tourism activities at alpine resorts. The market expansion occurs because of winter tourism patterns and rising winter sports participation and Australian demand for advanced lightweight safe equipment.

The Australian winter sports equipment market receives government support through its safety and athlete development and alpine tourism activities. The programs provide funding of AUD 34.9 million for water and snow safety and AUD 28.6 million for Winter Olympic preparation and AUD 38.4 million for Victorian alpine resort grants. The funding will result in increased equipment demand because more people will participate in activities and resorts will enhance their facilities.

The winter sports equipment market in Australia has seen its latest developments through local brands Stoke Ski Co. and Outdoor Tech Australia which introduced their new ski and snowboard products that feature lightweight and durable materials. Retailers are expanding their rental technology services together with their online product customization capabilities. The upcoming business prospects for the company will emerge from three areas which include environmentally friendly equipment development, expansion of online shopping, and creation of seasonal equipment rental packages through partnerships with ski resorts.

Report Coverage

This research report categorizes the market for the Australia winter sports equipment market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia winter sports equipment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia winter sports equipment market.

Australia Winter Sports Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 161.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.94% |

| 2035 Value Projection: | USD 304.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product, By End User |

| Companies covered:: | Snow Central, Auski Australia, Anaconda, X-Dream Snow & Ski Shop, Macs Snow Gear (Macs), Wilderness Sports AU, Mountain Trader, Pauls Ski Shop, Snow Alley, Bumps Snow & Ski, Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The winter sports equipment market in Australia is driven by the more people are participating in skiing and snowboarding together with increased alpine tourism and higher disposable incomes. The ski resorts experience growth because they implement new facilities and advanced snowmaking systems and receive strong backing from the government for winter sports development. The market maintains its growth because winter sports training programs attract more people and the demand for safety equipment increases and international winter sports events create a global influence.

Restraining Factors

The winter sports equipment market in Australia is mostly constrained by the snowfall patterns together with climate changes and the limited length of winter periods. The industry faces two main challenges which include high equipment prices and the need to import products and the existence of only a few ski resorts.

Market Segmentation

The Australia winter sports equipment market share is classified into product and end user.

- The ski equipment segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia winter sports equipment market is segmented by product into ski equipment, snowboard equipment, ice hockey equipment, and others. Among these, the ski equipment segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Skiing is more accessible to beginners, families, and tourists visiting alpine resorts. The ski resorts in Australia primarily concentrate on skiing which creates high demand for skis, boots, bindings, and poles. The government provides support for ski training programs and rental services at resorts and equipment upgrades and increased skier spending which leads to the segment gaining the highest revenue share and ongoing expansion.

- The amateurs segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia winter sports equipment market is segmented by end user into professional athletes, and amateurs. Among these, the amateurs segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to the substantial participation of visitors, first-time users, and recreational skiers and snowboarders at alpine resorts, amateurs make up the greatest share. Strong demand for mid-range and entry-level equipment, rentals, and frequent replacements is driven by this group.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia winter sports equipment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Snow Central

- Auski Australia

- Anaconda

- X-Dream Snow & Ski Shop

- Macs Snow Gear (Macs)

- Wilderness Sports AU

- Mountain Trader

- Pauls Ski Shop

- Snow Alley

- Bumps Snow & Ski

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- , In December 2025, the $700 million Winter Sports World indoor snow resort in Penrith, New South Wales, signed a significant agreement with Bon Ski, a Chinese company, with plans to open in 2028 and offer year-round skiing and tourism.

- In September 2025, Snow Resorts Australia (previously ASAA) announced that the 2025 ski season was off to a terrific start, with excellent snow conditions and a rise in the number of people participating in snow sports.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia winter sports equipment market based on the below-mentioned segments:

Australia Winter Sports Equipment Market, By Product

- Ski Equipment

- Snowboard Equipment

- Ice Hockey Equipment

- Others

Australia Winter Sports Equipment Market, By End User

- Professional Athletes

- Amateurs

Frequently Asked Questions (FAQ)

-

Q: What is the Australia winter sports equipment market size?A: Australia winter sports equipment market size is expected to grow from USD 161.5 million in 2024 to USD 304.8 million by 2035, growing at a CAGR of 5.94% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by more people are participating in skiing and snowboarding together with increased alpine tourism and higher disposable incomes. The ski resorts experience growth because they implement new facilities and advanced snowmaking systems and receive strong backing from the government for winter sports development.

-

Q: What factors restrain the Australia winter sports equipment market?A: Constraints include the snowfall patterns together with climate changes and the limited length of winter periods.

-

Q: How is the market segmented by product?A: The market is segmented into ski equipment, snowboard equipment, ice hockey equipment, and others.

-

Q: Who are the key players in the Australia winter sports equipment market?A: Key companies include Snow Central, Auski Australia, Anaconda, X-Dream Snow & Ski Shop, Mac’s Snow Gear (Mac’s), Wilderness Sports AU, Mountain Trader, Paul’s Ski Shop, Snow Alley, Bumps Snow & Ski, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?