Australia Wine Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Still Wine, Sparkling Wine, Fortified Wine, and Vermouth), By Color (Red Wine, Rose Wine, White Wine), and Australia Wine Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesAustralia Wine Market Insights Forecasts to 2035

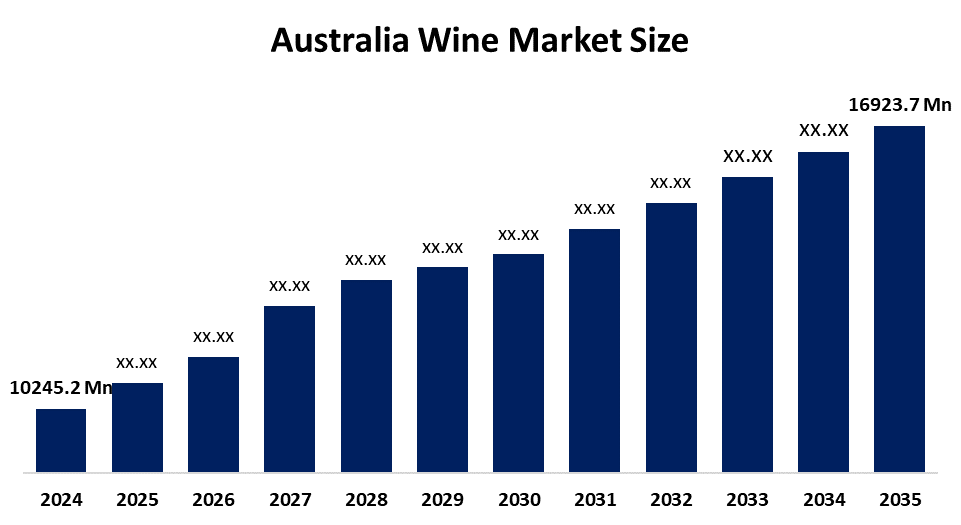

- The Australia Wine Market Size Was Estimated at USD 10245.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.67% from 2025 to 2035

- The Australia Wine Market Size is Expected to Reach USD 16923.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Australia Wine Market size is anticipated to reach USD 16923.7 Million by 2035, growing at a CAGR of 4.67% from 2025 to 2035. The Wine market in Australia is driven by the high-end wines, increased interest in sustainable and health-conscious choices, and significant export prospects. While eco-friendly packaging gains traction, wine tourism and technological innovation also contribute to industry growth. All of these elements work together to support the consistent development of Australia's wine market.

Market Overview

Wine is among the oldest alcoholic beverages that humanity has ever encountered. It is typically produced from fermented grapes or other fruits. The general process for creating wine is based on the fermentation of crushed grapes or fruit juice by yeast, which converts the juice's carbohydrates into carbon dioxide and alcohol. There is an extensive selection of types and styles of wine, including red, white, rose, and sparkling wines. Key driving factors include premiumization, export growth, tourism, sustainable viticulture, government support, technological innovation, and rising global demand for Australian wines. According to Wine Australia, the wine industry sector is a significant contributor to the economy, with more than 2,000 wineries producing more than 1.3 billion liters each year. With government support to increase exports and sustainable growing practices, the wine industry adopts new technologies such as precision growing technologies, AI crop monitoring, and automation in the wine-making process to increase quality and efficiencies. The biggest export markets for wine include China, the US, and the UK. Opportunities for the future include drinking premium wine, sustainable and organic wines, and expanding digital channels to consumers due to changing consumer preferences and demand for an authentic Australian wine experience.

Report Coverage

This research report categorizes the market for the Australia wine market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia wine market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia wine market.

Australia Wine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10245.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.67% |

| 2035 Value Projection: | USD 16923.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Product Type, By Color |

| Companies covered:: | Treasury Wine Estates, Accolade Wines, Casella Family Brands, Hill-Smith Family Estates, Australian Vintage, Calabria Family Wine Group, Andrew Peace Wines, Qualia Wine Services, Zilzie Wines, Berton Vineyards, Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The wine market in Australia is driven by export demand from its major markets in the U.S., U.K., and Asia, which is influenced by government programs promoting sustainability, regional branding, and competitiveness. The growth of precision viticulture, AI-enabled monitoring, and automation is all about productivity and quality improvements in grape production, leading to efficiency of production in wineries and increased product quality. There is also a continued trend in premiumization with a rising consumer interest in boutique, organic, and high-value wines. In addition to growing wine tourism in regions like the Barossa Valley and Hunter Valley, a connection to regional identity is fostered. There are ongoing sustainability improvements with a growing number of wineries looking to produce carbon-neutral wines or to adopt more environmentally-friendly practices. All of these factors contribute to Australia’s reputation and attractiveness in the global wine market.

Restraining Factors

The wine market in Australia is mostly constrained by climate change. Rising temperatures and drought conditions have a significant negative effect on grape quality, resulting in variability in the quality and availability of wine. Trade barriers, especially trade tensions with China, are obstacles to developing a stable market. Increasing production and logistics costs have been a pressure on profit, as many producers no longer expect a return to higher prices. The shift in consumer preferences, particularly to low or no alcohol products, is reducing the demand for wine. The saturated market for wine, and the disruption of the supply chain also limit the growth potential and timely global distribution of Australian wine.

Market Segmentation

The Australia wine market share is classified into product type and color.

- The still wine segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia wine market is segmented by product type into still wine, sparkling wine, fortified wine, and vermouth. Among these, the still wine segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The still wine segment most significantly represents the Australian wine market due to its high domestic consumption, broad price availability, and high export demand. Its versatility and broad appeal create the segment generating the most revenue.

- The red wine segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia wine market is segmented by color into red wine, rose wine, and white wine. Among these, the red wine segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The red wine category leads the wine market in Australia on account of strong domestic and international demand, high production, and premium positioning, making it the segment with the largest revenue.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia wine market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companie

- Treasury Wine Estates

- Accolade Wines

- Casella Family Brands

- Hill-Smith Family Estates

- Australian Vintage

- Calabria Family Wine Group

- Andrew Peace Wines

- Qualia Wine Services

- Zilzie Wines

- Berton Vineyards

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In 2025, Treasury Wine Estates (TWE) announced a dual strategy for future growth, with a new $15 million No and Low Alcohol (NOLO) facility opening in June and reporting a 15.5% increase in profits in August. The new investment in NOLO production is a strategic response to evolving consumer preferences, while an increase in profits signals the strong performance of TWE's premium brands.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia wine market based on the below-mentioned segments:

Australia Wine Market, By Product Type

- Still Wine

- Sparkling Wine

- Fortified Wine

- Vermouth

Australia Wine Market, By Color

- Red Wine

- Rose Wine

- White Wine

Frequently Asked Questions (FAQ)

-

Q: What is the Australia wine market size?A: Australia Wine market size is expected to grow from USD 10245.2 million in 2024 to USD 16923.7 million by 2035, growing at a CAGR of 4.67% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by export demand from its major markets in the U.S., U.K., and Asia, which is influenced by government programs promoting sustainability, regional branding, and competitiveness.

-

Q: What factors restrain the Australia wine market?A: Constraints include climate change. Rising temperatures and drought conditions have a significant negative effect on grape quality, resulting in variability in the quality and availability of wine.

-

Q: How is the market segmented by product type?A: The market is segmented into still wine, sparkling wine, fortified wine, and vermouth.

-

Q: Who are the key players in the Australia wine market?A: Key companies include Treasury Wine Estates, Accolade Wines, Casella Family Brands, Hill-Smith Family Estates, Australian Vintage, Calabria Family Wine Group, Andrew Peace Wines, Qualia Wine Services, Zilzie Wines, and Berton Vineyards.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?