Australia Sunglasses Market Size, Share, and COVID-19 Impact Analysis, By Product (Polarized, and Non-Polarized), By Material (CR-39, Polycarbonate, Polyurethane, and Others), and Australia Sunglasses Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsAustralia Sunglasses Market Insights Forecasts to 2035

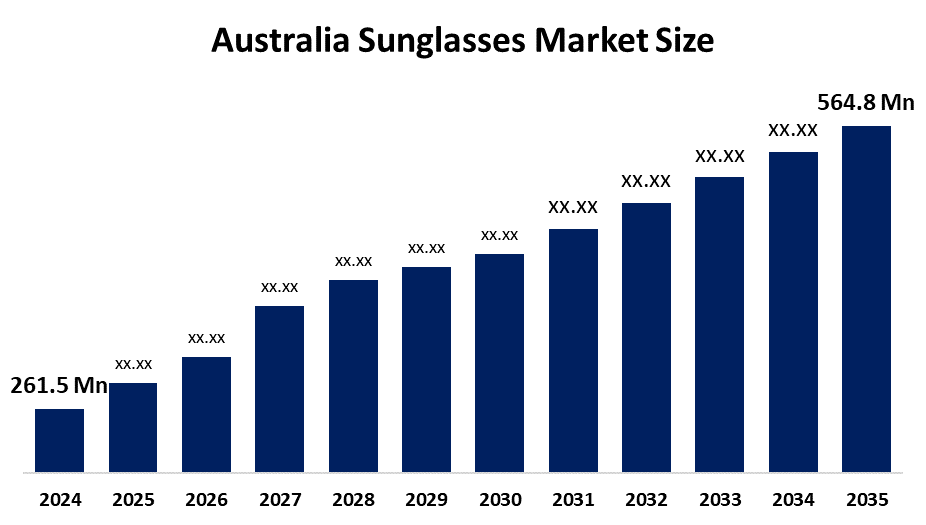

- The Australia Sunglasses Market Size Was Estimated at USD 261.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.25% from 2025 to 2035

- The Australia Sunglasses Market Size is Expected to Reach USD 564.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Australia sunglasses market size is anticipated to reach USD 564.8 million by 2035, growing at a CAGR of 7.25% from 2025 to 2035. The sunglasses market in Australia is driven by rising UV awareness, a strong outdoor lifestyle culture, growing fashion consciousness, the desire for luxury eyewear, the growth of tourism, and increased spending on eye protection and accessories.

Market Overview

The Australia sunglasses market refers to the production distribution and sale of eyewear which protects eyes from harmful UV radiation while providing visual comfort and stylish design. The sunglasses serve multiple purposes which include daily use and sports and outdoor activities and driving and fashion and luxury use and workplace safety. The combination of increased public knowledge about eye health and high ultraviolet radiation exposure and strong fashion trends leads to widespread acceptance of the product across all Australian age groups.

The Australian sunglasses market receives indirect government assistance through public health programs which operate without the need for financial aid. The SunSmart program, which receives funding from state governments, establishes a national system for promoting UV protection of eyes. Australia enforces AS/NZS 1067.1 sunglasses standards. With more than 200000 Australians using the Global UV App its users receive guidance to wear sunglasses which keeps the market demand for protective eyewear consistent.

The Australia market for sunglasses has seen new advancements because Specsavers Australia introduced designer partnerships and developed new lens technologies which include polarized and blue-light filtering capabilities. Virtual try-on systems and sustainable frame materials have become standard features for brands to implement. The future possibilities for smart sunglasses and eco-friendly products and high-end fashion eyewear and increased online sales stem from Australian outdoor activities and their understanding of UV protection.

Report Coverage

This research report categorizes the market for the Australia sunglasses market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia sunglasses market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia sunglasses market.

Australia Sunglasses Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 261.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.25% |

| 2035 Value Projection: | USD 564.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product ,By Material |

| Companies covered:: | Quay Australia, Spotters, Just Sunnies, Bright Eyes Sunglasses, Sunglass Culture, Oroton, Bailey Nelson, Sunglass Clearance Warehouse, AM Eyewear, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The sunglasses market in Australia is driven by the high UV radiation levels and increased public understanding of eye health and effective SunSmart programs that receive government support. Australian outdoor activities together with beach culture and increasing fashion trends and need for high-end polarized sunglasses create additional sales growth. Market expansion develops through three factors which include more people traveling and participating in sports activities and shopping through online platforms and the development of new lens technologies and eco-friendly materials.

Restraining Factors

The sunglasses market in Australia is mostly constrained by the high price sensitivity towards premium brands and there is easy access to inexpensive imported products and counterfeit goods and customers need to learn about certified UV protection standards before they will buy high-quality compliant sunglasses.

Market Segmentation

The Australia sunglasses market share is classified into product and material.

- The polarized segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia sunglasses market is segmented by product into polarized, and non-polarized. Among these, the polarized segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Polarized sunglasses are perfect for Australia's outdoor-loving culture because they cut down on glare from sand, water, and highways. Increased use has been fueled by increased UV exposure, increasing demand from beachgoers, drivers, and sports fans, as well as growing knowledge of the advantages of eye protection.

- The polycarbonate segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia sunglasses market is segmented by material into CR-39, polycarbonate, polyurethane, and others. Among these, the polycarbonate segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Polycarbonate lenses are perfect for Australia's active, outdoor lifestyle since they are lightweight, extremely impact-resistant, and offer superior UV protection. They are frequently used as sunglasses for daily use, sports, and driving. Their highest market share and rapid growth are supported by the growing demand for sturdy, shatter-resistant eyewear, particularly among athletes and youngsters, as well as by its affordability and compatibility with polarized coatings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia sunglasses market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Quay Australia

- Spotters

- Just Sunnies

- Bright Eyes Sunglasses

- Sunglass Culture

- Oroton

- Bailey Nelson

- Sunglass Clearance Warehouse

- AM Eyewear

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, Sunglass Hut's "Own Your Moment" campaign in Australia begins and features new seasonal styles from high-end brands including Versace, Oakley, Prada, and Ray-Ban in stores all throughout the country.

- In April 2025, Kering Eyewear expands its distribution agreement in Australia, continuing to supply luxury labels including Gucci, Cartier, and Balenciaga through Sunshades Eyewear.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia sunglasses market based on the below-mentioned segments:

Australia Sunglasses Market, By Product

- Polarized

- Non-Polarized

Australia Sunglasses Market, By Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Australia sunglasses market size?A: Australia sunglasses market size is expected to grow from USD 261.5 million in 2024 to USD 564.8 million by 2035, growing at a CAGR of 7.25% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the high UV radiation levels and increased public understanding of eye health and effective SunSmart programs that receive government support.

-

Q: What factors restrain the Australia sunglasses market?A: Constraints include the high price sensitivity towards premium brands and there is easy access to inexpensive imported products.

-

Q: How is the market segmented by material?A: The market is segmented into CR-39, polycarbonate, polyurethane, and others.

-

Q: Who are the key players in the Australia sunglasses market?A: Key companies include Quay Australia, Spotters, Just Sunnies, Bright Eyes Sunglasses, Sunglass Culture, Oroton, Bailey Nelson, Sunglass Clearance Warehouse, AM Eyewear, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?