Australia Propolis Market Size, Share, and COVID-19 Impact Analysis, By Product form (Capsules and Tablets, Liquids, Powders, and Extracts), By Application (Dietary supplements, Pharmaceuticals, Cosmetics and personal care, and Food and beverages), and Australia Propolis Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesAustralia Propolis Market Insights Forecasts to 2035

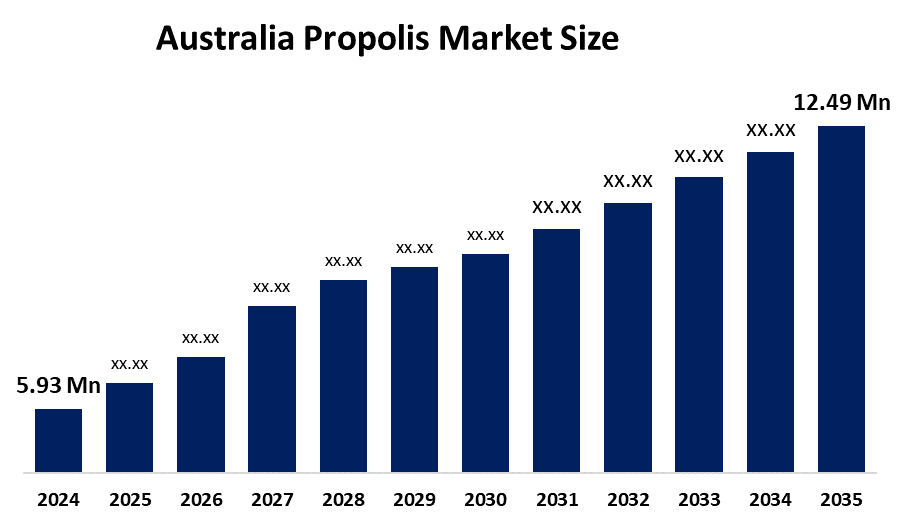

- The Australia Propolis Market Size Was Estimated at USD 5.93 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.01% from 2025 to 2035

- The Australia Propolis Market Size is Expected to Reach USD 12.49 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Australia propolis market size is anticipated to reach USD 12.49 million by 2035, growing at a CAGR of 7.01% from 2025 to 2035. The propolis market in Australia is driven by growing consumer preferences for natural health products, increased awareness of immunological advantages, expanding nutraceutical and cosmetic applications, growing adoption of herbal supplements, and a robust demand for clean-label ingredients.

Market Overview

The Australia propolis market identifies all activities that involve producing and processing and selling propolis which is a natural bee resin that people use to create products with antimicrobial and antioxidant and anti-inflammatory effects. The market serves applications across dietary supplements, pharmaceuticals, functional foods, cosmetics, and personal care products. Propolis is used in immune-support formulations and oral health products and skincare solutions and wellness supplements because Australian consumers increasingly prefer natural ingredients that have no artificial additives and help them stay healthy.

The federal and state governments of Australia provide funds for apiary and pollination programs. These include the $500,000 Community Bee Innovation Fund providing grants ranging from $5,000 to $50,000 to help protect bees and the health of beekeeping and biosecurity measures. South Australia has committed to invest at least $142,261 from its Apiary Industry Fund for various projects aimed at assisting beekeepers with their respective operations. Hives are supported in part through federal honey bee levies, which are generated by way of Agri Futures, that support research and development intended to provide the apiary industry with sustainable solutions.

Australian researchers discovered 16 high-grade propolis types which created industry interest because these materials can be used to develop commercial products for food, health, and cosmetic applications. Apis Flora and other companies work together to develop environmentally friendly beekeeping practices while Hive & Wellness Australia develops better methods for collecting honey. The company plans to develop three areas which include domestic production expansion, high-quality propolis extraction, and increased wellness product exportation.

Report Coverage

This research report categorizes the market for the Australia propolis market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia propolis market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia propolis market.

Australia Propolis Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.93 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.01% |

| 2035 Value Projection: | USD 12.49 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Natural Life Australia, Bee Healthy Australia, Australian by Nature, Honeylife Australia, Natural Hive Australia, Bens Bees, Healthylife Australia, Pure Peninsula Honey, Bee2 Honey, Natural High Australia, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The propolis market in Australia is driven by because of consumers now understand natural immunity boosters and people increasingly seek herbal supplements and the cosmetics market starts using propolis as an ingredient in functional foods. The beekeeping industry grows because of industry expansion and government initiatives that support sustainable apiary practices and research activities that focus on bioactive compound development. Market growth receives support from clean-label product demand and preventive health measures and rising export requirements from Asia-Pacific wellness markets.

Restraining Factors

The propolis market in Australia is mostly constrained by the limited raw material availability, seasonal bee production, and vulnerability to climate change and pests. The market faces obstacles which prevent large-scale production because of high production costs and lack of standardization and the need to comply with regulations and the changing demands of international markets.

Market Segmentation

The Australia propolis market share is classified into product form and application.

The liquids segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia propolis market is segmented by product form into capsules and tablets, liquids, powders, and extracts. Among these, the liquids segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because of its greater absorption, ease of dosage adjustment, and adaptability to dietary supplements, dental care, and functional beverages, liquid propolis is frequently used. Additionally, it is frequently utilized in tinctures and sprays, which makes it well-liked by customers looking for quick-absorbing, all-natural immune-supporting items, increasing sales volumes and revenue share.

The dietary supplements segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia propolis market is segmented by application into dietary supplements, pharmaceuticals, cosmetics and personal care, and food and beverages. Among these, the dietary supplements segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to high consumer awareness of propolis's anti-inflammatory, antioxidant, and immune-boosting properties, dietary supplements make up the greatest portion. Growing inclination for natural medicines, increased use of preventive healthcare, and the accessibility of propolis capsules, liquids, and sprays through pharmacies and internet channels all contribute to increased consumption, bolstering both present supremacies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia propolis market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Natural Life Australia

- Bee Healthy Australia

- Australian by Nature

- Honeylife Australia

- Natural Hive Australia

- Bens Bees

- Healthylife Australia

- Pure Peninsula Honey

- Bee2 Honey

- Natural High Australia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In May 2024, advance Queensland highlights current studies on the commercialization of stingless bee propolis, examining special bioactive qualities for potential products.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia propolis market based on the below-mentioned segments:

Australia Propolis Market, By Product Form

- Capsules and Tablets

- Liquids, Powders

- Extracts

Australia Propolis Market, By Application

- Dietary supplements

- Pharmaceuticals

- Cosmetics and personal care

- Food and beverages

Frequently Asked Questions (FAQ)

-

Q: What is the Australia propolis market size?A: Australia propolis market size is expected to grow from USD 5.93 million in 2024 to USD 12.49 million by 2035, growing at a CAGR of 7.01% during the forecast period 2025-2035. Q: What are the key growth drivers of the market?

-

Q: What are the key growth drivers of the market?A: Market growth is driven by because of consumers now understand natural immunity boosters and people increasingly seek herbal supplements and the cosmetics market starts using propolis as an ingredient in functional foods.

-

Q: What factors restrain the Australia propolis market?A: Constraints include the limited raw material availability, seasonal bee production, and vulnerability to climate change and pests.

-

Q: How is the market segmented by product form?A: The market is segmented into capsules and tablets, liquids, powders, and extracts.

-

Q: Who are the key players in the Australia propolis market?A: Key companies include Natural Life Australia, Bee Healthy Australia, Australian by Nature, Honeylife Australia, Natural Hive Australia, Bens Bees, Healthylife Australia, Pure Peninsula Honey, Bee2 Honey, Natural High Australia, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?