Australia Pharmaceutical Filtration Market Size, Share, and COVID-19 Impact Analysis, By Technique (Cross Flow Filtration, Nanofiltration, Microfiltration, Ultrafiltration, and Others), By Application (Final Product Processing, Water Purification, Raw Material Filtration, Cell Separation, and Air Purification), and Australia Pharmaceutical Filtration Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareAustralia Pharmaceutical Filtration Market Insights Forecasts to 2035

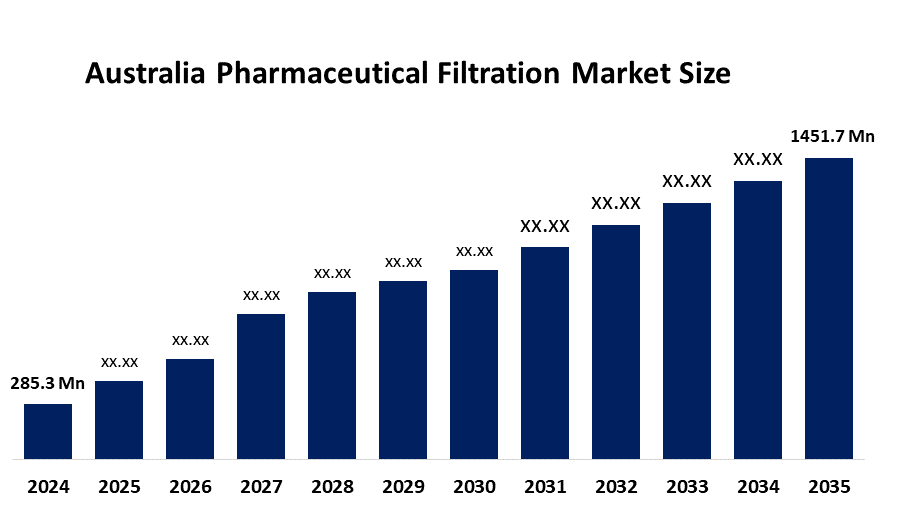

- The Australia Pharmaceutical Filtration Market Size Was Estimated at USD 285.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 15.94% from 2025 to 2035

- The Australia Pharmaceutical Filtration Market Size is Expected to Reach USD 1451.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Australia Pharmaceutical Filtration Market Size is anticipated to reach USD 1451.7 Million by 2035, Growing at a CAGR of 15.94% from 2025 to 2035. The pharmaceutical filtration market in Australia is driven by rising biologics production, stringent regulations, growing pharmaceutical R&D, the need for sterile injectables, cutting-edge membrane technologies, and an increase in the capacity of local manufacturing and contract development organizations.

Market Overview

The Australian pharmaceutical filtration market refers to the application of sophisticated filtration techniques to remove unwanted substances, microbes, and fine particles in the production and processing of drugs. This is performed in the case of sterile injectables, biologics, vaccines, active pharmaceutical ingredients (APIs), and water purification, thus guaranteeing the safety of the product, compliance with regulations, and efficient processes, as well as the maintenance of the same high quality of pharmaceuticals throughout research, clinical, and commercial production stages.

Strong healthcare spending and manufacturing initiatives foster Australia’s pharmaceutical filtration support. Among them are the AUD 12 billion Pharmaceutical Benefits Scheme, R&D Tax Incentive, AUD 2.5 billion Modern Manufacturing Strategy, AUD 1.5 billion National Reconstruction Fund, AUD 500 million Medical Research Future Fund, and the zero-rate Production Grant, which are all contributing to local pharmaceutical production, biologics manufacturing, and the advanced filtration technology transfer.

Recent advancements in pharmaceutical filtration in Australia comprise modular tangential flow filtration (TFF) systems suitable for small-scale production of biologics and increased reliance on single-use sterile filters across vaccine and biologics production sites in Melbourne and Queensland. Leading providers such as Danaher’s Supor Prime filters improve performance. There are prospective areas to explore in nanofiltration, membrane developments, and increased local bioprocessing capacity, which would match the production of vaccines and sterile drugs.

Report Coverage

This research report categorizes the market for the Australia pharmaceutical filtration market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia pharmaceutical filtration market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia pharmaceutical filtration market.

Australia Pharmaceutical Filtration Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 285.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 15.94% |

| 2035 Value Projection: | USD 1451.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Technique, By Application |

| Companies covered:: | Filchem Australia, Pearl Filtration, FilterCare Australia, Qtech Australia Pty Ltd, BHF Technologies, AEB Filtration, Filtersafe Australia, FILTRUM, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The pharmaceutical filtration market in Australia is driven by the strict TGA regulatory standards, the upward trend in production of biologics and vaccines, the increasing investments in R&D by pharmaceuticals, and the rising demand for sterile injectables. Furthermore, the local manufacturing plant expansion, use of single-use filtration systems, technological progress in membrane materials, and government assistance for domestic pharmaceutical production contribute to the rapid growth of the market.

Restraining Factors

The pharmaceutical filtration market in Australia is mostly constrained by the high capital and operational costs of advanced filtration systems, complex regulatory compliance, limited local manufacturing scale, and reliance on imported filtration technologies and specialized raw materials.

Market Segmentation

The Australia pharmaceutical filtration market share is classified into technique and application.

- The microfiltration segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia pharmaceutical filtration market is segmented by technique into cross flow filtration, nanofiltration, microfiltration, ultrafiltration, and others. Among these, the microfiltration segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because it is widely used in sterile filtration, eliminates germs and particles, is highly compatible with injectables and biologics, is affordable, and has good regulatory support throughout pharmaceutical manufacturing processes.

- The final product processing segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia pharmaceutical filtration market is segmented by application into final product processing, water purification, raw material filtration, cell separation, and air purification. Among these, the final product processing segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. High regulatory scrutiny by the TGA, strict sterility and quality criteria for finished pharmaceuticals, particularly injectables and biologics, and the increasing need for safe, contamination-free final medication formulations are the main causes of this.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia pharmaceutical filtration market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Filchem Australia

- Pearl Filtration

- FilterCare Australia

- Qtech Australia Pty Ltd

- BHF Technologies

- AEB Filtration

- Filtersafe Australia

- FILTRUM

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In June 2024, the Danaher Corporation made available Supor Prime sterilizing-grade filters in Australia as its entry into the market of high-concentration biologics production.

- In March 2024, the TFG Group and AquaVoda partnered to release a 0.1-micron silicon carbide filtration skid for the pharmaceutical and industrial sectors, which not only enhanced bacteria elimination but also contributed to sustainability.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia pharmaceutical filtration market based on the below-mentioned segments:

Australia Pharmaceutical Filtration Market, By Technique

- Cross Flow Filtration

- Nanofiltration

- Microfiltration

- Ultrafiltration

- Others

Australia Pharmaceutical Filtration Market, By Application

- Final Product Processing

- Water Purification

- Raw Material Filtration

- Cell Separation

- Air Purification

Frequently Asked Questions (FAQ)

-

Q:What is the Australia pharmaceutical filtration market size?A:Australia pharmaceutical filtration market size is expected to grow from USD 285.3 million in 2024 to USD 1451.7 million by 2035, growing at a CAGR of 15.94% during the forecast period 2025-2035.

-

Q:What are the key growth drivers of the market?A:Market growth is driven by the strict TGA regulatory standards, the upward trend in production of biologics and vaccines, the increasing investments in R&D by pharmaceuticals, and the rising demand for sterile injectables.

-

Q:What factors restrain the Australia pharmaceutical filtration market?A:Constraints include the high capital and operational costs of advanced filtration systems, complex regulatory compliance, limited local manufacturing scale, and reliance on imported filtration technologies and specialized raw materials.

-

Q:How is the market segmented by technique?A:The market is segmented into cross flow filtration, nanofiltration, microfiltration, ultrafiltration, and others.

-

Q:Who are the key players in the Australia pharmaceutical filtration market?A:Key companies include Filchem Australia, Pearl Filtration, FilterCare Australia, Qtech Australia Pty Ltd, BHF Technologies, AEB Filtration, Filtersafe Australia, FILTRUM, and Others.

-

Q:Who are the target audiences for this market report?A:The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?