Australia Pet Wearable Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Cats, Dogs, and Other Animals), By Technology (Sensors, GPS, and RFID), and Australia Pet Wearable Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsAustralia Pet Wearable Market Insights Forecasts To 2035

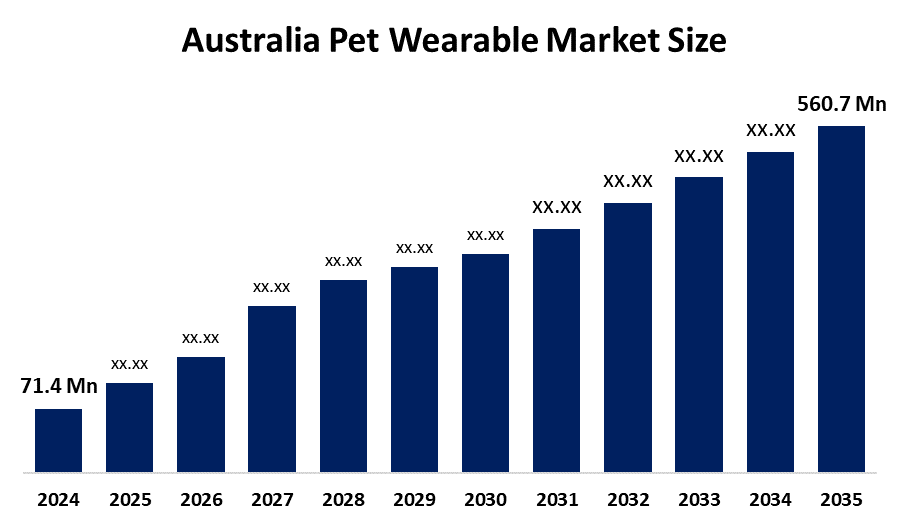

- The Australia Pet Wearable Market Size Was Estimated At USD 71.4 Million In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 20.61% From 2025 To 2035

- The Australia Pet Wearable Market Size Is Expected To Reach USD 560.7 Million By 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The Australia Pet Wearable Market Size Is Anticipated To Reach USD 560.7 Million By 2035, Growing At A CAGR Of 20.61% From 2025 To 2035. The pet wearable market in Australia is driven by rising pet ownership, expanding pet humanization, growing need for pet health monitoring, GPS tracking for safety, technology improvements, and increased expenditure on high-end smart pet care items.

Market Overview

The market size for Pet Wearables in australia consists of intelligent electronic gadgets that are made to be worn by animals for purposes such as health, activity, location, and behavior monitoring.These gadgets comprise, inter alia, GPS tracking systems, smart collars, fitness trackers, and health sensors. The use cases range from pet safety to activity tracking, health management, training, and veterinary monitoring, thus allowing the owners and professionals to not only enhance the well-being of pets and others but also reduce the chances of loss and rely on data-driven pet care in both residential and commercial pet services.

High pet ownership (approximately 68–70% of households) and increasing pet care expenditures are the main drivers of demand for gps and health-monitoring devices; Thus, The Australian Pet Wearable Market Size Is Positively Affected. Government animal welfare and tracking policies ensure safety for pets and the protection of their data, which consequently leads to the acquisition of smart pet wearables being indirectly encouraged.

The growing number of pets in australia has led to an increase in the demand for gps and activity trackers for pets, which in turn has increased the use of smart collars and health monitors that connect with mobile apps and vets for real-time insights.Businesses are working on sensor accuracy improvements, downsizing, and AI health analytics. One of the areas where AI-driven health prediction, veterinarian integration, and smart home connectivity will be future opportunities.

Report Coverage

This research report categorizesThe Market Size For The Australia Pet Wearable Market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia pet wearable market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia pet wearable market.

Australia Pet Wearable Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 71.4 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 20.61% |

| 2023 Value Projection: | USD 560.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Animal Type, By Technology |

| Companies covered:: | DogOn™ Australia, Hotchn Enterprises, MindMe, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Pet Wearable Market Size in australia is driven by the enhancement of pet ownership, pet humanization, and spending on the whole aspect of pet health and safety, getting to a new high.There is a growing need for GPS tracking, activity monitoring, and health analytics for pet loss prevention and early illness detection, which leads to easier adoption. Technical development in sensors, connectivity, and mobile apps, coupled with busy urban lifestyles and rising animal welfare issues, is the main driver of the market.

Restraining Factors

The pet wearable market in Australia is mostly constrained by the high device and subscription costs, lack of consumer awareness in rural regions, battery life and durability issues, data privacy concerns, and price sensitivity of pet owners, which can delay the use of advanced smart pet wearable solutions.

Market Segmentation

The Australia pet wearable market share is classified into animal type and technology.

- The dogs segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia Pet Wearable Market Size is segmented by animal type into cats, dogs, and other animals. Among these, the dogs segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Higher dog ownership rates, increased demand for GPS tracking and activity monitoring for outdoor mobility, and significant investment in dog health, safety, and training are the main causes of this dominance. As a result, smart collars and wearable technology for dogs are becoming more widely used.

- The GPS segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia Pet Wearable Market Size Is segmented by technology into sensors, GPS, and RFID. Among these, the GPS segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. GPS-enabled smart collars are a popular option among Australian pet owners due to the high demand for real-time pet tracking, pet safety concerns, an increase in outdoor activities, and an increase in lost pets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the australia pet wearable market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DogOn™ Australia

- Hotchn Enterprises

- MindMe

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In August 2025, the Fi Mini GPS Pet Tracker was launched, a small tracker for dogs and cats that gives real-time alerts and has a long-lasting battery.

- In June 2025, the Atrio Pet Pulse ECG wearable device was trialled in a veterinary clinic in Geelong, Australia, which locally pushed the pet health monitoring tech further.

- In January 2025, the PetPace Health 2.0 Smart Collar received the title of “IoT Wearable Device of the Year,” which brought to the limelight the advanced AI health monitoring in wearables.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia pet wearable market based on the below-mentioned segments:

Australia Pet Wearable Market, By Animal Type

- Cats

- Dogs

- Other Animals

Australia Pet Wearable Market, By Technology

- Sensors

- GPS

- RFID

Frequently Asked Questions (FAQ)

-

What is the Australia pet wearable market size?Australia pet wearable market size is expected to grow from USD 71.4 million in 2024 to USD 560.7 million by 2035, growing at a CAGR of 20.61% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the enhancement of pet ownership, pet humanization, and spending on the whole aspect of pet health and safety, getting to a new high. There is a growing need for GPS tracking, activity monitoring, and health analytics for pet loss prevention and early illness detection, which leads to easier adoption.

-

What factors restrain the Australia pet wearable market?Constraints include the high device and subscription costs, lack of consumer awareness in rural regions, battery life and durability issues, data privacy concerns, and price sensitivity of pet owners, which can delay the use of advanced smart pet wearable solutions.

-

How is the market segmented by animal type?The market is segmented into cats, dogs, and other animals

-

Who are the key players in the Australia pet wearable market?Key companies include DogOn™ Australia, Hotchn Enterprises, MindMe, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?