Australia Organic Farming Market Size, Share, and COVID-19 Impact Analysis, By Product (Fruits, Vegetables, Cereals and Grains, and Others), By Method (Crop Rotation, Polyculture, Mulching, Soil Management, Weed Management, Composting, and Others), By Application (Agriculture Companies and Organic Farms), and Australia Organic Farming Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureAustralia Organic Farming Market Insights Forecasts to 2035

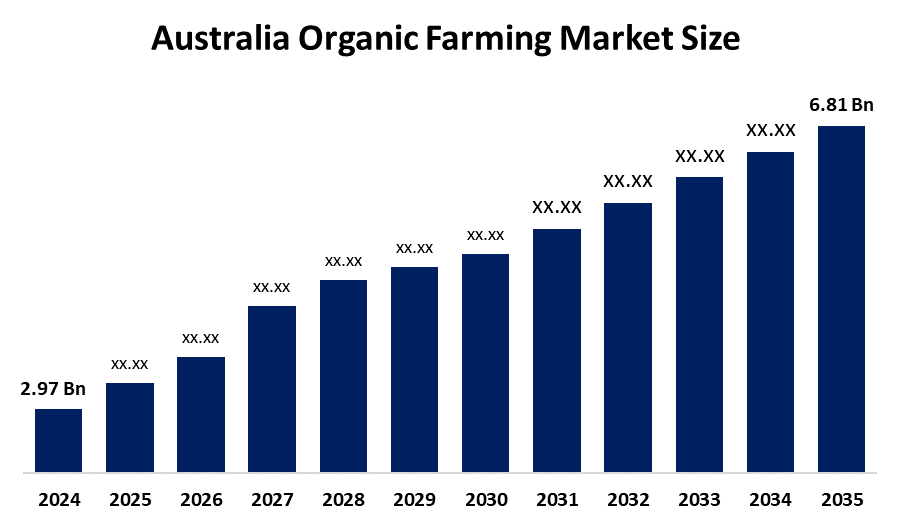

- The Australia Organic Farming Market Size Was Estimated at USD 2.97 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.84% from 2025 to 2035

- The Australia Organic Farming Market Size is Expected to Reach USD 6.81 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Australia organic farming market size is anticipated to reach USD 6.81 billion by 2035, growing at a CAGR of 7.84% from 2025 to 2035. The organic farming market in Australia is driven by the rise in the adoption of organic farming practices, including cover cropping, which support improved soil health and water retention to increase the resilience of farms, and the establishment of supermarkets and specialty stores, and online channels expanding their organic sections and providing access to fresh items to meet consumer demand.

Market Overview

Organic farming is the process of growing crops and raising livestock using natural methods and avoiding synthetic fertilizers, herbicides, and genetically modified organisms. Organic farming emphasizes ecological balance, biodiversity, and soil fertility to ensure sustainable and environmentally safe agricultural practices. In Australia, fruits, vegetables, grains, dairy, and livestock are considered organic, as they are certified as organic according to recognized standards. The market is growing due to factors like health consciousness, environmental sustainability, export opportunities, and government support for organic certification. The market for organic farming has been driven by the growing desire for products that are environmentally friendly and devoid of chemicals. A considerable movement towards healthier consumption patterns is evident in the fact that almost 70% of Australian families reported buying organic items at least once a month in 2023. Farmers have been encouraged to use organic methods by federal and state incentives for organic certification and sustainable farming practices. The government set aside USD 150 million in 2023 to fund infrastructural development and organic research, which further accelerated market expansion. Furthermore, organic livestock products have been growing in popularity through retail, food service, and e-commerce mechanisms. This industry, along with crop-based organic produce, contributes to the overall organic profile of Australia and is valuable to the long-term sustainability of organic produce within Australia.

Report Coverage

This research report categorizes the market for the Australia organic farming market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia organic farming market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia organic farming market.

Australia Organic Farming Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.97 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.84% |

| 2035 Value Projection: | USD 6.81 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product, By Method |

| Companies covered:: | Bellamy’s Organic, Barambah Organics, Manna Farms, Cleaver’s Organic, Australian Organic Food Co., Organic Farming Systems, Junee Licorice and Chocolate, Meredith Dairy, Kinross Station Lamb, Mungalli Creek Dairy And Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The organic farming market in Australia is driven by enhancing consumer awareness of health and nutrition, as well as a growing preference for chemical and pesticide-free food products, and a focus on environmental sustainability. An increased level of disposable income assists consumer readiness to pay a higher price, adding to the sector's growth. The government support and organic certifications have led to early adopters, who will develop organics for further growth opportunities. The increasing desire for organic and chemical-free products will increase exports of organic produce. Moreover, the trend towards clean-label foods or ethically sourced food items will increase demand for organic farming practices across Australia.

Restraining Factors

The organic farming market in Australia is mostly constrained by high production costs, lower yields than conventional farming, and limited organic inputs. Strict certification standards and regulatory compliance can make underlying processes cumbersome for farmers. Moreover, the relatively expensive nature of organic products can limit consumer acceptance and adoption. Vulnerability to climate change and pest pressures can potentially disrupt organic cropping classes of production, which can collectively limit market access for organic production, even with rising demand for organic products.

Market Segmentation

The Australia organic farming market share is classified into product, method, and application.

- The fruits segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia organic farming market is segmented by product into fruits, vegetables, cereals and grains, and others. Among these, the fruits segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The fruits segment dominates because of high consumer demand, premium pricing, favorable agro-climatic conditions, and strong retail and export channels, making it the most commercially viable and visible part of Australia’s organic farming industry.

- The crop rotation segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia organic farming market is segmented by method into crop rotation, polyculture, mulching, soil management, weed management, composting, and others. Among these, the crop rotation segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is the most basic, economical, and practical means in organic farming. It builds healthier soils, manages pest populations naturally, promotes increased cropping yields, and meets organic certification. It is the foundation of sustainable organic agriculture in Australia.

- The organic farms segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia organic farming market is segmented by application into agriculture companies and organic farms. Among these, the organic farms segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The organic farms segment leads the way because these farms are the primary certified producers, receive higher margins, and are aligned with current consumer preferences for sustainable, local, and traceable products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia organic farming market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bellamy's Organic

- Barambah Organics

- Manna Farms

- Cleaver's Organic

- Australian Organic Food Co.

- Organic Farming Systems

- Junee Licorice and Chocolate

- Meredith Dairy

- Kinross Station Lamb

- Mungalli Creek Dairy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2024, the Queensland Government announced four fertilizer project winners under the BBBF and REFF programs, providing grants from USD 50,000 to 12.75 million. The initiatives aim to strengthen regional agriculture, promote sustainable, locally produced fertilizers, and support organic farming through biofertilizers, composting, and nutrient recycling, enhancing productivity and soil health while reducing reliance on imported chemicals.

- In September 2023, High Valley Dawn Permaculture, located in Rosslyn Bay, Queensland, began constructing a facility for processing and packaging organic vegetables and fruits to supply local markets, businesses, and its paddock-to-plate eatery, Beaches Rosslyn Bay. The farm was selected among 24 enterprises for the fifth cycle of the RED Grants program, totaling USD 3.9 million, aimed at creating up to 215 permanent jobs.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia organic farming market based on the below-mentioned segments:

Australia Organic Farming Market, By Product

- Fruits

- Vegetables

- Cereals and Grains

- Others

Australia Organic Farming Market, By Method

- Crop Rotation

- Polyculture

- Mulching

- Soil Management

- Weed Management

- Composting

- Others

Australia Organic Farming Market, By Application

- Agriculture Companies

- Organic Farms

Frequently Asked Questions (FAQ)

-

What is the Australia organic farming market size?Australia organic farming market size is expected to grow from USD 2.97 billion in 2024 to USD 6.81 billion by 2035, growing at a CAGR of 7.84% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the enhancing consumer awareness of health and nutrition, as well as a growing preference for chemical and pesticide-free food products, and a focus on environmental sustainability. An increased level of disposable income assists consumer readiness to pay a higher price, adding to the sector's growth.

-

What factors restrain the Australia organic farming market?Constraints include high production costs, lower yields than conventional farming, and limited organic inputs. Strict certification standards and regulatory compliance can make underlying processes cumbersome for farmers.

-

How is the market segmented by product type?The market is segmented into fruits, vegetables, cereals and grains, and others.

-

Who are the key players in the Australian organic farming market?Key companies include Bellamy's Organic, Barambah Organics, Manna Farms, Cleaver's Organic, Australian Organic Food Co., Organic Farming Systems, Junee Licorice and Chocolate, Meredith Dairy, Kinross Station Lamb, and Mungalli Creek Dairy.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?