Australia Online Gambling Market Size, Share, and COVID-19 Impact Analysis, By Game Type (Casino, Bingo, Lottery, Sports Betting, Others), By Device Type (Mobile, Desktop, Others), and Australia Online Gambling Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsAustralia Online Gambling Market Insights Forecasts to 2035

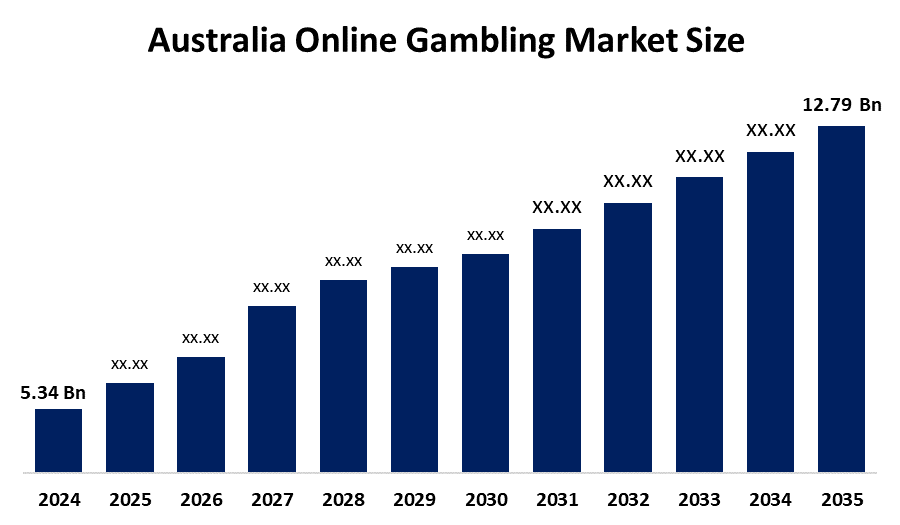

- The Australia Online Gambling Market Size Was Estimated at USD 5.34 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.26% from 2025 to 2035

- The Australia Online Gambling Market Size is Expected to Reach USD 12.79 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Australia online gambling market size is anticipated to reach USD 12.79 billion by 2035, growing at a CAGR of 8.26% from 2025 to 2035. The online gambling market in Australia is driven by supportive regulations, technology, changing consumer preferences, increased promotional campaigns, and greater access to a range of gambling products, contributing to increased engagement and access by users.

Market Overview

The Online Gambling Market Size refers to digital platforms that provide consumers with the ability to place bets, play casino games, poker, and lotteries, and engage in sports betting using a computer or smartphone over the internet. Examples of the online gambling market encompass real money or virtual betting activities taking place via licensed online operators. By allowing regulated operators to provide online betting services, the Interactive Gambling Act of 2001 established a structure that promoted industry growth. In an effort to reduce the financial dangers connected with gambling debts, the government also banned the use of credit cards for online gambling in August 2024. These actions are in line with a rising regulatory emphasis on responsible gaming and consumer protection. Government measures to promote responsible gambling backed by licensing rules and ethical practices have increased trust in the market. The introduction of technology (especially artificial intelligence, blockchain, and virtual reality) has improved the user experience and ensured safe transactions and gaming experiences. The growing popularity of gambling on mobile devices and eSports also indicates a further opportunity for growth. Potential future innovation may involve futuristic gaming experiences, alternative digital payment solutions, and the use of data to develop targeted promotions, assisting in cementing Australia's position as a destination for regulated progressive online gambling.

Report Coverage

This research report categorizes the market for the Australia online gambling market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia online gambling market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia online gambling market.

Australia Online Gambling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.34 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.26% |

| 2035 Value Projection: | 12.79 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Game Type, By Device Type |

| Companies covered:: | WinnersBet Pty Ltd., Puntaa Pty Ltd., Unibet/Betchoice Corporation Pty Ltd., PuntNow Pty Ltd., Merlehan Bookmaking Pty Ltd., boombet.com.au pty ltd, PlayUp Interactive Pty Ltd. And Others Player |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The online gambling market in Australia is driven by the supportive government regulations for licensed operators, increased internet and smartphone penetration, and consumer demand for digital gambling experiences. Advancements in technology, including artificial intelligence, blockchain-enabled payments, and virtual reality gaming, are improving user engagement and security while increasing popularity in sports betting, eSports, and live casino games. Aggressive marketing campaigns and promotional offers by leading operators also contributed to the online gambling growth in Australia. Data gathered from the Australian Communications and Media Authority (ACMA) and media reports suggests that online gambling was responsible for around 64% of more than 1 million betting advertisements on free-to-air television and radio between May 2022 and April 2023. This increased advertising had a significant impact in attracting younger users to online gambling sites, raising concerns about exposure and the potential for responsible gambling.

Restraining Factors

The online gambling market in Australia is mostly constrained by a host of challenges that could limit its growth prospects. The Interactive Gambling Act 2001 has established government regulations that prohibit any operators from providing unregulated services or certain gambling services, like online casinos. Added regulatory scrutiny has followed on advertising and payment methods, permitting operators to be flexible; added legislation commencing in 2024, prohibiting credit card payments for online wagering, is a significant development. Growing public concerns about gambling addiction, risks to financial security, and gambling-related harm led to a much greater focus on a responsible gambling framework and campaigns.

Market Segmentation

The Australia online gambling market share is classified into games type and devices type.

- The casino segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia online gambling market is segmented by game type into casino, bingo, lottery, sports betting, and others. Among these, the casino segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Online casinos showcase an extensive variety of fun games like slots, poker, roulette, and blackjack, appealing to a wide spectrum of the market. The convenience of being able to access casino games at any time on mobile apps or websites is an additional factor encouraging participation.

- The mobile segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia online gambling market is segmented by device type into mobile, desktop, and others. Among these, the mobile segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to high usage of smartphones and internet connectivity; the mobile segment is the leading type of online gambling in Australia. The availability of mobile applications and responsive websites enables an attractive, smooth, and user-friendly interface and allows for secure payment options with a more personalized gaming experience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia online gambling market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- WinnersBet Pty Ltd.

- Puntaa Pty Ltd.

- Unibet/Betchoice Corporation Pty Ltd.

- PuntNow Pty Ltd.

- Merlehan Bookmaking Pty Ltd.

- boombet.com.au pty ltd

- PlayUp Interactive Pty Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In July 2024, Australia's first lottery game with a set reward was introduced by 4D Lotto. It provides draws every five minutes through a mobile app, with a target of 150,000 players in its first quarter. It has a Northern Territory government license and offers 5D, 2D, 3D, 4D Classic, and the soon-to-be 4D Jackpot game.

- In November 2023, the $15 million AUD Series A funding round was led by Discerning Capital and included Drive by DraftKings, Manifest Investment Partners, and Jeff Sagansky. Picklebet is an Australian esports and sports betting firm. Growth, technological innovation, media expansion, and Picklebet's intended global expansion are all supported by the funding.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia online gambling market based on the below-mentioned segments:

Australia Online Gambling Market, By Game Type

- Casino

- Bingo

- Lottery

- Sports Betting

- Others

Australia Online Gambling Market, By Device Type

- Mobile

- Desktop

- Others

Frequently Asked Questions (FAQ)

-

What is the Australia online gambling market size?Australia online gambling market size is expected to grow from USD 5.34 billion in 2024 to USD 12.79 billion by 2035, growing at a CAGR of 8.26% during the forecast period 2025-2035

-

What are the key growth drivers of the market?Market growth is driven by the supportive government regulations for licensed operators, increased internet and smartphone penetration, and consumer demand for digital gambling experiences. Advancements in technology, including artificial intelligence, blockchain-enabled payments, and virtual reality gaming, are improving user engagement and security while increasing popularity in sports betting, eSports, and live casino games.

-

What factors restrain the Australia online gambling market?Constraints include a host of challenges that could limit its growth prospects. The Interactive Gambling Act 2001 has established government regulations that prohibit any operators from providing unregulated services or certain gambling services, like online casinos.

-

How is the market segmented by game type?The market is segmented into casino, bingo, lottery, sports betting, and others.

-

Who are the key players in the Australia online gambling market?Key companies include WinnersBet Pty Ltd., Puntaa Pty Ltd., Unibet/Betchoice Corporation Pty Ltd., PuntNow Pty Ltd., Merlehan Bookmaking Pty Ltd., boombet.com.au pty ltd, and PlayUp Interactive Pty Ltd., and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?