Australia Microgreens Market Size, Share, and COVID-19 Impact Analysis, By Farming Type (Indoor Vertical Farms, Commercial Greenhouse, and Others), By Distribution Channel (Farmers Market, Retail Stores, Online, and Others), and Australia Microgreens Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureAustralia Microgreens Market Insights Forecasts to 2035

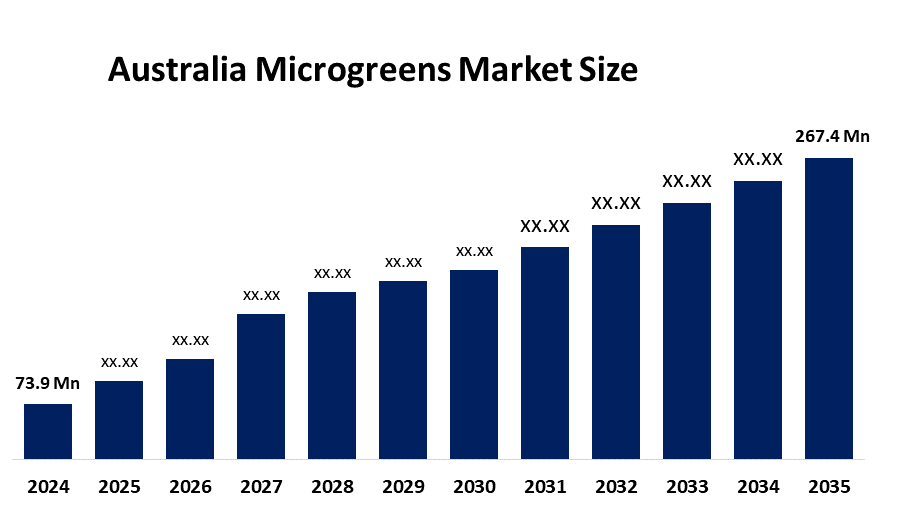

- The Australia Microgreens Market Size Was Estimated at USD 73.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 12.4% from 2025 to 2035

- The Australia Microgreens Market Size is Expected to Reach USD 267.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Australia Microgreens Market Size is anticipated to reach USD 267.4 Million by 2035, Growing at a CAGR of 12.4% from 2025 to 2035. The microgreens market in Australia is driven by growing health consciousness, the need for nutrient-dense foods, the expansion of indoor and urban farming, the growing use of foodservice, and the growing desire for sustainable, locally grown, fresh specialty crops.

Market Overview

The market of Australia microgreens is defined as the whole process of growing and selling tiny greens of vegetables that are very rich in nutrients and are picked just after their germination. Microgreens are used widely in the culinary world for garnishing, salads, and gourmet dishes, as well as in functional foods because of their nutritional richness. They are also being used in health-conscious diets, urban farming, indoor farming, and the commercial foodservice sectors, looking for fresh, locally grown produce.

Through the wider horticulture initiatives, the Australian government is backing the microgreens market. The Climate-Smart Agriculture Program is one of the largest and most effective so far, with its A$302.1 million budget, followed by A$1.5 million innovation grants and Hort Innovation financial support that is more than A$500 million. Besides, the state schemes encourage practices like agri-tech adoption, controlled-environment farming, and sustainability, which indirectly help the microgreens growers.

One of the newest developments in the Australian microgreens market is the announcement of expansion made by Eden Towers in April 2025, which will lead to a sustainable, year-round microgreens supply in major cities. The month of September 2023 witnessed the collaboration between Nanollose Limited and Greenspace ESG for the provision of MicroGel soilless growth media that would facilitate the controlled environment cultivation. Future scenarios revolve around the vertical farms, indoor technology, and sustainable substrates increasing efficiency and local production.

Report Coverage

This research report categorizes the market for the Australia microgreens market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia microgreens market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia microgreens market.

Australia Microgreens Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 73.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 12.4% |

| 2035 Value Projection: | USD 267.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Farming Type, By Distribution Channel |

| Companies covered:: | Ainslie Urban Farm, Australian Microgreens, Pocket Herbs, Amberly Microgreens, Sprout House Farms, Fresh Microgreens, Mount Victoria Microgreens, Flowerdale Farm, Ausallium, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The microgreens market in Australia is driven by consumer awareness regarding health and nutrition, demand for functional and nutrient-rich foods, urban farming and controlled-environment agriculture, and increased activity in the foodservice and gourmet restaurant sectors. In addition to this, technology related to hydroponics and vertical farming continues to grow, hence aiding in accelerating the already existing growth of the market due to preferences for local fresh produce, sustainability consciousness, etc.

Restraining Factors

The microgreens market in Australia is mostly constrained by the high production and labor costs, lack of large-scale cultivation infrastructures, short product shelf-life, dependencies on controlled-environment technologies, and limited consumer awareness.

Market Segmentation

The Australia microgreens market share is classified into farming type and distribution channel.

- The commercial greenhouse segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia microgreens market is segmented by farming type into indoor vertical farms, commercial greenhouse, and others. Among these, the commercial greenhouse segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because of its capacity to provide controlled environmental conditions that allow for consistent year-round production, higher yields, and protection from pests and climate fluctuation. For commercial farmers and foodservice suppliers, greenhouses are the best option because they provide scalability, effective resource usage, and quality assurance.

- The retail stores segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia microgreens market is segmented by distribution channel into farmers market, retail stores, online, and others. Among these, the retail stores segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because they are widely available, have a steady supply, and can offer customers fresh, premium microgreens. Retail stores are the favored method over farmers' markets or internet platforms because they facilitate convenience shopping, bulk distribution, and branding.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia microgreens market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ainslie Urban Farm

- Australian Microgreens

- Pocket Herbs

- Amberly Microgreens

- Sprout House Farms

- Fresh Microgreens

- Mount Victoria Microgreens

- Flowerdale Farm

- Ausallium

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2023, a Memorandum of Understanding was signed between Nanollose Limited and Greenspace ESG Pty Ltd, whereby the latter will be provided with MicroGel™, a revolutionary soilless growth medium for the commercial production of microgreens in Australia, thereby contributing to the eco-friendly controlled environment agriculture.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia microgreens market based on the below-mentioned segments:

Australia Microgreens Market, By Farming Type

- Indoor Vertical Farms

- Commercial Greenhouse

- Others

Australia Microgreens Market, By Distribution Channel

- Farmers Market

- Retail Stores

- Online

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Australia microgreens market size?A: Australia microgreens market size is expected to grow from USD 73.9 million in 2024 to USD 267.4 million by 2035, growing at a CAGR of 12.4% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by consumer awareness regarding health and nutrition, demand for functional and nutrient-rich foods, urban farming and controlled-environment agriculture, and increased activity in the foodservice and gourmet restaurant sectors.

-

Q: What factors restrain the Australia microgreens market?A: Constraints include the high production and labor costs, lack of large-scale cultivation infrastructures, short product shelf-life, dependencies on controlled-environment technologies, and limited consumer awareness.

-

Q: How is the market segmented by type?A: The market is segmented into indoor vertical farms, commercial greenhouse, and others.

-

Q: Who are the key players in the Australia microgreens market?A: Key companies include Ainslie Urban Farm, Australian Microgreens, Pocket Herbs, Amberly Microgreens, Sprout House Farms, Fresh Microgreens, Mount Victoria Microgreens, Flowerdale Farm, Ausallium, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?