Australia Livestock Health Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Poultry, Swine, Cattle, Sheep & Goats, and Fish), By Product (Biologics, Pharmaceuticals, Diagnostics, Equipment & Disposables, Medicinal Feed Additives, and Others), and Australia Livestock Health Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareAustralia Livestock Health Market Size Insights Forecasts To 2035

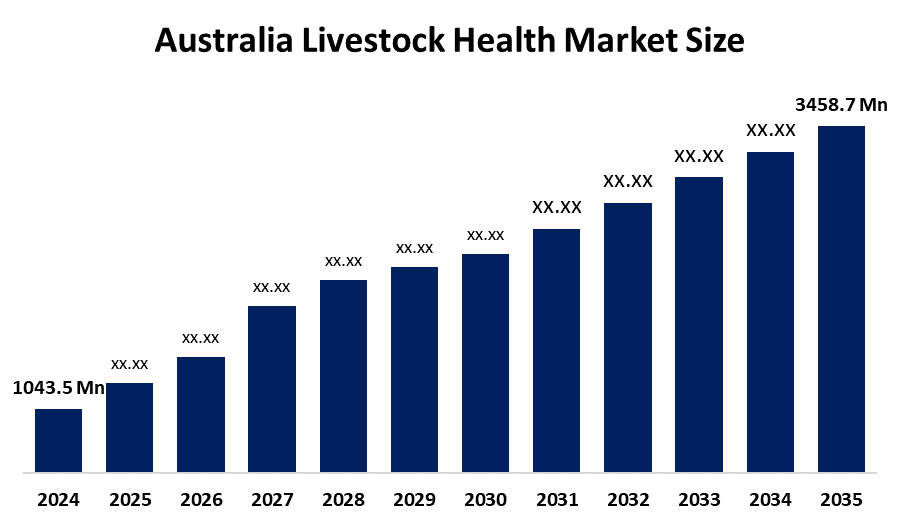

- The Australia Livestock Health Market Size Was Estimated At USD 1043.5 Million In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 11.51% From 2025 To 2035

- The Australia Livestock Health Market Size Is Expected To Reach USD 3458.7 Million By 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Australia Livestock Health Market Size Is Anticipated To Reach USD 3458.7 Million By 2035, Growing At A CAGR Of 11.51% From 2025 To 2035. The livestock health market in Australia is driven by growing livestock populations, an increase in disease outbreaks, the use of preventive veterinary care, government biosecurity initiatives, technological advancements in vaccinations and diagnostics, productivity optimization, export quality standards, and farm digitization.

Market Overview

The livestock health market size in Australia includes veterinary pharmaceuticals and vaccines and diagnostic tools and feed additives and health management services that help prevent and detect and treat diseases in cattle and sheep and poultry and swine. The market helps commercial farming operations by improving animal welfare and farm productivity and maintaining food safety standards. The key applications of the system support producers in attaining sustainable livestock production through disease control reproductive health management parasite control and herd monitoring and biosecurity compliance.

Australia is funding livestock health improvements through the Bolstering Australia’s Biosecurity System Package which includes a $3.9 million NLIS traceability grant that will enhance disease monitoring and food safety measures. The government allocated $46.7 million for national livestock traceability improvements. The Victoria 2025 Livestock Biosecurity Fund approved approximately $15.2 million in funding for animal health and disease prevention projects that will benefit cattle, sheep, swine, and honey bee populations. National plans like Animal plan 2022-2027 further strengthen animal health systems.

Zoetis expanded its Melbourne manufacturing site to boost livestock vaccines and diagnostics production in March 2024, strengthening local health capability. MEQ Solutions developed AI-powered solutions for meat quality which received $23 million in funding to create precise methods of evaluating livestock. The future of our business development will focus on biosecurity technology development and vaccine research and artificial intelligence health monitoring systems and predictive analytics solutions for better animal productivity and disease management.

Report Coverage

This research report categorizes the market for the Australia livestock health market size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia livestock health market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia livestock health market.

Australia Livestock Health Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1043.5 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 11.51% |

| 2023 Value Projection: | USD 3458.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Animal Type, By Product |

| Companies covered:: | Pharmsmart Australia, Abbey Labs, Virbac Australia, International Animal Health Products (IAHP), Herd Health Pty Ltd, Apiam Animal Health, Animal Health Australia (AHA), Elders Limited, Australian Agricultural Company (AACo), Sea Forest, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The livestock health market size in Australia is driven by the rising demand for animal protein products which meet high quality standards and because more livestock animals become available and better methods to prevent diseases and protect animals against risks are developed. The market expansion receives additional support from government programs which establish traceability standards and animal welfare requirements. The combination of export quality standards and productivity optimization methods and climate-related disease threats and digital herd monitoring systems creates a business environment that encourages investment in preventive techniques and data-based livestock health management systems.

Restraining Factors

The livestock health market size in Australia is mostly constrained by the high costs for treatment and vaccines and limited access to veterinary services in remote areas and the time needed for regulatory approvals and small farmers who show low price sensitivity and antimicrobial resistance issues and supply chain interruptions which make producers hesitant to use advanced animal health technologies.

Market Segmentation

The Australia livestock health market share is classified into animal type and product.

- The cattle segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia livestock health market size is segmented by animal type into poultry, swine, cattle, sheep & goats, and fish. Among these, the cattle segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to Australia's sizable herd of cattle and dairy products, robust export demand, and increased per-animal expenditure on vaccines, parasiticides, diagnostics, and reproductive health products, cattle are the most popular animal. Cattle health is the largest income generator among all animal segments due to ongoing government biosecurity efforts, disease control regulations, and productivity optimization across dairy and beef farms.

- The pharmaceuticals segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia livestock health market size is segmented by product into biologics, pharmaceuticals, diagnostics, equipment & disposables, medicinal feed additives, and others. Among these, the pharmaceuticals segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Pharmaceuticals are in the lead because they are frequently used in large quantities to treat infections, parasites, and metabolic diseases in sheep, cattle, and poultry. To sustain herd productivity and adhere to export health standards, farmers continuously spend money on reproductive medications, antibiotics, antiparasitics, and anti-inflammatories.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia livestock health market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pharmsmart Australia

- Abbey Labs

- Virbac Australia

- International Animal Health Products (IAHP)

- Herd Health Pty Ltd

- Apiam Animal Health

- Animal Health Australia (AHA)

- Elders Limited

- Australian Agricultural Company (AACo)

- Sea Forest

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia livestock health market based on the below-mentioned segments:

Australia Livestock Health Market, By Animal Type

- Poultry

- Swine

- Cattle

- Sheep & Goats

- Fish

Australia Livestock Health Market, By Product

- Biologics

- Pharmaceuticals

- Diagnostics

- Equipment & Disposables

- Medicinal Feed Additives

- Others

Frequently Asked Questions (FAQ)

-

What is the Australia livestock health market size?Australia livestock health market size is expected to grow from USD 1043.5 million in 2024 to USD 3458.7 million by 2035, growing at a CAGR of 11.51% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the rising demand for animal protein products which meet high quality standards and because more livestock animals become available and better methods to prevent diseases and protect animals against risks are developed.

-

What factors restrain the Australia livestock health market?Constraints include the high costs for treatment and vaccines and limited access to veterinary services in remote areas and the time needed for regulatory approvals.

-

How is the market segmented by animal type?The market is segmented into poultry, swine, cattle, sheep & goats, and fish.

-

Who are the key players in the Australia livestock health market?: Key companies include Pharmsmart Australia, Abbey Labs, Virbac Australia, International Animal Health Products (IAHP), Herd Health Pty Ltd, Apiam Animal Health, Animal Health Australia (AHA), Elders Limited, Australian Agricultural Company (AACo), Sea Forest, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?