Australia Healthcare Digital Twin’s Market Size, Share, and COVID-19 Impact Analysis, By Component (Software and Service), By Application (Medical Device Design and Testing, Drug Discovery & Development, Personalized Medicine, Healthcare Workflow Optimization & Asset Management, Surgical Planning and Medical Education, and Others), and Australia Healthcare Digital Twin’s Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareAustralia Healthcare Digital Twin’s Market Size Insights Forecasts To 2035

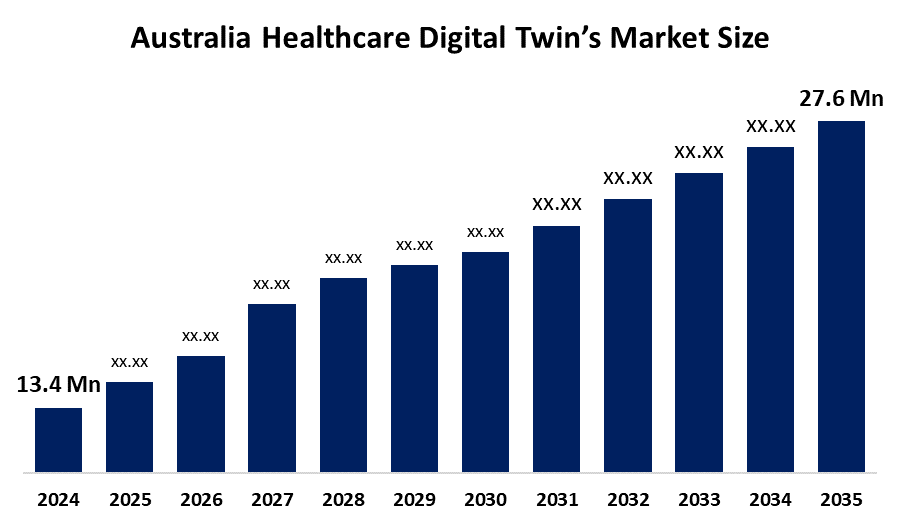

- The Australia Healthcare Digital Twin’s Market Size Was Estimated At USD 13.4 Million In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 27.6% From 2025 To 2035

- The Australia Healthcare Digital Twin’s Market Size Is Expected To Reach USD 195.7 Million By 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Australia Healthcare Digital Twin’s Market Size Is Anticipated To Reach USD 195.7 Million By 2035, Growing At A CAGR Of 27.6% From 2025 To 2035. The healthcare digital twin’s market in Australia is driven by increasing prevalence of chronic illnesses, government digital health programs, the use of AI and IoT, the need for individualized treatment, hospital efficiency requirements, the expansion of remote monitoring, interoperability enhancements, a lack of workers, and analytics expenditures.

Market Overview

Australia's healthcare digital twin market size creates virtual patient replicas together with medical device and hospital and healthcare system digital twins which use real-time data and artificial intelligence and Internet of Things technology to forecast and optimize treatment results. The applications enable healthcare providers to improve their operations through personalized treatment design and chronic illness control and hospital management and medical equipment evaluation and population health research and remote patient observation and clinical decision support systems which deliver precise data-based healthcare throughout Australia.

Australia's National Digital Health Strategy 2023 to 2028 requires development of interoperable digital health systems which will use My Health Record and Health Connect Australia to enable real-time data sharing between different healthcare facilities. The investments for digital health transformation and better EHR functions total AU$503 million. The investments for My Health Record modernization amount to AU$228.7 million. The state governments also provide AI funding for digital health development, which includes AU$3 million in Western Australia.

Bupa is creating digital health twins for each individual to use in their predictive care system while academic research projects such as DT-GPT build artificial intelligence patient models. The development of real-time simulation technology together with predictive analytics solutions helps healthcare providers deliver accurate treatments to patients while detecting diseases at their earliest stages and enhancing telehealth services which creates numerous possibilities for future development of customized preventive medical treatments.

Report Coverage

This research report categorizes the market size for the Australia healthcare digital twin’s market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia healthcare digital twin’s market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia healthcare digital twin’s market.

Australia Healthcare Digital Twin’s Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13.4 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 27.6% |

| 2023 Value Projection: | USD 195.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By Component |

| Companies covered:: | Bupa Australia, Beamtree, Heidi Health, Opyl Limited, Kismet Healthcare, Twinsight, d-Twin, Willow, Australia New Zealand Digital Twin Hub, Griffith University Healthcare Digital Twin Research, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The healthcare digital twin’s market size in Australia is driven by the rising need for personalized and predictive care and growing adoption of artificial intelligence and advanced analytics and the need to achieve better clinical results while decreasing expenses. The adoption of digital health technology receives a push from government support together with the expansion of electronic health records and the increasing need to manage chronic diseases. Australian hospitals and research institutions use digital twins to improve their treatment planning and remote monitoring and operational efficiency because the country has developed a robust health IT system.

Restraining Factors

The healthcare digital twin’s market size in Australia is mostly constrained by the high implementation costs and data privacy and cybersecurity concerns and interoperability issues with legacy health systems and limited clinical validation and shortages of skilled AI and digital health professionals.

Market Segmentation

The Australia healthcare digital twin’s market share is classified into component and application.

- The software segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia healthcare digital twin’s market size is segmented by component into software, and service. Among these, the software segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because it is the foundation of digital twin deployment and enables data integration, AI-driven modeling, real-time simulation, and predictive analytics, the software segment leads Australia's healthcare digital twin market. In contrast to services, which are usually one-time or project-based, hospitals and providers prioritize scalable platforms for patient modeling, workflow optimization, and clinical decision support.

- The personalized medicine segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia healthcare digital twin’s market size is segmented by application into medical device design and testing, drug discovery & development, personalized medicine, healthcare workflow optimization & asset management, surgical planning and medical education, and others. Among these, the personalized medicine segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because of the increasing frequency of chronic diseases, the widespread use of AI-driven patient modeling, the need for precise treatment planning, and the expanding use of real-time patient data for predictive care, personalized medicine is at the forefront.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia healthcare digital twin’s market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bupa Australia

- Beamtree

- Heidi Health

- Opyl Limited

- Kismet Healthcare

- Twinsight

- d-Twin

- Willow

- Australia New Zealand Digital Twin Hub

- Griffith University Healthcare Digital Twin Research

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In August 2025, Telstra Health granted AUD 33 million contract to spearhead the transformation of the My Health Record system to real-time interoperable health data, paving the way for future digital twin solutions.

- In June 2025, Health Connect Australia unveiled its Strategy, Architecture, and Roadmap, outlining phases to improve national digital health information sharing a critical enabler for scalable healthcare twin platforms.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia healthcare digital twin’s market based on the below-mentioned segments:

Australia Healthcare Digital Twin’s Market, By Component

- Software

- Service

Australia Healthcare Digital Twin’s Market, By Application

- Medical device design and testing

- Drug discovery & development

- Personalized medicine

- Healthcare workflow optimization & asset management

- Surgical planning and medical education

- Others

Frequently Asked Questions (FAQ)

-

What is the Australia healthcare digital twin’s market size?Australia healthcare digital twin’s market size is expected to grow from USD 13.4 million in 2024 to USD 195.7 million by 2035, growing at a CAGR of 27.6% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by rising need for personalized and predictive care and growing adoption of artificial intelligence and advanced analytics and the need to achieve better clinical results while decreasing expenses.

-

What factors restrain the Australia healthcare digital twin’s market?Constraints include the high implementation costs and data privacy and cybersecurity concerns and interoperability issues with legacy health systems.

-

How is the market segmented by application?The market is segmented into medical device design and testing, drug discovery & development, personalized medicine, healthcare workflow optimization & asset management, surgical planning and medical education, and others.

-

Who are the key players in the Australia healthcare digital twin’s market?Key companies include Bupa Australia, Beamtree, Heidi Health, Opyl Limited, Kismet Healthcare, Twinsight, d-Twin, Willow, Australia New Zealand Digital Twin Hub, Griffith University Healthcare Digital Twin Research, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?