Australia Ground-based Air Defense Systems Market Size, Share, By Component (Radar Systems, Command and Control Systems, Launchers, and Interceptor Missiles), By End Use (Military, Defense Contractors, and Government), Australia Ground-based Air Defense Systems Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseAustralia Ground-based Air Defense Systems Market Insights Forecasts to 2035

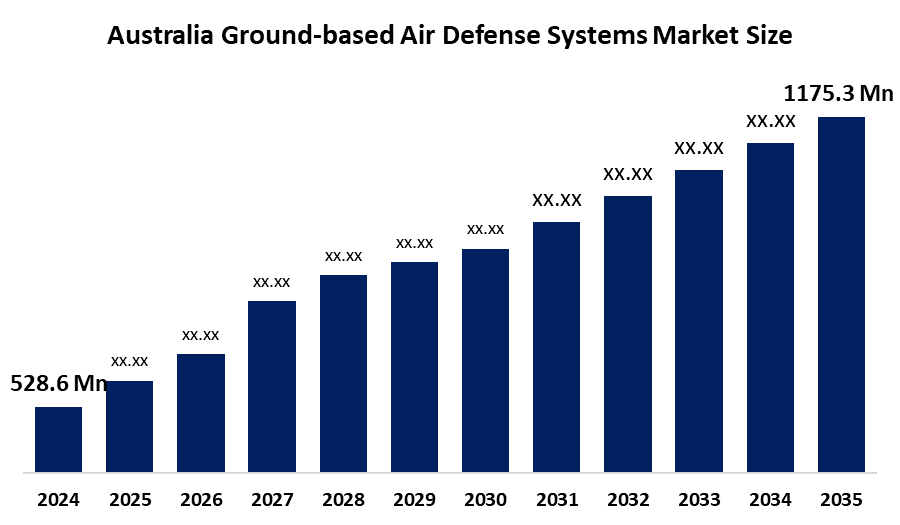

- Australia Ground-based Air Defense Systems Market Size 2024: USD 528.6 Mn

- Australia Ground-based Air Defense Systems Market Size 2035: USD 1175.3 Mn

- Australia Ground-based Air Defense Systems Market CAGR 2024: 7.53%

- Australia Ground-based Air Defense Systems Market Segments: Component and End Use

Get more details on this report -

The market for ground-based air defense systems in Australia indicates the activity of acquiring, integrating, manufacturing, installing, and servicing the instruments and gadgets for air defense capable of spotting, tracking, shooting, and destroying aerial threats (for example, planes, drones, and missiles) right from the ground. Factors that expand the market growth include the increase of regional security challenges, the upgrading of defense capabilities, the increment of defense budgets, and the advancements in technology concerning radars and missiles, which together make Australia's airspace more protected and its deterrence stance stronger.

The Australian ground-based air defense market is mainly driven by significant government initiatives, such as the defense modernization program worth around AUD 50.3 billion, AUD 1.25 billion for short-range air defense systems, and AUD 2.12 billion for advanced missiles. In fact, the AIR6500 project is further proof of this trend as it aims to not only modernize radar and command but also integrate air defense capabilities, which is basically a strong commitment to national security and technological enhancement through investment.

During the year 2025, Australian firms such as Raytheon Australia, CEA Technologies, and Silentium Defence progressed ground based air defence with the integration of AIM 9X missiles, the development of AESA radars, and the installation of passive sensors, while companies like Drone Shield improved detection of and resistance to drones, thus reinforcing the air defence system of Australia, which is built in layers.

Market Dynamics of the Australia Ground-based Air Defense Systems Market:

The Australia ground-based air defense systems market is driven by the increasing threats to security in the region, the rising probabilities of aerial attacks, and the expansion of the defense modernization programs. The high defense budgets of the governments and their initiatives allow the purchase of the latest missiles, radars, and integrated command networks. Moreover, the market is already thriving with the presence of technological improvements in the areas of AESA radars, long- and short-range missiles, and counter-drone systems, as well as the demand for local manufacturing and better situational understanding, thus ensuring effective national airspace coverage and powerful defensive action.

The Australia ground-based air defense systems market is restrained by the high costs associated with procurements and maintenance, lengthy periods for development and integration, the small size of domestic manufacturing, the complexity of regulatory approvals, and, lastly, dependence on foreign technology and suppliers, which could eventually slow down the deployment and adoption.

The Australia ground-based air defense systems market foresees future opportunities in layered and integrated air & missile defense architectures, the growing demand for counter-drone/UAS technologies, and the establishment of indigenous radar and sensor development. The advancements are taking place in AESA and passive radar systems, AI-enabled threat detection, networking command and control, and hypersonic/multi-domain defense solutions, which will improve response capability, interoperability, and autonomous operations across the defense networks.

Market Segmentation

The Australia Ground-based Air Defense Systems Market share is classified into component and end user.

By Component:

The Australia ground-based air defense systems market is divided by component into radar systems, command and control systems, launchers, and interceptor missiles. Among these, the interceptor missiles segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because of their vital role in eliminating airborne threats, such as aircraft, drones, and missiles, as well as the significant government investment in the acquisition of cutting-edge missiles, modernization initiatives, and integrated air defense systems.

By End Use:

The Australia ground-based air defense systems market is divided by end use into military, defense contractors, and government. Among these, the military segment accounted for the largest share in 2024 and is projected to grow at a significant CAGR during the forecast period. This is because the Australian Defence Force directly purchases and deploys air defense systems, such as missiles, radars, and command systems, motivated by national security priorities, modernization initiatives, and growing regional threats, which create the greatest demand when compared to defense contractors or other government agencies.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Australia ground-based air defense systems market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Australia Ground-based Air Defense Systems Market:

- Raytheon Australia

- Thales Australia

- BAE Systems Australia

- CEA Technologies

- DroneShield

- NIOA

- Silentium Defence

- Babcock Australasia

- ASC Pty Ltd

- Nova Systems

- Others

Recent Developments in Australia Ground-based Air Defense Systems Market:

In July 2025, the integration of the AIM-9X Sidewinder missile with the high-mobility launcher of NASAMS was successfully completed by Raytheon Australia, which resulted in the enhancement of the ground-based air defense capability at a short range.

In July 2025, the Australian army conducted a live firing of the NASAMS air defense system during the Talisman Sabre 2025 exercise, thus confirming their readiness for operational use.

In July 2025, A new phase of the investments in air defense was announced by the Albanese government with the decision on the purchase of the next generation of advanced medium-range missiles (AIM-120 variants), which will allow up to AUD 2.12 billion to be spent on the missiles, thereby strengthening both the air defense and strike.

In April 2024, the Australian government, through the Project AIR6500 Phase 1, entered into a contract for the sum of AUD 500 million with Lockheed Martin Australia for the development of the Joint Air Battle Management System, which will enhance the integrated air and missile defense infrastructure.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia ground-based air defense systems market based on the below-mentioned segments:

Australia Ground-based Air Defense Systems Market, By Component

- Radar Systems

- Command and Control Systems

- Launchers

- Interceptor Missiles

Australia Ground-based Air Defense Systems Market, By End Use

- Military

- Defense Contractors

- Government

Frequently Asked Questions (FAQ)

-

Q: What is the Australia ground-based air defense systems market size?A: Australia ground-based air defense systems market is expected to grow from USD 528.6 million in 2024 to USD 1175.3 million by 2035, growing at a CAGR of 7.53% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing threats to security in the region, the rising probabilities of aerial attacks, and the expansion of the defense modernization programs. The high defense budgets of the governments and their initiatives allow the purchase of the latest missiles, radars, and integrated command networks. Moreover, the market is already thriving with the presence of technological improvements in the areas of AESA radars, long- and short-range missiles, and counter-drone systems, as well as the demand for local manufacturing and better situational understanding, thus ensuring effective national airspace coverage and powerful defensive action.

-

Q: What factors restrain the Australia ground-based air defense systems market?A: Constraints include the high costs associated with procurements and maintenance, lengthy periods for development and integration, the small size of domestic manufacturing, the complexity of regulatory approvals, and, lastly, dependence on foreign technology and suppliers, which could eventually slow down the deployment and adoption.

-

Q: How is the market segmented by component?A: The market is segmented into radar systems, command and control systems, launchers, and interceptor missiles.

-

Q: Who are the key players in the Australia ground-based air defense systems market?A: Key companies include Raytheon Australia, Thales Australia, BAE Systems Australia, CEA Technologies, DroneShield, NIOA, Silentium Defence, Babcock Australasia, ASC Pty Ltd, Nova Systems, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?