Australia Green Cement Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Fly Ash-Based, Slag-Based, Limestone-Based, Silica Fume-Based, and Others), By End Use (Residential, Non-Residential, and Infrastructure), and Australia Green Cement Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsAustralia Green Cement Market Insights Forecasts to 2035

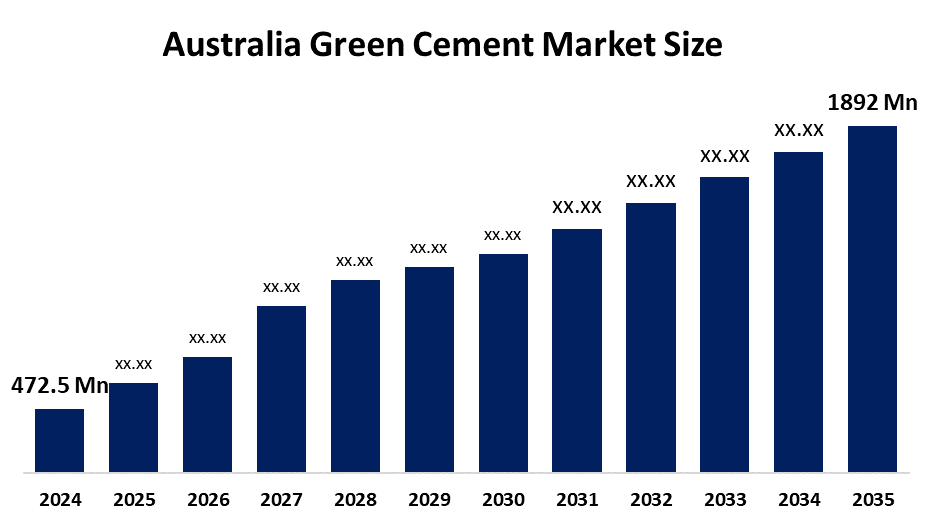

- The Australia Green Cement Market Size Was Estimated at USD 472.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 13.45% from 2025 to 2035

- The Australia Green Cement Market Size is Expected to Reach USD 1892.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Australia green cement market size is anticipated to reach USD 1892.9 million by 2035, growing at a CAGR of 13.45% from 2025 to 2035. The green cement market in Australia is driven by increased construction activity, stringent carbon emission regulations, the need for sustainable building materials, government net-zero targets, infrastructure investments, and the growing use of low-carbon substitutes like fly ash and slag-based cement

Market Overview

The Australia green cement market refers to the production and use of environmentally sustainable cement alternatives that reduce carbon emissions compared to traditional Portland cement. Green cement is produced through industrial by-product processing which includes fly ash and slag and silica fumes and through methods that achieve low-carbon production. The material serves residential, commercial and infrastructure construction projects which include roads and bridges and buildings to help Australia achieve its sustainability targets and net-zero carbon objectives

The South Australian Government provided a $12 million loan to Hallett Group for green cement production, alongside a $20 million federal investment. Cement Australia received $52.9 million to reduce emissions at its Railton plant. The federal Environmentally Sustainable Procurement Policy (2024) mandates projects which exceed 7.5 million dollars to use low-carbon materials as a requirement for green cement implementation.

Australia achieved significant advancements when Cement Australia introduced its low-carbon cement product which decreases embodied carbon emissions by approximately 30 percent at the IHG Expo 2025. The Hallett Group launched its $200 million Green Cement Transformation Project at Port Augusta to develop sustainable large-scale green cement manufacturing. Green360 develops sustainable low-carbon mixtures from kaolin and red mud which will drive future growth through their ability to create environmentally friendly technology and reusable construction materials

Report Coverage

This research report categorizes the market for the Australia green cement market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia green cement market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia green cement market.

Australia Green Cement Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 472.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 13.45% |

| 2035 Value Projection: | USD 1892.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Product, By End Use |

| Companies covered:: | Hallett Group, Cement Australia, Green360 Technologies Ltd, UniqueCem, Boral Limited, Adbri Limited, Zeotech, Andromeda Metals Ltd, Calix Limited, Fortescue Metals Group, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The green cement market in Australia is driven by the strict carbon emission regulations and the country's net-zero targets and rising demand for eco-friendly construction materials. The adoption process experiences acceleration through three factors which include rising infrastructure development and businesses obtaining green building certifications and organizations implementing environmentally sustainable procurement policies. The development of green cement production and use receives strong backing through three factors which include investments in low-carbon technologies and growing public knowledge about embodied carbon reduction and government support for clean manufacturing initiatives.

Restraining Factors

The green cement market in Australia is mostly constrained by the high production costs and expensive technology, restricted access to alternative raw materials, absence of standardized regulations and traditional builders, who need better performance and lower costs.

Market Segmentation

The Australia green cement market share is classified into product type and end use.

- The fly ash-based segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia green cement market is segmented by product type into fly ash-based, slag-based, limestone-based, silica fume-based, and others. Among these, the fly ash-based segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is mostly because fly ash from coal-fired power plants is widely available, reasonably priced, and has been shown to drastically lower carbon emissions when compared to conventional Portland cement. Because fly ash-based cement improves workability, durability, and long-term strength, it is frequently used in commercial and infrastructural construction projects throughout Australia.

- The infrastructure segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia green cement market is segmented by end use into residential, non-residential, and infrastructure. Among these, the infrastructure segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is fueled by significant government spending on public infrastructure projects like roads, bridges, and railroads, where sustainable procurement practices are increasingly requiring the use of low-carbon materials. Cement

consumption in infrastructure projects is high, and the drive for net-zero goals greatly speeds up the use of green cement in this market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia green cement market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market

List of Key Companies

- Hallett Group

- Cement Australia

- Green360 Technologies Ltd

- UniqueCem

- Boral Limited

- Adbri Limited

- Zeotech

- Andromeda Metals Ltd

- Calix Limited

- Fortescue Metals Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In February 2026, Hallett Group's $200 million green cement project at the former Port Augusta power station was supported by a AUD 12 million loan from the South Australian Government, which created jobs and established hubs for the manufacturing of low-carbon cement.

- In March 2025, at the IHG Expo 2025 in Adelaide, Cement Australia publicly unveiled their Low Carbon Cement product, which has an embodied carbon content that is up to 30% lower than that of conventional cement.

- In July 2025, Cementir Group introduced D-Carb CEM II A-LL 52.5N, a white cement product with a lower carbon content that reduced CO2 emissions by about 12% in Australia.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia green cement market based on the below-mentioned segments:

Australia Green Cement Market, By Product Type

- Fly Ash-Based

- Slag-Based

- Limestone-Based

- Silica Fume-Based

- Others

Australia Green Cement Market, By End Use

- Residential

- Non-Residential

- Infrastructure

Frequently Asked Questions (FAQ)

-

Q: What is the Australia green cement market size?A: Australia green cement market size is expected to grow from USD 472.5 million in 2024 to USD 1892.9 million by 2035, growing at a CAGR of 13.45% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by strict carbon emission regulations and the country's net-zero targets and rising demand for eco-friendly construction materials. The adoption process experiences acceleration through three factors which include rising infrastructure development and businesses obtaining green building certifications and organizations implementing environmentally sustainable procurement policies.

-

Q: What factors restrain the Australia green cement market?A: Constraints include the high production costs and expensive technology, restricted access to alternative raw materials, absence of standardized regulations and traditional builders, who need better performance and lower costs.

-

Q: How is the market segmented by product type?A: The market is segmented into fly ash-based, slag-based, limestone-based, silica fume-based, and others.

-

Q: Who are the key players in the Australia green cement market?A: Key companies include Hallett Group, Cement Australia, Green360 Technologies Ltd, UniqueCem, Boral Limited, Adbri Limited, Zeotech, Andromeda Metals Ltd, Calix Limited, Fortescue Metals Group, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?