Australia Flexible Foam Market Size, Share, and COVID-19 Impact Analysis, By Type (Polyurethane (PU), Polyethylene (PE), Polypropylene (PP), Ethylene-Vinyl Acetate (EVA), Latex, and Others), By Application (Furniture & Bedding, Transportation, Packaging, Building & Construction, and Others), and Australia Flexible Foam Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsAustralia Flexible Foam Market Size Insights Forecasts to 2035

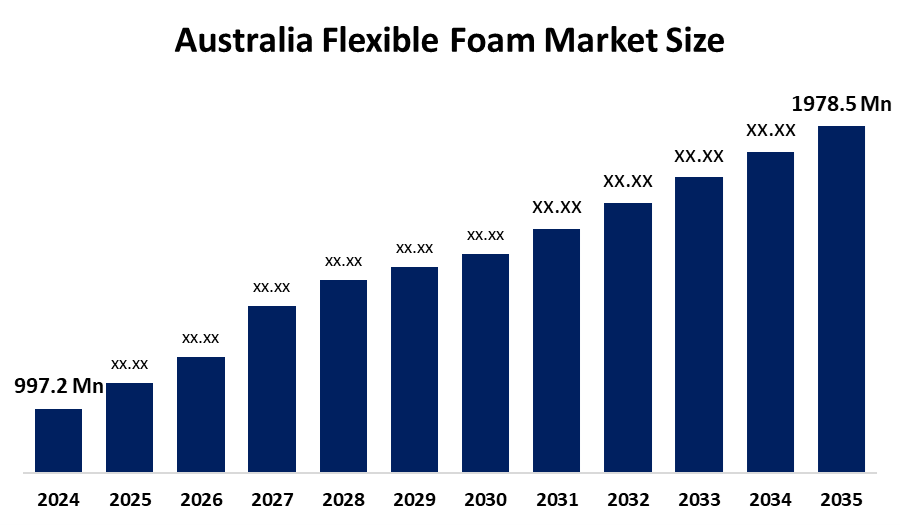

- The Australia Flexible Foam Market Size Was Estimated at USD 997.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.43% from 2025 to 2035

- The Australia Flexible Foam Market Size is Expected to Reach USD 1978.5 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Australia flexible foam market size is anticipated to reach USD 1978.5 Million by 2035, Growing at a CAGR of 6.43% from 2025 to 2035. The flexible foam market in Australia is driven by growing consumer comfort preferences, growing building activity, automotive lightweighting trends, rising demand from furniture and bedding, and growing adoption of energy-efficient insulating materials.

Market Overview

The Australia Flexible Foam Market Size refers to the manufacturing and utilization of lightweight, elastic foam materials, mainly polyurethane, designed for cushioning, insulation, and comfort. The foams show exceptional ability to recover their original shape, maintain their structural integrity, and undergo dynamic movements. The main applications of this material include furniture and bedding products, which consist of mattresses and sofas, automotive seating and interior components, construction materials that provide sound and temperature insulation, packaging systems that protect against impacts, footwear, and various consumer products that need to provide comfort and safety while absorbing vibrations.

The Australian government supports the flexible foam market through energy-efficient manufacturing initiatives and its various programs. The National Construction Code and the Green Building Fund, with its $50 million in funding and R&D Tax Incentive and state rebates that reach up to AUD 10,000, promote the use of insulation and advanced materials. The policies create demand for polyurethane foams used in building, automotive, and industrial applications, while promoting environmentally friendly production methods and innovation.

Recent developments in Australia's flexible foam market include eco-friendly biodegradable formulations and AI-enabled manufacturing, which improve efficiency while decreasing waste. Advanced foam insulation technologies become more accessible through partnerships and distribution agreements. The future will present business possibilities which stem from green building materials, healthcare specialty foams, automotive specialty foams, and exports to Asia-Pacific sustainability markets.

Report Coverage

This research report categorizes the market for the Australia flexible foam market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia flexible foam market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia flexible foam market.

Australia Flexible Foam Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 997.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.43% |

| 2035 Value Projection: | USD 1978.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Joyce Foam Products, Future Foams Pty Ltd, ACMA Industries, Sekisui Foam Australia, Enviro-Foam, Foam International, Urecel Pty Ltd, Dalchem Australia, The Foam Company, Sheela Foam, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The flexible foam market in Australia is driven by the furniture and bedding demand increases, construction and renovation work, and the automotive industry needs lightweight, durable materials. The market expands because consumers prefer comfort and ergonomic products, energy-efficient insulation solutions become widely adopted, and technological advancements produce eco-friendly, high-performance foams, which create chances for manufacturers to develop new products and enter international markets.

Restraining Factors

The flexible foam market in Australia is mostly constrained by the expensive raw materials, strict chemical emission regulations, recycling difficulties, and competition from different cushioning and insulation materials.

Market Segmentation

The Australia Flexible Foam Market Size share is classified into type and application.

- The polyurethane (PU) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia flexible foam market is segmented by type into polyurethane (PU), polyethylene (PE), polypropylene (PP), ethylene-vinyl acetate (EVA), latex, and others. Among these, the polyurethane (PU) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to PU foam's exceptional toughness, durability, and adaptability, which make it perfect for use in insulation, bedding, furniture, and car seats. Its high market share and steady growth are fueled by its exceptional comfort, cushioning qualities, and capacity to be tailored for density and stiffness.

- The furniture & bedding segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia flexible foam market is segmented by application into furniture & bedding, transportation, packaging, building & construction, and others. Among these, the furniture & bedding segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because of their comfort, durability, and adjustable density, flexible foams, particularly polyurethane foams, are widely utilized in mattresses, couches, upholstered furniture, and sofas. The segment's highest market share and ongoing expansion are driven by growing customer demand for comfortable and ergonomic home furnishings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia flexible foam market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

artnerships and distribution agreements. The future will present business possibilities which stem from green building materials, healthcare specialty foams, automotive specialty foams, and exports to Asia-Pacific sustainability markets.

List of Key Companies

• Joyce Foam Products

• Future Foams Pty Ltd

• ACMA Industries

• Sekisui Foam Australia

• Enviro-Foam

• Foam International

• Urecel Pty Ltd

• Dalchem Australia

• The Foam Company

• Sheela Foam (Joyce Foam Australia operations)

• Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In May 2025, Victoria starts a free recycling program for small electronics, foam packaging, and flexible plastics to help achieve trash reduction and circular economy objectives.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia flexible foam market based on the below-mentioned segments:

Australia Flexible Foam Market Size, By Type

- Polyurethane (PU)

- Polyethylene (PE)

- Polypropylene (PP)

- Ethylene-Vinyl Acetate (EVA)

- Latex

- Others

Australia Flexible Foam Market Size, By Application

- Furniture & Bedding

- Transportation

- Packaging

- Building & Construction

- Others

Frequently Asked Questions (FAQ)

-

What is the Australia Flexible Foam Market Size?Australia flexible foam market size is expected to grow from USD 997.2 million in 2024 to USD 1978.5 million by 2035, growing at a CAGR of 6.43% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by furniture and bedding demand increases, construction and renovation work, and the automotive industry needs lightweight, durable materials.

-

What factors restrain the Australia Flexible Foam Market Size?Constraints include the expensive raw materials, strict chemical emission regulations, and recycling difficulties.

-

How is the market segmented by type?The market is segmented into polyurethane (PU), polyethylene (PE), polypropylene (PP), ethylene-vinyl acetate (EVA), latex, and others.

-

Who are the key players in the Australia Flexible Foam Market Size?Key companies include Joyce Foam Products, Future Foams Pty Ltd, ACMA Industries, Sekisui Foam Australia, Enviro‑Foam, Foam International, Urecel Pty Ltd, Dalchem Australia, The Foam Company, Sheela Foam / Joyce Foam Australia operations, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?