Australia Electric Substation Market Size, Share, and COVID-19 Impact Analysis, By Type (AIS Substation and GIS Substation), By Application (Power Transmission and Distribution and Manufacturing and Processing), and Australia Electric Substation Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsAustralia Electric Substation Market Size Insights Forecasts to 2035

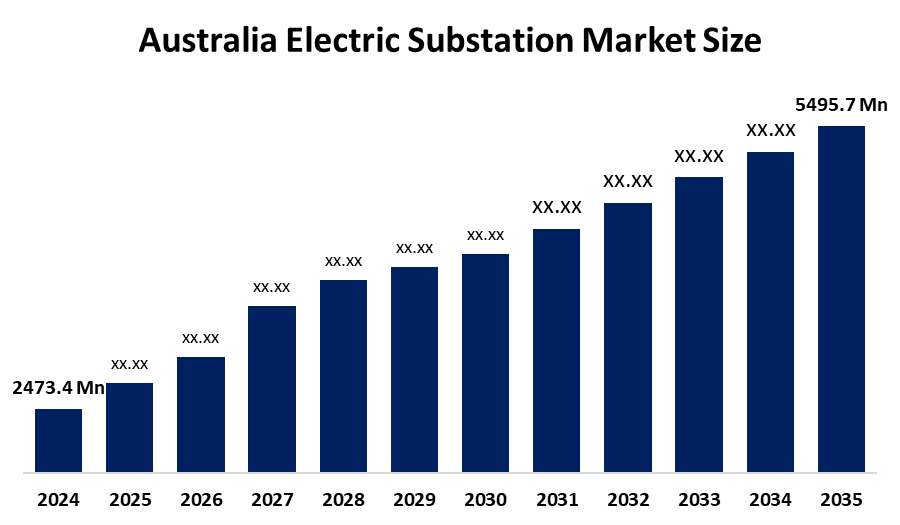

- The Australia Electric Substation Market Size Was Estimated at USD 2473.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.53% from 2025 to 2035

- The Australia Electric Substation Market Size is Expected to Reach USD 5495.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Australia Electric Substation Market Size is anticipated to reach USD 5495.7 Million by 2035, Growing at a CAGR of 7.53% from 2025 to 2035. The electric substation market in Australia is driven by grid modernization programs, the integration of renewable energy sources, the expansion of EV charging infrastructure, transmission upgrades, the replacement of aged power assets, smart grid investments, urbanization, industrial growth, and government decarbonization targets.

Market Overview

The Australian Electric Substation Market Size includes all infrastructure systems which transform electrical voltages to manage power distribution throughout transmission and distribution networks between power generation facilities and end users. The system supports power transmission and distribution between solar and wind energy generation facilities and electric vehicle charging stations and industrial sites and urban utility systems and smart grid infrastructure to ensure Australia can transition to new energy sources while modernizing its grid system and meeting rising electricity consumption from homes and businesses and factories.

Australia's Rewiring the Nation program allows for AUD 20 billion in affordable financing which will be used to update transmission lines and substations needed for renewable energy integration. The government provides AUD 30 million through its Grid Enhancing Technologies grants for network improvement projects. The Clean Energy Finance Corporation dedicated an unprecedented AUD 3.5 billion to grid infrastructure during 2024-25 which will boost renewable energy connections while improving grid dependability.

Australia completed the Energy Connect project through the construction of the Buronga substation and the activation of the Broad sound Solar Farm substation link and the development of advanced digital substations throughout New South Wales. The system improvements enable better integration of renewable energy sources while enhancing grid dependability which creates potential future developments in storage-ready substations and smart grid expansion.

Report Coverage

This research report categorizes the market for the Australia Electric Substation Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia Electric Substation Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia Electric Substation Market Size.

Driving Factors

The electric substation market in Australia is driven by the increasing need for power and their efforts to upgrade transmission systems and develop new grid infrastructure and their active work to modernize grid systems. Government programs which promote decarbonization together with Renewable Energy Zones development work to increase funding for high-voltage substations. The market expansion for transmission and distribution networks receives additional support from four factors which include growing EV charging infrastructure and the need to replace aging power networks and urban development and the adoption of digital and smart substations which enhance reliability and operational efficiency.

Restraining Factors

The electric substation market in Australia is mostly constrained by the high capital investment requirements, lengthy regulatory approvals, land acquisition challenges, supply chain disruptions, skilled labor shortages, and project delays caused by environmental assessments and community opposition, which collectively slow deployment timelines and increase overall project costs.

Market Segmentation

The Australia Electric Substation Market Size share is classified into type and application.

- The AIS substation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia Electric Substation Market Size is segmented by type into AIS substation and GIS substation. Among these, the AIS substation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. AIS substations are superior to GIS because of their simpler design, easier maintenance, and less equipment and installation costs. Because of AIS's demonstrated dependability, adaptability for future growth, and quicker construction schedules, utilities also favor it for high-voltage and rural applications, which increases adoption and revenue share.

- The power transmission and distribution segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia Electric Substation Market Size is segmented by application into power transmission and distribution and manufacturing and processing. Among these, the power transmission and distribution segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth of Renewable Energy Zones, extensive system upgrading, increased demand for power, and government-sponsored transmission upgrades have made this segment the leader. T&D is the biggest source of revenue because the majority of substation investments are focused on bolstering transmission and distribution networks to incorporate wind and solar, increase reliability, replace old infrastructure, and facilitate EV charging.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia Electric Substation Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Powercor Australia

- Transgrid

- Jemena

- AusNet

- Endeavour Energy

- John Holland

- Downer Group

- Transwitch

- APD Engineering

- Stowe Australia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia Electric Substation Market Size based on the below-mentioned segments:

Australia Electric Substation Market Size, By Type

- AIS Substation

- GIS Substation

Australia Electric Substation Market Size, By Application

- Power Transmission and Distribution

- Manufacturing and Processing

Frequently Asked Questions (FAQ)

-

What is the Australia Electric Substation Market Size?Australia Electric Substation Market Size is expected to grow from USD 2473.4 million in 2024 to USD 5495.7 million by 2035, growing at a CAGR of 7.53% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by increasing need for power and their efforts to upgrade transmission systems and develop new grid infrastructure and their active work to modernize grid systems. Government programs which promote decarbonization together with renewable energy zones development work to increase funding for high-voltage substations.

-

What factors restrain the Australia Electric Substation Market Size?Constraints include the high capital investment requirements, lengthy regulatory approvals, land acquisition challenges, and supply chain disruptions.

-

How is the market segmented by type?The market is segmented into AIS substation, and GIS substation.

-

Who are the key players in the Australia Electric Substation Market Size?Key companies include Powercor Australia, Transgrid, Jemena, AusNet, Endeavour Energy, John Holland, Downer Group, Transwitch, APD Engineering, Stowe Australia, and Others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?