Australia E-liquid Market Size, Share, and COVID-19 Impact Analysis, By Flavor (Chocolate, Tobacco, Menthol, Dessert, Fruits & Nuts, and Others), By Distribution Channel (Online, and Retail Store), and Australia E-liquid Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsAustralia E-Liquid Market Insights Forecasts To 2035

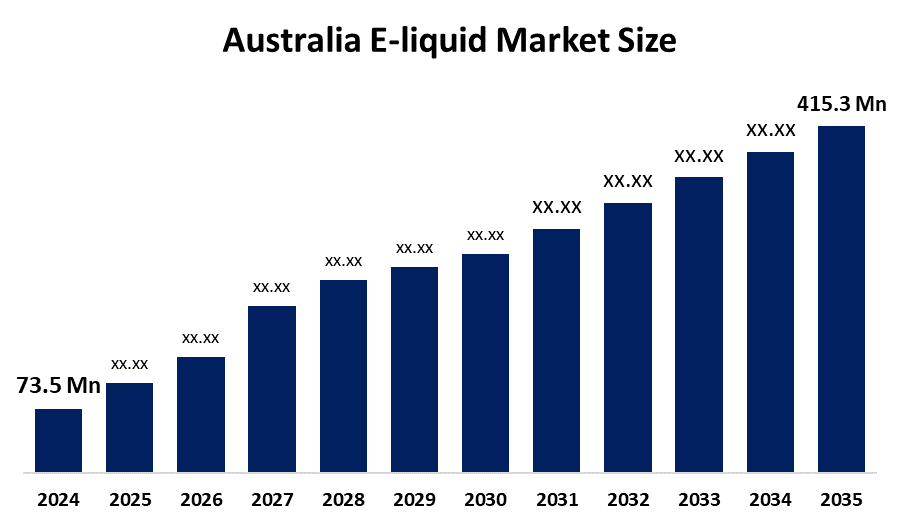

- The Australia E-Liquid Market Size Was Estimated At USD 73.5 Million In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 17.05% From 2025 To 2035

- The Australia E-Liquid Market Size Is Expected To Reach USD 415.3 Million By 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The Australia E-Liquid Market Size Is Anticipated To Reach USD 415.3 Million By 2035, Growing At A CAGR Of 17.05% From 2025 To 2035. The e-liquid market in Australia is driven by the need for flavored and nicotine-free options, increased e-cigarette penetration, favorable lifestyle trends, rising vaping uptake, growing awareness of smoking alternatives, and technological advancements in e-liquid formulations.

Market Overview

The Australia E-Liquid Market consists of liquid mixtures intended for e-cigarettes and vaping devices, containing nicotine, flavorings, and other ingredients. These liquids are designed to produce aerosols through vaporization, which are inhaled similarly to smoke. E-liquids are available through retail vape stores, online platforms, and specialty shops, primarily targeting adult consumers seeking a variety of flavors and nicotine strengths, as well as alternatives perceived to be less harmful than traditional tobacco products.

The Australian e-liquid market operates under strict regulatory oversight, with nicotine-containing e-liquids accessible only via prescription. Government measures include import restrictions, mandatory age verification, advertising bans, and enforcement actions. Notably, in 2025, the Queensland government confiscated illegal vaping products valued at AUD 15.7 million. The market is strongly shaped by public health policies and potential excise taxation, emphasizing consumer safety and controlled access.

In 2025, the evolution of the Australian e-liquid market focused on the development of nicotine-salt formulations and advanced disposable vape devices featuring longer-lasting batteries and enhanced flavor technology. Despite these innovations, stringent prescription and import regulations remained firmly in place. Additionally, the first therapy for vaping addiction was approved in August 2025, reflecting national health priorities. Looking ahead, the market is expected to emphasize high-quality formulations, regulatory compliance, and tightly controlled distribution channels.

Report Coverage

This research report categorizes The Market Size For The Australia E-Liquid Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia e-liquid market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia e-liquid market.

Australia E-liquid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 73.5 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 17.05% |

| 2023 Value Projection: | USD 415.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Flavor, By Distribution Channel |

| Companies covered:: | The Australian eJuice Company, Vape Lab Group Australia, Vape King Australia, Vape Empire Australia, JustVapes Australia, Vape World Australia, ALIBARBAR, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The E-Liquid Market Size in australia is driven by the growing awareness of smoking harm-reduction alternatives, the increasing adult vaping adoption, and the demand for customized flavors and nicotine strengths. With the increasing acceptability of e-cigarettes for smoking cessation, continued development of e-liquid formulations, and access to prescription-based nicotine products via pharmacies, the market is really expanding despite strict regulation.

Restraining Factors

The E-Liquid Market Size in australia is mostly constrained by the strict government regulations, prescription-only access for nicotine e-liquids, import and sales restrictions, advertising bans, high compliance costs, and strong public health opposition.

Market Segmentation

The Australia e-liquid market share is classified into flavor and distribution channel.

- The tobacco segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia E-Liquid Market Size Is Segmented by flavor into chocolate, tobacco, menthol, dessert, fruits & nuts, and others.Among these, the tobacco segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. It is the ideal option for adult smokers switching to vaping to quit because it closely mimics the flavor of regular cigarettes. Furthermore, tobacco flavors, which are more commonly acceptable under Australia's prescription-based nicotine access framework, are favored by harsher laws and taste limits.

- The online segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia E-Liquid Market Size Is segmented by distribution channel into online, and retail store.Among these, the online segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Stricter retail laws, prescription-based access to nicotine e-liquids, increased product availability, convenience, privacy, and competitive pricing provided by authorized online pharmacies and compliant digital platforms all contribute to greater consumer adoption and sustained growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the australia e-liquid market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Australian eJuice Company

- Vape Lab Group Australia

- Vape King Australia

- Vape Empire Australia

- JustVapes Australia

- Vape World Australia

- ALIBARBAR

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In July 2025, the implementation of tightened safety and quality standards for therapeutic e-liquid and vaping products in Australia was aimed at securing conformity in the country's pharmacies.

- In March 2025, the beginning of very tough regulations concerning the names, packages, and nicotine levels of vape products resulted in stricter import and supply standards.

- In October 2024, the new TGA standards for therapeutic vaping products were announced, including more precise rules for the type of ingredients used, packaging, and labeling.

- In July 2024, new Australia vaping laws came into effect, disallowing sales of vapes outside pharmacies and making it mandatory to get prescriptions or consult pharmacists for nicotine e-liquids and devices.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia e-liquid market based on the below-mentioned segments:

Australia E-liquid Market, By Flavor

- Chocolate

- Tobacco

- Menthol

- Dessert

- Fruits & Nuts

- Others

Australia E-liquid Market, By Distribution Channel

- Online

- Retail Store

Frequently Asked Questions (FAQ)

-

What is the Australia e-liquid market size?Australia e-liquid market size is expected to grow from USD 73.5 million in 2024 to USD 415.3 million by 2035, growing at a CAGR of 17.05% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by growing awareness of smoking harm-reduction alternatives, the increasing adult vaping adoption, and the demand for customized flavors and nicotine strengths.

-

What factors restrain the Australia e-liquid market?Constraints include the strict government regulations, prescription-only access for nicotine e-liquids, import and sales restrictions, advertising bans, high compliance costs, and strong public health opposition.

-

How is the market segmented by type?The market is segmented into chocolate, tobacco, menthol, dessert, fruits & nuts, and others.

-

Who are the key players in the Australia e-liquid market?Key companies include The Australian eJuice Company, Vape Lab Group Australia, Vape King Australia, Vape Empire Australia, JustVapes Australia, Vape World Australia, ALIBARBAR, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?