Australia Customer Self-service Software Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, and Services), By Deployment (BFSI, Manufacturing, Retail & E-commerce, Media & Entertainment, IT & Telecom, Healthcare, Government, and Others), and Australia Customer Self-service Software Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyAustralia Customer Self-service Software Market Insights Forecasts to 2035

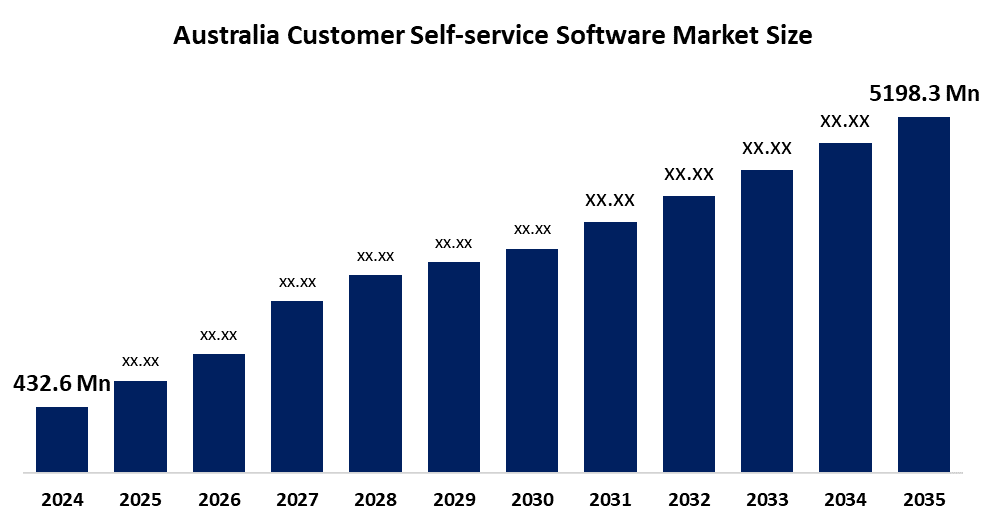

- The Australia Customer Self-service Software Market Size Was Estimated at USD 432.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 25.36% from 2025 to 2035

- The Australia Customer Self-service Software Market Size is Expected to Reach USD 5198.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Australia Customer Self-Service Software Market Size Is Anticipated To Reach USD 5198.3 Million By 2035, Growing At A CAGR Of 25.36% From 2025 To 2035. The customer self-service software market in Australia is driven by growing digital transformation, AI-powered chatbots, the need for round-the-clock customer service, cost-cutting measures, and the expansion of e-commerce and omnichannel service strategies.

Market Overview

The Australia customer self-service software market refers to digital platforms and tools that enable customers to access information, resolve issues, and complete transactions without direct human assistance. The solutions of the system provide AI chatbots together with knowledge bases, self-service portals and interactive voice response (IVR) systems, and mobile applications. The applications of the technology support banking and retail, telecommunications, healthcare, and government services to enhance customer experience while decreasing operational expenses and increasing service delivery efficiency.

The Australian Government supports customer self-service software adoption through the Digital Transformation Agency, which enforces the Digital Service Standard for user-centric platforms. The improved myGov portal now combines multiple services to serve more than 25 million users. The countrywide digital economy investments, which exceed AUD 1 billion, will support the development of cloud AI and automated customer service technologies.

Recent developments in the Australia customer self-service software market include AI-enhanced chatbots, knowledge bases, and automated support platforms from firms like Zendesk Australia and Freshworks Australia. The banking and telecom sectors show increasing adoption of self-service portals together with virtual assistants. The company can develop new business opportunities through AI automation, omnichannel support and integrated analytics for enhanced customer experience.

Report Coverage

This research report categorizes the market for the Australia customer self-service software market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia customer self-service software market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia customer self-service software market.

Australia Customer Self-service Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 432.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 25.36% |

| 2035 Value Projection: | USD 5198.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Deployment |

| Companies covered:: | Helpfruit, Unith, Dubber, Abbacus Technologies, Savvient Technologies, Intesols, AI Assist Pty Ltd, Smart Serve Technologies, Chat Genie Solutions, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The customer self-service software market in Australia is driven by businesses transforming their digital operations, and customers prefer instant support that operates throughout the day and uses AI-powered chatbots and virtual assistants. Organizations use automation to decrease operational expenses while they work to improve customer service. The market expansion process accelerates because of e-commerce, mobile banking, omnichannel platforms, and cloud adoption by both SMEs and large enterprises.

Restraining Factors

The customer self-service software market in Australia is mostly constrained by the high initial implementation costs, data security and privacy concerns, integration complexities with legacy systems, limited technical expertise among small businesses, and resistance to change from customers preferring human-assisted support channels.

Market Segmentation

The Australia customer self-service software market share is classified into component and deployment.

- The solution segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia customer self-service software market is segmented by component into solution, and services. Among these, the solution segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is a result of the increased demand for information management systems, automated customer engagement platforms, self-service portals, and chatbots driven by AI. Scalable software solutions are prioritized by organizations in order to improve customer experience, lower operating costs, and provide round-the-clock digital assistance, all of which increase income relative to services.

- The BFSI segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia customer self-service software market is segmented by deployment into BFSI, manufacturing, retail & e-commerce, media & entertainment, IT & telecom, healthcare, government, and others. Among these, the BFSI segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The widespread use of mobile apps, AI chatbots, digital banking, and automated customer support portals is what is causing this domination. 24/7 self-service solutions are given top priority by financial institutions to improve client satisfaction, increase security, lower operating expenses, and effectively handle large transaction volumes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia customer self-service software market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Helpfruit

- Unith

- Dubber

- Abbacus Technologies

- Savvient Technologies

- Intesols

- AI Assist Pty Ltd

- Smart Serve Technologies

- Chat Genie Solutions

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, according to a survey, 57% of Australian companies currently employ chatbots and virtual assistants, which are AI-enabled customer support tools, to enhance customer satisfaction and operational effectiveness.

- In May 2025, Telstra, a major Australian telco, focuses on integrating AI into customer service to increase efficiency through automation and virtual agents.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia customer self-service software market based on the below-mentioned segments:

Australia Customer Self-service Software Market, By Component

- Solution

- Services

Australia Customer Self-service Software Market, By Deployment

- BFSI

- Manufacturing

- Retail & E-commerce

- Media & Entertainment

- IT & Telecom

- Healthcare

- Government

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Australia customer self-service software market size?A: Australia customer self-service software market size is expected to grow from USD 432.6 million in 2024 to USD 5198.3 million by 2035, growing at a CAGR of 25.36% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by businesses transforming their digital operations, and customers prefer instant support that operates throughout the day and uses AI-powered chatbots and virtual assistants.

-

Q: What factors restrain the Australia customer self-service software market?A: Constraints include the high initial implementation costs, data security and privacy concerns, and integration complexities with legacy systems.

-

Q: How is the market segmented by deployment?A: The market is segmented into BFSI, manufacturing, retail & e-commerce, media & entertainment, IT & telecom, healthcare, government, and others.

-

Q: Who are the key players in the Australia customer self-service software market?A: Key companies include Helpfruit, Unith, Dubber, Abbacus Technologies, Savvient Technologies, Intesols, AI Assist Pty Ltd, Smart Serve Technologies, Chat Genie Solutions, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?