Australia Cookies Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Drop Cookies, Bar Cookies, Molded Cookies, No-Bake Cookies, Ice Box Cookies, Rolled Cookies, Sandwich Cookies, and Others), By Packaging (Rigid, Flexible, and Others), and Australia Cookies Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesAustralia Cookies Market Insights Forecasts to 2035

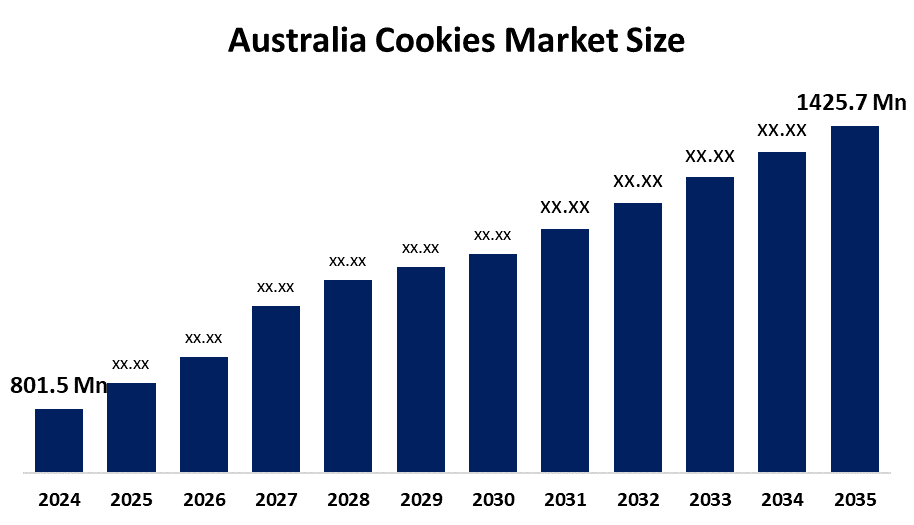

- The Australia Cookies Market Size Was Estimated at USD 801.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.38% from 2025 to 2035

- The Australia Cookies Market Size is Expected to Reach USD 1425.7 Million by 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The Australia Cookies Market Size Is Anticipated To Reach USD 1425.7 Million By 2035, Growing At A CAGR Of 5.38% From 2025 To 2035. The cookies market in Australia is driven by growing consumer demand for handy snack foods, a preference for healthier and more upscale options, the expansion of retail distribution channels, urbanization, and a strong desire for decadent bakery goods.

Market Overview

The cookies market in Australia consists of baked snack products such as cookies containing primarily flour, sugar, fat (or oils), and flavourings. Examples of types of cookies produced include: chocolate chip, sandwich, oatmeal, digestive, and premium artisan cookies. Cookies are consumed by most people within Australia as both quick snack items and as desserts or while on-the-go. All types of cookies are sold to consumers from supermarkets, convenience stores, Internet retailers, or through food service establishment.

The Australian Government's Food and Beverage Manufacturing Growth Program provides financial assistance through grants which can reach AUD 5 million for companies that want to enhance their processing and packaging operations and adopt new technologies. The Industry Growth Program provides AUD 400 million in co-funding for innovation. The Export Market Development Grants (EMDG) reimburse up to 50% of eligible export promotion costs. These snack sector supports which include cookies help companies to expand their product lines while maintaining high quality and competitive advantages.

Report Coverage

This research report categorizes the market for the Australia cookies market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia cookies market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia cookies market.

Australia Cookies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 801.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.38% |

| 2035 Value Projection: | USD 1425.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Product Type, By Packaging |

| Companies covered:: | Arnott’s Biscuits Limited, Bickford’s Australia, Sunbake Foods Pty Ltd, Peters Ice Cream & Bakery, Rowie’s, Sweetness & Bite, The Gluten Free Cookie Co., Muffin Break / Craveables |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The cookies market in Australia is driven by because people want ready-to-eat snacks while urban areas expand and people live more active lives. The market expands because consumers now prefer premium products that offer both indulgence and healthier options like gluten-free and low-sugar and high-fiber cookies. People can access products better because supermarkets and private labels and e-commerce platforms continue to expand their operations. The market grows because of seasonal consumption patterns and new innovative flavors and strong brand recognition in the industry.

Restraining Factors

The cookies market in Australia is mostly constrained by the rising raw material expenses which include wheat, sugar and dairy products and from growing public health concerns about sugar and calorie consumption. The market expansion faces three main challenges which include strict food labeling rules, strong competition from healthier snack options and disruptions to the supply chain.

Market Segmentation

The Australia cookies market share is classified into product type and packaging.

- The drop cookies segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia cookies market is segmented by product type into drop cookies, bar cookies, molded cookies, no-bake cookies, ice box cookies, rolled cookies, sandwich cookies, and others. Among these, the drop cookies segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Their widespread appeal, ease of use, and effective mass production are the main causes of this. This category includes varieties that appeal to a wide range of consumer preferences, like chocolate chip and oatmeal. Their leading revenue share and ongoing growth are supported by their robust retail presence, competitive pricing, innovative products, and availability in both private-label and premium formats.

- The flexible segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia cookies market is segmented by packaging into rigid, flexible, and others. Among these, the flexible segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because of its affordability, portability, and ease of use in single-serve and family-sized portions. Flexible packaging, such wraps and pouches, promotes eye-catching branding and increases shelf life. Its substantial market share and anticipated CAGR growth are further driven by the growing need for resealable and sustainable packaging solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia cookies market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arnott’s Biscuits Limited

- Bickford’s Australia

- Sunbake Foods Pty Ltd

- Peters Ice Cream & Bakery

- Rowie’s

- Sweetness & Bite

- The Gluten Free Cookie Co.

- Muffin Break / Craveables

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, Health Food Symmetry and Indigenous-led Cooee Cookies collaborated to introduce a new line of gut-friendly cookies enhanced with prebiotic Phyto Biome for better digestive health.

- In July 2024, Brumby's Bakery opened its retail cafés around the country to sell limited-edition gourmet cookies in two new chocolate-based flavors.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia cookies market based on the below-mentioned segments

Australia Cookies Market, By Product Type

- Drop Cookies

- Bar Cookies

- Molded Cookies

- No-Bake Cookies

- Ice Box Cookies

- Rolled Cookies

- Sandwich Cookies

- Others

Australia Cookies Market, By Packaging

- Rigid

- Flexible

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Australia cookies market size?A: Australia cookies market size is expected to grow from USD 801.5 million in 2024 to USD 1425.7 million by 2035, growing at a CAGR of 5.38% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by people want ready-to-eat snacks while urban areas expand and people live more active lives. The market expands because consumers now prefer premium products that offer both indulgence and healthier options like gluten-free and low-sugar and high-fiber cookies.

-

Q: What factors restrain the Australia cookies market?A: Constraints include the rising raw material expenses which include wheat, sugar and dairy products and from growing public health concerns about sugar and calorie consumption.

-

Q: How is the market segmented by product type?A: The market is segmented into drop cookies, bar cookies, molded cookies, no-bake cookies, ice box cookies, rolled cookies, sandwich cookies, and others.

-

Q: Who are the key players in the Australia cookies market?A: Key companies include Arnott’s Biscuits Limited, Bickford’s Australia, Sunbake Foods Pty Ltd, Peters Ice Cream & Bakery, Rowie’s, Sweetness & Bite, The Gluten Free Cookie Co., Muffin Break / Craveables, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?