Australia Consumer Electronics Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Digital Cameras, Hard Disk Drives, Tablets, Desktops, Laptops/Notebooks, Smartphones, Televisions, and E-readers), By End Use (Residential, and Commercial), and Australia Consumer Electronics Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsAustralia Consumer Electronics Market Insights Forecasts to 2035

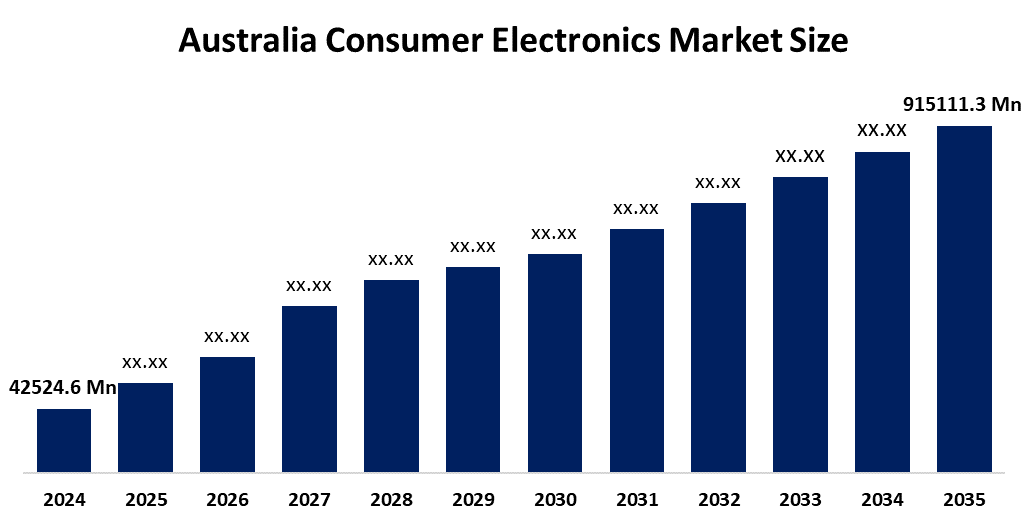

- The Australia Consumer Electronics Market Size Was Estimated at USD 42524.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.22% from 2025 to 2035

- The Australia Consumer Electronics Market Size is Expected to Reach USD 91511.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Australia Consumer Electronics Market Size Is Anticipated To Reach USD 91511.3 Million By 2035, Growing At A CAGR Of 7.22% From 2025 To 2035. The consumer electronics market in Australia is driven by rising disposable incomes, fast digitization, the growing demand for smart devices, the growth of e-commerce platforms, the growing use of IoT-enabled products, and ongoing technological advancements in wearables, smartphones, and home entertainment systems.

Market Overview

The Australia consumer electronics market refers to the industry involved in the manufacturing, distribution, and sale of electronic devices which are designed for personal and household use throughout Australia. The market includes smartphones, laptops, televisions, home appliances, wearables, gaming consoles and smart home devices. Digital transformation, together with changing consumer lifestyles, creates applications that exist across communication, entertainment, education, remote work, home automation and personal productivity fields.

The Australian government provides support to the consumer electronics industry through programs that include the R&D Tax Incentive that grants tax deductions for businesses that pursue innovative projects. The Digital Economy Strategy provides funding of AUD 1.2 billion to support digital technology implementation. The country has invested more than AUD 500 million to develop battery manufacturing facilities and advanced technologies, which create stronger capabilities for domestic electronics production and technological advancement.

The Australian consumer electronics market has experienced recent growth through the rising adoption of smart home devices, the development of e-commerce platforms and the establishment of local research and development centres by companies such as JB Hi-Fi and Harvey Norman. The current advancements work toward two main objectives, which involve connecting all devices through IoT technology and creating environmentally friendly electronic products. The upcoming opportunities for development exist through the creation of AI-based products, the introduction of 5G technology and the development of consumer electronics powered by renewable energy sources.

Report Coverage

This research report categorizes the market for the Australia consumer electronics market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia consumer electronics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia consumer electronics market.

Australia Consumer Electronics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 42524.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.22% |

| 2035 Value Projection: | USD 91511.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By End Use |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The consumer electronics market in Australia is driven by the rising disposable incomes, strong internet penetration and growing adoption of smartphones and smart home devices. The sales growth of e-commerce platforms such as JB Hi-Fi and Harvey Norman creates new opportunities for business expansion. The market experiences rapid development because of increasing demand for IoT-enabled products, 5G connectivity, remote working trends and ongoing technological advancement.

Restraining Factors

The consumer electronics market in Australia is mostly constrained by the high dependency on imports and supply chain interruptions, changes in currency exchange rates, increasing product prices, fierce competition and the rising concerns about electronic waste and the environmental regulations that affect production and disposal practices.

Market Segmentation

The Australia consumer electronics market share is classified into product type and end use.

- The smartphones segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia consumer electronics market is segmented by product type into digital cameras, hard disk drives, tablets, desktops, laptops/notebooks, smartphones, televisions, and e-readers. Among these, the smartphones segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to its high penetration rates, regular device upgrades, robust 5G adoption, and increasing dependence on mobile devices for digital payments, communication, entertainment, and remote work, this market leads in terms of revenue share.

- The residential segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia consumer electronics market is segmented by end use into residential, and commercial. Among these, the residential segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Strong consumer spending is being driven by the widespread usage of smartphones, TVs, computers, gaming consoles, and smart home appliances in households, as well as the growing desire for remote work, online learning, and home entertainment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia consumer electronics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In January 2026, Samsung presented hero goods from its 2026 lineup ahead of CES, signalling new device launches in Australia.

- In September 2025, Apple unveiled the brand-new iPhone Air, giving Australian customers more alternatives for high-end smartphones.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia consumer electronics market based on the below-mentioned segments:

Australia Consumer Electronics Market, By Product Type

- Digital Cameras

- Hard Disk Drives

- Tablets

- Desktops

- Laptops/Notebooks

- Smartphones

- Televisions

- E-readers

Australia Consumer Electronics Market, By End Use

- Residential

- Commercial

Frequently Asked Questions (FAQ)

-

Q: What is the Australia consumer electronics market size?A: Australia consumer electronics market size is expected to grow from USD 42524.6 million in 2024 to USD 91511.3 million by 2035, growing at a CAGR of 7.22% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by rising disposable incomes, strong internet penetration and growing adoption of smartphones and smart home devices. The sales growth of e-commerce platforms such as JB Hi-Fi and Harvey Norman creates new opportunities for business expansion.

-

Q: What factors restrain the Australia consumer electronics market?A: Constraints include the high dependency on imports and supply chain interruptions, changes in currency exchange rates, and increasing product prices.

-

Q: How is the market segmented by product type?A: The market is segmented into digital cameras, hard disk drives, tablets, desktops, laptops/notebooks, smartphones, televisions, and e-readers.

-

Q: Who are the key players in the Australia consumer electronics market?A: Key companies include JB Hi‑Fi, The Good Guys, Jaycar Electronics, Bing Lee, Digi Direct, Retravision, Officeworks, Kogan.com, Centrecom, Scorptec, and others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?