Australia Ceramic Tiles Market Size, Share, By Product (Glazed ceramic tiles, Porcelain tiles, Scratch free ceramic tiles, and Others), By Application (Wall tiles, Floor tiles, and Others), Australia Ceramic Tiles Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsAustralia Ceramic Tiles Market Size Insights Forecasts to 2035

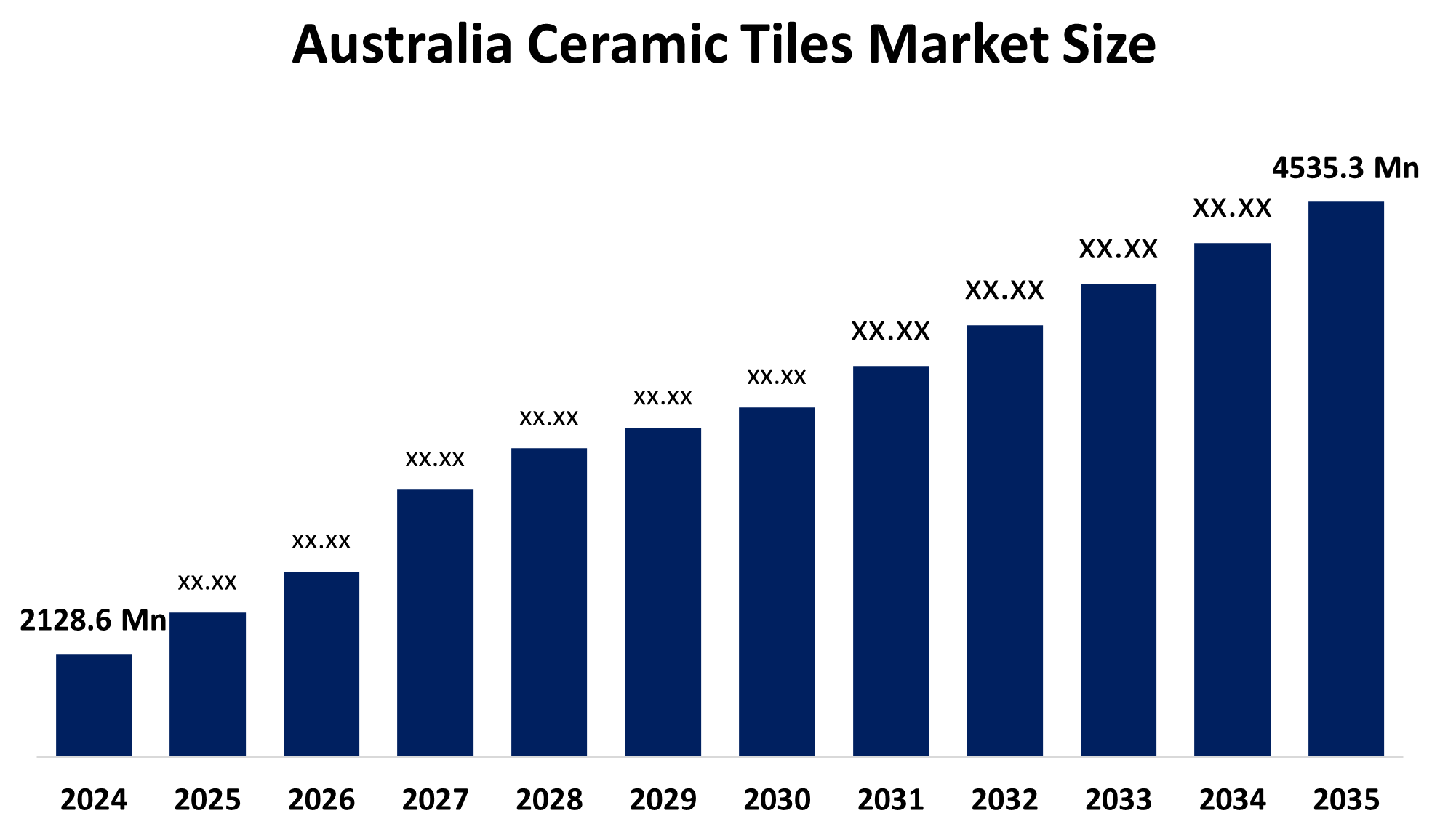

- Australia Ceramic Tiles Market Size 2024: USD 2128.6 Mn

- Australia Ceramic Tiles Market Size 2035: USD 4535.3 Mn

- Australia Ceramic Tiles Market CAGR 2024: 7.12%

- Australia Ceramic Tiles Market Segments: Product and Application

Get more details on this report -

The market for ceramic tiles in Australia includes the making, delivering, and marketing of long-lasting and beautiful covering materials for floors, walls, and other applications. All this is happening because of strong construction for residential and commercial purposes, trends in home renovations, and the demand for low-maintenance, good-looking designs in an expanding economy. The ceramic tiles are clay-based products that are transformed through heating into hard and water-resistant coverings. They have become very popular in Australia due to their versatility, realism (wood/stone imitation), and applicability in high-traffic areas and modern design, with porcelain dominating because of its superior density and water resistance.

The government support for construction and housing contributes positively to the ceramic tiles market in Australia. The measures taken are about AUD 900 million to enhance productivity in construction, AUD 10,000 alluringments for apprentices in building, and AUD 54 million for quickening housing and prefab projects. Environmentally-friendly building standards, such as Green Star and others, make it possible for the application of ceramic tiles, which are durable and sustainable, in both residential and commercial construction, thus encouraging the use of such materials.

In the year 2025, Artedomus finished bespoke digitally printed porcelain tile facades for Arden Train Station, Melbourne. Johnson Tiles Australia rolled out anti-slip, antibacterial tile ranges, and at the same time, YHJ Tiles increased their eco-friendly, recycled-content ceramic collections, indicating advancements in design, sustainability, and functional performance.

Market Dynamics of the Australia Ceramic Tiles Market:

The Australia Ceramic Tiles Market Size is driven by the growth in construction activities in the residential, commercial, and industrial sectors, the increase in renovation and remodeling projects in homes, and urban sprawl. Demand for flooring and wall solutions that are durable, easy to maintain, and visually pleasing is a major factor that supports the growth of the market. Government spending on housing and infrastructure, the use of eco-friendly and energy-efficient building materials, and the introduction of advanced digital printing and large-format tile designs are all factors that drive the growth of the market in various sectors, including residential, commercial, and public infrastructures.

The Australia Ceramic Tiles Market Size is restrained by the high costs of raw materials and energy, fluctuating import prices, supply chain disruptions, and the competition from alternative flooring materials, which is fierce and impacts pricing, profit margins, and overall market growth negatively.

The demand for green buildings, urban redevelopment, and renovation projects is creating opportunities in the Australia Ceramic Tiles Market Size. Digital printing of designs, large sizes of slabs, antibacterial coatings, and green manufacturing are some of the innovations that will be contributing to the future growth of the market by improving the beauty, longevity, and environmental friendliness of the products.

Australia Ceramic Tiles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2128.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.12% |

| 2035 Value Projection: | USD 4535.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Artedomus, YHJ Tiles, Johnson Tiles Australia, Beaumont Tiles, National Tiles, Elegant Living Tiles, Tile Republic, Doma Tiles & Stone, ROCERSA Australia, Globex Ceramics, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The Australia Ceramic Tiles Market share is classified into product and application.

By Product:

The Australia Ceramic Tiles Market Size is divided by product into glazed ceramic tiles, porcelain tiles, scratch free ceramic tiles, and others. Among these, the porcelain tiles segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because of their exceptional strength, low water absorption, excellent durability, and adaptability for both indoor and outdoor uses. Strong demand and steady growth are being driven by expanding applications in residential, commercial, and infrastructural projects, as well as the availability of large-format and digitally printed designs.

By Application:

The Australia Ceramic Tiles Market Size is divided by application into wall tiles, floor tiles, and others. Among these, the floor tiles segment accounted for the largest share in 2024 and is projected to grow at a significant CAGR during the forecast period. Because floor tiles are a popular option in high-traffic areas due to their durability, water resistance, ease of maintenance, and aesthetic variety, they are in great demand from residential and commercial construction, restorations, and infrastructure projects.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Australia ceramic tiles market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Australia Ceramic Tiles Market:

- Artedomus

- YHJ Tiles

- Johnson Tiles Australia

- Beaumont Tiles

- National Tiles

- Elegant Living Tiles

- Tile Republic

- Doma Tiles & Stone

- ROCERSA Australia

- Globex Ceramics

- Others

Recent Developments in Australia Ceramic Tiles Market:

In December 2024, Volt Solar Tiles, a company part of the Leeson Group in Australia, got more than AUD 1.1 million through equity crowdfunding, and this was the first step for them to enter the US market while making themself a competitor to Tesla’s Solar Roof in terms of pricing.

In October 2024, the Dimora Collection from Kaolin Porcelain Surfaces was awarded the Australian Good Design Award, thereby emphasizing the innovation of sustainable and luxurious porcelain tiles.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia Ceramic Tiles Market Size based on the below-mentioned segments:

Australia Ceramic Tiles Market, By Product

- Glazed ceramic tiles

- Porcelain tiles

- Scratch free ceramic tiles

- Others

Australia Ceramic Tiles Market, By Application

- Wall tiles

- Floor tiles

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Australia ceramic tiles market size?A: Australia ceramic tiles market is expected to grow from USD 2128.6 million in 2024 to USD 4535.3 million by 2035, growing at a CAGR of 7.12% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the growth in construction activities in the residential, commercial, and industrial sectors, the increase in renovation and remodeling projects in homes, and urban sprawl. Demand for flooring and wall solutions that are durable, easy to maintain, and visually pleasing is a major factor that supports the growth of the market. Government spending on housing and infrastructure, the use of eco-friendly and energy-efficient building materials, and the introduction of advanced digital printing and large-format tile designs are all factors that drive the growth of the market in various sectors, including residential, commercial, and public infrastructures.

-

Q: What factors restrain the Australia ceramic tiles market?A: Constraints include the high costs of raw materials and energy, fluctuating import prices, supply chain disruptions, and the competition from alternative flooring materials, which is fierce and impacts pricing, profit margins, and overall market growth negatively.

-

Q: How is the market segmented by product?A: The market is segmented into glazed ceramic tiles, porcelain tiles, scratch free ceramic tiles, and others.

-

Q: Who are the key players in the Australia ceramic tiles market?A: Key companies include Artedomus, YHJ Tiles, Johnson Tiles Australia, Beaumont Tiles, National Tiles, Elegant Living Tiles, Tile Republic, Doma Tiles & Stone, ROCERSA Australia, Globex Ceramics, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?