Australia Cell Counting Market Size, Share, and COVID-19 Impact Analysis, By Product (Instruments, Consumables & Accessories), By Application (Stem Cell Research, Cell Based Therapeutics, Bioprocessing, Toxicology, and Others), and Australia Cell Counting Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareAustralia Cell Counting Market Insights Forecasts to 2035

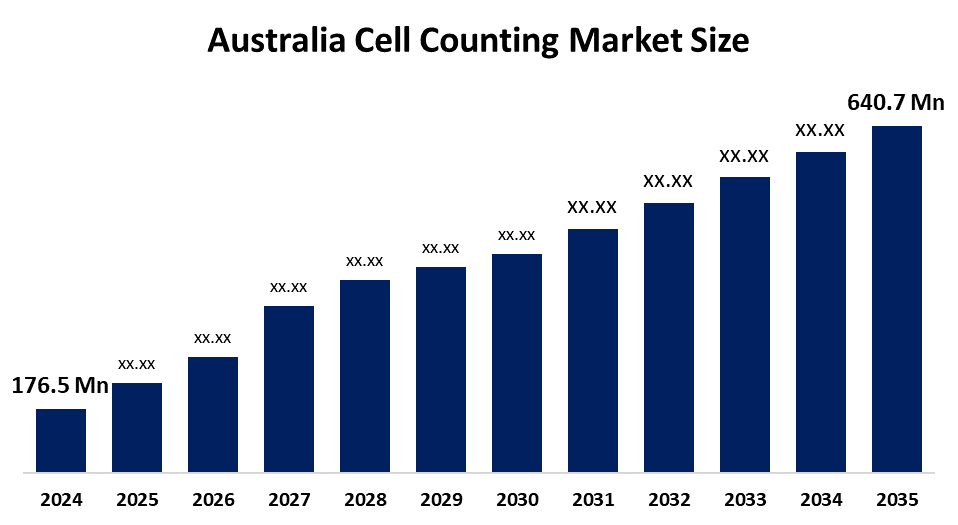

- The Australia Cell Counting Market Size Was Estimated at USD 176.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 12.43% from 2025 to 2035

- The Australia Cell Counting Market Size is Expected to Reach USD 640.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Australia Cell Counting Market Size Is Anticipated To Reach USD 640.7 Million By 2035, Growing At A CAGR Of 12.43% From 2025 To 2035. The cell counting market in Australia is driven by rising biomedical research activities, the prevalence of chronic diseases, the growing use of automated cell analysis technologies, the growth of the pharmaceutical and biotechnology industries, and the increased need for sophisticated diagnostic and laboratory testing solutions.

Market Overview

The Australia Cell Counting Market refers to the industry involved in the development, production, and use of instruments and consumables for counting and analysing cells in biological samples. The system includes automated cell counters together with flow cytometers and hemocytometers. The applications cover clinical diagnostics and cancer research as well as immunology and drug discovery and stem cell research and biotechnology manufacturing. Cell counting serves as a fundamental requirement for disease diagnosis and treatment monitoring and laboratory research and quality control in pharmaceutical and biopharmaceutical production.

The Australian Government supports the cell counting market through major research funding programs. The Medical Research Future Fund (MRFF) provides over AUD 20 billion for health research. The BioMedical Translation Fund allocates AUD 500 million for commercialization. State initiatives including Victoria's AUD 2 billion biomedical investment program create better laboratory infrastructure and help laboratories to adopt advanced technologies.

Australian laboratories improve their cell counting procedures through the implementation of automated imaging systems at research centers such as the Peter MacCallum Cancer Centre. Cytiva Australia expanded supply of advanced cell analysis instruments. University partnerships with biotechnology companies will enhance research that develops practical applications. The upcoming future will provide opportunities for AI-based cell analysis and single-cell technology development and greater implementation of these technologies in immunotherapy and regenerative medicine.

Report Coverage

This research report categorizes the market for the Australia cell counting market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia cell counting market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia cell counting market.

Australia Cell Counting Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 176.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.43% |

| 2035 Value Projection: | USD 640.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Cytiva Australia, Merck Millipore, Thermo Fisher Scientific, Bio-Rad Laboratories Australia, Zoex Australia, Luna Cell Counting, Beckman Coulter Life Sciences, BD (Becton Dickinson), PerkinElmer Australia, Idexx Laboratories Australia, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The cell counting market in Australia is driven by the increasing biomedical, clinical research activities, the growing rates of cancer and chronic diseases, and the rising need for accurate diagnostic equipment. The industry adopts new technologies because companies increase their investments in biotechnology and pharmaceutical research and development and regenerative medicine. Automated systems together with AI-based cell counting technologies enable higher operational efficiency and precise measurement capabilities. Strong government funding for medical research and laboratory infrastructure development creates an environment which drives market expansion.

Restraining Factors

The cell counting market in Australia is mostly constrained by the expensive equipment together with its maintenance and a shortage of qualified laboratory workers and the implementation of strict industry standards. The high costs of advanced automated cell counting systems create two main challenges for smaller research laboratories and healthcare facilities which results in limited budget capabilities.

Market Segmentation

The Australia cell counting market share is classified into product and application.

- The consumables & accessories segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia cell counting market is segmented by product into instruments, consumables & accessories. Among these, the consumables & accessories segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because regular laboratory testing and research operations frequently call for consumables such as chemicals, assay kits, slides, chambers, and other items. Unlike one-time instrument purchases, their recurring purchasing nature creates ongoing revenue. Strong CAGR development in this market is also driven by expanding biotech and pharmaceutical laboratories, increasing research output, and increasing diagnostic testing frequency.

- The bioprocessing segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia cell counting market is segmented by application into stem cell research, cell-based therapeutics, bioprocessing, toxicology, and others. Among these, the bioprocessing segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The reason for this is the expanding biopharmaceutical and biotechnology manufacturing industry, where precise cell counting is crucial for tracking production-related factors such cell viability, density, and productivity. High demand is fueled by rising investments in biologics, vaccines, and cell-based production techniques.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia cell counting market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cytiva Australia

- Merck Millipore

- Thermo Fisher Scientific

- Bio-Rad Laboratories Australia

- Zoex Australia

- Luna Cell Counting

- Beckman Coulter Life Sciences

- BD (Becton Dickinson)

- PerkinElmer Australia

- Idexx Laboratories Australia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In July 2025, the Australian government gave about AU$100 million in funding to biopharma/med-tech incubators, which might promote local innovation in diagnostics and analytical devices.

- In March 2025, Thermo Fisher Scientific introduced an AI-powered smart automated cell counter, which improves precision and throughput for cell counting and viability analysis in research and clinical settings.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia cell counting market based on the below-mentioned segments:

Australia Cell Counting Market, By Product

- Instruments

- Consumables & Accessories

Australia Cell Counting Market, By Application

- Stem Cell Research

- Cell Based Therapeutics

- Bioprocessing

- Toxicology

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Australia cell counting market size?A: Australia cell counting market size is expected to grow from USD 176.5 million in 2024 to USD 640.7 million by 2035, growing at a CAGR of 12.43% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by increasing biomedical, clinical research activities, the growing rates of cancer and chronic diseases, and the rising need for accurate diagnostic equipment. The industry adopts new technologies because companies increase their investments in biotechnology and pharmaceutical research and development and regenerative medicine.

-

Q: What factors restrain the Australia cell counting market?A: Constraints include the expensive equipment together with its maintenance and a shortage of qualified laboratory workers and the implementation of strict industry standards.

-

Q: How is the market segmented by product?A: The market is segmented into instruments, consumables & accessories.

-

Q: Who are the key players in the Australia cell counting market?A: Key companies include Cytiva Australia, Merck Millipore, Thermo Fisher Scientific, Bio-Rad Laboratories Australia, Zoex Australia, Luna Cell Counting, Beckman Coulter Life Sciences, BD (Becton Dickinson), PerkinElmer Australia, Idexx Laboratories Australia, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?