Australia Breakfast Cereals Market Size, Share, and COVID-19 Impact Analysis, By Type (Ready-to-Eat and Hot Cereals), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Stores, and Others), and Australia Breakfast Cereals Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesAustralia Breakfast Cereals Market Size Insights Forecasts to 2035

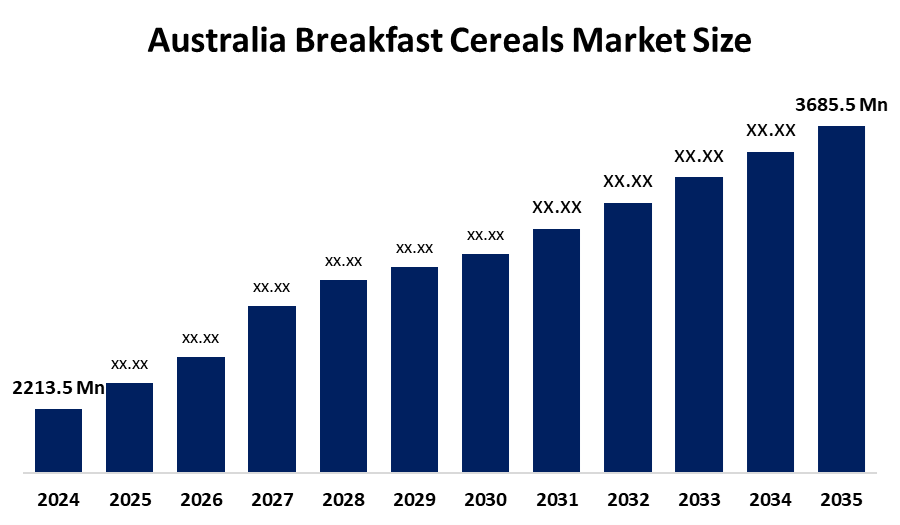

- The Australia Breakfast Cereals Market Size Was Estimated at USD 2213.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.74% from 2025 to 2035

- The Australia Breakfast Cereals Market Size is Expected to Reach USD 3685.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Australia Breakfast Cereals Market Size is anticipated to reach USD 3685.7 Million by 2035, Growing at a CAGR of 4.74% from 2025 to 2035. The breakfast cereals market in Australia is driven by growing health consciousness, the need for quick breakfast options, hectic urban lifestyles, product innovation in protein and high-fiber cereals, clean-label trends, growing retail distribution, premiumization, and an increasing inclination for functional and fortified foods.

Market Overview

Australia's Breakfast Cereals Market Size consists of breakfast cereals which are produced from wheat and oats and corn and rice to provide products that people can eat for their daily meals. The market serves households, foodservice, and institutional buyers. The primary uses of the product include breakfast consumption at home and food consumption for people who need meals while traveling and school nutrition programs and hotel and café food services which use functional cereal products that contain high fiber and protein and additional nutrients.

The Australian Government uses AU$3.5 million funding through the National Food Security Strategy to support food system development and supply chain security. The Healthy Food Partnership establishes two goals to decrease sugar content and enhance nutritional value across all processed foods including breakfast cereals. The Health Star Rating System helps consumers choose healthier packaged foods, which affects both breakfast cereal development and advertising.

Kellanova introduced Nutri-Grain High Protein Crunch while Kellogg's launched a main advertising campaign that promoted their healthier cereal products. The demand for plant-based products which contain low sugar content and have protein enhancements, drives e-commerce growth and online personalized snack services, which create market opportunities for health-oriented products and digital shopping platforms.

Report Coverage

This research report categorizes the market for the Australia Breakfast Cereals Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia Breakfast Cereals Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia Breakfast Cereals Market Size.

Australia Breakfast Cereals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024`` |

| Market Size in 2024``: | USD 2213.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.74% |

| 2035 Value Projection: | USD 3685.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Distribution Channel |

| Companies covered:: | Kellogg’s / Kellanova, Sanitarium Health and Wellbeing Company, Uncle Tobys, Freedom Foods Group, Carman’s Fine Foods Pty Ltd., Weetabix, The Muesli Company Pty Ltd., Brookfarm Pty Ltd., Grain & Bake Co Pty Ltd., Aldi’s GoldenVale, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The breakfast cereals market in Australia is driven by the rising health consciousness and demand for quick breakfast options and the needs of people who work in urban environments. Market growth occurs because consumers choose cereals that contain high fiber content and low sugar content and high protein content and fortified ingredients. Consumers are attracted to products because of their innovative features and clean-label packaging and high-quality pricing. The market continues to grow because of expanded retail and e-commerce channels and increased emphasis on functional nutrition and marketing campaigns that promote balanced dietary practices to both households and foodservice providers.

Restraining Factors

The breakfast cereals market in Australia is mostly constrained by the rising raw material costs and increasing competition from fresh and alternative breakfast options and consumer concerns over sugar and additives and price sensitivity and supply-chain volatility and growing preference for homemade or minimally processed foods.

Market Segmentation

The Australia Breakfast Cereals Market Size share is classified into type and distribution channel.

- The ready-to-eat segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia Breakfast Cereals Market Size is segmented by type ready-to-eat and hot cereals. Among these, the ready-to-eat segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because of their ease of use, extended shelf life, extensive range of flavors, and robust retail availability, ready-to-eat cereals are the industry leader. Busy urban lifestyles, higher demand for quick morning meals, and continuous innovation in healthier RTE options (high-fiber, protein-fortified, low-sugar) further drive higher consumer adoption compared with hot cereals.

- The supermarkets and hypermarkets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia Breakfast Cereals Market Size is segmented by distribution channel supermarkets and hypermarkets, specialty stores, online stores, and others. Among these, the supermarkets and hypermarkets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Supermarkets and hypermarkets dominate because of their extensive product selection, robust national presence, affordable prices, and regular sales. The market share of this channel is further reinforced by well-established supply chains and private-label products in comparison to specialized and internet retailers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia Breakfast Cereals Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kellogg’s / Kellanova

- Sanitarium Health and Wellbeing Company

- Uncle Tobys

- Freedom Foods Group

- Carman’s Fine Foods Pty Ltd.

- Weetabix

- The Muesli Company Pty Ltd.

- Brookfarm Pty Ltd.

- Grain & Bake Co Pty Ltd.

- Aldi’s GoldenVale

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In July 2024, Sanitarium launches Weet-Bix Bites Coco Crunch, a brand-new whole grain and fiber cereal, across the country.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia Breakfast Cereals Market Size based on the below-mentioned segments:

Australia Breakfast Cereals Market Size, By Type

- Ready-to-Eat

- Hot Cereals

Australia Breakfast Cereals Market Size, By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Frequently Asked Questions (FAQ)

-

What is the Australia Breakfast Cereals Market Size?Australia Breakfast Cereals Market Size is expected to grow from USD 2213.5 million in 2024 to USD 3685.7 million by 2035, growing at a CAGR of 4.74% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by rising health consciousness and demand for quick breakfast options and the needs of people who work in urban environments. Market growth occurs because consumers choose cereals that contain high fiber content and low sugar content and high protein content and fortified ingredients.

-

What factors restrain the Australia Breakfast Cereals Market Size?Constraints include the rising raw material costs and increasing competition from fresh and alternative breakfast options and consumer concerns over sugar.

-

How is the market segmented by type?The market is segmented into ready-to-eat, and hot cereals.

-

Who are the key players in the Australia Breakfast Cereals Market Size?Key companies include Kellogg’s / Kellanova, Sanitarium Health and Wellbeing Company, Uncle Tobys, Freedom Foods Group, Carman’s Fine Foods Pty Ltd., Weetabix, The Muesli Company Pty Ltd., Brookfarm Pty Ltd., Grain & Bake Co Pty Ltd., Aldi’s GoldenVale, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?