Australia Automotive Coolant Market Size, Share, By Type (Ethylene Glycol, Propylene Glycol, And Glycerol), By End Use (Passenger Car, Commercial Vehicle, Two Wheeler, And OTR), And Australia Automotive Coolant Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationAustralia Automotive Coolant Market Size Insights Forecasts to 2035

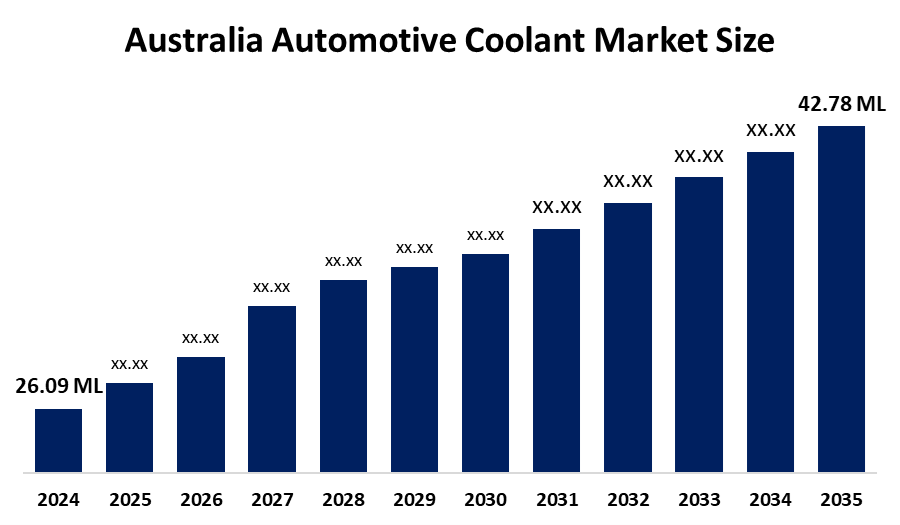

- Australia Automotive Coolant Market Size 2024: 26.09 Million Liters

- Australia Automotive Coolant Market Size 2035: 42.78 Million Liters

- Australia Automotive Coolant Market Size CAGR 2024: 4.6%

- Australia Automotive Coolant Market Size Segments: Type and End Use

Get more details on this report -

The Australia Automotive Coolant Market Size refers to industry segment that includes manufacturing, distribution and selling of motor vehicle engine coolants and other thermal management fluids that are used in vehicles to maintain the proper operating temperature of the engine, preventing overheating or freezing. The growth in the sector has been driven by an increase in ownership of motor vehicles, increased awareness of vehicle maintenance, and an increase in overall motor vehicle fleets. Furthermore, new and innovative solutions being developed in the marketplace are creating a completely different landscape within this market.

The automotive coolant in Australia is backed by government support, including the Product Stewardship for Oil (PSO) Scheme, aimed to improve environmental performance of coolant products and waste streams, aligning with national sustainability objectives. Australia’s vehicle market with robust growth over 1.21 million new vehicles were sold in 2023, marking one of the highest annual figures on record and underscoring strong automotive demand that directly correlates with increased consumption of maintenance fluids such as coolants

As technology advances, Australia’s automotive coolant providers are now using advanced organic acid technology type coolants, which provide exceptional corrosion protection, extended service life, and reduced environmental impact. The emergence of hybrid and electric vehicle applications has also stimulated the development of the unique thermal management fluids to address the specific cooling requirements of battery systems as well as the components of electric powertrains, thereby increasing the range of technology and future opportunities for coolant manufacturers in the market.

Australia Automotive Coolant Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 26.09 Million Liters |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.6% |

| 2035 Value Projection: | 42.78 Million Liters |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End Use |

| Companies covered:: | Nulon Products Australia Pty Ltd., Castrol Australia Pty Ltd., Shell Australia Pty Ltd., Penrite Oil Co. Pty Ltd., Ampol Limited, Gulf Western Premium Quality Lubricating Oils, Prestone Products Corporation, Valvoline Australia Pty Ltd., TotalEnergies Marketing Australia Pty Ltd., Chevron Australia Downstream Pty Ltd., Fuchs Lubricants Pty Ltd., Chiron Coolants, PrixMax Engine Coolants, BASF SE, Liquid Intelligence Pty Ltd., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Australia Automotive Coolant Market Size:

The Australia Automotive Coolant Market Size is driven by the continuous rise in vehicle ownership across the country, heightened consumer awareness about proper cooling system care, increased demand for quality coolants that prevent engine damage, increased manufacturers recommendations for longer service intervals, introduction of advanced coolants that support extended vehicle maintenance cycles, and strong shift toward eco-friendly, biodegradable coolants further propel the market growth.

The Australia Automotive Coolant Market Size is restrained by the price sensitivity among consumers, limiting manufacturers ability for advanced innovation, environmental and regulatory constraints, high compliance costs for producers, and increasing adoption of electric vehicles.

The future of Australia Automotive Coolant Market Size is bright and promising, with versatile opportunities emerging from the increasing sustainable and advanced thermals solutions including a sustainable and biodegradable refrigerants. Manufacturers are able to attract environmentally friendly customers due to the shift towards eco-friendly, biodegradable and compact refrigerants with lower toxicity levels, as well as the growth in hybrid and battery electric vehicles along with their needs for new refrigerants designed specifically for battery & electronic cooling systems will provide a tremendous growth opportunity to the manufacturers as the trend towards electrification of vehicles is continuing and diversifying their thermal solutions.

Market Segmentation

The Australia Automotive Coolant Market Size share is classified into type and end use.

By Type:

The Australia Automotive Coolant Market Size is divided by type into ethylene glycol, propylene glycol, and glycerol. Among these, the ethylene glycol segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Superior thermal performance characteristics, affordable solution, widespread adoption by both manufacturers and for aftermarket maintenance, cost effectiveness, and widely used as the primary base fluid all contribute to the ethylene glycol segment's largest share and higher spending on sodium lauryl ether sulfate when compared to other type.

By End Use:

The Australia Automotive Coolant Market Size is divided by end use into passenger car, commercial vehicle, two wheeler, and OTR. Among these, the passenger car segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The passenger car segment dominates because of high demand for coolant, higher maintenance cycle, requiring regular coolant changes to prevent corrosion and overheating, rapid urbanization, and increased passenger car ownership rates with sustainability in Australia.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Australia Automotive Coolant Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Australia Automotive Coolant Market Size:

- Nulon Products Australia Pty Ltd.

- Castrol Australia Pty Ltd.

- Shell Australia Pty Ltd.

- Penrite Oil Co. Pty Ltd.

- Ampol Limited

- Gulf Western Premium Quality Lubricating Oils

- Prestone Products Corporation

- Valvoline Australia Pty Ltd.

- TotalEnergies Marketing Australia Pty Ltd.

- Chevron Australia Downstream Pty Ltd.

- Fuchs Lubricants Pty Ltd.

- Chiron Coolants

- PrixMax Engine Coolants

- BASF SE

- Liquid Intelligence Pty Ltd.

- Others

Recent Developments in Australia Automotive Coolant Market Size:

In November 2025, CoolDrive Auto Parts announced the arrival of the new Jayrad Coolant Range including pre-mix and concentrate coolants, corrosion inhibitors, and radiator flushes. It was designed to cover standard passenger vehicles, light trucks, motorcycles, and agricultural equipment.

In April 2025, LIQUI MOLY partnered with CoolDrive Auto Parts to distribute its full range of premium, German engineered lubricants and coolants in Australia.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia Automotive Coolant Market Size based on the below-mentioned segments:

Australia Automotive Coolant Market Size, By Type

- Ethylene Glycol

- Propylene Glycol

- Glycerol

Australia Automotive Coolant Market Size, By End Use

- Passenger Car

- Commercial Vehicle

- Two Wheeler

- OTR

Frequently Asked Questions (FAQ)

-

What is the Australia Automotive Coolant Market Size?Australia Automotive Coolant Market Size is expected to grow from 26.09 million liters in 2024 to 42.78 million liters by 2035, growing at a CAGR of 4.6% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the continuous rise in vehicle ownership across the country, heightened consumer awareness about proper cooling system care, increased demand for quality coolants that prevent engine damage, increased manufacturers recommendations for longer service intervals, introduction of advanced coolants that support extended vehicle maintenance cycles, and strong shift toward eco-friendly, biodegradable coolants further propel the market growth.

-

What factors restrain the Australia Automotive Coolant Market Size?Constraints include the price sensitivity among consumers, limiting manufacturers ability for advanced innovation, environmental and regulatory constraints, high compliance costs for producers, and increasing adoption of electric vehicles.

-

How is the market segmented by type?The market is segmented into ethylene glycol, propylene glycol, and glycerol.

-

Who are the key players in the Australia Automotive Coolant Market Size?Key companies include Nulon Products Australia Pty Ltd., Castrol Australia Pty Ltd., Shell Australia Pty Ltd., Penrite Oil Co. Pty Ltd., Ampol Limited, Gulf Western Premium Quality Lubricating Oils, Prestone Products Corporation, Valvoline Australia Pty Ltd., TotalEnergies Marketing Australia Pty Ltd., Chevron Australia Downstream Pty Ltd., Fuchs Lubricants Pty Ltd., Chiron Coolants, PrixMax Engine Coolants, BASF SE, Liquid Intelligence Pty Ltd., and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?