Australia Ammunition Market Size, Share, and COVID-19 Impact Analysis, By Product (Bullets, Aerial Bombs, Grenades, Mortars, Artillery Shells, and Others), By Application (Civil & Commercial, and Defense), and Australia Ammunition Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseAustralia Ammunition Market Insights Forecasts to 2035

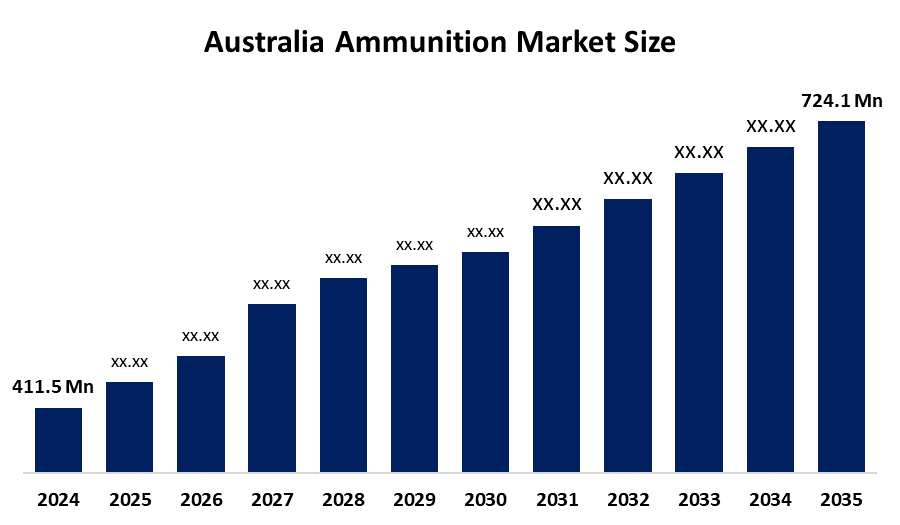

- The Australia Ammunition Market Size Was Estimated at USD 411.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.27% from 2025 to 2035

- The Australia Ammunition Market Size is Expected to Reach USD 724.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Australia Ammunition Market Size is anticipated to reach USD 724.1 Million by 2035, Growing at a CAGR of 5.27% from 2025 to 2035. The ammunition market in Australia is driven by rise of shooting sports, government investments in domestic ammunition manufacturing capabilities, escalating defense modernization programs, increased military procurement, and growing law enforcement.

Market Overview

The Australia ammunition market covers the production, distribution, and use of small, medium, and large-caliber ammunition for defense, law enforcement, and civilian applications. The market includes all types of ammunition used for firearms and artillery and training systems, which includes bullets and shells and cartridges. Military operations border security police activities hunting shooting sports and tactical training represent the main uses of key applications. The market supports national defense readiness public safety and recreational shooting across Australia.

The Australian Government allocates substantial funding to develop domestic ammunition and munitions production capabilities which includes AU USD 220 million funding for munitions factory upgrades at Mulwala (NSW) and Benalla (VIC) to produce artillery shells and aerial bombs. The program provides USD 16–USD 21 billion funding over the next ten years to develop Guided Weapons and Explosive Ordnance (GWEO) capabilities which include building facilities that manufacture 155 mm artillery rounds and rockets to create new employment opportunities and increase national defense capabilities. The defense industry provides additional grants that match 50 percent of costs to support local manufacturing operations and develop workforce skills.

Australia has started its domestic ammunition production operations. NIOA manufactures Boxer vehicle rounds at its Benalla facility. The government supports munitions manufacturing through its USD 220 million investment program and establishment of new artillery shell forging plants. Defence and civilian sectors will experience future growth through partnerships and expanded GMLRS/precision programs and export potential.

Report Coverage

This research report categorizes the market for the Australia ammunition market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia ammunition market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia ammunition market.

Australia Ammunition Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 411.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.27% |

| 2035 Value Projection: | USD 724.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By Application |

| Companies covered:: | NIOA Group, Rheinmetall NIOA Munitions Pty Ltd, Australian Munitions, ARES Armaments Australia, AEOTM Group, Winchester Australia Ltd, Australian Missile Corporation, Defence & Tactical Ammunition Suppliers, Chemring Australia, Custom Ammunition Workshops/Engineering Houses, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ammunition market in Australia is driven by the rising defence expenditures and military modernization efforts and increasing sovereign manufacturing production of guided weapons and explosive ordnance and growing demand for artillery and small-calibre ammunition. Law enforcement requirements and regulated civilian shooting sports and training programs create additional growth opportunities. The market expansion and development of permanent capabilities receive acceleration from governmental funding which establishes local production facilities and strengthens supply chain defense and forms strategic alliances with domestic defense contractors.

Restraining Factors

The ammunition market in Australia is mostly constrained by the strict firearms regulations and complex licensing requirements and expensive manufacturing operations and mandatory compliance procedures and the need to obtain raw materials through imports. The installation of new capacity faces restrictions because of environmental regulations and supply chain disruptions and extended times needed for defence procurement processes.

Market Segmentation

The Australia ammunition market share is classified into product and application.

- The bullets segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia ammunition market is segmented by product into bullets, aerial bombs, grenades, mortars, artillery shells, and others. Among these, the bullets segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because small-calibre rounds are used in the greatest quantities in civilian shooting sports, law enforcement, and defence training, the bullets segment dominates Australia's ammunition market. The greatest revenue share and steady growth are driven by their regular replenishment, ongoing need for military training, and extensive civilian use.

- The defense segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia ammunition market is segmented by application into civil & commercial, and defense. Among these, the defense segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The defense segment dominates Australia’s ammunition market because of rising government defence spending, force modernisation programs, large-scale procurement of artillery and small-calibre rounds, and investments in sovereign munitions manufacturing, driving much higher volumes and contract values than civil and commercial demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia ammunition market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NIOA Group

- Rheinmetall NIOA Munitions Pty Ltd

- Australian Munitions

- ARES Armaments Australia

- AEOTM Group

- Winchester Australia Ltd

- Australian Missile Corporation

- Defence & Tactical Ammunition Suppliers

- Chemring Australia

- Custom Ammunition Workshops/Engineering Houses

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2025, the Australian Department of Defence terminated a 155 mm ammunition purchase arrangement with Thales Australia, suggesting a rethink of domestic artillery production ambitions.

- In August 2025, NIOA launched primary explosives manufacturing at the Benalla munitions complex, expanding local production of grenades and detonators.

- In March 2025, to improve sovereign munitions capability, Australia and the United States signed Memorandums of Understanding to allow local assembly of GMLRS rounds and co-produce 155 mm artillery ammunition.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia ammunition market based on the below-mentioned segments:

Australia Ammunition Market, By Product

- Bullets

- Aerial Bombs

- Grenades

- Mortars

- Artillery Shells

- Others

Australia Ammunition Market, By Application

- Civil & Commercial

- Defense

Frequently Asked Questions (FAQ)

-

Q: What is the Australia ammunition market size?A: Australia ammunition market size is expected to grow from USD 411.5 million in 2024 to USD 724.1 million by 2035, growing at a CAGR of 5.27% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by rising defence expenditures and military modernization efforts and increasing sovereign manufacturing production of guided weapons and explosive ordnance and growing demand for artillery and small-calibre ammunition.

-

Q: What factors restrain the Australia ammunition market?A: Constraints include the strict firearms regulations and complex licensing requirements and expensive manufacturing operations and mandatory compliance procedures and the need to obtain raw materials through imports.

-

Q: How is the market segmented by product?A: The market is segmented into bullets, aerial bombs, grenades, mortars, artillery shells, and others.

-

Q: Who are the key players in the Australia ammunition market?A: Key companies include NIOA Group, Rheinmetall NIOA Munitions Pty Ltd, Australian Munitions, ARES Armaments Australia, AEOTM Group, Winchester Australia Ltd, Australian Missile Corporation, Defence & Tactical Ammunition Suppliers, Chemring Australia, Custom Ammunition Workshops/Engineering Houses, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?