Australia Airborne ISR Market Size, Share, and COVID-19 Impact Analysis, By Fuel Type (Hydrogen Fuel-Cells, Solar Powered, Alternate Fuel, Battery Operated, and Gas-Electric Hybrids), By Platform (Air, Space, Land, and Sea), and Australia Airborne ISR Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseAustralia Airborne ISR Market Insights Forecasts to 2035

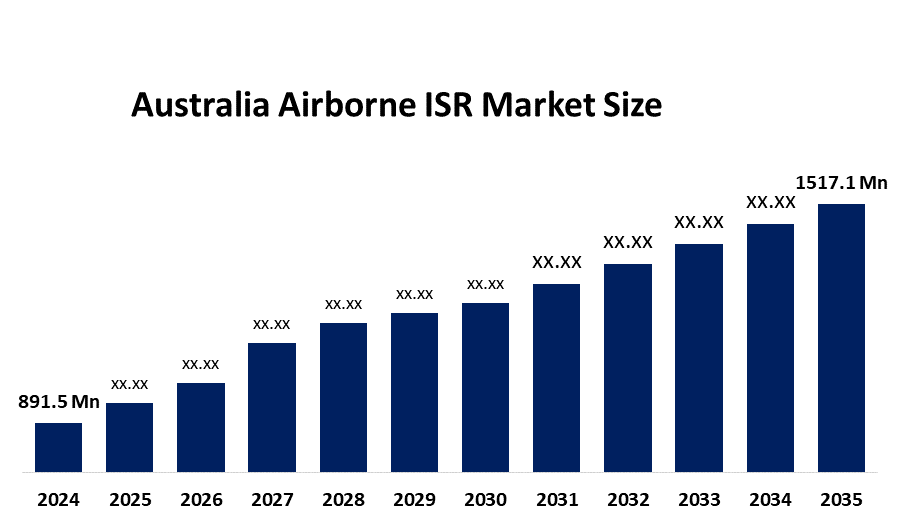

- The Australia Airborne ISR Market Size Was Estimated at USD 891.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.95% from 2025 to 2035

- The Australia Airborne ISR Market Size is Expected to Reach USD 1517.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Australia Airborne ISR Market Size is anticipated to reach USD 1517.1 Million by 2035, Growing at a CAGR of 4.95% from 2025 to 2035. The airborne ISR market in Australia is driven by rising defense modernization, border surveillance requirements, regional security concerns, UAV adoption, integration of AI-enabled sensors, and government investments in intelligence, reconnaissance, and situational awareness capabilities.

Market Overview

The Australia airborne ISR (Intelligence, Surveillance, and Reconnaissance) market covers airborne platforms and sensor systems used to collect, process, and analyze real-time intelligence. The system consists of manned aircraft, UAVs, radar systems, EO/IR sensors, and communication payloads. The primary applications of the system include military operations, border security, maritime patrol, disaster response, and environmental monitoring. The market enables national defence capabilities for situational awareness and swift decision-making throughout Australia's extensive airspace and coastal areas.

The Australian government is making substantial financial commitments toward airborne ISR and unmanned aerial vehicles. Defence is dedicating a total of USD 600 million for drone development throughout the 10-year period of the Sovereign UAS Challenge, while the Integrated Investment Program has earmarked an additional USD 4 to USD 5 billion for drone systems and counter-drone capabilities. Defence’s Project Land 156 includes a USD 1.3 billion counter-UAS initiative to enhance ISR and security systems. The funding will be used to develop domestic ISR technology and manufacturing capabilities and to establish operational readiness.

Australia finished building a USD 355 million drone hangar in Katherine to support MQ-4C Triton operations which will begin in January 2026. The Army chose Arkeus's hyperspectral ISR sensor to use with its surveillance UAVs in November 2025. The first MC-55A Peregrine ISR aircraft arrived to enhance national airborne ISR capabilities which created new opportunities for developing autonomous sensors and platform integration and sovereign ISR tech.

Report Coverage

This research report categorizes the market for the Australia Airborne ISR market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia Airborne ISR market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia Airborne ISR market.

Australia Airborne ISR Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 891.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.95% |

| 2035 Value Projection: | USD 1517.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Fuel Type, By Platform |

| Companies covered:: | Sentient Vision Systems, Aerosonde Ltd, Drone Shield, Thales Australia, Raytheon Australia, Quantum Systems Australia Pty Ltd, Falcon UAV, AVT Australia, Innovaero, Defence UAS Innovators Group, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The airborne ISR market in Australia is driven by the increased defense modernization efforts and heightened regional security threats and the requirement for continuous maritime and land border surveillance. Government investments in UAVs, ISR aircraft, and advanced sensor technologies support growth. The demand for real-time intelligence together with disaster response capabilities and better situational awareness supports greater adoption of technology which benefits operational performance through AI and data analytics and network-centric warfare system integration.

Restraining Factors

The airborne ISR market in Australia is mostly constrained by the high acquisition and lifecycle costs and extended defense procurement times and the need for regulatory approval and the presence of data integration challenges and the lack of skilled operators and systems engineers.

Market Segmentation

The Australia airborne ISR market share is classified into fuel type and platform.

- The gas-electric hybrids segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia airborne ISR market is segmented by fuel type into hydrogen fuel-cells, solar powered, alternate fuel, battery operated, and gas-electric hybrids. Among these, the gas-electric hybrids segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Hybrid systems offer longer surveillance missions, carry powerful ISR sensors, and connect seamlessly with current platforms, making them more practicable for defense operations than developing hydrogen, solar, or battery-only alternatives.

- The air segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia airborne ISR market is segmented by platform into air, space, land, and sea. Among these, the air segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The air sector dominates Australia’s Airborne ISR market because manned aircraft and UAVs are the major vehicles for ISR missions, enabling wide-area coverage, rapid deployment, and high-payload capacity for advanced sensors. Strong defence investment in patrol aircraft and drones, combined their proven operational efficacy for border surveillance and maritime monitoring, underpins the greatest share and sustained expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia airborne ISR market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sentient Vision Systems

- Aerosonde Ltd

- Drone Shield

- Thales Australia

- Raytheon Australia

- Quantum Systems Australia Pty Ltd

- Falcon UAV

- AVT Australia

- Innovaero

- Defence UAS Innovators Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia airborne ISR market based on the below-mentioned segments:

Australia Airborne ISR Market, By Fuel Type

- Hydrogen Fuel-Cells

- Solar Powered

- Alternate Fuel

- Battery Operated

- Gas-Electric Hybrids

Australia Airborne ISR Market, By Platform

- Air

- Space

- Land

- Sea

Frequently Asked Questions (FAQ)

-

Q: What is the Australia airborne ISR market size?A: Australia airborne ISR market size is expected to grow from USD 891.5 million in 2024 to USD 1517.1 million by 2035, growing at a CAGR of 4.95% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increased defense modernization efforts and heightened regional security threats and the requirement for continuous maritime and land border surveillance. Government investments in UAVs, ISR aircraft, and advanced sensor technologies support growth.

-

Q: What factors restrain the Australia airborne ISR market?A: Constraints include the high acquisition and lifecycle costs and extended defense procurement times and the need for regulatory approval.

-

Q: How is the market segmented by fuel type?A: The market is segmented into hydrogen fuel-cells, solar powered, alternate fuel, battery operated, and gas-electric hybrids.

-

Q: Who are the key players in the Australia airborne ISR market?A: Key companies include Sentient Vision Systems, Aerosonde Ltd, Drone Shield, Thales Australia, Raytheon Australia, Quantum Systems Australia Pty Ltd, Falcon UAV, AVT Australia, Innovaero, Defence UAS Innovators Group, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?