Australia Agricultural Films Market Size, Share, and COVID-19 Impact Analysis, By Product (Conventional Plastics, and Biodegradable Plastics), By Application (Mulching Films, Silage Films, and Greenhouse Films), and Australia Agricultural Films Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureAustralia Agricultural Films Market Insights Forecasts to 2035

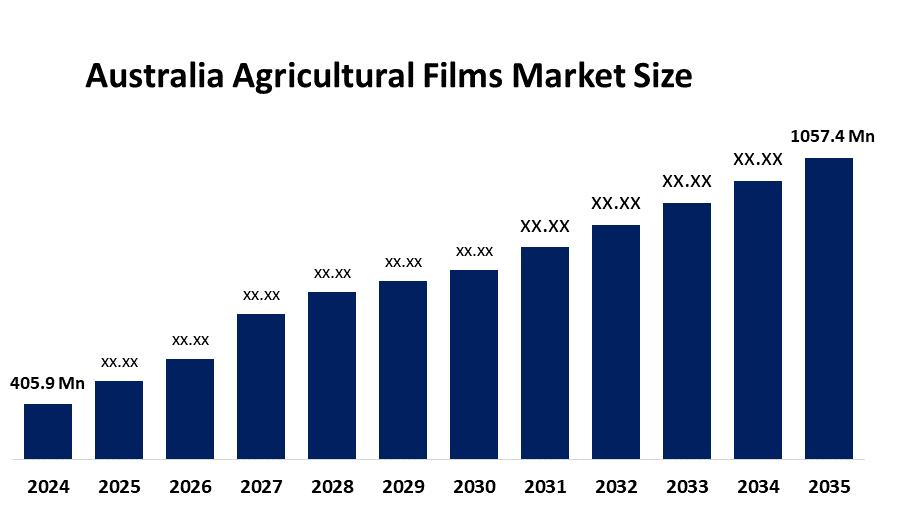

- The Australia Agricultural Films Market Size Was Estimated at USD 405.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.09% from 2025 to 2035

- The Australia Agricultural Films Market Size is Expected to Reach USD 1057.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Australia Agricultural Films Market Size is anticipated to reach USD 1057.4 Million by 2035, Growing at a CAGR of 9.09% from 2025 to 2035. The agricultural films market in Australia is driven by expanding use of protected agriculture, the need to conserve water, the expansion of greenhouse farming, climate variability, and increased awareness of cutting-edge farming technologies.

Market Overview

The Australia agriculture films market comprises plastic films, which are further used in farming to improve the yield and protection of crops. These films are being used for different purposes such as mulching, covering greenhouses, wrapping silages, and making tunnels, which help in the preservation of moisture, very good regulation of soil temperature, weed control, the quality of yield improvement, and protection of crops from bad weather, pests, and UV rays through a variety of agricultural practices.

Australia's agriculture sector embraces the use of synthetic films through various programs such as the Climate-Smart Agriculture Program, which allocates $302 million, innovation grants for eco-friendly farming, and the National Agricultural Plastics Stewardship Scheme that supports the recycling of mulch and silage films. Through R&D Tax Incentives, the production of high-tech and green agricultural films continues to gain momentum, which in turn enhances both productivity and sustainability in farming.

Australia's BioAgri soil-biodegradable mulch film is an innovative solution to support eco-friendly agriculture. Its presence makes it possible to have agricultural films that are completely compostable, plastic-free, and that dissolve in soil without being taken away, thus promoting sustainability and reducing waste at the same time. New trends will include biodegradable films widely used in agriculture, multi-layer greenhouse films with UV stability, and sensor-integrated smart films to yield more and maintain a healthy environment.

Report Coverage

This research report categorizes the market for the Australia agricultural films market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia agricultural films market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia agricultural films market.

Australia Agricultural Films Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 405.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.09% |

| 2035 Value Projection: | USD 1057.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product, By Application |

| Companies covered:: | BioAgri, Teramax Pty Ltd, Australian Bio-Plastics, Hortitech Pty Ltd, Green Master Packaging, AGROPRO Australia Pty Ltd, Yangtai Australia, Aus Bio-Plastics / Australian Bio-Plastics, Local Agricultural Co-ops & Grower Suppliers, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The agricultural films market in Australia is driven by the rising acceptance of greenhouses and precision agriculture, along with the need for higher crop production and water conservation due to changing weather patterns. The market is also supported by the growth of greenhouse and horticulture farming, government support for climate-smart agriculture, technological breakthroughs in UV-resistant and biodegradable films, and the adoption of sustainable farming practices.

Restraining Factors

The agricultural films market in Australia is mostly constrained by the negative perception of plastic waste on the environment, the high price of biodegradable films, the absence of proper recycling facilities, and the instability of raw material prices.

Market Segmentation

The Australia agricultural films market share is classified into product and application.

- The conventional plastics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia agricultural films market is segmented by product into conventional plastics, and biodegradable plastics. Among these, the conventional plastics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to its low cost, widespread availability, demonstrated durability, and robust mechanical strength, the conventional plastics segment dominates the Australian agricultural films industry. Farmers greatly choose these films for mulching, greenhouse covers, and silage applications in large-scale farming operations because they provide efficient moisture retention, UV resistance, and crop protection.

- The mulching films segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia agricultural films market is segmented by application into mulching films, silage films, and greenhouse films. Among these, the mulching films segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to its extensive application in enhancing agricultural output, temperature regulation, weed control, and soil moisture retention. Mulch films are widely used in row crop farming and horticulture because they are affordable, simple to use, and enable robust market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia agricultural films market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BioAgri

- Teramax Pty Ltd

- Australian Bio-Plastics

- Hortitech Pty Ltd

- Green Master Packaging

- AGROPRO Australia Pty Ltd

- Yangtai Australia

- Aus Bio-Plastics / Australian Bio-Plastics

- Local Agricultural Co-ops & Grower Suppliers

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In November 2025, Teramax unveiled a new generation of compostable mulch film tailored to Australian conditions, with reliable performance in the field and readily predictable breakdown at the end of the cycle.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia agricultural films market based on the below-mentioned segments:

Australia Agricultural Films Market, By Product

- Conventional Plastics

- Biodegradable Plastics

Australia Agricultural Films Market, By Application

- Mulching Films

- Silage Films

- Greenhouse Films

Frequently Asked Questions (FAQ)

-

Q:What is the Australia agricultural films market size?A:Australia agricultural films market size is expected to grow from USD 405.9 million in 2024 to USD 1057.4 million by 2035, growing at a CAGR of 9.09% during the forecast period 2025-2035.

-

Q:What are the key growth drivers of the market?A:Market growth is driven by rising acceptance of greenhouses and precision agriculture, along with the need for higher crop production and water conservation due to changing weather patterns.

-

Q:What factors restrain the Australia agricultural films market?A:Constraints include the negative perception of plastic waste on the environment, the high price of biodegradable films, the absence of proper recycling facilities, and the instability of raw material prices.

-

Q:How is the market segmented by product?A:The market is segmented into conventional plastics, and biodegradable plastics.

-

Q:Who are the key players in the Australia agricultural films market?A:Key companies include BioAgri, Teramax Pty Ltd, Australian Bio-Plastics, Hortitech Pty Ltd, Green Master Packaging, AGROPRO Australia Pty Ltd, Yangtai Australia, Aus Bio-Plastics / Australian Bio-Plastics, Local Agricultural Co-ops & Grower Suppliers, and Others.

-

Q:Who are the target audiences for this market report?A:The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?