Australia Aerospace & Defense MRO Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Single Aisle (Narrow Body) Aircraft, Twin Aisle (Wide Body) Aircraft, Regional Aircraft, and Others), By End Use (Commercial, Business & General Aviation, Military, and Others), and Australia Aerospace & Defense MRO Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseAustralia Aerospace & Defense MRO Market Size Insights Forecasts to 2035

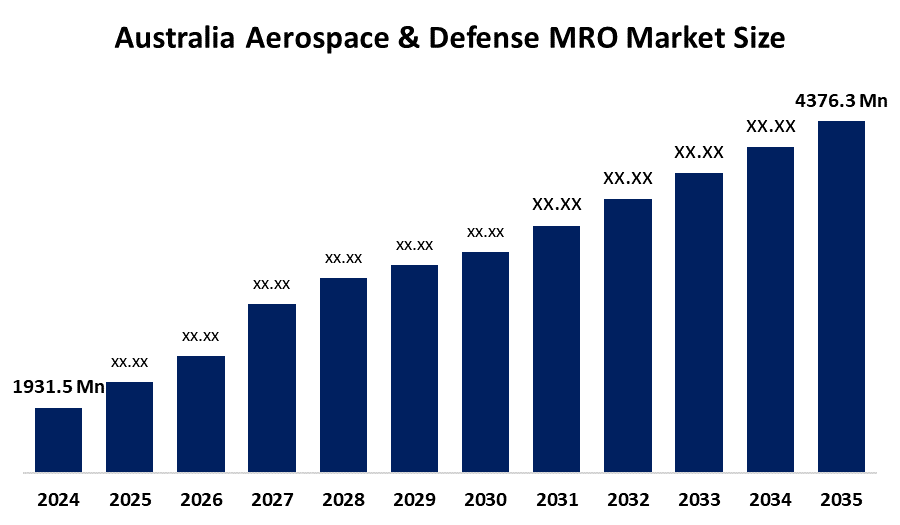

- The Australia Aerospace & Defense MRO Market Size Was Estimated at USD 1931.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.72% from 2025 to 2035

- The Australia Aerospace & Defense MRO Market Size is Expected to Reach USD 4376.3 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Australia Aerospace & Defense MRO Market Size is anticipated to Reach USD 4376.3 Million by 2035, Growing at a CAGR of 7.72% from 2025 to 2035. The aerospace & defense MRO market in Australia is driven by rising defense budgets, expanding aircraft fleets, increasing air travel, the need for maintenance on aged aircraft, technical developments, and robust government backing for homegrown aerospace capabilities.

Market Overview

The Australia aerospace & defense MRO (Maintenance, Repair, and Overhaul) market which provides services to maintain, repair, inspect, upgrade military, commercial aircraft, helicopters, engines and their components requires these services to maintain operational efficiency and safety. The system provides airframe and engine and avionics and component maintenance services. The system supports fleet operational readiness and compliance with rules and extension of equipment life across commercial aviation defense forces space systems and unmanned aerial vehicles.

The Australian government supports the aerospace & defense MRO market through grants and subsidies like the Defence Industry Development Grants Program which provides funding of up to AUD 1 million for each project and matching funds of 50 percent to develop domestic maintenance abilities. The program provides Joint Strike Fighter sustainment grants which range from AUD 50,000 to AUD 250,000 to support MRO operations on F-35 components that enhance local employment and business development. The growth of defense budget expenditures supports both infrastructure development and skill enhancement activities.

Recent developments in Australia’s aerospace & defense MRO market include expanded complex heavy maintenance capabilities by ExecuJet and new MRO line facilities in Perth boosting domestic services. Companies like ASDAM are acquiring global MRO assets to strengthen sovereign sustainment capabilities, while advanced projects such as Boeing’s MQ-28 Ghost Bat production plant highlight future growth. Future opportunities lie in defence modernization, autonomous systems, and expanded export-oriented maintenance services.

Report Coverage

This research report categorizes the market for the Australia aerospace & defense MRO market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia aerospace & defense MRO market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia aerospace & defense MRO market.

Australia Aerospace and Defense MRO Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1931.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.72% |

| 2035 Value Projection: | USD 4376.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 183 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Aircraft Type, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Heston MRO Group, Flight One Engineering, Omni Aerospace, Rosebank Engineering, RUAG Australia, Australian Aerospace Engineering (AAE), Skytek Pty Ltd, SIGMA Aerospace, Airflite Pty Ltd, MTU Maintenance Australia Pty Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The aerospace & defense MRO market in Australia is driven because defense organizations spend more money on their military operations and they implement their capability development programs through fleet modernization and new aircraft procurement. The demand for maintenance services increases because commercial air traffic volume rises and airlines expand their fleets. The need to service aging aircraft, strengthen sovereign sustainment capabilities, and reduce foreign dependency also supports growth. The market develops because companies use predictive maintenance technology and digital maintenance repair operations systems and government-supported industrial programs to introduce new products.

Restraining Factors

The aerospace & defense MRO market in Australia is mostly constrained by the high operating costs, labor expenses, its shortage of skilled workers, its supply chain interruptions and its need to rely on foreign products. The complicated nature of regulatory requirements together with the limitations of existing infrastructure prevents companies from increasing their market presence and maintaining their competitive edge.

Market Segmentation

The Australia aerospace & defense MRO market share is classified into aircraft type and end use.

- The single aisle (narrow body) aircraft segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia aerospace & defense MRO market is segmented by aircraft type into single aisle (narrow body) aircraft, twin aisle (wide body) aircraft, regional aircraft, and others. Among these, the single aisle (narrow body) aircraft segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The main cause of this is the large number of narrow-body aircraft utilized in regional and domestic commercial aviation. Compared to other aircraft types, narrow-body fleets in Australia require more regular maintenance cycles, including routine inspections, engine servicing, and component overhauls, due to the country's robust domestic air travel network and frequent short-haul trips.

- The commercial segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia aerospace & defense MRO market is segmented by end use into commercial, business & general aviation, military, and others. Among these, the commercial segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Strong domestic and international air travel, sizable fleets of narrow-body aircraft, and the need for regular maintenance to adhere to stringent aviation safety standards are the main causes of this. Compared to the military and business aviation divisions, the commercial aviation industry's constant fleet utilization, cabin improvements, engine overhauls, and component servicing create a higher and more stable MRO demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia aerospace & defense MRO market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Heston MRO Group

- Flight One Engineering

- Omni Aerospace

- Rosebank Engineering

- RUAG Australia

- Australian Aerospace Engineering (AAE)

- Skytek Pty Ltd

- SIGMA Aerospace

- Airflite Pty Ltd

- MTU Maintenance Australia Pty Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In August 2025, AMSL Aero expects to launch a hydrogen-electric eVTOL globally, highlighting the need for sophisticated aircraft types in future MRO operations.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia aerospace & defense MRO market based on the below-mentioned segments:

Australia Aerospace & Defense MRO Market, By Aircraft Type

- Single Aisle (Narrow Body) Aircraft

- Twin Aisle (Wide Body) Aircraft

- Regional Aircraft

- Others

Australia Aerospace & Defense MRO Market, By End Use

- Commercial

- Business & General Aviation

- Military

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Australia aerospace & defense MRO market size?A: Australia aerospace & defense MRO market size is expected to grow from USD 1931.5 million in 2024 to USD 4376.3 million by 2035, growing at a CAGR of 7.72% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven because defense organizations spend more money on their military operations and they implement their capability development programs through fleet modernization and new aircraft procurement.

-

Q: What factors restrain the Australia aerospace & defense MRO market?A: Constraints include the high operating costs, labor expenses, its shortage of skilled workers, its supply chain interruptions and its need to rely on foreign products.

-

Q: How is the market segmented by aircraft type?A: The market is segmented into single aisle (narrow body) aircraft, twin aisle (wide body) aircraft, regional aircraft, and others.

-

Q: Who are the key players in the Australia aerospace & defense MRO market?A: Key companies include Heston MRO Group, Flight One Engineering, Omni Aerospace, Rosebank Engineering, RUAG Australia, Australian Aerospace Engineering (AAE), Skytek Pty Ltd, SIGMA Aerospace, Airflite Pty Ltd, MTU Maintenance Australia Pty Ltd, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?