Global Asset Finance Market Size, Share, and COVID-19 Impact Analysis, By Asset Class (High-Value Commercial Vehicles (HVCVs) (Trucks & Lorries (Rigid, Articulated), Vans & Light Commercial Vehicles (LCVs), Buses & Coaches), Construction & Earthmoving Equipment (Excavators, Cranes, Bulldozers, Loaders, Dump Trucks, Concrete Mixers, Compactors), Agricultural Machinery (Tractors, Combine Harvesters, Specialist farming equipment), Plant & Manufacturing Machinery (CNC Machines, Lathes, Industrial Robots, Injection Molding Machines), Technology & Office Equipment (Servers, IT Hardware, Telecommunications Systems, Office Fit-outs and furniture), and Other Specialist Assets (Medical Equipment, Aircraft & Marine Vessels, Renewable Energy Assets), By Finance Asset Class (Hire Purchase (HP), Finance Lease, Operating Lease, Contract Hire, and Asset-Based Lending (ABL)), By Lender Type (Captive Lenders, High Street / Major Banks, Specialist Asset Finance Providers, and Challenger Banks & FinTech Lenders), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Banking & FinancialGlobal Asset Finance Market Insights Forecasts to 2035

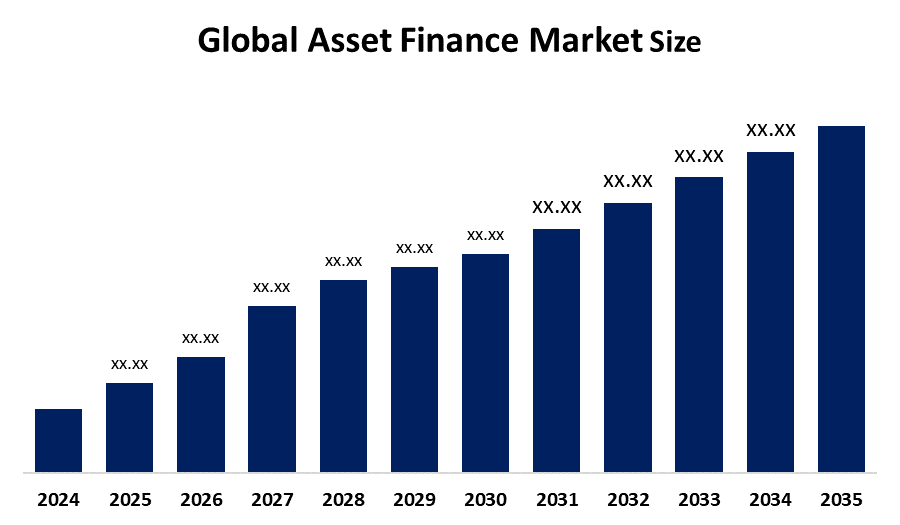

- The Market Size is Expected to Grow at a CAGR of around 8.4% from 2025 to 2035

- The Global Asset Finance market size is expected to hold a significant share by 2035.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the Global asset finance market size is expected to hold a significant share by 2035, at a CAGR of 8.4% during the forecast period 2025-2035. Opportunities in the asset finance market include expanding infrastructure development in both developed and emerging nations, growing SME expansion, acceptance of digital lending platforms, favorable regulatory support, and growing demand for equipment and technology finance.

Global Asset Finance Market Forecast and Revenue Outlook

- CAGR (2025-2035): 8.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The Asset Finance Market Size is a specialized area of commercial lending where companies use structured financial instruments, such as hire purchase agreements, operating leases, finance leases, and asset-backed securitizations, to acquire vital capital assets, including machinery, automobiles, real estate, and technology infrastructure. By using the intrinsic value of the assets as collateral, this market allows asset acquisition without significant upfront capital expenditures, improving cash flow, boosting liquidity, and reducing balance sheet encumbrances. For instance, in April 2025, Barclays and Brookfield Asset Management announced a long-term strategic partnership to expand and transform Barclays’ payment acceptance business, aiming to establish it as a standalone entity and drive innovation in digital payments. The growing need for contemporary cars, machinery, and technology by companies looking to increase operational effectiveness and maintain their competitiveness is one of the primary contributors. Asset finance is a desirable way for businesses, especially small and finance lease-sized organizations (SMEs), to get necessary equipment without having to make large upfront investments due to these businesses frequently struggle with capital constraints. The banking sector digitalization and technological developments are also greatly boosting asset finance market expansion.

Key Market Insights

- North America is expected to account for the largest share in the asset finance market size during the forecast period.

- In terms of asset class, the high-value commercial vehicles segment is projected to lead the asset finance market size throughout the forecast period

- In terms of finance asset class, the finance lease segment is projected to lead the asset finance market size throughout the forecast period

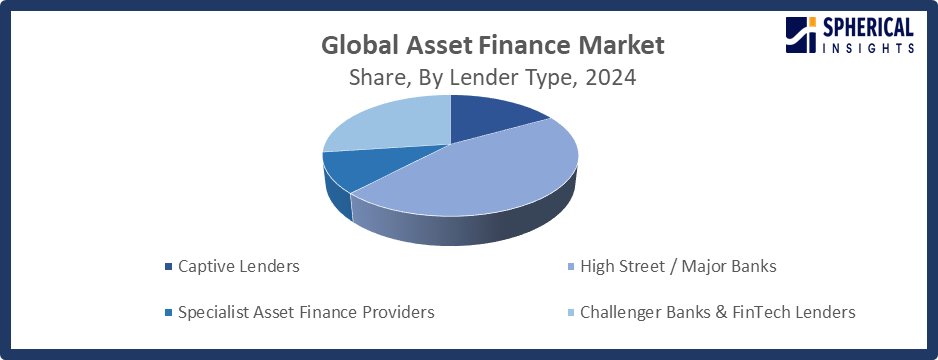

- In terms of lender type, the high street / major banks segment captured the largest portion of the market

Asset Finance Market Trends

- Expansion of asset finance for sustainable and energy-efficient equipment.

- Focus on customized financing solutions catering to specific industry requirements.

- Rising use of data analytics and AI for risk assessment and credit evaluation.

- Increasing adoption of digital lending and fintech platforms for faster, automated asset financing.

- Growing demand for leasing and hire-purchase solutions among SMEs and startups.

- Integration of cloud-based platforms for streamlined loan processing and portfolio management.

Report Coverage

This research report categorizes the asset finance market size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the asset finance market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the asset finance market.

Global Asset Finance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Asset Class, By Regional |

| Companies covered:: | Lloyds Bank Commercial Barclays Bank Caterpillar Financial Services Volvo Financial Services Société Générale Equipment Finance Dll Close Brothers Asset Finance Shawbrook Bank Ald / Leaseplan Hitachi Capital and other, key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving factors

The Market Size for Asset Finance is expanding due to a number of interconnected variables that increase its acceptance across sectors and regions. The banking sector's digitalization and technological developments are also greatly boosting asset finance market expansion. Globally, the growth of transportation networks, industrial projects, and infrastructure is generating a steady demand for financed assets, especially in developing nations. Additionally, the demand for specialist financing solutions to purchase cutting-edge technology has increased due to growing awareness of sustainable and energy-efficient equipment. The asset financing process has been made simpler by the rise of fintech platforms and automated lending solutions, which provide quicker approval processes, real-time monitoring, and improved risk assessment.

Restraining Factor

High default risks, strict regulations, uncertain economic conditions, volatile lending rates, low awareness among SMEs, and difficulties in accurately determining asset depreciation and collateral value all restrict the asset finance market.

Market Segmentation

The global asset finance market is divided into asset class, finance asset class, and lender type.

Global Asset Finance Market, By Asset Class:

- The high-value commercial vehicles segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on asset class, the global asset finance market size is segmented into high-value commercial vehicles (hVCVs) (trucks & lorries (rigid, articulated), vans & light commercial vehicles (lCVs), buses & coaches), construction & earthmoving equipment (excavators, cranes, bulldozers, loaders, dump trucks, concrete mixers, compactors), agricultural machinery (tractors, combine harvesters, specialist farming equipment), plant & manufacturing machinery (cNC machines, lathes, industrial robots, injection molding machines), technology & office equipment (servers, iT hardware, telecommunications systems, office fit-outs and furniture), and other specialist assets (medical equipment, aircraft & marine vessels, renewable energy assets. Among these, the high-value commercial vehicles segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The upgrading of transportation infrastructure, increased logistics and freight operations in developed and emerging nations, and the growing demand for fleet growth are the main factors driving the high-value commercial vehicles (HVCVs) market. Businesses can maximize cash flow while acquiring expensive assets by financing trucks, lorries, vans, buses, and coaches using leasing and hire-purchase strategies.

The technology and office equipment segment in the asset finance market is expected to grow at the fastest CAGR over the forecast period. The adoption of asset finance solutions in this category is being driven by the technology and office equipment segment's growing digital transformation across industries, as well as the demand for sophisticated IT infrastructure, servers, and telecommunications systems. Companies are upgrading their IT assets while maintaining liquidity by utilizing financing solutions.

Global Asset Finance Market, By Finance Asset Class:

- The finance lease segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on finance asset class, the global asset finance market is segmented into hire purchase (HP), finance lease, operating lease, contract hire, and asset-based lending (ABL). Among these, the finance lease segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The flexibility, cost effectiveness, and tax benefits of the finance leasing segment are the main factors that make it a desirable financing choice for companies in a variety of industries. Finance leases improve liquidity and maximize working capital by allowing businesses to use high-value assets like cars, machinery, and equipment without making a sizable upfront investment.

The operating lease segment in the asset finance market is expected to grow at the fastest CAGR over the forecast period. The growing inclination for asset-light business models and the requirement for flexible financing solutions that permit recurring asset upgrades are the reasons behind the expansion of the operating lease industry. Operating leases are especially popular in industries where asset degradation happens quickly, like information technology, transportation, and equipment leasing.

Global Asset Finance Market, By Lender Type:

- The high street / major banks segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on lender type, the global asset finance market is segmented into captive lenders, high street / major banks, specialist asset finance providers, and challenger banks & fintech lenders. Among these, the high street / major banks segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The main reasons for the high street/major banks segment's ability to provide competitive interest rates and a variety of lending options are their vast financial infrastructure, well-established clientele, and robust capital capacity. Major banks are essential in providing well-structured leasing, hire purchase, and asset-based lending solutions to small and finance lease-sized businesses as well as major corporations.

Get more details on this report -

The challenger banks & fintech lenders segment in the asset finance market is expected to grow at the fastest CAGR over the forecast period. Digital transformation, creative financing structures, and the application of cutting-edge technologies like artificial intelligence and data analytics for credit evaluation and decision-making are driving the expansion of the challenger banks and fintech lenders segment.

Regional Segment Analysis of the Global Asset Finance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Asset Finance Market Trends

North America is expected to hold the largest share of the global asset finance market over the forecast period.

Strong economic activity, a developed leasing and financing ecosystem, and a well-established financial infrastructure all contribute to North America's success. Businesses can effectively access a variety of funding options due to the region's thriving banking industry, a large number of non-banking financial institutions, and specialist asset finance providers. Additionally, the area gains from a high rate of adoption of cutting-edge credit assessment technology and digital financial solutions, which expedite approval procedures, shorten transaction times, and enhance risk management. For Instance, in October 2025, the U.S. Department of Transportation launched the $45.98 million Innovative Finance and Asset Concession Grant Program to boost public-private infrastructure partnerships, addressing a $2.6 trillion funding gap; applications.

U.S Asset Finance Market Trends

The market for asset finance in the United States is propelled by technology integration, digital transformation, and changing financing options. Fintech platform use and automated lending procedures have improved risk assessment, expedited approval timelines, and improved client satisfaction. Leasing, hire-purchase, and sustainable asset financing are becoming more popular, especially in the transportation, technology, and industrial sectors. Businesses, notably SMEs, are also being encouraged to use asset finance for operational expansion by government-backed initiatives and regulatory support.

Canada Asset Finance Market Trends

The growing need for flexible financing options in industries including manufacturing, construction, transportation, and technology is what defines the Canadian asset finance market. Efficiency, transparency, and risk management are being improved by digitalization and the use of advanced analytics in credit evaluation. SMEs are increasingly using leasing and hire-purchase agreements to maximize capital allocation. Asset-backed finance is expanding as a result of government programs promoting green technologies and infrastructure development.

Asia Pacific Asset Finance Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the asset finance market during the forecast period.

Rapid industrialization, infrastructure expansion, and rising demand for cutting-edge equipment across a variety of industries are the main drivers of the Asia-Pacific region. Due to their growing manufacturing base, growing number of small and finance lease-sized businesses (SMEs), and increasing use of technology-driven financing options, nations like China, India, Japan, and South Korea are leading the way in this expansion. The demand for machinery, automobiles, and technology assets has expanded dramatically as a result of the region's economic growth, growing urbanization, and greater industrial investments. This has increased the use of asset finance. Hong Kong launched its November 2025 tokenisation pilot scheme and eased digital asset regulations to enhance trading liquidity, foster innovation, and accelerate growth in the virtual asset financing sector.

Get more details on this report -

China Asset Finance Market Trends

Rapid industrialization, infrastructural development, and a rise in the use of cutting-edge gear and equipment are the main drivers of the China asset finance market. Small and finance lease-sized businesses (SMEs) are increasingly choosing leasing and hire-purchase options for effective capital management. Fintech platforms, automated lending procedures, and digitalization are boosting risk assessment, cutting approval times, and increasing operational efficiency. Demand is also being fueled by government programs that assist industrial upgrading, green technology, and infrastructural projects.

Japan Asset Finance Market Trends

The demand for cutting-edge technology, industrial gear, and transportation equipment has propelled the steady rise of the Japanese asset finance sector. To maximize capital allocation and operational efficiency, businesses are increasingly implementing leasing and hire-purchase strategies. Fintech integration and automated credit evaluation are two examples of how digital transformation in the financial industry is improving risk management and streamlining procedures. Government-backed finance initiatives and regulatory support promote asset purchase in important industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global asset finance market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Asset Finance Market Include

- Lloyds Bank Commercial

- Barclays Bank

- Caterpillar Financial Services

- Volvo Financial Services

- Société Générale Equipment Finance

- Dll

- Close Brothers Asset Finance

- Shawbrook Bank

- Ald / Leaseplan

- Hitachi Capital

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In October 2025, GeoPura has secured a £27 million green loan, structured by Barclays and EIFO, to scale hydrogen energy operations and build a Danish electrolyser hub, showcasing growing asset finance market support for sustainable infrastructure and Power-to-X initiatives.

- In June 2025, Barclays launched an Innovation Hub in London, in collaboration with Microsoft and NVIDIA. Powered by Barclays Eagle Labs, the Hub will accelerate AI and deep tech startups by connecting entrepreneurs, industry experts, and investors.

- In March 2025, Lloyds has partnered with Lumio, an innovative money app, to revolutionize shared financial management, making it easier and more collaborative for couples to plan, track, and manage their joint finances more effectively and efficiently.

- In November 2024, DLL has launched its upgraded Equipment Showroom, offering pre-owned and end-of-lease equipment globally. The enhanced platform provides ‘Buy Now’ options, open and closed auctions across industries, improving accessibility and efficiency in the global used equipment market.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the asset finance market based on the following segments:

Global Asset Finance Market, By Asset Class

- High-Value Commercial Vehicles (HVCVs):

- Trucks & Lorries (Rigid, Articulated)

- Vans & Light Commercial Vehicles (LCVs)

- Buses & Coaches

- Construction & Earthmoving Equipment:

- Excavators, Cranes, Bulldozers

- Loaders, Dump Trucks

- Concrete Mixers, Compactors

- Agricultural Machinery

- Tractors

- Combine Harvesters

- Specialist farming equipment

- Plant & Manufacturing Machinery

- CNC Machines, Lathes

- Industrial Robots, Injection Molding Machines

- Technology & Office Equipment

- Servers, IT Hardware

- Telecommunications Systems

- Office Fit-outs and furniture

- Other Specialist Assets

- Medical Equipment

- Aircraft & Marine Vessels

- Renewable Energy Assets

Global Asset Finance Market, By Finance Asset Class

- Hire Purchase (HP)

- Finance Lease

- Operating Lease

- Contract Hire

- Asset-Based Lending (ABL)

Global Asset Finance Market, By Lender Type

- Captive Lenders

- High Street / Major Banks

- Specialist Asset Finance Providers

- Challenger Banks & FinTech Lenders

Global Asset Finance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the asset finance market over the forecast period?The global asset finance market is projected to expand at a CAGR of 8.4% during the forecast period.

-

2.What is the market size of the asset finance market?The Global asset finance market size is expected to hold a significant share by 2035, at a CAGR of 8.4% during the forecast period 2025-2035.

-

3.Which region holds the largest share of the asset finance market?North America is anticipated to hold the largest share of the asset finance market over the predicted timeframe.

-

4.Who are the top companies operating in the global asset finance market?Lloyds Bank Commercial, Barclays Bank, Caterpillar Financial Services, Volvo Financial Services, Société Générale Equipment Finance, DLL, Close Brothers Asset Finance, Shawbrook Bank, ALD / LeasePlan, Hitachi Capital, and Others.

-

5.What factors are driving the growth of the asset finance market?Growth in the asset finance market is driven by rising demand for machinery, vehicles, and technology, expanding SME financing needs, digital lending adoption, favorable regulations, and infrastructure development globally.

-

6.What are market trends in the asset finance market?Digitalization of lending procedures, greater use of hire-purchase and leasing, emphasis on sustainable assets, integration of fintech, data-driven risk assessment, and growth of asset financing services in emerging nations are some of the major trends

-

7.What are the main challenges restricting wider adoption of the asset finance market?Market adoption is limited by high default risks, complex regulatory requirements, economic uncertainty, fluctuating interest rates, challenges in asset valuation, and limited awareness of asset finance solutions among SMEs.

Need help to buy this report?